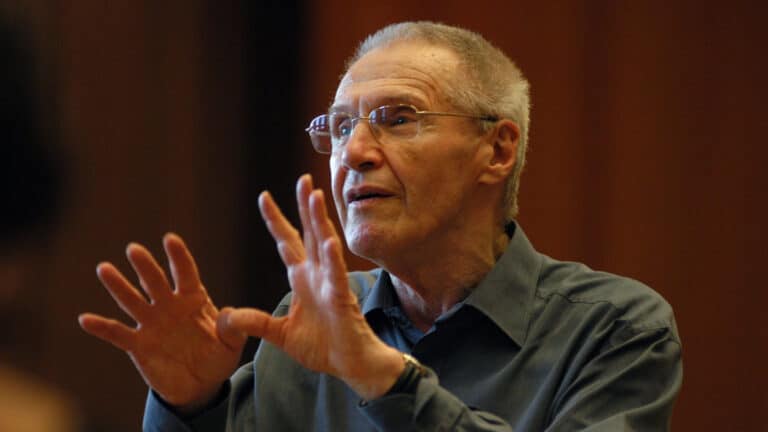

Kazakhstan’s Agency for Regulation and Development of Financial Market (ARDFM) has prepared a corporate environmental, social and governance (ESG) information disclosure handbook. The agency is expecting that the guideline will facilitate businesses to go through the process of switching over to ESG standards, according to Madina Abylkasova, head of ARDFM.

On November 16, during a conference called ESG as a New Paradigm in the Financial Sector, she said that ESG projects could transform the entire economy of the country, with the financial sector playing a key role in this process.

«At the initial stage, we will implement rules for ESG information disclosure. In order to achieve this goal, we have prepared the guideline on ESG disclosure,» she stated.

According to the official, businesses will be obliged to provide free access to their environmental, social and governance information to all interested parties to make them able to estimate how strongly ESG factors can affect the financial results of an entity.

ARDFM is suggesting implementing information disclosure within three blocks. The first one includes environment, climate, personnel, products, customers, financial inclusion and ethics. The second block is linked to the disclosure of which structure and processes a financial entity relies on to manage ESG factors. The third block includes corporate governance, activities of a board of directors, rights of shareholders and interested parties, and also reflects an entity’s commitments in the field of ESG.

As a result, financial organizations can rely on the ARDFM’s ESG disclosure handbook whenever they want to disclose any information.

Abylkasymova admits that the government has to stimulate businesses to switch over to new practices. That’s why the agency is going to require financial organizations to implement these ESG standards into their daily activities. In 2022, the agency signed an agreement on cooperation in this field with the International Financial Corporation and the European Bank for Reconstruction and Development. Under the agreement, ESG information disclosure and risk management standards must be implemented in the near future.

Kazakhstan already has an opportunity to issue green bonds. Since 2021, Kazakhstan Stock Exchange has facilitated nine ESG bond issues for $285 million, including three issues for $139.2 million this year. According to the ARDFM head, global financial markets now are more prone to require ESG information disclosure.

In 2021 investments in ESG funds rose threefold to $330 billion. The official noted that this year ESG funds have continued to receive more and more investments.

Abylkasymova believes that Kazakhstan has to find an optimal balance between economic growth and decarbonization of its plants and processing industry. This will require the country to transform the entire structure of its economy. Currently, green energy production accounts for just 3%. This rate is expected to reach 15% by 2030. According to the Ministry of National Economy, Kazakhstan needs to invest about $229 billion by 2030 to reach carbon neutrality and $648 billion by 2060 to secure this result.