Kazakhstani stock exchanges play major role in the region

What role do Kazakhstani stock exchanges play in the region / Shutterstock

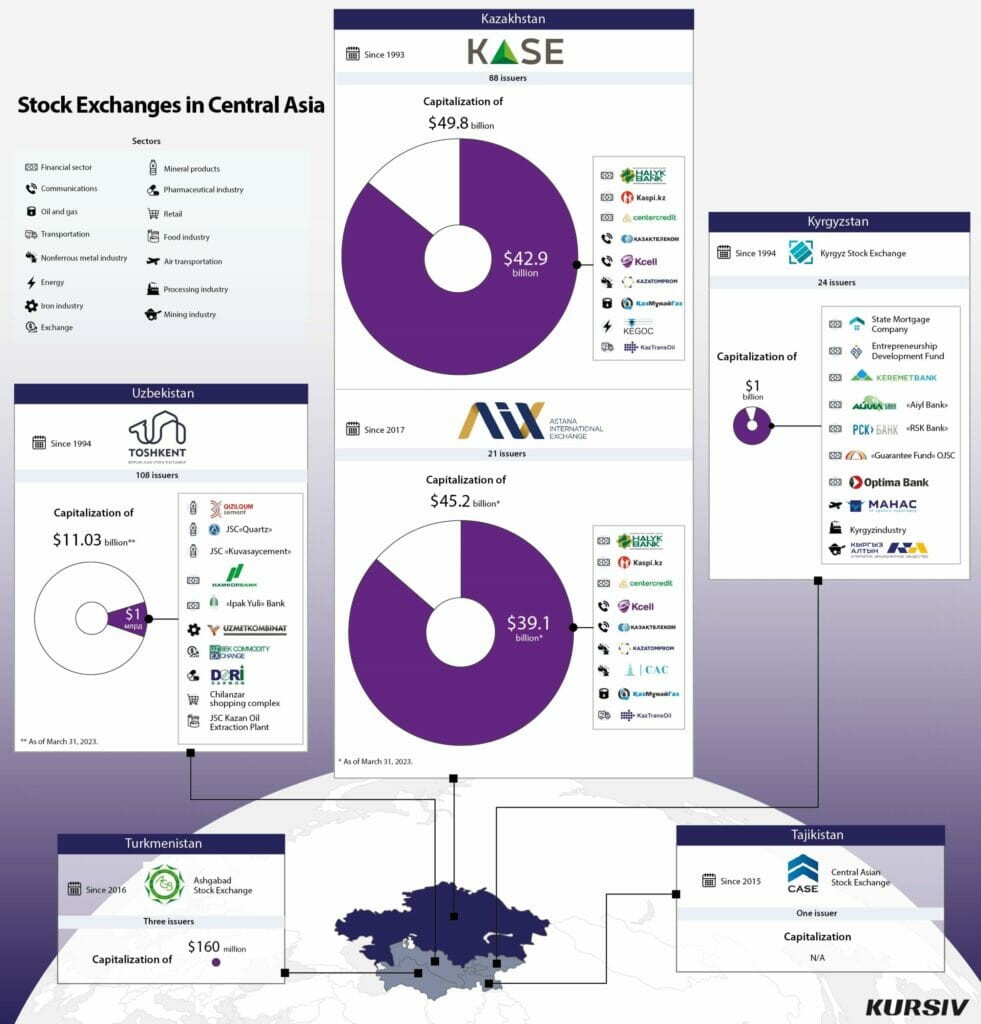

Even though both the Astana International Exchange and Toshkent Stock Exchange have doubled since 2020, KASE is still the biggest stock exchange in the region.

There are six stock exchanges in Central Asia with a total capitalization of more than $100 billion.

Kazakhstan

There are two stock exchanges in Kazakhstan: the Kazakhstan Stock Exchange (KASE) in Almaty and Astana International Exchange (AIX) in Astana. The first one was established in 1993 as an interbank currency exchange. In 1997, the exchange started to trade with stocks and in 2000, it launched the KASE_Share indicator which is currently known as KASE Index. In April 2023, the index reported a 9% increase and reached 3,400 points.

There are stocks by 85 issuers or 99 stocks if both common and privileged stocks are taken into account on the exchange. The total capitalization of stock on KASE is $49.8 billion. The KASE Index is based on nine stocks with a combined cap of $42.9 billion or 86% of the entire stock market. Among the companies in the index are banks, telecommunications companies, the national uranium company, the national oil company, the pipeline operator and the electricity grid operator.

Astana International Exchange or AIX was established in 2017 within the Astana International Financial Center. The key feature of AIX is the English law which the exchange leans on in its daily operations. As of March 31, 2023, the total cap of companies listed on AIX was $45.2 billion. (The companies’ capitalization on all stock exchanges is taken into account.)

Currently, there are 23 stocks by 21 issuers and five global depository receipts on the AIX. The exchange runs AIX Qazaq Index (AIXQI) based on nine key stocks traded on AIX, KASE and LSE. Over the past 12 months, the index grew by 2.1% to 967.64 points.

This list of nine big stocks is almost identical to the index on KASE except for Central Asia Metals, which is presented in the index instead of KECOG. The total cap of all these stocks is $39.1 billion or 86.5% of the entire exchange’s cap.

Uzbekistan

The only stock exchange in Uzbekistan – Republican Stock Exchange Toshkent – was established in April 1994. As of March 31, 2023, there were 112 issuers including 108 share issuers on the exchange. The total cap of all issuers on the Tashkent Stock Exchange is about $11 billion.

The exchange has an index UCI which has been developed to weight stocks by the cap of their issuers. Over the past 12 months, the index dropped twofold to 512.9 points. Since 2021, the exchange has calculated the rating of companies based on several markers such as the number of shareholders, the number of trading days on the exchange and the number of shares available to the public for trading. Among the leaders of the index are Uzbek Commodity Exchange, Ipak Yo’li, Hamkorbank, Dori-Darmon, Chilanzar Trading Center, Uzbek Metallurgical and Kogon Oil Extraction Plant.

Kyrgyzstan

The Kyrgyz Stock Exchange (KSE) was established in 1994 as a nongovernmental organization. In 1995, KSE started trading with stocks. Since 2003, the exchange work has been based on a trading system created by KASE. In 2018, KSE launched its commodity section.

As of April 17, 2023, the market cap of companies on KSE was roughly $1 billion. At the same time, the KSE index, which tracks the fluctuation of the exchange’s cap, reached 2526.85 points. This is a 68% increase over the same period last year. The index is calculated based on the market price of all stocks listed on the exchange.

So far, there are 27 stocks by 24 issuers on KSE. The ten biggest companies account for 94% of the entire exchange’s cap. These ten include banks, microfinance organizations, the state-owned guaranty fund, Kyrgyzindustry, Kyrgyzaltyn mining company and the international airport of Manas.

Tajikistan

The Central Asian Stock Exchange (CASE) was established in April 2015 as a platform for trading with stocks and other securities. GMEX Group, a global market infrastructure vendor from the U.K. is one of the founders of the exchange.

According to CASE, almost all transactions with securities are conducted between commercial banks. Concerning securities themself, these are usually securities by the country’s National Bank or government bills issued by the Ministry of Finance. The first trade on CASE was registered in April 2017 when local Bank Eskhata placed two-year corporate bonds for $2 million. By now, there are still no other participants on the exchange except Eskhata.

Turkmenistan

The Ashgabad Stock Exchange was established in 2016 by Senagat Bank, the state agency Turkmen Standards, the state insurance organization and the insurance company Ätiýaçlandyryş Hyzmatlary.

Currently, there are 8.5 million shares of Senagat, one million shares of Halkbank and 17,300 shares of Rysgal Bank available for trading in Turkmenistan. The total market cap of the companies on the exchange is about $160 million.