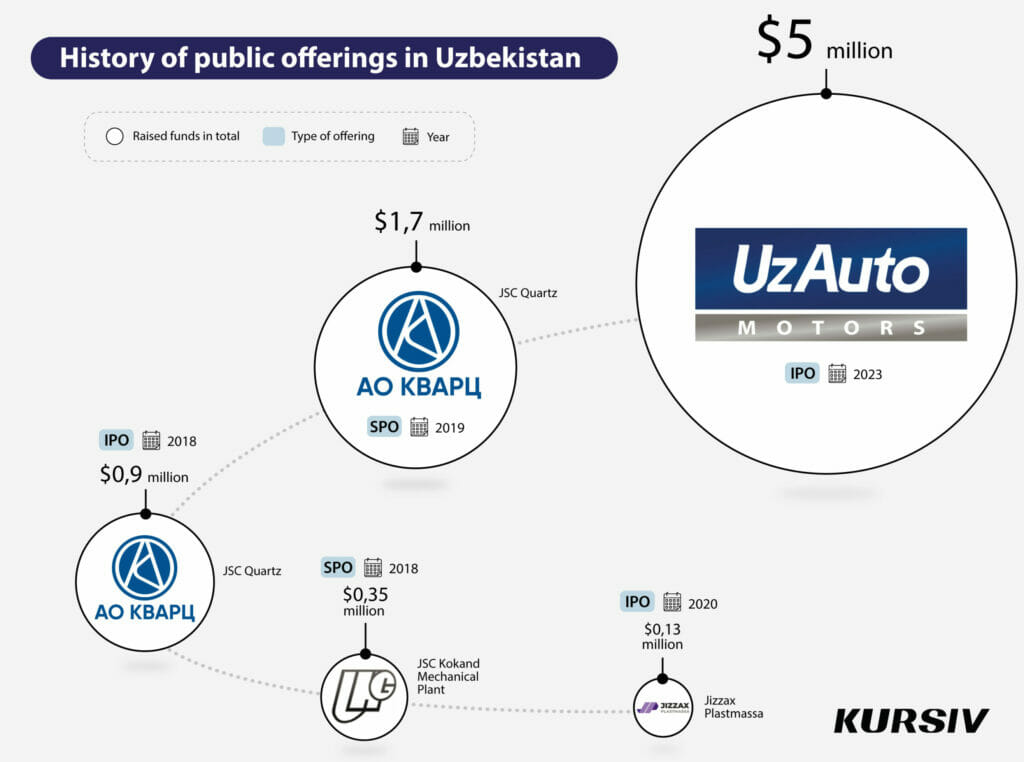

Uzbekistan holds its first IPO in three years. How it was?

UzAuto Motors, Uzbekistan’s automobile giant, hoped to sell at least 5% of its shares during the initial offering. In reality, it managed to sell just 0.29% of its shares. The company raised about $5 million instead of $90 million. Even so, it is still the biggest IPO in the country’s history.

On February 20, 2023, the Tashkent Stock Exchanges included UzAuto Motors stock in its standard trading books. It was presumed that the carmaker would hold an IPO last year, but due to low demand, the company was forced to reschedule the event from December 22, 2022, to December 28, 2022, and then to February 15, 2023. As a result, the IPO process took more than two months.

Stock exchanges as a point of attraction

UzAuto Motors planned to sell 5% of its shares and raise about $90 million. However, the IPO underwriter Freedom Broker came to the conclusion that the local market wasn’t ready to buy more than 1% of the shares.

Given the price range of $6.40–$7.19 per share, the company hoped to raise about $17.3-19.5 million.

On December 28, the company said that it had applications for only 8.65% of shares meant to be sold. Later, investors showed a bit more interest in the IPO and the company sold 29.1% out of the 1% of shares that were expected to be bought. In the end, the company attracted just $5 million, which is threefold less than expected.

«The initial public offering of UzAuto Motors shares is considered a start for the national program of privatization of state-owned entities and a new chapter of the capital market development in our country. No doubt, this IPO will encourage a local community of investors and speed up the integration of our company into the international economic community,» the company stated after the IPO.

Last year, the government of Uzbekistan approved a list of two dozen candidates for privatization. UzAuto Motors was the first. Uzmetkombinat is expected to hold an FPO (Follow on Public Offer), while Uztelecom has already found an underwriter for its IPO.

People have no clue

Along the way to IPO, UzAuto Motors received 1,383 applications, including more than 1,000 applications from individuals. However, institutional investors have acquired about 80% of the shares. Given that retail investors bought 20% of shares ($1 million), each of them spent about $1,000 on average.

«We expected that the demand would exceed the supply because we know that more than three million Uzbekistanis use products made by the company. We thought that most of the shares would be acquired by residents with an average check of $200-500. It was supposed that at least 15,000 individuals would take part in the IPO,» Eugene Mozheiko, executive director of Freedom Broker said.

According to Mozheiko, the market has learned its lesson: even a very well-known brand couldn’t help UzAuto Motors with the IPO. Lack of investment culture and limited access to financial services prevented people from participating in the IPO. They simply didn’t know why they have to buy UzAuto Motors shares and how they can make money with the help of the IPO.

«If we are going to organize new IPOs this fall, we have to launch a massive national awareness campaign now. It is necessary to explain to people what an IPO is, what purpose does it have and what kind of benefits a retail investor can get when he buys shares of big national companies,» he added.

Discount helps

The IPO of UzAuto Motors was announced as a «People’s IPO.» This is why the company’s shares were meant to be sold at a discount. During the preliminary discussion, Freedom Broker suggested a 30% discount, while the issuer wanted the discount to be not more than 15%. As a result, the two sides decided to fix a 20% discount. Mozheiko believes that it was quite a good discount for the local market, especially given that the company said it would allocate at least 30% of its net profit to make dividend payouts.

However, Farrukh Khodzhayev from Kapital-Depozit holds the opposite opinion. He says that those who organized the IPO didn’t take the interests of retail investors into account. «It was the fault of the issuer. The company was overvalued and the recommendations by the underwriter weren’t accepted. Moreover, the company’s reputation isn’t faultless, so the underwriter was forced to put more effort to solve the problem,» Khodzhayev said.

Bekhruzbek Ochilov from Alkes Research agrees. «We need larger discounts in developing markets, larger than the discount offered by UzAuto Motors, especially due to high rates for banking deposits in Uzbekistan (20% and higher),» he said. IPO of KazMunayGas in Kazakhstan also sparked less interest from investors than expected, Ochilov reminded. Another factor was outside of the company’s control. «Foreign investors hardly take part in any offering in Uzbekistan, because we have no correspondent relations with international depositories,» he highlighted.

New expectations

During the UzAuto Motors IPO, the company’s shares were sold at $6.40. On February 20, the shares’ price rose by 8.5% to $6.95 in the secondary market. Later, this price soared to $7.50 and plunged to $6.40 again. However, the volume of trade was extremely small (less than $1,000).

«Unfortunately, UzAuto Motors shares aren’t as popular as we expected. This stock was supposed to be one of the leaders at the exchange, but it hasn’t happened yet. We probably have to wait for a quarterly report or any other news that can spark more interest in the stock and cause its price to grow,» Ochilov said.

UzAuto Motors shares have already been included in the EqRe Blue index. Another index UCI by the Tashkent Stock Exchange reflects the total capitalization of all companies listed on the stock exchange. Initially, the market value of UzAuto Motors shares was pegged to the nominal value of the stock ($0.44). When the exchange started trading with the stock at the IPO price, the index grew by 25% from 393.36 points to 490.48 points, according to Indira Khabibulina, head of the business development department of the stock exchange.

Alkes Research believes that the car maker’s stock has a good potential for growth, given that the company is implementing several investment programs. For example, the company plans to expand its production to 500,000 cars a year. (Last year it produced 307,000 cars.) This means that those investors who prefer to play long games might be interested in the stock.

UzAuto Motors still wants to enter foreign stock markets, but it would depend on the situation in international financial markets. Currently, this is not a good idea, says Mozheiko.