And how the “infrastructure for tomorrow” can affect the development of the region in the future.

During the recent 2023 Asian Infrastructure Investment Bank (AIIB) Annual Meeting in Egypt, the Bank announced that it would host its next Annual Meeting in Central Asia. The ninth annual meeting of the Bank will be held in Samarkand, Uzbekistan, in September 2024. Earlier this summer, Kursiv caught up with AIIB Vice President Sir Danny Alexander about the Bank, its mission and priorities, and why Central Asia is a region of importance to the Bank.

By high standards

– The AIIB is the youngest Multilateral Development Bank. Could you briefly describe the bank?

– AIIB is a multilateral development bank that was established in 2016 by a consensus of countries, with Beijing being elected as host country of its headquarters. Therefore, we are still relatively young as an international financial organization. To date, AIIB counts 109 members, including Kazakhstan, Kyrgyzstan, Tajikistan and Uzbekistan.

The bank’s mission is to support the sustainable development of our members by financing green, technology-enabled infrastructure, including through private capital mobilization. At the same time, as an Asian development institution, we promote the development of the Asian continent at large, as well as interregional relations between Asia and our members in Central in South America, Africa, and the Middle East to promote multilateralism.

– What is the value added of AIIB to the domain of development institution and how is it different from its other peer MDBs and does competition for projects pose any challenges to cooperation?

– AIIB is part of the global multilateral development family. Therefore, MDBs do not consider each other as competitors but rather partners. The need for investment in infrastructure is so great that we need to work together, co-finance, align on policies, debarments, ESG standards, ethics, professional standards. To achieve our mutual goal and follow our respective missions, there should be no place for competition. Instead, we need to work together and take care of how to use capital effectively to support development.

At the very conception and establishment stages of AIIB, the governance models, policies, experience and functions of other financial institutions were taken as basis to develop our own. This is, first of all, the high management standards and guarantees of the favorable impact of our projects on the environment and society, promoted by our peers.

But still there are some differences. the unique angle of AIIB and its added value to the domain of international development institutions is our niche focus on infrastructure, hard and digital, by contract to the wider scope of competence of our peers, say the World Bank and EBRD. Likewise, a significant difference is the shareholder composition of our board of directors. Another important difference is that according to our mission statement, we have to have at least 75% of our investments in regional members i.e., Asia, and no more than 25% of our investments in non-regional members.

Infrastructure for tomorrow

– What infrastructure projects do you support?

– We invest in the so-called “infrastructure for tomorrow”, that is, we invest in projects that will be relevant for our members over the next decades. When selecting and implementing each project, we are guided by four thematic priorities. The first one is green infrastructure. We aim to have at least half of our investments in climate finance by 2025, i.e., renewable energy, clean transport and climate change mitigation and adaptation.

Secondly, cross-border connectivity projects that help improve trade or logistics links between our members are prioritized. The third priority is technology-enabled infrastructure. In Asia, there are significant digital divides between and within countries. For instance, AIIB co-financed a satellite launch that took place on June 19th, 2023, in Indonesia.

Finally, the fourth priority is private capital mobilization. We see a big role of our international organization in encouraging and mobilizing private sector investments in public infrastructure. We aim to have at least 50% of the mobilized investments for our project to be from private sector capital by 2030. Therefore, we support business through credit mechanisms including partial credit guarantees, partnerships with banks, on-lending bonds such as Panda bonds, USD/EU bonds and CHF bonds.

-Why does the bank focus on infrastructure as the main development tool?

– High-quality infrastructure is one of the main engines of economic development, improving the living standards of people, as well as solving global problems, including climate change. Infrastructure is key and you can see this by looking at some of the success stories in Asia. Infrastructure investment in South Korea, and especially in China, has been the backbone of the rapid economic development of these countries in recent years.

– Do you primarily invest in government backed projects, or also participate in PPPs?

– We have all. We do government-backed projects, PPPs and private sector-backed projects too. All this is possible.

– Can businesses take part in your projects?

– If you have a project, come and discuss. We are very easy to contact. We are open to discussion. Here in Uzbekistan, I had several meetings with companies investing in the energy sector of the country, with very interesting projects. Therefore, if businesses in the AIIB member countries have any ideas for infrastructural development, they can feel free to contact us.

Strategic importance

– What is the significance of the Central Asian region for the bank?

– Due to its convenient location at the crossroads of Asia, Europe and the Middle East, Central Asia is a strategically important transportation and logistics nexus, the development of each could improve the efficiency and increase the volume of trade and resources fluxes between East and West. In addition, Central Asia’s topography and climate offers a very significant potential for clean energy production and sustainable growth.

Four Central Asian countries are currently members of AIIB. These are, Kazakhstan, Kyrgyzstan, Tajikistan, and Uzbekistan. We have a fast-growing project pipeline in Uzbekistan. To date, we have mobilized over $2bn capital invested in Uzbekistan.

In Uzbekistan, we were very fortunate, as it was upon President Mirziyoyev’s initiatives that a joint declaration for a three-year rolling pipeline of government-backed infrastructure project was developed. This is the first partnership of its kind that AIIB has with a member country that secures a line of projects selected from across the sectors supported by AIIB. Our projects are implemented with the alignment of the member country’s needs and AIIB priorities in such sectors as energy, water, transport, digital technology development and others.

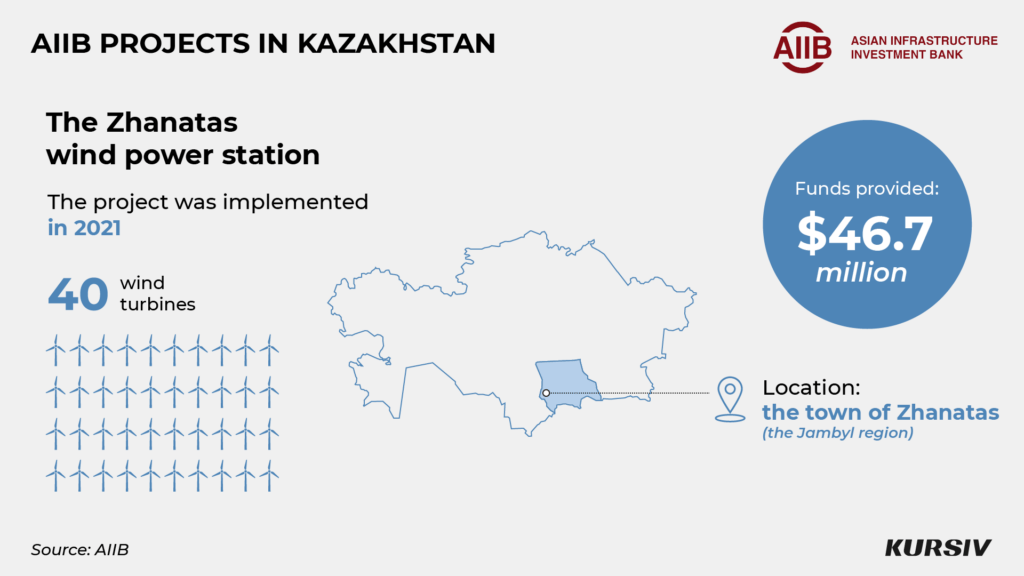

In Kazakhstan, we currently have only one approved project. We do, however, welcome the opportunity for a greater AIIB project footprint in this member country. We are currently exploring more opportunities in the wind and solar energy sectors in Kazakhstan.

What’s next

– What are the bank’s priorities for the region in the future? Do you plan to expand your influence?

– I think for such a young institution as AIIB we already have a strong footprint in Central Asia and we are also active in the Caucasus. In Central Asia, we do plan to expand significantly in the coming years, driven by ambitious plans for sustainable economic development in these countries and a strong partnership with our bank.

In the coming years, we expect the energy demand to grow exponentially with the fast-increasing population and acceleration of industry, which requires greater generation capacity to meet this growing demand especially renewable energy, requires upgrading grids and transmission lines. We also see great potential for the greater population to drive demand in irrigation, sanitation, transportation vehicles, drinking water, housing, roads, land and air carriers, banking system/network, greater economic and trade integration.

We are a client-oriented bank. So if the government of Uzbekistan or Kazakhstan comes to us and says, «These are the priorities that we would like you to focus on,» as long as it is closely aligned with our own strategy, we will identify which of the proposed projects fit our mandate and we accommodate to find solutions and identify the most adequate financial instruments following the ESG and management standards that AIIB promotes.