Stock market in Uzbekistan cools down

The long-awaited IPO of UzAuto Motors was rescheduled to February 2023 due to low interest in the company’s stocks. The Kursiv edition took a look at which factors prevented the IPO from happening and reviewed the key trends in the stock market in Uzbekistan in 2022.

When one percent is enough

It was expected that UzAuto’s IPO will open the door for many other public offerings in the country. In August the government of Uzbekistan even published a list of companies that were going to go private. In order to raise the attractiveness of UzAuto Motors, its stock has already been checked by Accounting and Auditing Organization for Islamic Financial Institutions.

Initially, the authorities wanted to offer the market 5% of UzAuto Motors to raise $90 million. However, an underwriter’s assessment of demand by showed that the market won’t be able to buy more than 1% of the stock. This means that the potential amount of the expected IPO is about $17.3-$19.5 million. It was supposed that investors applied before December 22 to make the IPO happen on December 23. Nevertheless, the deadline for accepting applications was rescheduled to December 28 and then to February 15, 2023.

According to Bekhruzbek Ochilov from Freedom Broker, the problem was bad timing. «The IPO was scheduled for the end of December when international investment banks and funds were on holiday. On the other hand, it was almost impossible for local investors to cover the entire amount of the offering. This market is too young and its development needs time,» he said.

When the Republican Stock Exchange Toshkent (RSE) announced the rescheduling of the IPO, some investors withdrew their applications for the stock. As of December 28, they were ready to buy only 8.65% of the 2.7 million shares in the offering (1,200 applications in total). As of January 10, 2023, the number of applications shrunk to 1,160 (6.52% from the whole stock offering).

This move by investors seemed quite reasonable because when an investor sends an application for an IPO, he should deposit some money. He can’t use this money until the end of the IPO, but if withdraws his application, this investor can take his money back and invest it into something else. He always can take part in the IPO later.

Lack of foreign actors

Chairman of the Republican Stock Exchange Toshkent Giorgi Paresishvili believes that the reason the IPO of UzAuto Motors hasn’t happened is adverse conjuncture on the one side and immature infrastructure in Uzbekistan on the other side.

«Many foreigners can buy Uzbek stocks, but many have no trust in the local infrastructure; that’s why they prefer to keep their securities in international depositaries like Clearstream. We started working on the issue last year, but we need more time to make these institutions work properly in Uzbekistan. This is a long process and we won’t see big interest from international investors in the IPO of UzAuto Motor,» Paresishvili noted.

However, that is not all bad, says the stock exchange chairman. The number of transactions and the amount of trading is growing, which gives hope for the successful completion of not only UzAuto Motor’s IPO, but all IPOs scheduled for 2023, he highlighted.

Bahodir Atakhanov, chairman of the National Association of Investment Institutions, isn’t so optimistic. He believes that the current year is going to be a tough year for the stock market. «There are many factors that can affect the market. One of them is the ongoing war between Russia and Ukraine. Many investors chose to leave the developing markets during crises. This is why they were reluctant to invest in our country and similar markets last year,» the expert said.

Different trends

Throughout 2022, there were 80,700 transactions with securities for $423.9 million in the stock market of Uzbekistan. This is a 12% growth in terms of transactions and a fourfold increase in terms of money. However, the key driver of this growth was a set of big transactions, not a development of the market itself. Investors bought big stakes in companies in the negotiated market where buyers and sellers know each other very well. For instance, 98.57% of shares of Ahangarancement were sold this way for $167.8 million. This figure accounts for about 40% of the entire amount of trading. Stakes in Kapitalbank, Garant Bank and other companies were sold the same way as well.

Investor sentiment can be easily seen by stock indexes. The three key indicators – UCI, EqRe Blue and KD – were in the red zone at the end of 2022. The first index, which includes shares of the RSE issuers, declined by 63.85%. EqRe Blue dropped by 23.20%. It includes nine popular stocks. KD (including 11 stocks) lost 4.78%. Given the inflation rate of 12.3% in Uzbekistan, losses for investors were twice as big.

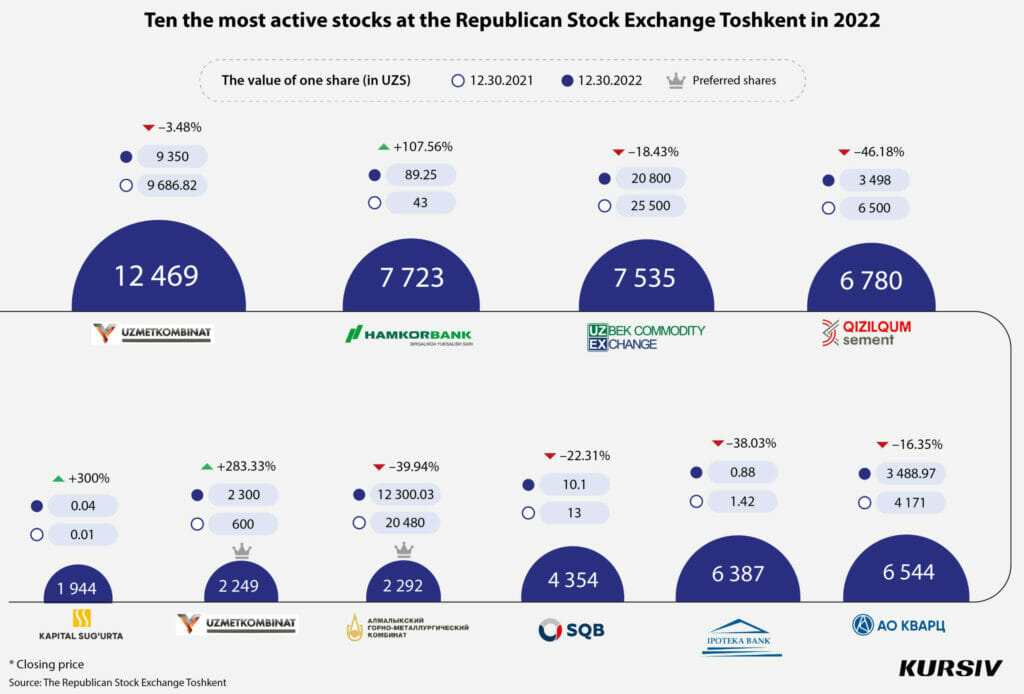

Even though market indexes significantly declined (compared to 2021), some stocks achieved quite good results. For example, the value of Hamkorbank’s shares has doubled.

Trust is needed

According to Bahodir Atakhanov, the story of UzAuto Motors’ IPO proved that the stock market in Uzbekistan isn’t so deep and it won’t be a good idea to expect an influx of foreign investments in 2023.

The alternative source of money is local citizens. But there is a set of factors that prevent people from giving their money to the stock market.

«I would say there are several factors that prevent the stock market from developing. The population and businesses aren’t sure that the government has a crystal clear understanding of what must be done to achieve social and economic reforms because the cabinet often changes its approaches midway. It seems that the authorities have no clear strategy. They do not see through the line and spend public funds inefficiently. Of course, we shouldn’t forget about the COVID-19 pandemic and the following lockdowns that also affected public sentiment. Also, we have such an unstable neighbor as Afghanistan. And now we have a global crisis driven by the war in Eastern Europe. The key participant of the conflict is Russia, which is also the key trading partner of Uzbekistan,» the expert said.

Another important factor is the government’s policy of issuing easy loans to businesses. «This policy causes imbalances between different sectors of the financial market and undermines free competition. Some businesses receive public funds; others have to raise funds on the stock exchange. Of course, they aren’t happy,» Atakhanov noted.

Lack of financial literacy, technological underdevelopment of the stock exchange infrastructure and absence of market makers also prevent the market from achieving bigger goals, the expert said.

The government understands that there are loads of loopholes that must be addressed. In December 2022, the Ministry of Finance started looking for fintech companies that can develop a mobile app for the stock exchange.

This app must include features such as remote identification (including Face ID), the opening of accounts at a distance; the possibility to trade on the stock exchange online and to put and withdraw money from the account. Also, this app should be integrated with some other apps and services.

So far, there are no tools with this functionality in Uzbekistan.