Why it would be a good idea to accelerate the tempo of the base rate lowering process

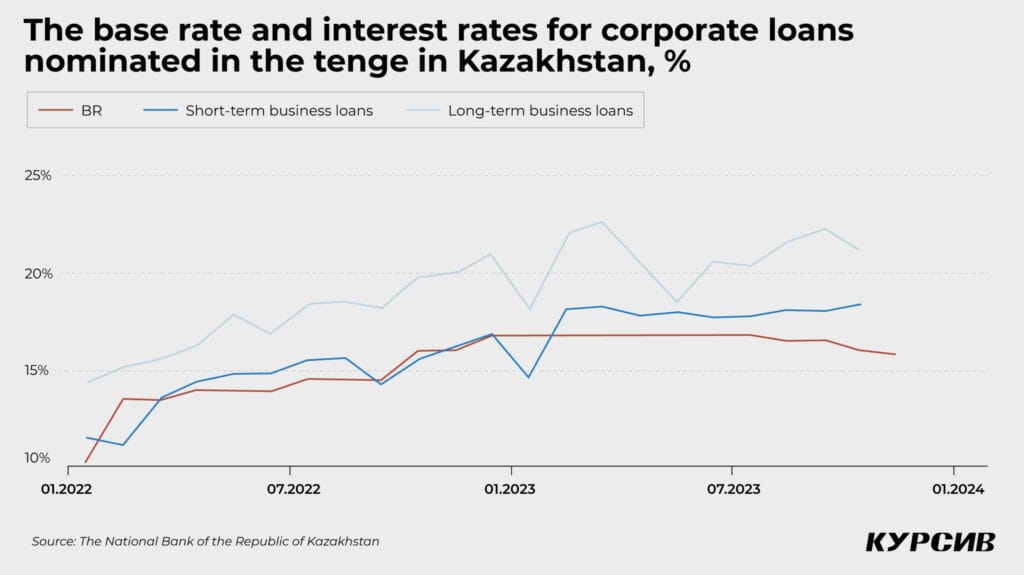

The National Bank of Kazakhstan has lowered the base rate from 16.00% to 15.75%. According to the regulator, the third consecutive lowering of the rate followed favorable domestic conditions and a decline in external inflationary pressure. At the same time, National Bank data shows that the long-lasting period of tough monetary policy has nearly killed the credit activity of certain types of businesses.

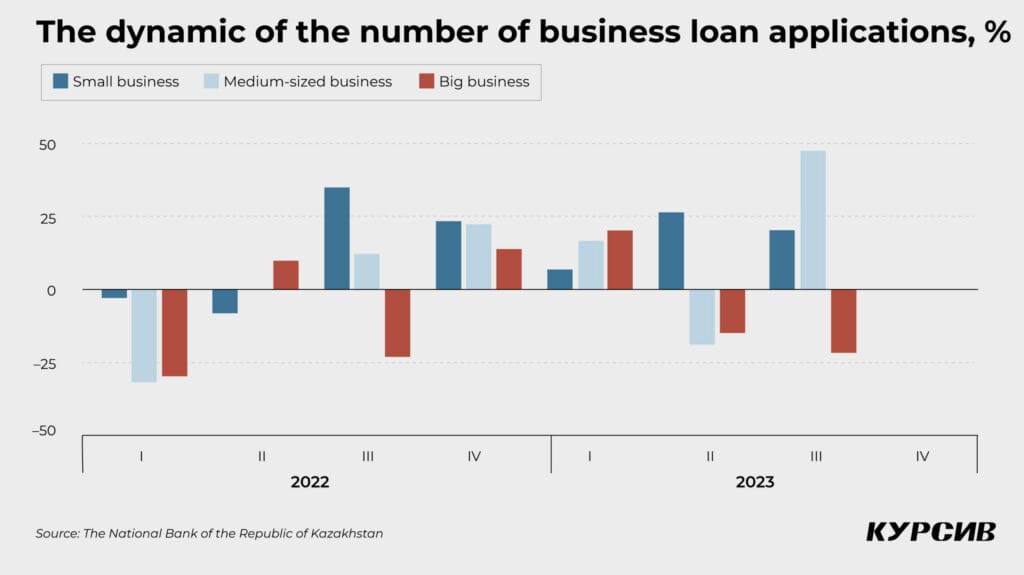

Several days before the official announcement of the decision on the base rate, the National Bank published a survey on banking lending for the third quarter of 2023. According to the survey, only small and medium-sized businesses demonstrate growing interest in loans. However, the survey’s authors admitted that the interest in lending within this sector has grown not because of monetary policy but due to the development of online lending and expectations that banks will join public soft loan programs.

The situation is more complex around big businesses that are involved in more capital-intensive projects and remain the backbone of the country’s economy. The number of loan applications from big companies declined by 22% in Q3 of 2023 compared to Q2 when the rate dropped by 15%. Credit activity among big businesses has declined over the two quarters in a row. This happened for the first time with the corporate sector in the post-pandemic period.

The only reason this has happened is the tight monetary policy. «The vast majority of banks reported that big businesses aren’t eager to raise funds under the current terms and expect that the cost of borrowed resources will decrease in the short term. They want to obtain funding for long-term projects under better conditions. On the other hand, banks reported that few big companies demonstrate an interest in loans once again, which has caused an increase in the size of average loan applications,» the survey said. Banks hope that this demand from big businesses won’t fall again and in Q4 the lending will rebound against the backdrop of softening of lending terms.

Another survey of enterprises by the National Bank shows that interest rates for funds raised in the third quarter were two to three times higher than rates that companies consider reasonable. So, why do companies continue to take loans in this situation? If the factor of government subsidies is excluded, it would be safe to say that this money isn’t for all: like banks, enterprises also hope that interest rates will be lower one day.

In support of its November decision on lowering the base rate, the National Bank said that it was driven by the current slowing of annual inflation (10.8% in October and 11.8% in September) and retuning of monthly inflation to historical averages (0.7% in October), slowing of the FAO Food Price Index and positive external conditions like slowing of inflation in the EU and deflation in China.

It’s worth noting that all these arguments the regulator already made in August and October when it explained the lowering of the rate by 25 and 50 points, respectively. At the same time, inflation year-on-year has been slowing since March, the FAO Index has declined since spring 2022, China has been balancing at the edge of deflation since the beginning of the year, while inflation expectations in Kazakhstan have been moderately high for the entire period of observation. The regulator has never cited data on changes in the number of loan applications when trying to explain its approach toward the base rate.

On the one hand, the lowering of the base rate by 25 basis points, which is more symbolic than practical, is another step toward more active corporate lending. Three weeks ago, the regulator’s rhetoric was tougher than today and it seemed that it wouldn’t get softer even if the credit activity of businesses worsened. On the other hand, such a tiny softening of monetary policy may not be enough to revive bank lending for businesses. The overall monetary policy vector is indeed changing in Kazakhstan, but this process is just very slow.