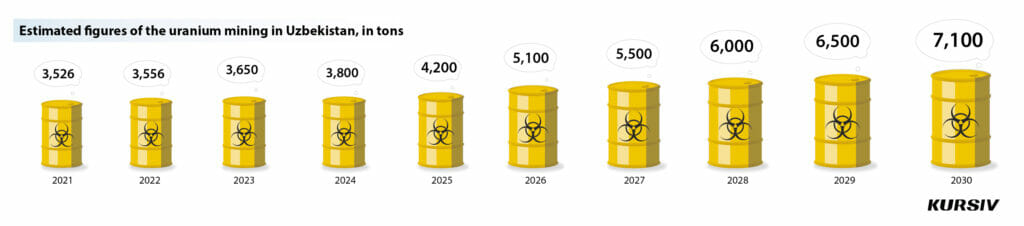

Uzbekistan is going to double its uranium production to 7,100 tons by 2030. To achieve this ambitious goal, the country has already allowed its public company Navoiyuran to publish statistical data about uranium reserves and output with no limitations.

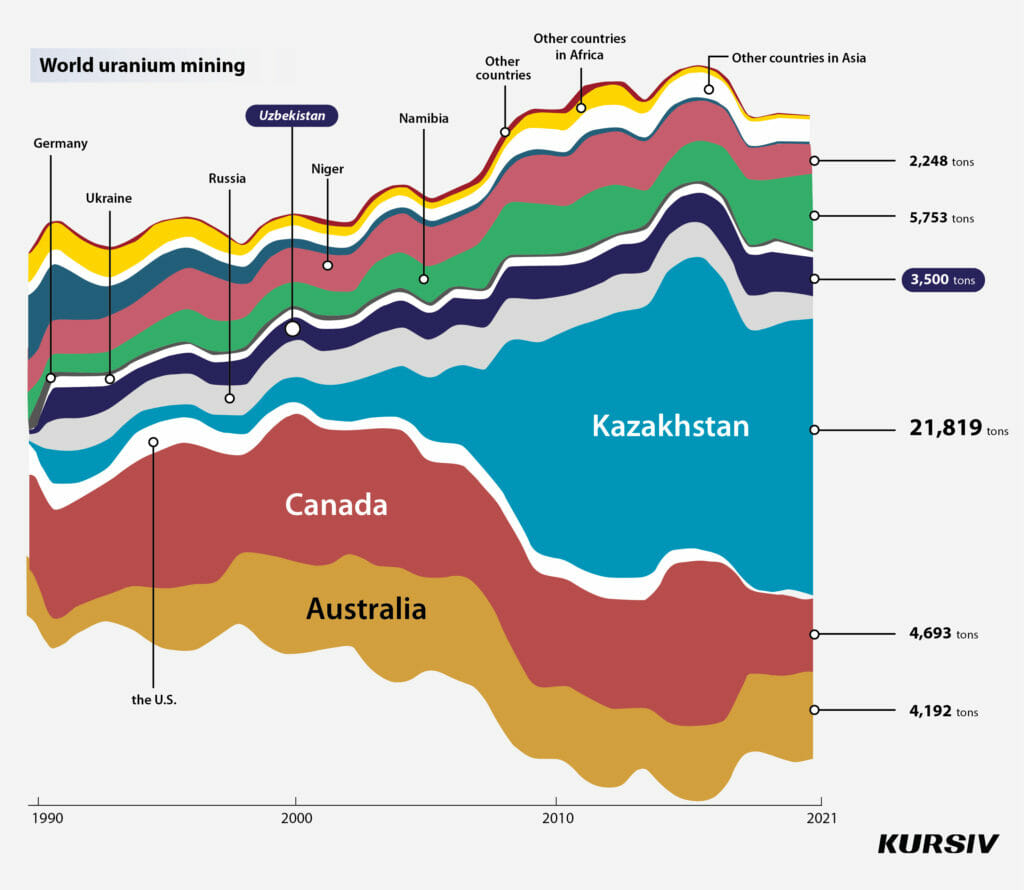

So far, the country’s official statistics don’t show any data about the quantity of uranium Uzbekistan had produced and sold. However, the country could have produced 3,500 tons of uranium last year, according to the World Nuclear Association.

All uranium produced in Uzbekistan is exported to big processing companies such as Orano (France), ConverDyn (the U.S.), Cameco (Canada) and CNEIC (China). The International Trade Center’s data shows that Uzbekistan sold 5,600 tons of uranium last year.

Nevertheless, even with 3,500 tons, Uzbekistan is ranked fifth among the largest uranium producers, falling behind Kazakhstan (21,800 tons in 2021), Namibia (5,750), Canada (4,700) and Australia (4,200).

Uranium enrichment

Navoiyuran is the only uranium producer in Uzbekistan. This company was established in January 2022 while the former Navoi Mining and Metallurgy Combine (NMMC) was transformed into three entities: Navoiy MMC, Navoiyuran and NMMC Foundation. The first one is responsible for the production of gold and silver, while Navoiyuran produces raw materials for nuclear fuel.

Currently, this company runs 18 uranium fields diffused in the Navoiy, Samarkand and Bukhara regions.

Industrial-scale uranium production in Uzbekistan began in 1958 at the Uchkuduk field. Since 1994 Uzbekistan has relied on the process of in-situ leaching when minerals such as copper and uranium are recovered through boreholes drilled into a deposit. With the help of this method, even poor uranium rock can bring profit for its producer.

However, Navoiyuran has no available mineral reserves to reach the goal of 7,100 tons of uranium by 2030. That’s why the company is planning to launch several new investment projects.

Investment outlook

There are several foreign players in the industry, including Orano. The French company owns a 51% share in the joint company of Nurlikum Mining, which is involved in uranium exploration in the Navoiy region of the country. The State Committee of Geology and Mineral Resources of Uzbekistan holds a 49% share of this company.

Orano is expecting good results from this work. «We are working in the area where the State Committee of Geology has already confirmed reserves of 12,000 tons of uranium and we want to increase this resource base. Even though Uzbekistan has fewer uranium reserves than Kazakhstan, the country managed to establish a highly effective business model of uranium production,» Orano’s spokesperson told the Kursiv edition.

According to the Orano Uzbekistan website, «Nurlikum Mining is going to proceed with exploration over the period from 2020 to 2023, including well-drilling, laboratory research, representations and testing to make sure that in-situ leaching at the Jengeldy field is worth further investments from a technical, financial and environmental points of view. The company plans to drill 300,000 meters of wells and conduct two pilot tests.»

Sherali Jurayev, head of uranium and rare metals in the State Committee of Geology says that foreign investors are interested in Uzbek uranium because «the world needs green energy, including nuclear power. That’s why global demand for uranium exploration and production is growing, while investors are prone to put their money in uranium projects,» he said.

As the official noted, Boston Consulting Group, the World Bank and the European Bank for Development and Reconstruction recommended Uzbekistan cut its royalty and the country has agreed to do so. The mining tax has been reduced from 10% to 8%. «We also have reconsidered the way we work with foreign investors. Currently, we offer investors 100% control over a project, with all related gains and risks. The government benefits from taxes and indirect payments,» Jurayev said.

Moreover, Uzbekistan no longer requires extra fees for exploration and mining licenses, land tax, and customs charges for equipment temporarily used in the country for exploration purposes. In order to increase the resource base up to 100,000 tons Uzbekistan is going to implement exploration operations at more than 50 uranium fields.

Information access

Kursiv hasn’t succeeded in receiving information about uranium production costs in Uzbekistan. However, in 2019 Nurmat Julibekov, deputy head of NMMC said in an interview with the Economic Review magazine that the production cost of uranium in the country was $62.5 per kilogram. In other words, the company’s net profit in 2019 was $9.4 million with 5.2% profitability.

In 2022 Navoiyuran reported $319 million in earnings, including $117 million in production costs (37%) and a net profit of $134 million.

Under a new edict signed by the president of the country, all the money Navoiyuran has already gotten will be spent on investment programs. The plan designed for the enterprise for 2022-2030 includes a set of such programs for almost $459 million in total. Six $216.3-million projects including technological upgrades are already on their way. Eight other projects on uranium production and processing for $242.6 million in total are set to be launched over 2023-2027.

The State Committee of Geology must give over its share in Nurlikum Mining to Navoiyuran. In turn, the latter has to prepare a long-term strategy for its development. A team of foreign consultants will be hired to facilitate this task. The company has to expand its supervisory board and governing board with independent members and specialists with international work experience respectively.

The president’s edict also allows Navoiyuran to publish its financial reports to let foreign investors see the company’s business outlook. Moreover, the company will be able to post information about uranium reserves, production, processing and export.

The president’s edict mentioned the amount of uranium produced in the country last year – 3,526 tons which fully meets the figure reported by WNA.

Uranium supply and demand

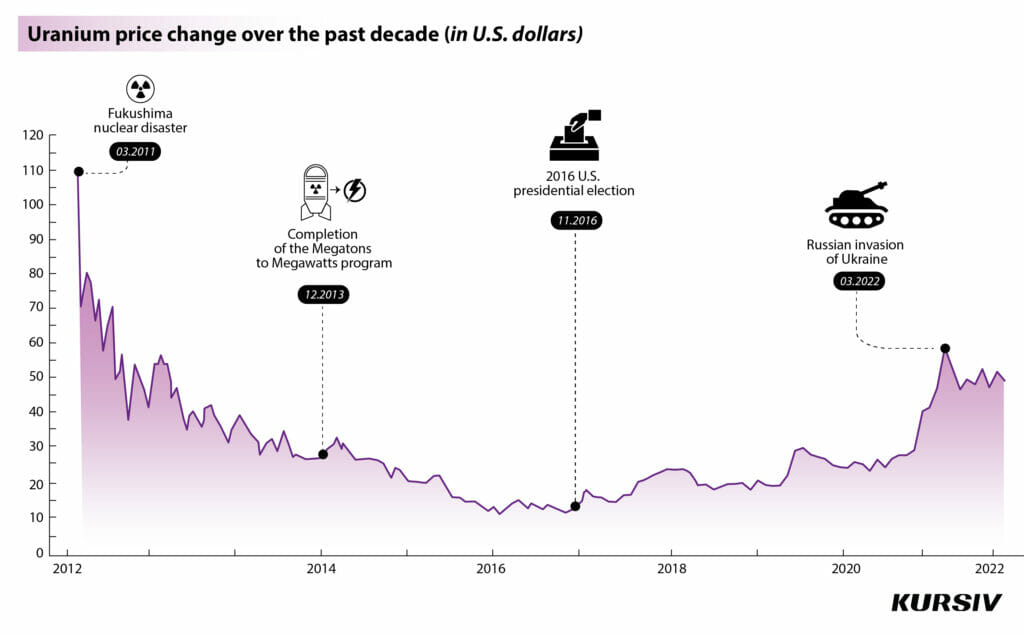

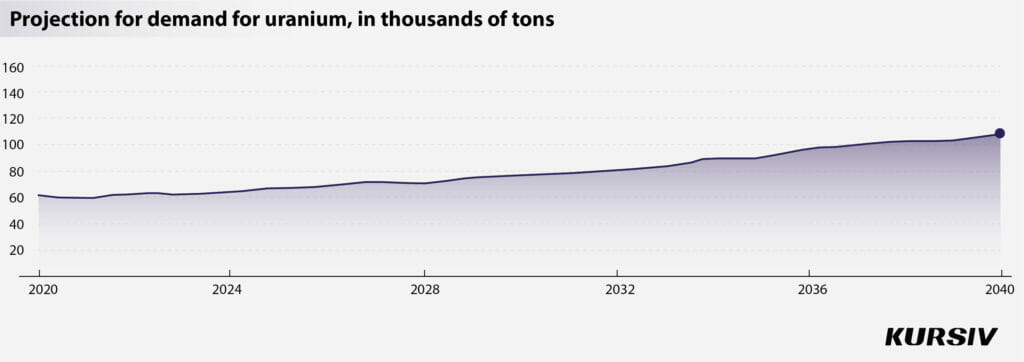

Uzbekistan’s hopes that twofold growth in uranium supply will be fully absorbed by the broader market are justified by the current demand forecasts. For example, Orano believes that the long-term outlook for the uranium market is positive because more and more countries plan to launch their nuclear power plants or increase their capacity to meet carbon neutrality goals. According to the 2020 Red Book of IAEA, global demand for uranium may reach 100,000 tons by 2040 compared to 40,000 today.

The world’s largest uranium producer Kazatomprom agrees. The company’s Senior Commercial Director Askar Batyrbayev says that the market is in balance so far. «Analysis shows that by 2030 the gap between supply and demand will start to emerge. That’s why we can see some deficit of uranium after 2030. And with no expansion in production, this deficit is going to get bigger and bigger,» he said.

Research company UxC also believes that demand for nuclear fuel will be the same until 2025, but then it may grow significantly, which would require additional uranium fields and production sites.