Careful start: Consumer confidence is fading away just as the year begins

The Consumer Confidence Index (CCI) has been gradually declining since early January after active growth in late 2023. It is still in the positive zone, though. Inflation is also slowing down, which is why Kazakhstanis less often report price increases looking back to last year and last month. They’ve also been less worried about possible price surges in the future. At the same time, people have become a bit more anxious about the risk of unemployment and switched their behavior from spending to saving mode.

Cautious optimism

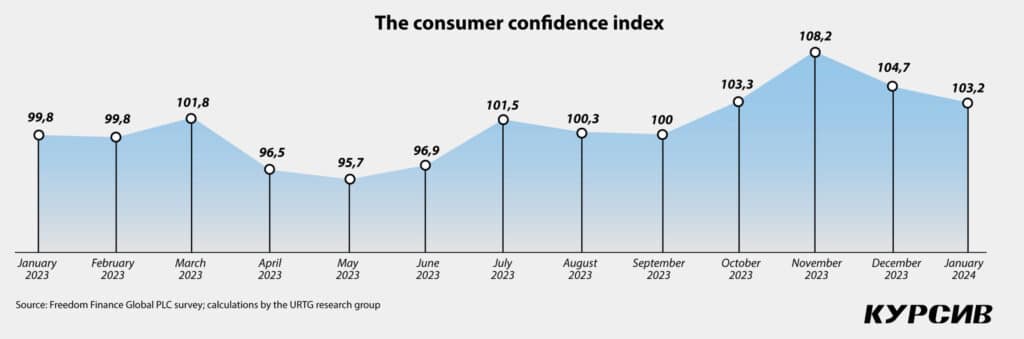

Observing the increase of the CCI in October and November 2023, experts expected this trend to continue. However, in December, the CCI started to decline. In January 2024, it slipped by 1.5 percentage points, reaching 103.2 points. As a result, in January 2024, the CCI rate was the same as in October 2023 (103.3 points), staying in the positive zone at just slightly above 100 points.

Subindexes have also declined. For instance, the index of current state assessment dropped to 83.6 points (-1.3 points), while the index of consumer expectations reached 133.5 points (-1.7). At the same time, the index of changes in the economic situation (78.5 points) and the major purchase index (69.6 points) are still in the negative zone. The index of economic changes in the region (which isn’t part of the CCI) showed the biggest decline, plunging by 3.9 points to 87.9 in January.

Women and youth report less confidence

Gender differences in consumer confidence reached their minimal showings in January as men and women have shown similar figures since August 2023. Interestingly, the CCI’s decline was primarily driven by women as their consumer confidence dropped by 3.1 points to 103, whereas men’s consumer confidence grew by 0.4 points, reaching 103.4.

For two groups of young consumers, the indicator was reported as being in the positive zone. People aged 18-29 reported consumer confidence at 115 points (still quite high despite a decline of 3.8 points) and young adults at 105 points (decreasing by just 0.7 points and staying in the positive zone). People of pre-retirement age became the only group of respondents with confidence growing by 0.8 points in January despite their previous pessimism. However, they are still in the negative zone with 97.2 points. Retired people were the least optimistic respondents in January, which is quite usual for them. In January, their indicator went a little bit further into the negative zone, declining by 2.8 points to reach 93.5.

Central regions enter the positive zone

In January, an increase in consumer confidence was reported in the central and eastern regions of Kazakhstan. For instance, the Pavlodar region reached the positive zone (+5.9 points), while the Karaganda region was very close to the threshold of 100 points, reaching 99.7 points (+5.8). The Atyrau and Kyzylorda regions also reported an increase in the index by 5.7 and 9 points, respectively.

The CCI sharply declined in the Aktobe region (-9.7 points), which is still in the positive zone (101.1 points). Astana and Shymkent also remained in the positive zone despite a significant decrease in consumer confidence (by 4.6 and 6.4 points, respectively). The Turkestan (-7.1 points), Almaty (-2.6) and Jambyl (-5.7) regions also reported a decline, although this wasn’t big enough to push them into the negative zone.

Less anxiety despite natural disasters

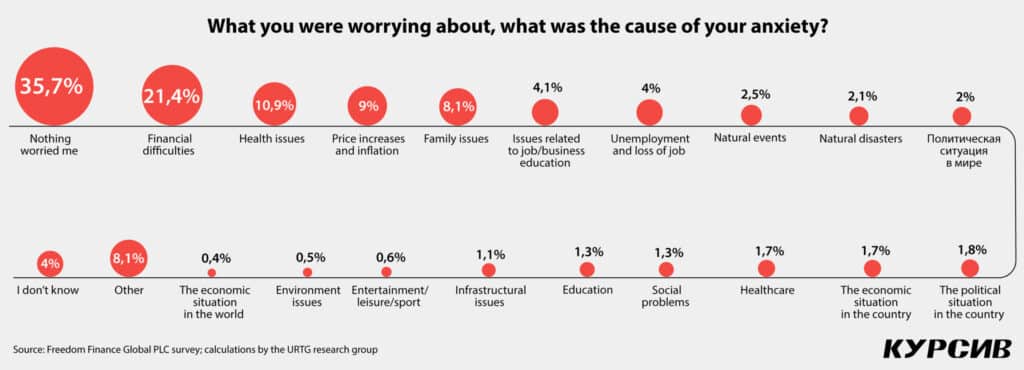

As usual, the vast majority of Kazakhstanis were worried about financial issues and lack of money in January, although this indicator declined from 24.3% in December to 21.4% last month. Respondents were also concerned about their health: almost every tenth (10.9%) was worried about their health and the health of their loved ones. Even though the number of those who said that nothing was worrying them has grown slightly (from 31.7 to 35.7%), Kazakhstanis became more concerned about natural disasters (2.1%) and other natural events (2.5%). Likely, negative events such as the earthquake in January, aftershocks in China and abnormally low temperatures throughout Kazakhstan have strengthened concerns about climate and natural disasters in the country. However, the number of those concerned about natural events and disasters is still lower than the number of people worried about financial issues.

Kazakhstanis have become a bit less concerned about inflation and tariff increase this year (9% compared to 12.1% in December). The number of people worried about education, jobs or business also dropped. In January, these issues worried just every 20th person (4.1%). Moreover, Kazakhstani were less concerned about family and household issues in January 2024 (8.1%) compared to December 2023 (10.7%).

Slowing inflation

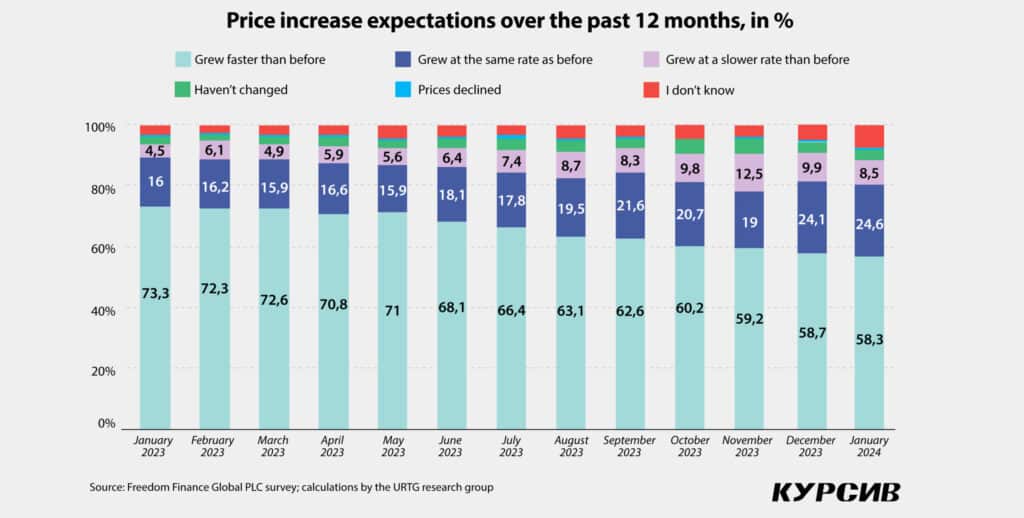

Inflation has been slowing in Kazakhstan since September 2023. It slowed by 0.3% year-on-year from 9.8% in December to 9.5% in January, according to the Bureau of National Statistics (BNS). No surprise that last month left fewer Kazakhstani consumers reporting price increases: a fast price surge was reported by 58.3% of the respondents in January compared to 73.3% over the same period of 2023.

The same situation was observed month-on-month: the share of those who noticed a sharp price increase dropped from 48% in December to 45.4% in January. (According to the BNS, inflation in January was the same as in December at 0.8%). On the other hand, the share of those who reported a slight price increase in January has increased by 1.5 p.p. compared to December 2023).

What about expectations?

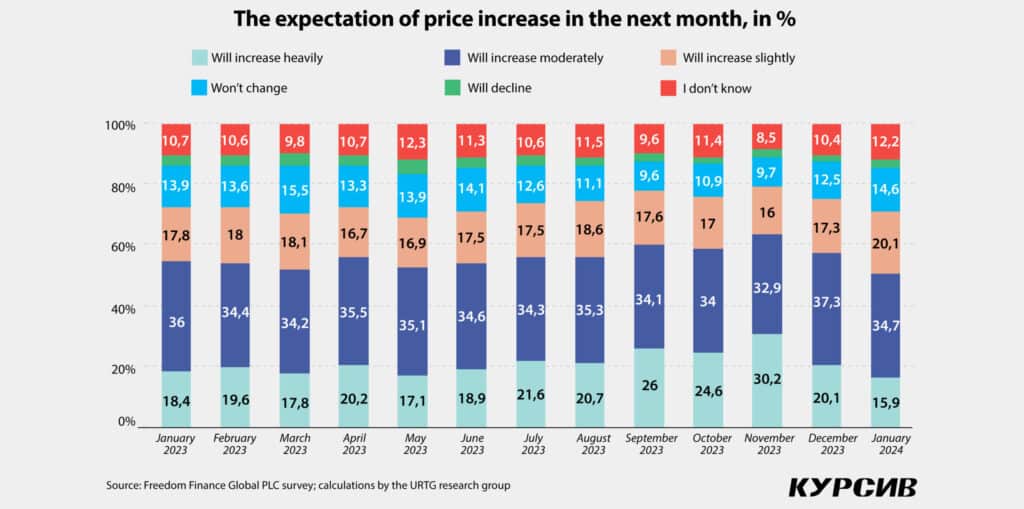

The expected annual inflation rate in January, calculated by the quantification method, reached 9%, which is lower than the actual annual inflation of 9.5% (January 2024 compared to January 2023). Level of uncertainty, or the number of those who haven’t given any decisive answer on inflation, remained the same in January as in December (12.3%). At the same time, the share of radical «pessimists» who expect a sharp price increase similar to an increase last year declined by 1.7%.

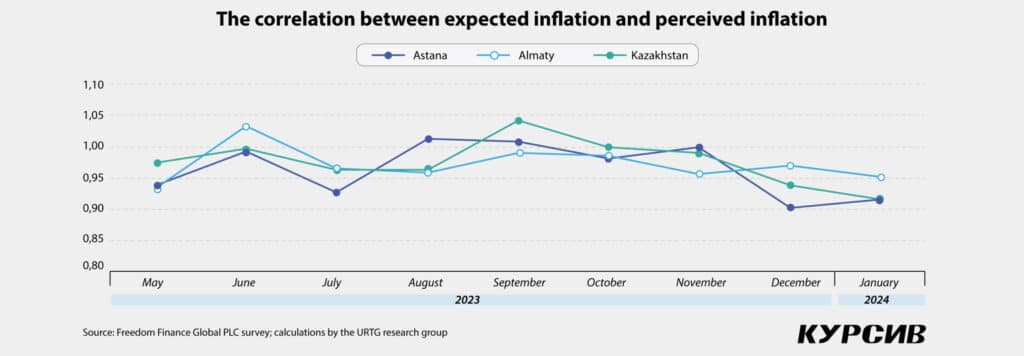

As a result, the correlation between expected inflation and perceived inflation in January slipped compared to December, reaching 0.92 (the lowest rate since April 2023). The rate’s decrease indicates that consumers expect inflation to lower further if there are no negative inflationary factors such as a sharp surge in prices for important goods or high volatility of the foreign exchange rate. Interestingly, the New Year holidays which are usually associated with an increase in prices for food and other products and services didn’t influence overall inflationary expectations in January 2024. Despite some regional peculiarities, the vast majority of Kazakhstanis are quite moderate in their assessments of inflationary expectations.

In terms of regional perception of inflationary processes, we can point out that differences in the assessment of inflation in Almaty and Astana are gradually fading away. However, residents of the capital city of Astana are expecting inflation to slow more rapidly (the correlation is at 0.92), while in Almaty this rate is a bit higher – 0.95.

Who is concerned about prices?

Women are more likely to keep an eye on price changes as we noted in our previous surveys. These differences in assessment may be as big as 10%. For instance, 62.9% of women are more inclined to notice a sharp price increase at yearend compared to 53.2% of men. In January, the percentages were 49.9% and 40.4% for women and men, respectively. Also, women are prone to notice price surges as they are more actively involved in day-to-day procurement for family and household.

In terms of age, the situation is quite different. Unlike December 2023, when 30- to 44-year-olds were the most concerned about price increases, the January survey showed that retired people aged 60 and above expressed the highest level of concern regarding prices. In this group, 61.3% of respondents pointed out a sharp price increase year-on-year and 48.7% of them reported a price increase month-on-month. Price increases year-on-year were the most annoying for residents of the Mangystau region (70.3%). Meanwhile, price increases month-on-month primarily concerned people in the Ulytau region, with 61.2% expressing concern.

In focus: meat and eggs

As usual (January wasn’t an exception), Kazakhstanis kept an eye on prices for staples and important goods such as meat and poultry (41.6%), milk and dairy products (37.4%), pastries (33%), vegetables and fruits (31.8%). One-third to half of the respondents said that a price increase for these goods was the most painful. Among other top products that reported price increases were eggs (27.9%), flour (27.1%), grains and pastries (25.5%), sugar and salt (23.8%).

In January, respondents more often noticed price increases for meat and poultry (increasing by 3.2 p.p.), eggs (+1.1 p.p.) and flour (+2.9 p.p.) compared to December 2023. Another group of respondents (12.5%) pointed out utility tariff increases. These services reported the highest rate of price surge, according to those who have taken part in the survey. Concerning other categories of goods and services, Kazakhstanis are a bit more positive as they are less prone to notice an active price increase for many other products this year.

Will there be growth?

The survey showed not only a lowering of pessimistic forecasts for price dynamic year-on-year and month-on-month but also in predictive valuation of price changes in the following month and year. For instance, the number of those who expect a sharp price increase next year dropped by 4.3%, while the number of those who anticipate a little price increase and no price increase have risen by 2.8% and 2.1%, respectively. The expectation of a sharp price increase is modest: every fourth respondent is anticipating a more rapid price increase in the next month, although their share slipped by 1.7 p.p. On the other hand, 40.8% of respondents are expecting a price increase similar to the one last year (+1 p.p. compared to December 2023), while 15.2% (+1.4 p.p.) think that this year’s increase in prices for goods and services will be slower.

Women more often anticipate price increases in the next month (17% vs 14.5% of men), while men are more pessimistic when it comes to next year’s expectations. In general, youth and young adults anticipate a more rapid price increase. Residents of the Ulytau region expect price increases more often (25.3%) in a month perspective, while people in the Atyrau (30.9%) and West Kazakhstan (25.9%) regions more often anticipate the same in a year perspective.

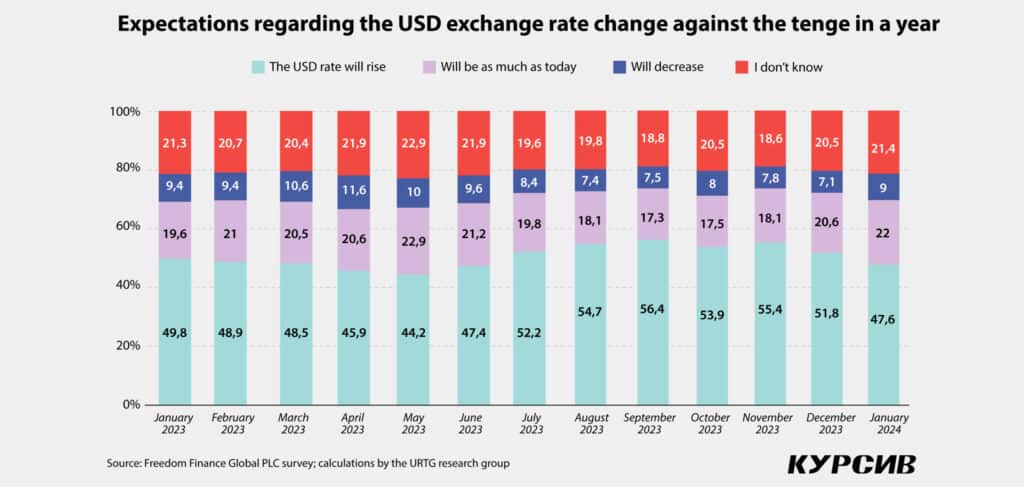

«Weakening» dollar

Kazakhstani’s faith in the American currency has been shaking for the second month in a row. Consequently, the share of those who expect an increase of the USD exchange rate against the tenge is decreasing in a year perspective (from 55.4% in November 2023 to 47.6% in January 2024) and in a month perspective (from 36.1% in November to 27.1% in January).

Men’s faith in the US dollar is quite strong – 52.1% (43.5% for women) in a year perspective and 29.5% in a month perspective (25% for women). Interestingly, this trend has been quite stable for many months of surveying. Traditionally, young people are more optimistic toward the perspectives of the American currency (57.2% males and 33.6% females). In terms of regions, residents of the Kyzylorda, Mangystau and Aktobe regions as well as people in the cities of Astana and Almaty tend to anticipate strengthening of the USD in a year perspective.

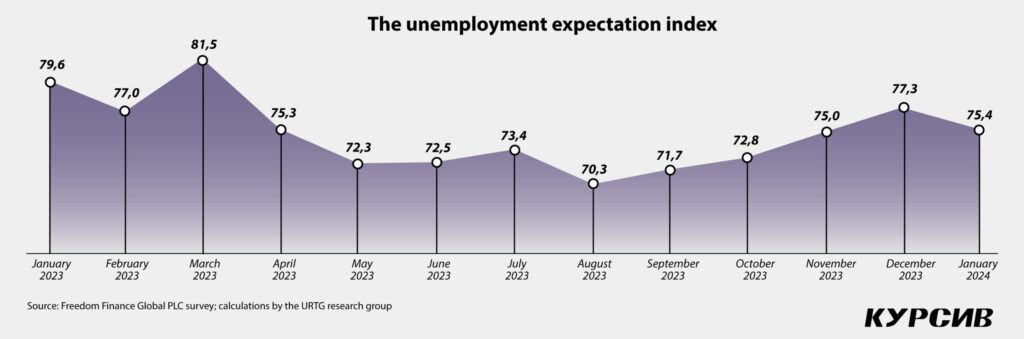

A bit more anxiety over unemployment

In January 2024, Kazakhstanis were more concerned over the unemployment rate compared to December 2023. This rate slipped by 1.9 points to 75.4 points, which indicates an increasing fear of unemployment. This rate had grown since August 2023, proving a contraction of anxiety among Kazakhstanis. However, in January, anxiety started to grow once again. At the same time, the number of people expecting an increase in unemployment remained the same this year – 39.1%. As usual, women and pre-retired people are more worried about unemployment: 39.5% and 41.4%, respectively. Pessimistic forecasts prevail in the West Kazakhstan (51%), Atyrau (46.7%), Turkestan (45.8%) and Ulytau (45%) regions.

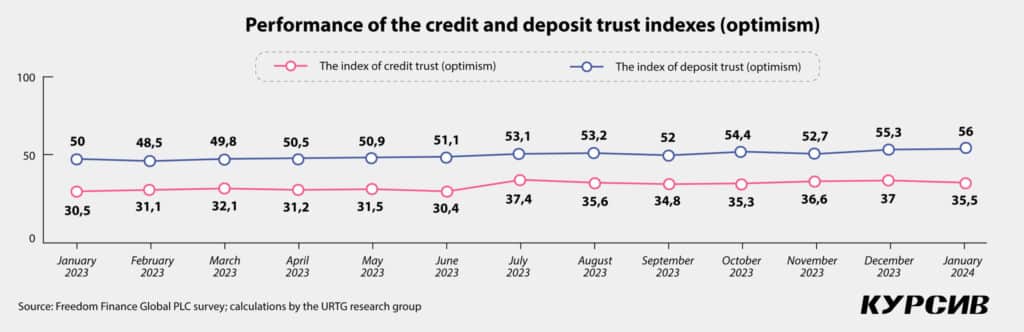

Switching to the saving mode

Unlike December 2023, Kazakhstani consumers were more cautious toward spending in January 2024. Fewer people now believe that it is a good time to borrow money from banks as the share of those who plan to take a loan within the next twelve months has decreased to 18.6%. Men were thinking about loans more often than women (19.6% vs. 17.8%), as were Kazakhstanis aged 30-44 (25.5%), residents of Shymkent (25%), and the Mangystau (23.8%) and Kyzylorda (23.5%) regions.

A similar trend was observed in credit optimism: almost half of Kazakhstanis (49.5%) believe that today is not a good time for loans, while the number of those who believe that it is a good or quite good time for taking a loan decreased by 0.9% to 13.2% and by 3.9% to 25.6%, respectively. As a result, credit trust dropped by 1.5 points, reaching 35.5 points. This event effectively stopped the growth of credit optimism that was observed from September 2023 until recently. Lowering credit optimism is common for both men (from 35.7 to 33.9 points) and women (from 38.2 to 36.9 points) and all age groups. Youth (from 40.1 to 38.4 points) and retired people (from 35.4 to 32 points) show the most active decline in credit trust.

Instead of taking loans, Kazakhstanis are now planning to save money: the index of deposit trust has grown by 0.7 p.p., reaching 56 points. More than one-third of Kazakhstanis (35.8%) believe that it is the right time to save money, which is 1.4 p.p. higher than in December. Deposit trust is more common for women (56.7 points), youth (60.6 points) and residents of the Aktobe (62.7 points) and Mangystau (65.5 points) regions.

No worries

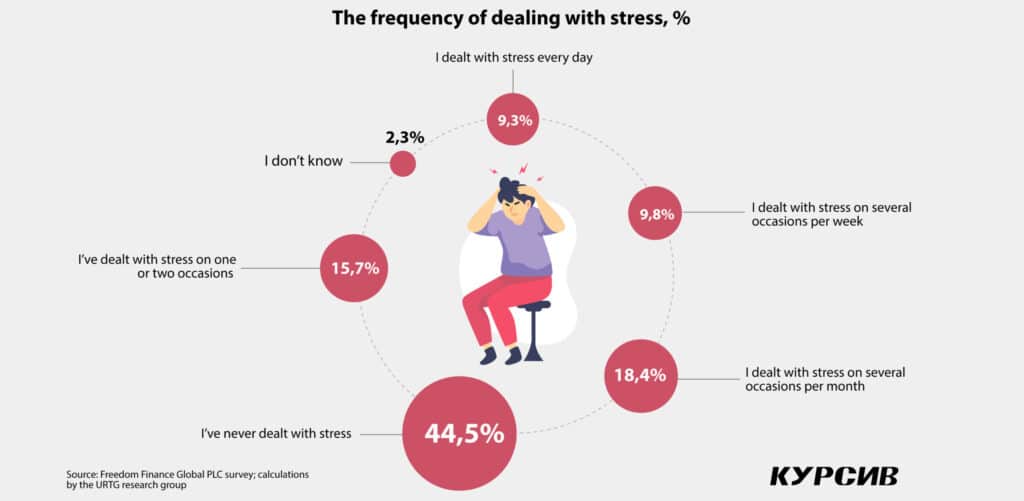

A relaxed mood is still common for the vast majority of Kazakhstanis. However, in January 2024, the share of those who felt relaxed slipped by 2.4 p.p. from 57.9% to 55.5%. This happened due to two factors: first, the number of those who couldn’t answer the question grew by 2 p.p., reaching 5.2%; second, the share of those who were anxious increased by 0.5% to 39.3%. Women more often notice anxiety in the people around them (44.5% vs. 33.6% for men), which is also common for Kazakhstanis aged 45 to 59 (44%) and above 60 (42%). All these groups of people showed similar levels of anxiety during previous surveys as well, whereas people aged 30 to 44 (40.6%) demonstrated an increase in anxiety only in January. They are still less anxious compared to other age groups. The Ulytau region holds an outstanding position in terms of anxiety: every second respondent (51.3%) here was anxious.

More than half of respondents interviewed in January (53.2%) said that they dealt with stress on several occasions per month. This situation has been observed since December 2023, while before November fewer people experienced regular stress. The number of those who have never been in a stress-inducing situation slipped by 2.6 p.p. compared to December, reaching 44.5%. Women reported stress more often (56.7% compared to 49.4% for men), followed by young people aged 18-29 (58.3%) and 30-44 (56.5%), as well as residents of Almaty (63.9%), Astana (60.8%) and the Atyrau region (60.8%).

Breaking down data for January 2024

The beginning of 2024 was marked by a decline in consumer confidence and corresponding subindexes. Indexes related to personal material status and index of changes in the economic situation (not included in the CCI) reported the most significant decline. Kazakhstanis are still reporting a slowdown in price increases both in a month and a year perspective.

However, people in Kazakhstan are also reporting a price increase for key foods and worrying about the labor market. Kazakhstanis have become less optimistic toward loans and do not want to take loans in the next twelve months. On the other hand, they are more eager to save money: people plan to spend less and save more this year. Even though Kazakhstanis were a bit less concerned about finances, health and inflation in January (even natural disasters had a minor impact on people’s sentiment), they reported a slight increase in anxiety. We will continue to track consumer sentiment in our future surveys of consumer confidence in Kazakhstan.