As Halyk Bank told Kursiv, it still wants to sell its Kyrgyzstani subsidiary to the Visor group. Both sides have been waiting for approval from the Kyrgyz regulator for three months now. In 2019, Aidan Karibzhanov, the majority shareholder of Visor, commented on assets in the neighboring country: «We still occupy too much room there. Expansion of existing projects is possible but not the launch of new ones.» Why has this «expansionist» policy changed now?

«People’s» business

On November 10, 2023, Halyk Bank (Halyk means «the people» in Kazakh) announced that a consortium of buyers from the Visor International DMCC investment group agreed to purchase Halyk Bank Kyrgyzstan. However, the Kyrgyz regulator hasn’t made any decision on the deal yet.

«In response to your request, Halyk Bank Kazakhstan confirms that the arrangement on sale of 100% shares of Halyk Bank Kyrgyzstan to a consortium of buyers from the Visor International DMCC investment group is still valid,» Halyk Bank told Kursiv.

As Chair of Halyk Bank Umut Shayakhmetova explained to Kapital.kz there is only one reason for the Kyrgyz subsidiary being sold: «The only motives of ours are business reasons. I mean, this is a business decision.» She also said that Halyk Bank is currently focused on more promising business lines such as non-banking products and expansion of the business in Uzbekistan and Georgia.

Given that in 2022, Halyk Bank, controlled by billionaires Timur Kulibayev and Dinara Kulibayeva, sold its subsidiaries in Tajikistan and Russia, the idea of leaving Kyrgyzstan doesn’t look unusual or strange. However, nobody expected that Visor would have an intention to acquire a bank in the neighboring country.

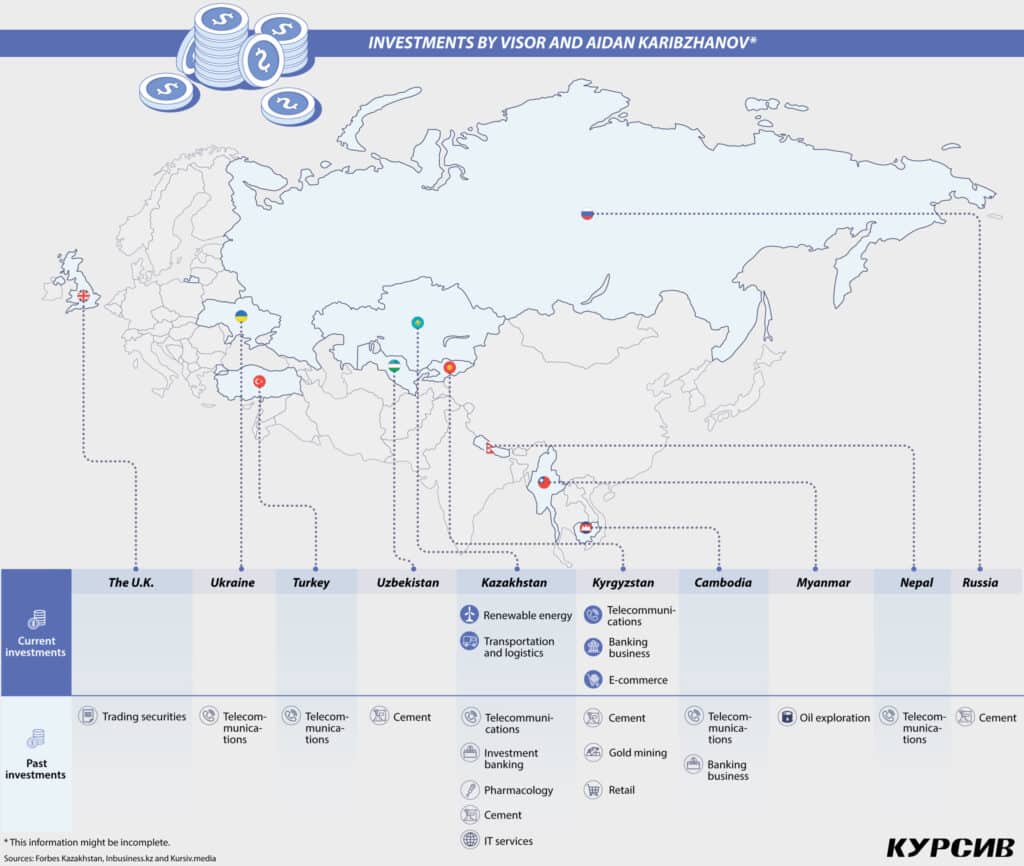

First, Visor has never invested in commercial banks in the former Soviet Union (see infographics below). Secondly, several years ago Aidan Karibzhanov, a millionaire from the Forbes Kazakhstan list, said that he was not interested in expansion and would be focusing on his business in Kazakhstan.

In 2019, he said:

«There is nothing interesting for us in Africa and we’re done with Asia. Almost no one wants to do business either in Russia or Ukraine. We won’t go to the Caucasus as we have nothing in common in terms of temperament or approach toward business. Azerbaijanis – they are like us; they won’t share business with strangers. Concerning Kyrgyzstan, we’ve already sold something in this country, although we still occupy a lot of room in Kyrgyzstan in terms of assets. Expansion of existing projects is possible but not the launch of new ones. In Uzbekistan, we are amidst a legal proceeding, so we can’t go there. In Tajikistan, we have done nothing so far, while Turkmenistan is too exotic for us. And interest in doing business in Kazakhstan is growing, so why do we need to go abroad?»

In Kyrgyzstan, Visor controls NurTelecom, a mobile operator well-known under the brand «O!» Precisely because of this, Visor was forced to think about expanding its business beyond telecommunication and purchasing a bank in Kyrgyzstan instead of establishing a banking structure in this country from scratch.

Intensification of the business

In 2017, the O! mobile operator launched O!Money, a payment service for its customers. Moreover, like many other mobile operators, O! had gradually developed services like top up friend mobile.

«Their appetite was growing. They started launching more and more services based on O!Money. Of course, the National Bank got annoyed; it gave a call to the company and said, ‘Hey guys. You aren’t a payment organization. Stop it,’» a source familiar with the matter told Kursiv.

As a result, О! was forced to obtain a payment organization license.

At the next stage of the business expansion, the operator started selling mobile devices on its ostore.kg website. Moreover, it offered installments.

«The National Bank came once again, ‘You are offering loans. This is not what a telecommunication company is supposed to do. You have to get a license.’ This is why they were forced to buy a microcredit organization with a license from the regulator,» the source added.

However, as a non-financial entity, the operator was struggling with the processing of a growing number of payments and loans. This is why Visor decided to separate its financial business from the operator, the source familiar with internal discussions said. But what was the plan?

Merchant – product – merchant

At the initial stage, Visor intended to establish a new bank on its own.

«Do you know what is necessary to obtain a banking license in Kyrgyzstan?» Our source this question before immediately explaining it right away, “The National Bank wants you to hire a team of banking specialists with corresponding background and work experience. How are you going to hire a future chair of a bank and his deputies in a small Kyrgyz market? Offer bigger salaries? But who on Earth would leave everything behind and agree to work in a bank that hasn’t even gotten a license?”

After close consideration of these issues, Visor decided to buy an already existing bank.

Halyk Bank Kyrgyzstan wasn’t the first or only option for the holding. Representatives of Visor met with owners of different banks, according to a person familiar with the matter. However, this interest made them feel like they needed to ask more for their businesses, although «the market value of their banks objectively was significantly lower than they asked,» the source noted.

At the same time, Halyk Bank was also negotiating with other potential buyers. Therefore, Halyk and Visor were bound to meet each other on the Kyrgyz market.

Even though Kazakhstan’s banking market is 15 times as big as its neighbor’s market ($103 billion vs $6.7 billion), the two countries have almost the same number of banks: 23 in Kyrgyzstan and 21 in Kazakhstan.

In terms of assets and revenue, Halyk Bank Kyrgyzstan is an average bank. It renders services mainly to corporate clients, the vast majority of which are from Kazakhstan.

According to the publication source, the bank’s new owners are going to focus on retail. This is quite understandable because the bank will be cooperating with Visor’s existing assets such as the mobile operator and its online store. Can you imagine a greater focus on retail than that?