Consumer confidence in Central Asia, in September: what worries residents of the region most?

Freedom Finance Global continues to conduct research on consumer confidence, inflation and devaluation expectations of residents of four Central Asian countries, including Kazakhstan, Uzbekistan, Kyrgyzstan and Tajikistan. The survey involved 3,600 respondents each from the first two listed countries and 1,600 and 1,200 informants from the latter.

The third month of the study, which is conducted by telephone survey, allows us to significantly complement the macroeconomic picture in the region. The results of the second wave for August were largely confirmed by the results of the third wave in September: changes in indicators in the last summer month were not a random event.

There are also certain trends that may be unique to one country or common to all of Central Asia. For example, one food product, flour, turned out to be a common problem for the vast majority of residents of the region. At the same time, inflation is once again becoming a hot topic in some countries.

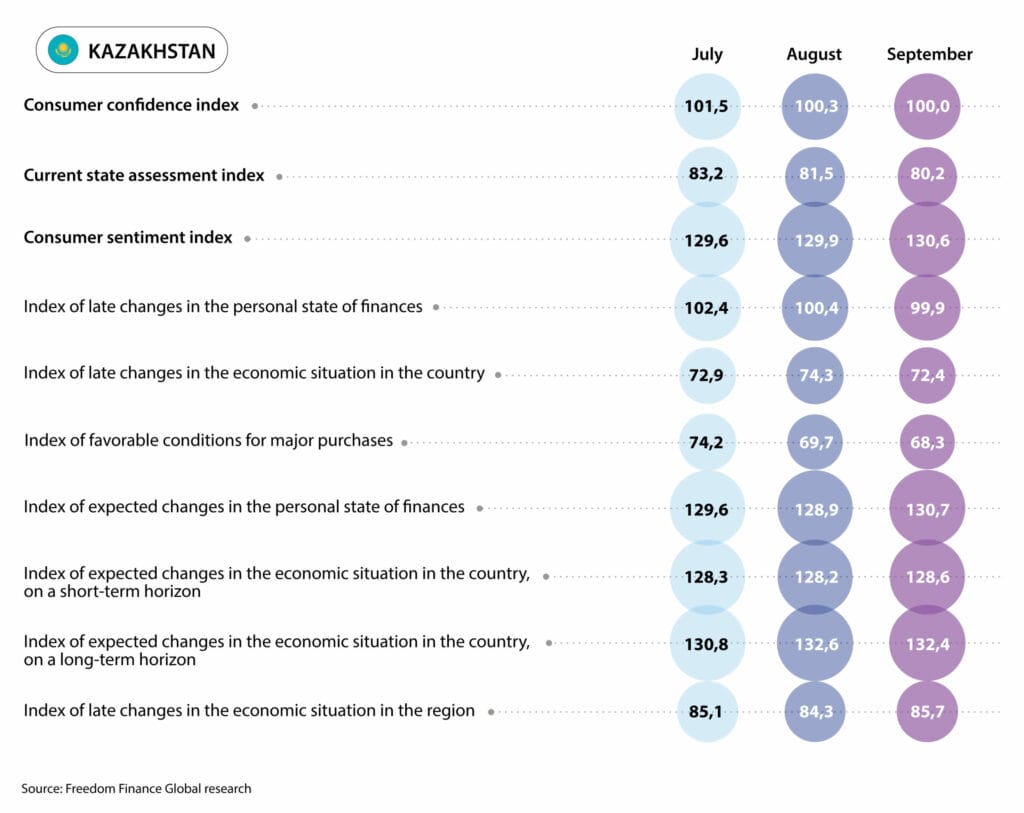

Kazakhstan

The consumer confidence index of Kazakhstanis in September amounted to exactly 100 points and continued to slowly decline. This situation has been observed for the second month in a row. This indicator indicates the neutral position of Kazakhstanis on issues of changes and forecasts of personal financial situation and the economy.

Are the oil regions the most prosperous?

The main factors behind the decline in the index were issues related to changes in the economic situation over the past year and the favorable conditions for making large purchases. Subindices for these issues decreased by 1.8 and 1.4 points, respectively. If in August 18.2% of Kazakhstanis believed that the country’s economy had improved to some extent, then in September the share fell to 16.4%. In general, the trend continues that Kazakh-speaking respondents turned out to be more optimistic than Russian-speaking ones. It is also clearly visible that the older the respondent, the lower the proportion of positive answers it has. For example, if 22% of young people chose positive answer options, then only 12% of people over 60 years old chose the same options. The most pessimistic region was the Pavlodar region, where the index of changes in the economic situation was 61.9 points, and the leaders were the Atyrau region, the Zhetysu region and the Mangistau region, scoring 86.6–90.1 points.

Regarding favorableness of current conditions for making large purchases, 62.5% of Kazakhstanis gave a negative answer, while only 29.4% of respondents disagreed with this. In August, slightly fewer people in the country answered this question negatively (61.4%). In this case, the difference in language proficiency did not have a significant impact on the result, but the age of the Kazakhstanis, on the contrary, affected the average. 43% of young people note favorable conditions for making large purchases, while in the oldest age group only 20% of informants came to this decision. Among the regions, the leaders are again the aforementioned three regions, including the Atyrau region, the Zhetysu region and the Mangistau region. Last on the list was the East Kazakhstan region, where only 21% of respondents noted favorable conditions for large purchases.

Despite the decline in the two above-mentioned subindices, the decline was somewhat offset by increased expectations of changes in personal financial situation. 49.4% of Kazakhstanis somehow expect their financial situation to improve during the year (47.7% in August). Kazakh-speaking respondents turned out to be much more optimistic: 62% expect improvement, while only 46% of Russian-speaking respondents had a similar opinion. And here, too, deterioration in results can be seen along with the increase in the age of respondents. The leader was Shymkent, where 60% of people expect an improvement in their personal financial situation, and the last place was again taken by the East Kazakhstan region, where the same figure was only 34%.

Inflation expectations have risen sharply

Inflation expectations of Kazakhstanis rose sharply in September, as expected in the previous material for August. The share of those expecting acceleration in price growth increased from 20.7 to 26% within a month, and from 21.9 to 26.3% within 12 months. These figures were the highest over many months of observation. In the case of monthly-ahead expectations, the figure is the highest since December 2022, and in the case of year-ahead expectations, the highest since at least November 2022. Although a study by the National Bank of the Republic of Kazakhstan in September, on the contrary, showed a decrease in inflation expectations.

Estimates of actual inflation turned out to be in different directions: the opinion regarding price growth increased over the past month, and decreased slightly over the year. 53.9% of Kazakhstanis (48.6% in August) noticed strong increase in prices in September. But over the course of one year, the share of these fell from 63.1 to 62.6%. Most likely, inflation expectations responded to the growth of USD in September by 4.4%. In addition, expectations for the growth of the exchange rate itself have increased: 56.4% of Kazakhstanis expect USD to strengthen against KZT in a year (54.7% in August), and 38.5% (34% in August) in a month. These figures broke records for the entire period of the study.

Prices for bread, flour and meat worry the population the most

Among individual goods and services, Kazakhstanis are most concerned about rising prices for bread and bakery products, flour, meat and poultry, milk and dairy products. Across all of these categories, between 32.5 and 35.2% of respondents saw strong price increases in September. More often, Kazakhstanis began to worry about the increase in the cost of bread and bakery products: their share over the month increased from 27.8 to 35.2%. For the second month in a row, the share of those worried about the rise in gasoline prices continues to decline (to 10.6%), as well as the share of those who are concerned about the cost of housing and communal services, from 12.8 to 11.8%. Fewer and fewer residents of the country are worried about rising prices for the last two items, despite the social significance and price increases in the summer.

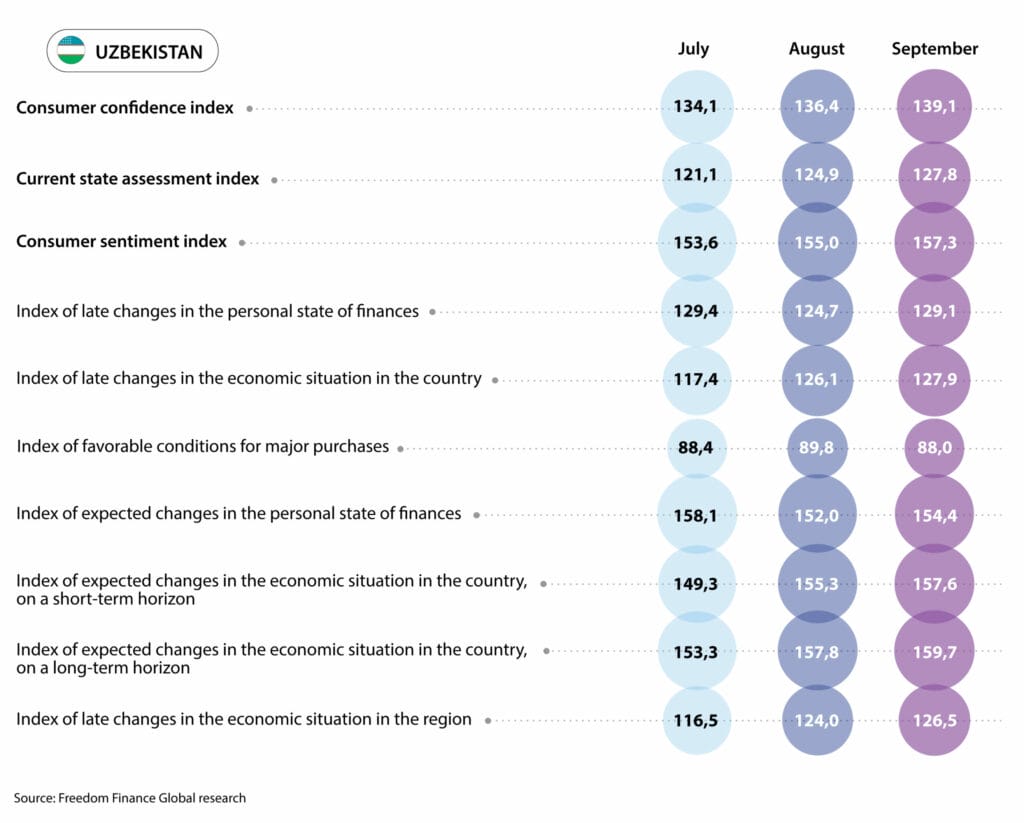

Uzbekistan

The consumer confidence index of Uzbek citizens continued to grow in September and amounted to 139.1 points, thereby indicating continued increase in positivity among the population. All subindex components showed growth, except for the favorable conditions for making large purchases – this indicator decreased from 89.8 to 88 points.

The personal situation of residents is improving

The largest increase can be seen in assessment of changes in the personal financial situation, which increased by 4.4 points. If in August the share of those who noted improvement in this component was 54.7%, then in September the figure increased to 57.5%. As in the case of Kazakhstan, Russian-speaking respondents also most often showed more pessimistic results. However, you need to understand that in Kazakhstan the share of Russian-speaking respondents is several times higher than in other countries in the region, where native speakers of the national language almost entirely predominate, and therefore this factor plays virtually no role in the analysis.

Young people also turned out to be more optimistic: 66% of their representatives indicate an improvement in their personal financial situation, while among the older generation this was only 47%. The assessment of financial situation increased most strongly in the Andijan and Bukhara regions, where this factor was noted by 65% of respondents. The region where people see the least improvement is the Syrdarya region: the share of such informants there is 47%. Additionally, we note that the survey results correlate well with the income level of the population. Among the richest, 81% note an improvement in their personal financial situation over the past year, while among the poorest only 25% report this.

Also, two subindices increased by 2.4 points: expectations for personal financial situation and the economic situation in the country within 12 months. If, as noted above, more than 57.5% of respondents indicate an actual improvement in their financial situation, then the majority is optimistic about the future. 70.9% of Uzbek citizens expect an improvement in their material well-being, which is slightly higher than the result of 70% in August.

The difference in the age of the respondents continues to play a role. However, the difference in results between young people and the older generation is much smaller than it was in assessing the actual change in the personal financial situation. 78% of young people expect improvement, and among the oldest, this figure is 62%.

Regionally, the differences in results among regions have also decreased significantly. The leaders were the Fergana region and the Andijan region, where 76% of people expect improvement in their financial situation within a year. The lowest results were shown by respondents from the Republic of Karakalpakstan, where the share of optimists was 65%.

Less pessimism in assessing economic prospects

Regarding expectations of the economic situation in a year, the share of positive responses in September changed slightly, from 66.6 to 67%. However, the percentage of negative responses has noticeably decreased, from 7.5 to 6.2%. The inverse correlation of answers by age is interesting: the older a person is, the more positive a forecast he gives regarding the economic situation. Among young people, the share was 65%, and among the older generation – 70. The first on the list is again the Fergana region, where 73% of people expect the country’s economy to improve. Tashkent took last place, where the share of people who have the same opinion is 61%. It is worth emphasizing that in terms of personal income, the difference in answers also did not turn out to be too high. Among the richest respondents, 76% were optimists, and among the poorest, 63%.

Inflation is getting worse

Uzbek inflation estimates rose sharply in September. If in August 25.4% of respondents noted a very strong increase in prices, then in September the share increased to 40.1%. Monthly inflation was 1.24%, the highest this year, while annual inflation accelerated to 9.2%. The survey, conducted by Freedom Finance Global, also shows that Uzbeks have noticed a sharp rise in flour prices. This turned out to be 59.4%, which is the highest result among all goods and services. Official statistics show an increase in the cost of flour by 15.7% in one month amid the suspension of supplies from Kazakhstan. Prices for eggs (+7.8% m/m) and a number of vegetables and fruits also increased significantly. These goods took 6th and 7th places, respectively, in the survey of the most expensive goods.

Inflation is felt most strongly in the Tashkent region, where 49.7% of people note a very strong increase in prices over the month. The population’s estimates of price growth over the past year have also increased. Now more than half (50.6%) of respondents have noticed their faster growth. Although in August the share of such people was only 42.7%.

At the same time, inflation expectations remained virtually unchanged. That is, in fact, rising prices and higher inflation estimates did not have a significant impact on expectations. Only 18.7% of the country’s residents expect a very strong rise in prices during the month, although in August the same figure was 17.2%. At the same time, even the share of those who expect prices to fall increased – from 6.2 to 7.8%. Expectations for faster price growth over the next 12 months continue to decline, with the share of pessimists falling from 29.2% in August to 27.7. Most of these people were in the Dzhizak region – 35.6%. Let us note a sharp decrease in expectations for an increase in prices in the Navoi region – from 40.4 to 26.8%.

Devaluation expectations are consistently high

In September, devaluation expectations of Uzbek citizens increased slightly. Let us recall that in August they fell sharply, largely due to an increase in the share of those who found it difficult to answer against the backdrop of a sharp increase in the dollar exchange rate by 4% in August. In September, the exchange rate increased slightly – only by 0.6%, but the share of those who found it difficult to answer rose from 23.4 to 24.6% with a one-year horizon and from 25.8 to 29% with a monthly horizon. The share of those who expect the sum to weaken has also increased. Within a year, 63.3% of the population expects weakening, and within a month – 49.1%.

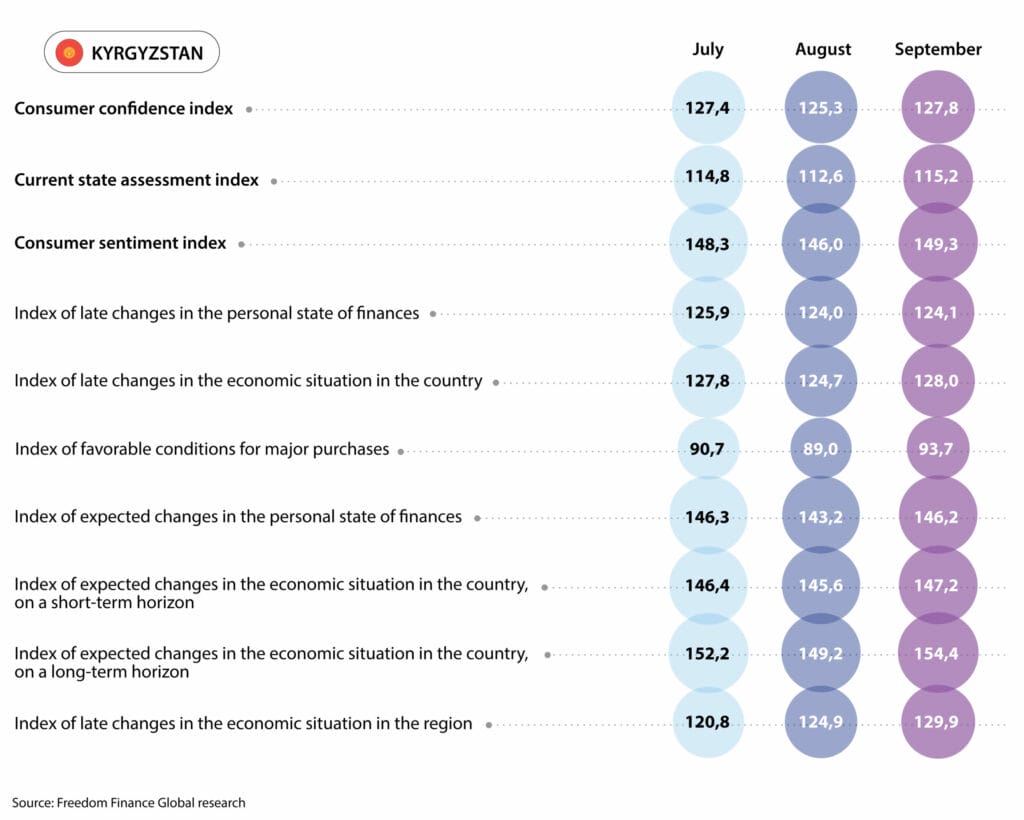

Kyrgyzstan

In Kyrgyzstan, the consumer confidence index in September amounted to 127.8 points, increasing by 2.5 points compared to August. All five subindices in Kyrgyzstan showed growth, but the most noticeable increase was demonstrated by the assessment of the favorable conditions for making large purchases. The August decline in the CCI index (consumer confidence index) was fully recouped, and the September indicator was slightly higher than the July indicator, amounting to 127.4 points.

Conditions for making large purchases have improved markedly

38% of Kyrgyzstanis considered the time to be more favorable for large purchases, while in August 33.8% thought the same. In September, the share of those who gave the opposite answer decreased – from 44.7 to 43.9%. Just as in the case of the entire Central Asian region, Russian-speaking residents turned out to be more pessimistic, however, their share in Kyrgyzstan is also small – 16.6%, so this factor does not play a significant role.

It is worth noting greater pessimism along with an increase in the age of respondents, which is also a general trend for the entire region. Among young people, 43% of people thought that the conditions for major acquisitions were positive, while among the older generation only 30% of people were like that. It is also noteworthy that in the case of Kyrgyzstan, a more noticeable difference is visible between the results of the rural and urban population. In general, villagers turned out to be much more optimistic on a number of issues. The difference in the composite CCI index between urban and rural residents was 10.8 points, although in Uzbekistan this figure is 4.5 points, in Kazakhstan – 3.7 points, in Tajikistan – 4.7 points.

The leader of the survey by a wide margin was the Naryn region: 48% of people gave a positive answer, while in Bishkek, which ranks last, only 28% of the population agreed with them. People’s incomes also showed the expected distribution without any particular surprises: 58% of the richest residents indicated favorable conditions for making large purchases; among the poorest, 19% did.

A fairly positive change was shown by the assessment of the economic situation, the index of which increased by 3.3 points compared to August. 54.4% of Kyrgyzstanis believe that the country’s economy has somehow shown improvement, although in August this figure was 53.9%. The share of pessimists decreased more noticeably – from 19.4 to 18.2%.

While the survey did not reveal the above-mentioned correlation by age, the rural population assesses changes in the economy noticeably better. 57% of rural residents versus 49% of urban residents gave a positive answer. The Naryn region again became the first, although with a small gap from the Batken region. In the Naryn region, 70% of residents gave a positive answer, while in the Chui region, which took last place, the share of positive answers was only 40%.

Inflation estimates are going down, but expectations are going up

Inflation estimates of Kyrgyzstanis have noticeably decreased compared to the indicators of July and August. If in August 39.1% of residents believed that prices had increased significantly over the past month, now this number is 36.9%. It’s a similar story with strong price increases over the past year: in September, 60.6% of people felt prices rose faster than before (in August there were 62.7%). Inflation expectations, on the contrary, have increased slightly and continue to do so for the second month in a row. During the month, 11.6% of residents expect a very strong rise in prices (versus 10.3% in August), and over a one-year horizon, the share of such people in September increased from 12.9 to 14.7%. Officially, inflation in September increased from 9.5 to 9.6% in annual terms.

Kyrgyzstanis, just like Kazakhstanis and Uzbekistanis, are very concerned about the increased price of flour. 72.8% of respondents noted that the cost of flour has increased significantly. Also, the leaders continue to be vegetable oil (49.7%), vegetables and fruits (40.9%), sugar and salt (39.2%). Although official statistics do not particularly confirm the rise in flour prices, several reports about this can be seen in the media. There has been a sharp increase in the price of imported flour from Kazakhstan, but, according to statistics, the average price remains at approximately 63 soms per kilogram of a premium product.

Devaluation expectations suddenly rise

The Kyrgyz som showed a slight weakening of 0.5% in September, but this did not prevent devaluation sentiment in the country from significantly increasing. If in August 28.8% of residents expected the som to weaken in a year, then in September this figure was already 31.2%. Also, regarding the growth of the dollar a month later, the increase in the share of people with this opinion turned out to be even more noticeable – from 17.6 to 21.3%. It is in the Naryn region that the largest share of those expecting a weakening of the som in a year is observed, despite the most positive assessments of the state of the economy and the favorable conditions for making large purchases.

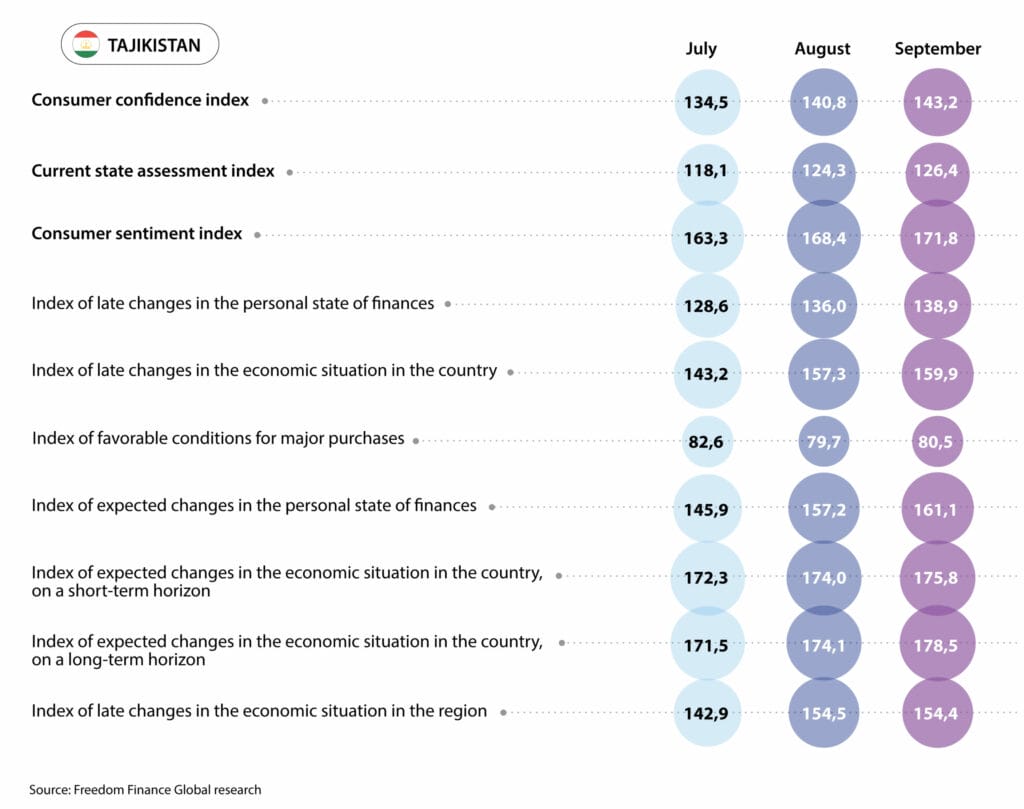

Tajikistan

The consumer confidence index in Tajikistan amounted to 143.2 points in September, which is again the highest value among the four Central Asian countries under consideration. Over the month, the index increased by 2.4 points, and all 5 subindices showed growth. The two components related to changes in personal financial situation during the year increased the most: «Forecast» and «Evaluation».

Personal financial situation is improving

The expectations of residents of Tajikistan regarding changes in their personal financial situation have noticeably improved in a year. If in August 71.2% of residents gave a positive answer, then in September their share increased to 75.7%. Unlike other countries in the region, the older generation in Tajikistan did not turn out to be more pessimistic. The share of positive answers in the oldest category was 73.1%, which is also identical to the share of the age group 30 years – 44 years. Nevertheless, the youngest showed the greatest optimism here: 79.6% of young people expect an improvement in their personal financial situation within a year.

Among the regions, the palm with a slight difference is shared by the Gorno-Badakhshan Autonomous Region and the Sughd Region, which received 84.2 and 83.8% of positive responses. The other three regions lagged behind, but not as significantly, gaining 69.4–73.9%. Income differences also showed the expected results, as in all other Central Asian countries.

Estimates of changes in personal financial situation over the past year have also increased noticeably, but to a slightly lesser extent than forecasts. In September, the share of those whose situation improved was 58.1% versus 55.7% in August. This time, the older generation noticeably lagged behind the youth: 48.7% of positive responses versus 67.2. Among the regions, the Gorno-Badakhshan Autonomous Region was again first with a result of 65.6%, while Dushanbe again became the last, although the share of positive responses exceeded 50% and amounted to 53.8%.

We also note the increased assessments of changes in the economic situation in Tajikistan. This subindex increased by 2.6 points in September and is at the highest value for all three months of observation. The share of those who believe that the economy has somehow improved over the past year increased from 72% in August to 74.8% in September. The best result was shown by young people at 81.2%, but the older generation was not too far behind, scoring the republican average of 74.8%. The most positive region was the Khatlon region, where 77.7% of people chose positive answers, and the Gorno-Badakhshan Autonomous Region, on the contrary, was an outsider with a result of 68.6%.

Inflation becomes a hot topic

Inflation estimates and expectations among the population of Tajikistan rose sharply in September and have been growing for at least the second month in a row. If in August 15.5% of residents expected a very strong rise in prices next month, then in September the share of such people increased to 20.8%. Expectations for a strong increase in prices during the year increased slightly – from 19.3 to 21.2%. The estimate of actual inflation has increased much more significantly. In September, 52.3% of the population felt a strong increase in prices over the past month, although in August the share of such people was 34.9%. The situation is similar with growth estimates over the past 12 months. In August, 37.4% of the country’s residents noted a faster rise in prices than before, but in September they were already 50.3%.

There are no inflation data for September yet, but the previous article also raised the issue of a sharp increase in population inflation estimates. Thus, in August, annual inflation increased to 4.2% (from 2.3% in July). Most likely, the price increase continued in September. And again, flour stands out here, the rise in prices for which also affected the mood of the residents of Tajikistan. 73% of the population noted that the increase in prices for this product was the most noticeable among all basic goods and services. The share of vegetable oil has also increased significantly. This was noted by 51.4% of respondents, although in August this figure was 35%.

Stable exchange rate – low expectations of weakening

Devaluation expectations in Tajikistan are much more stable and positive than in other Central Asian countries. This is not surprising, given that the dollar to somoni exchange rate has remained virtually unchanged over the past seven months. The share of those who expect the national currency to weaken within a month increased slightly from 20.6 to 20.8%, and 26.4% of the country’s population expects weakening within one year (29.6% in August).

Results of the study for September

In September, all Central Asian countries except Kazakhstan showed an improvement in consumer confidence. Kyrgyzstan fully recovered the fall in August, exceeding the first July figure by several fractions of a point. Tajikistan continues to show optimism, updating a new record for the CCI index among all countries. Uzbekistan is also trying to keep up with its southern neighbor and continues to demonstrate growth in consumer confidence. Kazakhstan stands out somewhat from this group, but the decline here turned out to be insignificant – only 0.3 points, which is well within the statistical error.

The growth of the index in Uzbekistan and Tajikistan correlates primarily with the growth of positivity in the matter of personal financial situation. Residents of these countries note an improvement in their situation and expect it to improve over the next 12 months. The population also has a positive assessment of the current state and prospects of the economies of their countries. But the favorable conditions for making large purchases continue to remain in the negative zone in all four countries. Nevertheless, Kyrgyzstan has emerged as a leader specifically on this issue. Over the past month, there has been a noticeable increase in the number of residents of the country who believe that they can now afford to make large purchases. At the same time, neighbors only in Tajikistan have seen an increase in positivity in this matter, and even then the degree of growth is scanty. In Kazakhstan and Uzbekistan, on the contrary, there is a decrease in favorable conditions for large acquisitions.

It is very interesting to note that inflation expectations have increased slightly in Tajikistan, Kazakhstan and Kyrgyzstan. In Kazakhstan, the growth is more significant than in Kyrgyzstan and Tajikistan, most likely due to the rising dollar exchange rate and expectations of a weakening tenge. We also highlight the sharp increase in inflation estimates in Tajikistan, where inflation accelerated noticeably in August. Due to the lack of data, it is not yet clear what inflation turned out to be in September, but it can be assumed that prices continued to rise in September. The same situation with the assessment of inflation can be seen in Uzbekistan and partially in Kazakhstan. The most pressing and pressing topic for the entire region was flour, the prices of which jumped sharply in Uzbekistan, Tajikistan and Kyrgyzstan amid restrictions on exports from Kazakhstan. Almost 7 out of 10 respondents noticed a strong increase in prices for this product, while in Kazakhstan the figure is slightly lower: only three out of 10 note this.

Expectations for a weakening of the national currency have grown in Kazakhstan, Kyrgyzstan and, to a slightly lesser extent, in Uzbekistan. In Tajikistan, everything remains unchanged against the backdrop of a stable dollar/somoni exchange rate. In Kazakhstan, expectations for dollar growth reached multi-month records during the study. In Uzbekistan and Kyrgyzstan, devaluation expectations are rising despite a relatively more stable exchange rate in September. It should be noted that in Uzbekistan, although the growth rate was lower, the vast majority of the population expects the soum to weaken throughout the year.

The third wave of the study in September on consumer confidence of residents of four Central Asian countries largely confirmed the results of the second wave in August. One can cautiously conclude that there are certain trends in some countries that are explained by fundamental features, official statistics, media reports and movements in national currency quotes. There is also some economic connection of the same product in the entire region. If last time rice was noted, then this time such a product turned out to be flour. This clearer and more complete picture could be useful to all major economic agents in the Central Asian region.