The government of Uzbekistan has reduced the value-added tax (VAT) to 12%. The new rule entered into force on January 1, 2023. The authorities expect that the move will help reduce the shadow economy, stimulate business activity in the country and increase public revenues.

After reducing the VAT to 12%, Uzbekistan put itself in the same row as Kazakhstan and Kyrgyzstan, which adopted the same rate long ago. So far, Tajikistan and Turkmenistan have the highest VAT rate in the region, at 15%.

A gift to the reprocessing industry

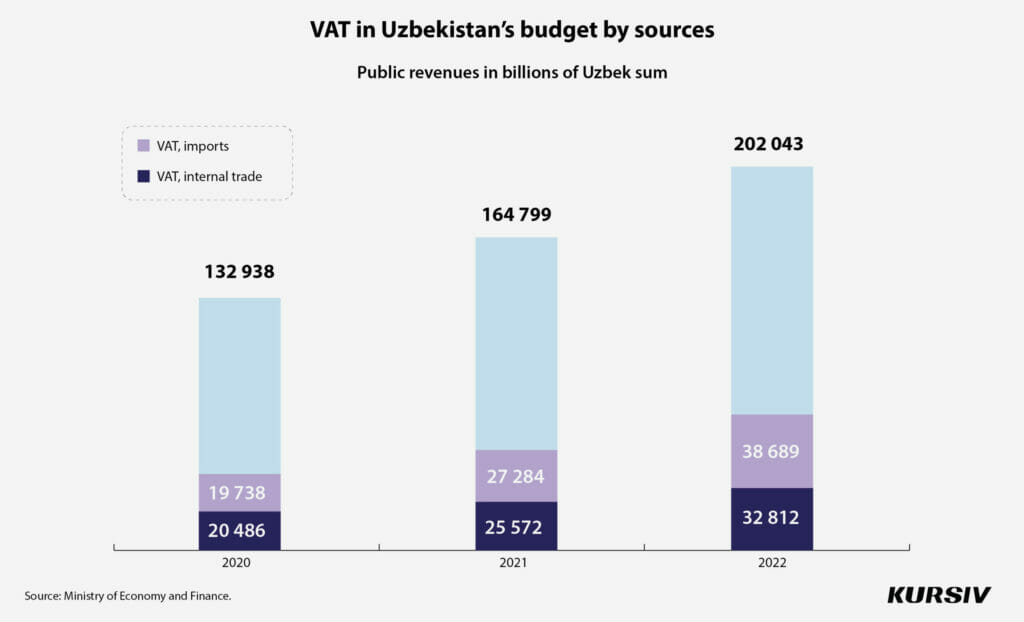

In October 2019, Uzbekistan decreased the VAT rate from 20% to 15%. As a result, the public revenues from VAT payments for domestic goods rose by half from 20.5 trillion sums in 2020 ($2.1 billion) to 32.8 trillion sums in 2022 ($3.0 billion). The VAT from imports increased twofold from 19.7 trillion sums to 38.7 trillion.

Last year, VAT accounted for a third of the state budget. In 2022, the government collected $6.3 billion of revenue thanks to VAT, much higher than the initial plan of $4.7 billion. In 2023, the country’s government expects about $5.6 billion in VAT revenue.

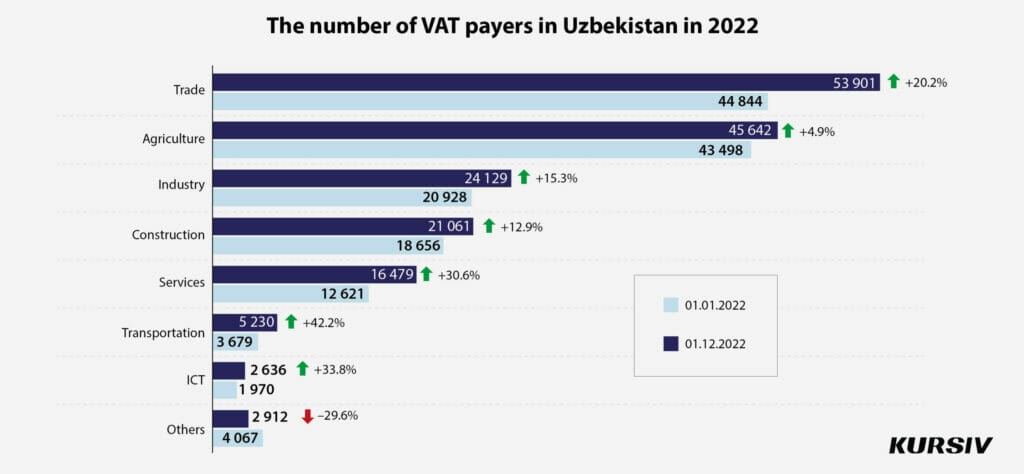

«When the country reduced its tax rates, including VAT, in 2019, it caused a significant expansion in the tax base. The number of companies registered as VAT payers has significantly increased and tax revenue now accounts for 15% instead of the previous 12-13%,» said Eric Levny, regional lead economist, Central Asia at European Bank for Reconstruction and Development.

According to the State Tax Committee of Uzbekistan, the number of VAT payers in the country increased to 171,900 (14.4% ) in 2022. This increase was most prominent in sectors such as trade (+31.3%), agriculture (+26.5%), industry (+14%) and construction (+12.2%).

In 2021, the reprocessing industry reported $788.5 million in VAT payments, the most significant share of public revenues. Construction companies paid $381 million in VAT, trade companies paid $345 million, and agricultural companies paid $124 million.

The less shadow, the more revenue

The state budget may lose about $1.2 billion in revenues because of a lower VAT rate of 12%. The government is going to compensate these losses by withdrawing privileges for geological services (not available starting April 1, 2023) and guarding services by the National Guard of Uzbekistan (from July 1), which is the authorized agency for property protection for businesses and individuals. Also, the government plans to withdraw some preferences associated with VAT.

According to Scott Osheroff from AFC Uzbekistan Fund, reducing the VAT rate won’t have a significant effect on tax revenue. «The reduction of the rate may have a short impact on revenues, but in the long run, it will stimulate demand for goods and services. “This is an example of sacrificing short-term outlook for the sake of long-term prosperity of the country,» the expert said.

«Many small businesses in Uzbekistan are still part of the shadow economy. That’s why reducing VAT and other taxes is good to make them come out of the shadow. The authorities would need to improve work of tax services, for example, to solve the problem with the VAT recovery for law-abiding taxpayers, if they want this process to go faster,» Livny said.

Over the first nine months of 2022, the total amount of VAT recovery reached $1.1 billion, which is a twofold increase compared to 2020. The industry and retail trade are the leaders of this process. They paid back $629 million and $124 million, respectively. Exporters have received $416 million in VAT recovery.

No change in prices

Among several expectations of Uzbekistani authorities, the initiative of the VAT reduction has also been targeting on stimulation of business activity and promotion of a completion. However, prices didn’t change so far, according to a representative of a retail chain.

«It was supposed that lower VAT would lower consumer prices as well. However, many suppliers haven’t cut their prices by 3%. I mean, the reduction of the VAT rate didn’t cause any changes for us. Cost prices didn’t change, nor did retail prices. Probably, in two to three months, the situation will get stable and final consumers finally see the lower financial burden,» a person familiar with the issue told the Kursiv edition.

In December, Deputy Finance Minister Dilshod Sultonov told in an interview with Gazeta.uz that the VAT rate reduction is unlikely to cause lower prices. «Prices might get lower only in those markets with high competition. It is unlikely that companies in markets with less level of competition to give up their extra profit of 3%,» the official said. He also recalled that when the country reduced the VAT rate from 20% to 15% in 2019, the cost of consumer goods didn’t change.