What Kazakhstani SME Business Barometer is showing: Q1 results and short-term expectations amid uncertainty and new challenges

In the first quarter of 2024, Kazakhstani small and medium-sized enterprises (SMEs) dealt with many problems. Various challenges – market-based, regulatory and natural – converged at one point. With regard to the factor of nature, probably, we haven’t yet seen all the consequences from the massive floods that hit Kazakhstan last month. This article analyzes the business’s assessment of Q1 results, its short-term outlook for changes in key indicators such as turnover, staff changes and funding sources, and the obstacles businesses have faced. Based on the collected data, we have set apart three main groups of indexes reflecting business sentiments, activity levels and the seriousness of each obstacle. In addition, we asked businesses to comment on amendments to the Tax Code, the universal declaration and control over mobile money transfers and the impact of these novelties on their income now or in the future.

Strength and weakness of business sentiment

The first index under the comprehensive SME Business Barometer (SME BB) study is the business sentiment index (BSI), consisting of four subindexes (Investments, Loans, Sales and Staff). It rose by 1.1 points in the first quarter to 58.7 points, the highest rate over the past three quarters.

Even though these subindexes had different dynamics during the first quarter, all of them were above 50 points, indicating the prevalence of positive business sentiment. The main driver of the sentiment index is the Investment subindex. It is the highest among all the subindexes with the strongest growth dynamic (+4.7 over the quarter, to 67 points). The Staff subindex also showed growth (+1.2 points, to 57.3 points), while the Sales and Loans subindexes have slightly declined (-0.4 points, to 54.3 points and -0.6 points, to 56.9 points, respectively).

United Research Technologies Group (URTG) has been conducting the «Kazakhstan SME Business Barometer» (SME BB) study since the first quarter of 2024. Its methodology is based on the best international practices including but not limited to practices of IHS Markit (UK) and the European Commission.

The data was collected through telephone interviews (CATI). For each wave of the research, we interviewed 500 representatives of small and medium-sized businesses in manufacturing and non-manufacturing industries quarterly. The sample groups represent regional (20 regions) and sectoral (trade, manufacturing and mining industries, agriculture, construction and services) quotas and businesses of different sizes, reflecting the number of businesses in the general population and their contribution to the country’s GDP.

The quarterly analysis was supplemented by the results of Freedom Finance Global and Kursiv research for Q3 and Q4 of 2023. They are available online.

1. Focus on re-investments

According to our research, businesses in almost all sectors plan to boost investments in their activities. For instance, business is going to beef up its investments by 1.3 times in the next three months compared to allocations during the first quarter of 2024. In the fourth quarter of 2023, the results of the FFG study showed this ratio at 0.9, which means that reality overperformed plans. Note that actual estimates reflect survey results, not external statistics.

Businesses still consider their revenue as the main tool for expansion; this indicator accounts for 77.5% of business expectations, compared to 22.5% of external borrowings. However, over the first quarter, the indicator of external borrowings grew by 4.7 p.p., driven by rising expectations in the agriculture (+16.7 p.p. to 16.7%) and industrial (+16.6 p.p. to 23.4%) sectors. We believe that this growth might be driven by support from development institutions.

The industrial sector was the leader in terms of expansion (at the expense of their own and borrowed funds): 66% of businesses did expand their activities in the reporting period (Q1 of 2024) and 83% plan to do so in the future (Q2 of 2024). This growth of optimism in the processing industry might be driven by the government’s plans to launch $3.3 billion worth of 180 projects aimed at import substitution and increasing the export potential of Kazakhstani goods and services this year. In the construction sector, businesses also plan to invest more in Q2 than they invested in Q1 (55.6% vs 46%). In the agricultural sector, 64.3% of businesses barely changed their activities in Q1 and only 19% of them invested in business expansion. However, when it comes to future expansion, the situation is different: 47.6% of respondents in this sector said they would expand their business compared to 35.7% who do not plan any changes in the second quarter. We believe that changes in sector expectations have been driven by the start of the spring sowing campaign, which the government is going to support with $3.1 billion of soft-term financing and $2.2 billion for big agricultural projects. At the same time, there are still many businesses in the agricultural sector that plan to reduce their activities in the future (14.3% compared to 4.3-7.3% in other sectors). Representatives of trade and services haven’t changed much in their businesses and do not plan any changes in Q2 as 47% of respondents in both sectors have given neutral responses.

Medium-sized businesses (60%) were the most active in their pursuit of business expansion along with enterprises with an annual turnover of $225,322 to $2.4 million (46.6%) and $2.4 million to $23.4 million (46.2%). Micro-businesses (37.2%) and enterprises with an income of less than $56,330 (37.3%) reported the least expansion. In terms of regions, the leaders were the Jambyl (55.6%) and Turkestan (52.1%) regions. Both regions, well-known for their livestock farming, were partially hit by floods caused by heavy spring rains. The key grain-producing regions – the Kostanay (6.3%), North Kazakhstan (11%) and Akmola (15.4%) regions, which suffered the most from the floods along with western regions of the country – became anti-leaders in terms of investments in Q1. In these regions, businesses most often reported absence of changes (85–88%). The North Kazakhstan region, however, not only reported no changes in business expansion (56%) but also experienced one of the largest reductions in investment (33%), along with the Abay region (35.7%). For comparison, this rate varies from 0% to 21% for other regions. None of the key grain-producing regions, except for the Akmola region, reported external borrowing funds among their funding sources. In the Akmola region, though, the share of these funds wasn’t big (7.7%).

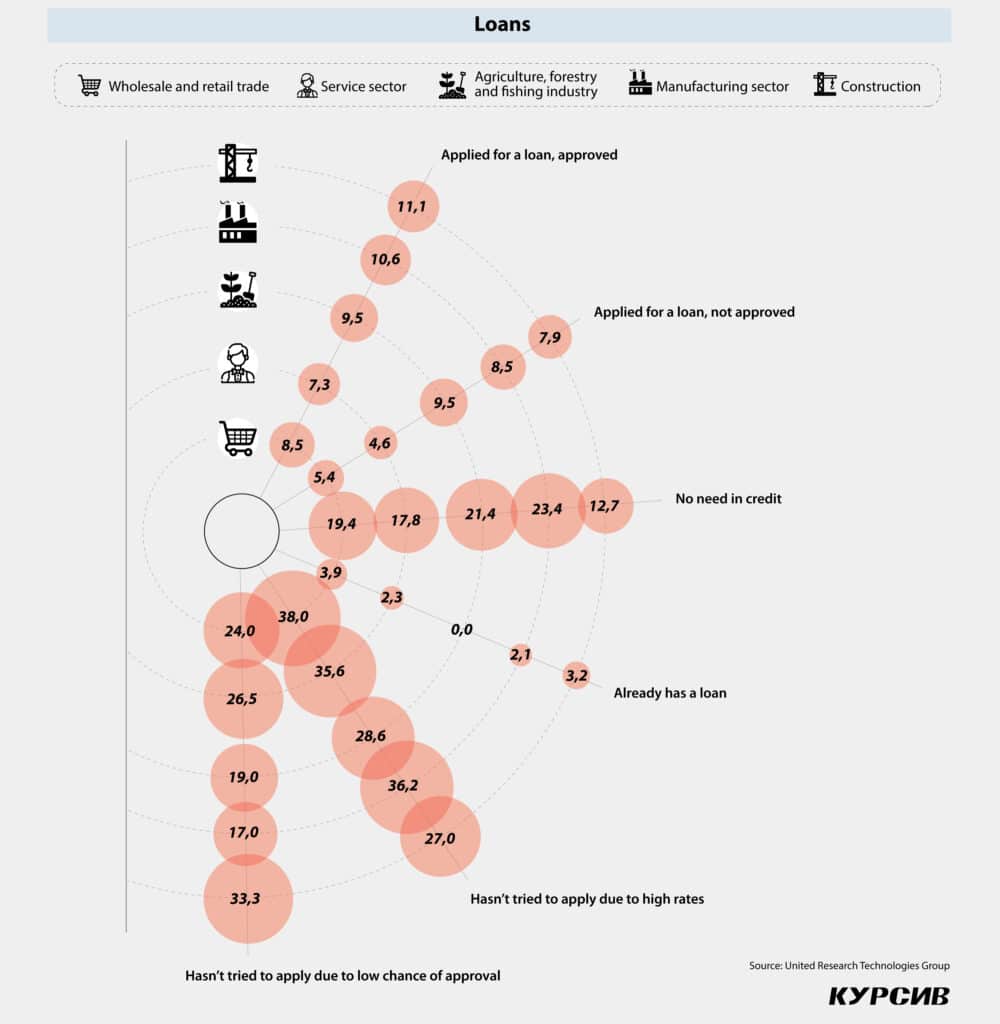

2. Growth limitations: high rates and existing loans

The Loans subindex, which was the only subindex that showed growth in the fourth quarter of 2023, according to the results of the FFG study, this time decreased. Representatives of all sectors, especially in the agricultural, construction and service sectors, said that they didn’t need additional finds in Q1 (-12.3 p.p. to 33.1% out of 500 surveyed enterprises from all sectors). Businesses in all sectors except for the industrial sector didn’t even try to take a loan because of high rates (+10.6 p.p. to 24%).

The vast majority of those who didn’t apply for additional loans due to existing loans (all sectors: +1.8 p.p. to 18.9%) were representatives of the industrial and agricultural sectors. A noticeable quarterly increase in this category is associated with the service and agricultural sectors. In this case, it is difficult to say with certain accuracy whether the existing borrowed funds were sufficient or the current debt reached its limit, which stopped the entrepreneurs from applying for additional borrowing.

Businesses that did apply for loans were equally divided in terms of the results: applications were approved in 9.4% of cases (-3.1 p.p.) and rejected in 9.5% of cases (+2.2 p.p.). Both cases were most often observed in the construction and industrial sectors.

Interestingly enough, the aforementioned answers didn’t depend greatly on the size of enterprises or their income. At the same time, companies with a turnover of $2.4 million to $23.4 million (the upper limit for SMEs) reported the least need in additional funds, since they already had existing loans. However, unlike small businesses, these enterprises reported approval of their loan applications all the time. We believe that this dynamic makes sense.

Regionally, the highest loan approval rate was reported in the Jambyl, Kostanay and Ulytau regions (18.5% to 20%), while the lowest rate was in the Akmola region (23%). The Aktobe and West Kazakhstan regions were the leaders in terms of existing loans (33-36%). The most pessimistic attitude toward loan approvals was in the Karaganda region where 12% of businesses didn’t even try to get a loan because they didn’t believe they had a chance to get one. The most confident in terms of funding were the Atyrau and Akmola regions and the city of Almaty (46-56%). Businesses in the Ulytau and Kyzylorda regions complained the most about high rates (40–44%).

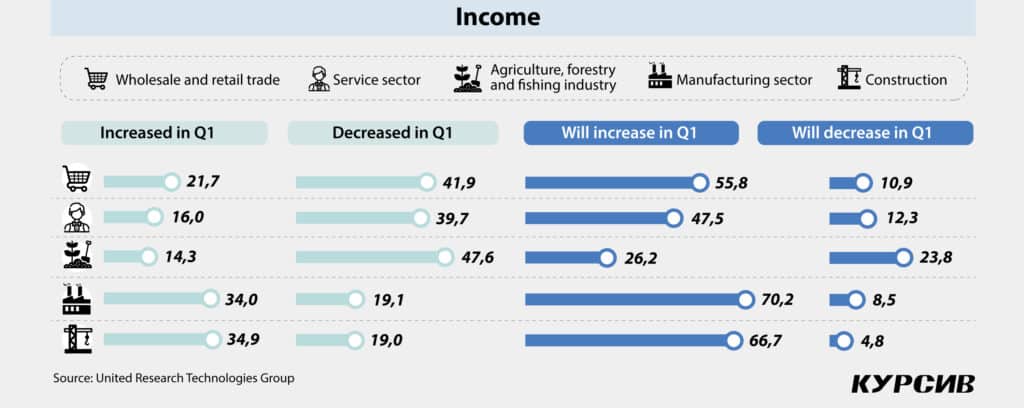

3. Trade optimism of SMEs is overshadowed by the agricultural sector. Is the service sector at risk?

The Sales subindex, which evaluates the actual and expected change in revenue of enterprises, has been declining for the second quarter in a row, according to the combined results of FFG and URTG research. It has reached the lowest value among all subindexes, at 54.3 points (-0.4 points per quarter). The agricultural sector has also slipped into the pessimistic zone (-12.1 points, to 41.1 points). The service sector dropped almost to the neutral line (-1.6 points to 50.1 points). A significant drop was also observed in the industrial sector, although turnover in the sector is still higher than in other sectors (-9.8 points, to 68.1 points). The construction sector has shown the second-best result after the industrial segment (+4.7 points, to 67.9 points). The trade sector is also still positive (+2.6 points, to 54.1 points). Let’s take a closer look at the situation in sales.

Actual changes in the Sales subindex showed negative quarterly dynamics due to an increase in the share of companies (+10.6 p.p. per quarter) that reported a decrease in revenue (33.5% out of 500 enterprises participating in the survey), while the share of those who reported growth (24.2%) decreased (-7.8 p.p. per quarter). Even though SMEs didn’t show great results in Q1, businesses are quite decisive toward boosting their sales in the second quarter. Thus, 53.3% of respondents expect an increase in revenue (+5.4 p.p. per quarter), while only 12% anticipate the opposite (-3.9 p.p. per quarter).

In terms of sectors, the most pessimistic situation was in the agricultural sector. For instance, the share of agribusinesses that reported declines in revenue in Q1 almost doubled over this period (47.6% compared to 19-42% in other sectors). Representatives of this sector do not expect significant improvements anytime soon, instead believing that the situation will remain the same (45.2% compared to 19-31% in other industries). While all other sectors are quite optimistic about the future (only 5% to 12% expect failures in other sectors), 24% of agricultural businesses expect a further decline in their revenue. The situation in agribusiness may be associated not only with seasonal factors and greater vulnerability to natural and climate changes but also with a stronger correlation between the size of a company and resources it has access to (medium-sized businesses compared to micro-businesses). This correlation isn’t as big in other sectors.

The trade and service sectors also reported a decrease in revenue – 42% and 39.7%, respectively. (The rate rose by 11.7 p.p. in each of these sectors.) However, unlike agribusiness, these sectors expect a noticeable increase in sales within the next three months. This is especially true for the trade sector (+20.9 p.p. per quarter, 55.8% of answers), while in the service sector, the situation is a bit closer to neutral but still positive (+8.8 p.p., to 47.5%).

Representatives of the construction and industrial sectors enjoyed stable revenue in Q1 as they less often reported changes in their income (+4.7 p.p. per quarter on average, to 44.4 to 44.7 points) or even reported growth, although the share of growing businesses decreased over the quarter by 16 p.p. for the industrial sector and by 6 p.p. for the construction sector. These shares, however, are still higher than in other sectors (34 and 34.9 points, respectively). Even though the share of businesses reporting an increase in their revenue in Q1 slightly declined, these two sectors either have improved their short-term expectations like the construction sector (+11.1 p.p. to 66.7%) or maintained their expectations like the industrial sector (-2.5 p.p., to 70.2%).

In terms of size, the largest quarterly changes occurred among enterprises in the upper-income level ($2.4 million to $23.4 million). The number of companies reporting revenue growth in the first quarter sharply decreased (-30.8 p.p. per quarter, to 7.7% out of all companies in this income category), while the number of those that saw reduced revenue (-15.4 p.p., to 38.5%) or reported no changes has increased. However, in terms of future income, their expectations change dramatically and look quite optimistic: businesses expect revenue growth at 38.5%, compared to 7.7% of those (-30.8 p.p. for the quarter) expecting its decline.

In terms of regions, the largest shares of companies indicating revenue growth in the first quarter were in the Turkestan (50%) and Kyzylorda (44%) regions. The Atyrau (69%) and Kostanay (62.5%) regions have given most of the «no change» answers. The Aktobe and Pavlodar regions reported the largest decline in revenue (by 71.4% each). Almost all regions except for the Abay, Akmola and Atyrau regions were quite optimistic about the future as the number of businesses, expecting more growth than the number of those anticipating the opposite. The Zhetysu and Ulytau regions and Almaty city were leaders in terms of growth (60-64%) in Q1.

4. Employment prospects: flattened growth

The workforce in small and medium-sized businesses has shown growth for the second quarter in a row. In the first quarter, 20.3% (+1.7 p.p. per quarter) of businesses reported an increase in their staff, while 14.4% reported the opposite (-1.3 p.p. per quarter). All other respondents reported no significant changes in the number of their employees (65.1%). Respondents were much more positive toward the short-term future unlike what they said about the first quarter. For instance, 38.3% (+18 p.p.) of enterprises out of 500 surveyed businesses expect an increase in staff, compared to only 6.1% (-2.3 times) that are going to reduce their personnel; the remaining 54% do not plan any staff changes (-11.1 p.p.).

In terms of sectors, the largest increase in employees in the first quarter was recorded in the industrial (29.8%) and construction (27%) sectors, while the agricultural sector reported the highest staff reduction (28.6%). In terms of plans for the near future, the industrial sector is starting to look less stable. Even though many in the sector had high expectations for staff increase (in almost 49% of cases in this sector), many representatives of the sector planned the biggest downsizing (10.6% compared to 3.1-6.3% in other sectors). The construction sector is expected to remain in the optimistic zone, with an expected staff increase in 51% of cases. In this regard, the service and trade sectors appear to be the most stable (64–67% versus 40–59.5% in other sectors).

Considering changes in the Staff subindex based on the size of enterprises, we observed that most often layoffs and hirings occurred in medium-sized businesses (25% on average). The situation appears unlikely to change much in the future and high staff turnover will continue. Given the highest expectations for growth in the number of employees (40% for medium-sized businesses compared to 32% to 36% for small and micro-businesses), the largest number of layoffs is also expected in this segment (10% compared to 3.2% to 5.4%). Small enterprises are more likely to hire people; we saw this in the past and we see this in their plans for the near future, while low staff turnover is more common for micro-businesses.

In Q1, regions were almost equally divided in terms of staff increases and reductions. Currently, they are equally optimistic. In the first quarter, the best situation with staff expansion was in the Mangistau (42.1%) and Kyzylorda (37.5%) regions. Moreover, businesses in the Mangistau region plan a larger expansion (63.2%) soon, followed by the Akmola region (46.2%) and Shymkent city (45.5%). The most massive staff reductions were observed in the Abay (28.6%), Akmola (23.1%) and Pavlodar (21.4%) regions. In the Abay and Pavlodar regions, layoffs are expected to continue with a lack of any noticeable hiring. Layoffs without hiring are also expected in the North Kazakhstan region.

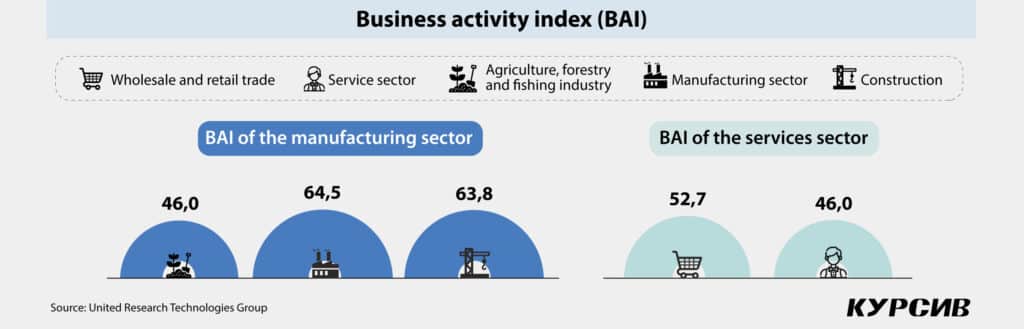

BAI warning signals

The business activity of SMEs is measured by two independent indexes: the manufacturing business activity index (BAI) and the service sector BAI. The first index covers sectors such as industry, construction, agriculture, forestry and fisheries. The second one observes wholesale and retail trade and the service sector. Each sector can be considered as an independent subindex. To measure the BAI, we asked businesses how much and how (for better, for worse or remaining unchanged) the conditions of their activities have changed over the past month in terms of production, new orders (exports), new purchases (imports), unfinished or unfulfilled orders, cost of raw materials and supplies, manufactured products or provided services, employment, balances of finished goods, as well as expectations and/or forecasts for business activities in the future.

In the first quarter, both indexes were in a downward trend following the aforementioned BSI results. The manufacturing BAI sharply dropped, remaining in the positive zone, though (59.1 points; -5.1 points for the quarter). On the other hand, the service sector BAI went into the negative zone, although its decline over the reported period wasn’t as big as in the manufacturing sector (48.5; -2.6 points). What has driven these changes? Let’s take a look at each BAI more closely.

Differently directed BAI of manufacturing sectors

The March survey showed that the decline in the manufacturing BAI (compared to December) was driven by deteriorating conditions in the agricultural sector, the subindex of which went into the negative zone (-10.9 p.p. per quarter, to 46 points). Even though the industrial subindex also showed a decrease, it still has growth potential (-6 p.p., to 64.5 points). The construction subindex, which has taken the second place, is growing steadily (+5.8 p.p., to 63.8 points).

In terms of the size of businesses, the largest decrease was observed in micro- (-6.3 p.p. by December, to 58.3 points) and medium-sized (-5.9 p.p., to 62.6 points) businesses. Small businesses didn’t show significant changes, remaining at their lowest level (-0.2 p.p., to 57.5 points).

The study shows that in the agricultural sector, all indicators slipped into the negative zone. The most dramatic was a price decline for manufactured products (a price increase in 14% of cases and a decrease in 43% of cases) that happened against the backdrop of a serious price increase for raw materials (increasing in 62% of cases and decreasing in 14% of cases). On top of that, the sector reported problems with exports (domestic sales were going relatively well, although below the normal of 50 points), an increase in unfulfilled orders, increased delivery time, forced staff reduction, as well as pessimism toward the short-term future.

In the industrial sector, the subindex was also pushed down by the price factor as prices of manufactured goods fell behind price increases for raw materials. All other indicators weren’t that dramatic, but a slight increase in unfulfilled orders, delivery time and finished product balances is a bit alarming. Among the obvious advantages are an increase in new orders and positive expectations.

The construction sector is doing pretty well. Prices for manufactured products and production itself either increased or remained the same. Moreover, prices for raw materials didn’t surge here as fast as in the agricultural and industrial sectors. However, an increase in incomplete orders (below the norm of 50 points) is visible, causing some concerns.

2. Prevailing pessimism in the service sector BAI

As we mentioned before, the service sector BAI, calculated based on the March survey, went into the negative zone (48.5 points) driven by the service sector subindex, which had decreased for two quarters in a row (-2.8 p.p. by December, to 46 points). The sector was also affected by pricing problems as procurement prices and business expenses grew faster than prices for the services it provided. Even though the volume of services provided and new orders decreased, entrepreneurs tried to fulfill their obligations on time. No serious employment problems were observed.

The second component of the service sector BAI – the subindex of wholesale and retail trade – is still in the positive zone, despite a slight decrease (-0.6 p.p., to 52.7 points). The sector reported a slight increase in delivery time and smaller inventories. Nevertheless, sales and new orders slightly increased. Even though the gap between procurement and selling prices wasn’t big, prices for manufactured goods and services surged slower than prices for raw materials, sometimes putting profitability into question. All in all, the situation in trade is better than in agribusiness and the service sector.

In terms of prospects, the trade and service sectors are quite positive, although this is not as pronounced as in the industrial and construction sectors.

The study shows that micro-businesses have been experiencing the longest period of decline in the service BAI (-3.1 p.p., to 46.8 points). Small businesses are showing some stability (-1.8 p.p., to 52.5 points), while medium-sized businesses feel much more confident, and this confidence is still growing (+1.5 p.p., to 60.7 points).

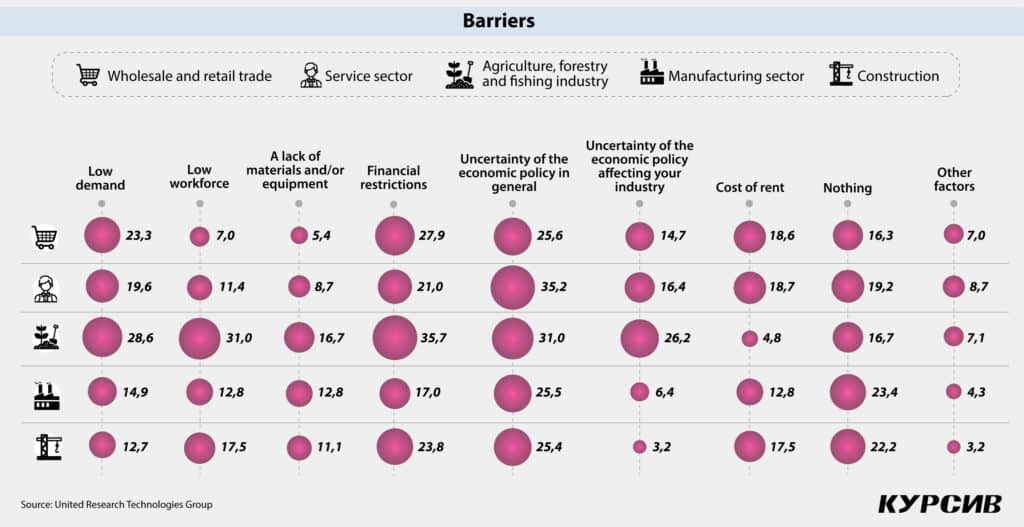

Barriers: focus on economic policy, finances and demand

The Business Barrier Index (BBI) reflects respondents’ assessment of the main factors that hinder their business activities. The latest survey showed the index surged to 122.9 points (+0.7 p.p. for the quarter). When the index is above 100 points, this indicates the presence of significant pessimism in assessing the obstacles hindering business development.

It is worth noting that in the first quarter, there were multidirectional dynamics. Even though factors such as «labor/staff shortages» (12.8% of responses), «uncertainty of economic policy affecting the respondent’s sector» (14.2%) and «rental costs» (16.8%) were still in place, they no longer had a strong negative impact, decreasing by 15-19% over the quarter. On the other hand, fewer SME representatives said that nothing bothered them (-22%, to 19%).

At the same time, factors such as «uncertainty of economic policy» (taxes, public spending, regulation, the National Bank’s policy, etc.), «financial restrictions,» «insufficient demand in the domestic market,» and «shortage of raw materials/materials/equipment» have worsened by 30.2%, 24%, 20% and 9.2%, respectively. The latter factor showed the largest quarterly increase (1.5 times) compared to other barriers (6% to 18%).

The IBI was off the charts in the agriculture sector (161.4 points), with a significant quarterly increase, which was also confirmed by BSI and BIA studies. If we omit such a factor as «uncertainty of economic policy,» which is the number one barrier for all sectors under consideration (in the range of 25.4% to 35.2%, depending on the industry), the biggest challenges for agribusiness are finances, employees, demand and uncertainty of economic policy in the sphere of agriculture itself (26–36%). Interestingly enough, the latter indicator (public regulation in a particular industry) showed a significant quarterly decline in all other sectors (3.2% to 16.4%, depending on the sector), while in the agricultural sector, it soared to 26.2%.

The service and trade sectors have also reported a significant increase in barriers (128 and 120 points, respectively). Financial issues, demand and rent were the most important barriers for them (19% to 28%) along with overall economic policy in the country. Industry and construction felt relatively good (96.8 and 140.8 points, respectively), often saying that nothing bothers them (22–23%). Nevertheless, both sectors mentioned some financial problems (17% and 23.8%, respectively).

Micro-businesses reported the largest number of barriers: 129.8 points compared to an average 106 points for small and medium-sized enterprises.

The North Kazakhstan region reported the highest rate of stress (231.1 points), especially over demand, followed by the Pavlodar (186 points), Jambyl (183 points) and Aktobe (175 points) regions. The three regions were concerned about economic policy.

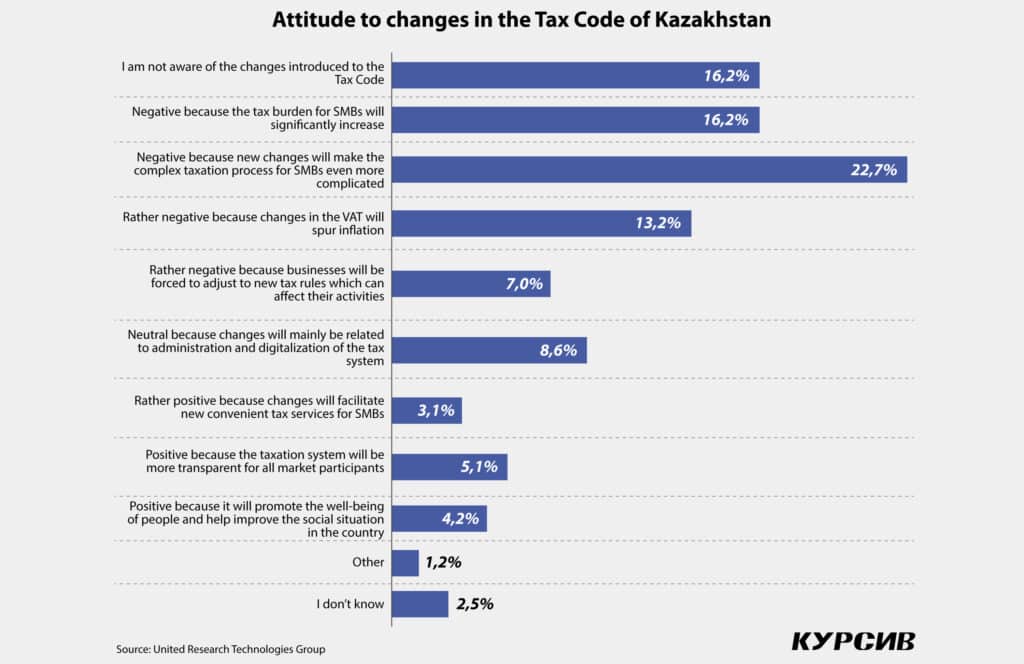

Growing tax concerns

During our survey, we asked SMEs about their attitude toward changes in the Tax Code. The expected increase of the VAT from 12% to 16% didn’t happen in the first quarter, though. Nevertheless, the number of negatively-minded businesses in that period increased (59% of the survey participants). Many of them said that «the changes will make the already complex taxation process for SMEs more complicated» (23%), «the tax burden on SMEs will increase significantly» (16.2%) and «changes in VAT tariffs will spur inflation up» (13.2%). At the same time, almost a fifth of respondents were unfamiliar with the changes or found it difficult to answer this question. In addition, 12.4% of answers were positive toward changes and 8.6% were neutral.

These sentiments were quite similar for all sectors and companies despite their size. For instance, pessimism prevails in the trade sector (66% compared to 53–58% in other sectors) and among micro-businesses (61% compared to 50–57%). Representatives of the agricultural (17% compared to 8–16% in other sectors) and medium-sized businesses were the most positive about future changes (17% vs 12–13%). Most neutral responses came from the construction sector (13% vs 6–12%) and small businesses (13.4% versus 6–8%).

Interestingly, enterprises with higher turnover believe that changes to the Tax Code will further complicate the already complex taxation process (25–29% of responses). At the same time, enterprises with an annual turnover of $2.4 million to $23.4 million were more often unfamiliar with the changes, while businesses with a turnover of $225,322 to $2.4 million appeared more informed.

Representatives from the Abay, North Kazakhstan and Karaganda regions were the most negatively minded toward the topic (80% of answers in each region).

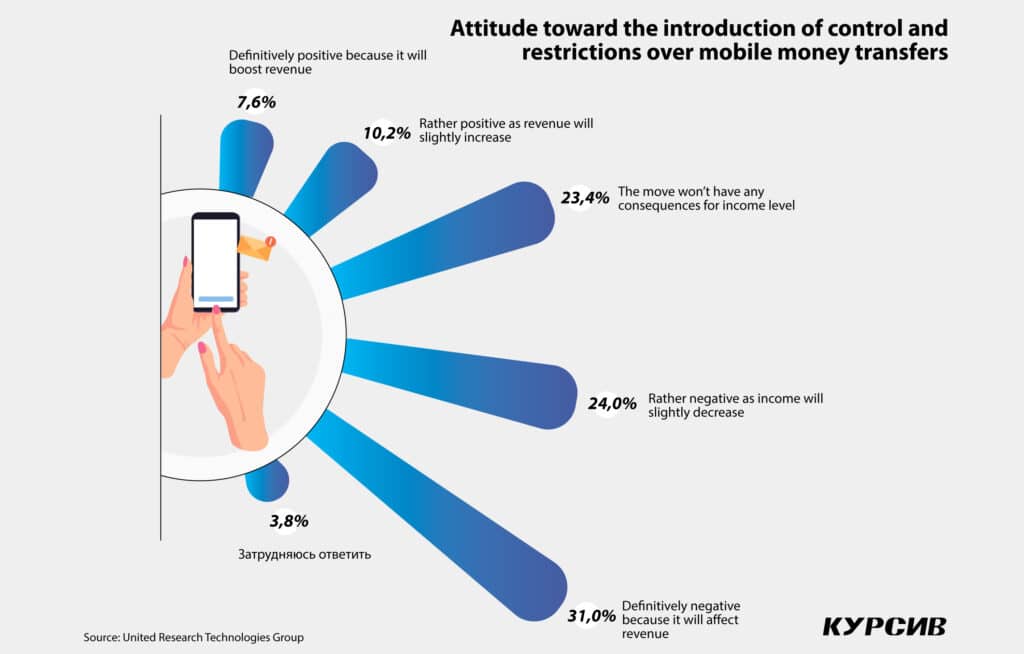

Limitation of mobile money transfers could reduce SME income

The second additional question was related to the possible impact of mobile money transfer control on SME income. This issue was painful for many respondents who believed the move would hurt their income (55%). Only 17.8% of them said that control over mobile money transfers would improve their economic situation, while 23.4% of answers were neutral.

Most respondents in the service (58%) and industrial (57.4%) sectors believe that any restrictions in this sphere will affect their income. In the agricultural sector, the situation was quite interesting as the vast majority of the sector representatives were neutral to control over mobile money transfers (41% compared to 11–27% in other sectors); they gave both the least negative responses (45% vs 49–58%) and the least positive (7% vs 15–28% in other sectors). The agribusiness attitude to the issue is probably based on lower availability of internet in many remote areas and specific ways of settlement common for the industry.

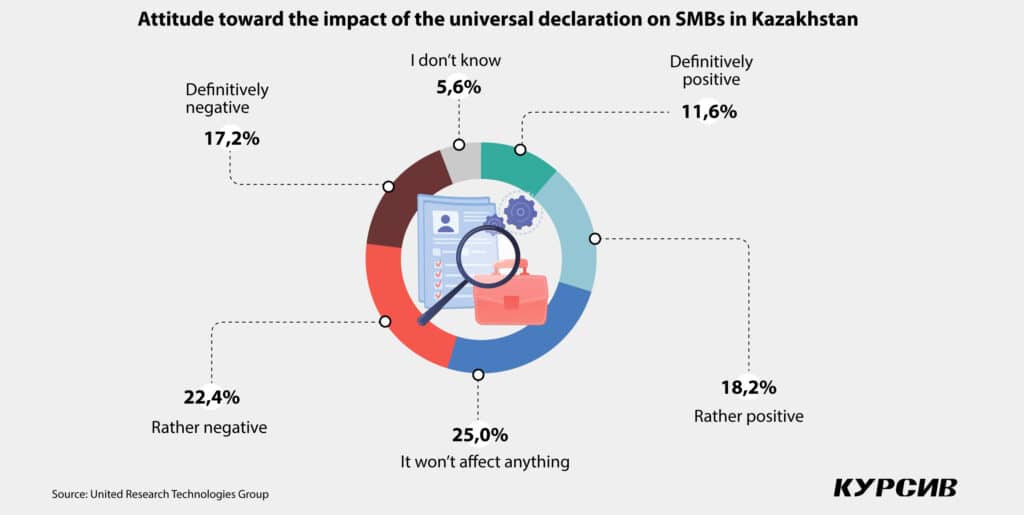

SME attitude to the universal declaration

The third additional question we asked respondents during the survey was related to the potential impact of the universal declaration on SME activities. As a result, we have received the following answers: 40% were negative-minded, mostly from micro-businesses; 30% were positive (medium-sized businesses) and 25% were neutral (mainly small businesses).

The most decisive responses were given by representatives of the industrial sector, whose answers were equally distributed between positive and negative attitudes (44.7% each), the highest rate in terms of sectors. Regionally, the most negatively inclined were respondents in the Pavlodar and Karaganda regions (60% to 64%), while businesses in the Zhetysu region were more positive (57%).

Conclusions or an SME hope barometer

As the study has shown, in the first quarter of 2024, entrepreneurs were forced to work in increased uncertainty. This uncertainty was associated not only with market challenges that began earlier (with businesses still trying to adapt to these challenges, losing profit and operating in a risky environment) but also with new regulatory requirements and natural disasters. In addition to the lack of available funds, unstable domestic demand and concerns about taxation policy, businesses now have to deal with the control over mobile money transfers and the gradual introduction of the universal declaration. Businesses tend to rely more on their own resources, reinvesting their profits. For some enterprises, first of all, for medium-sized businesses in the manufacturing industry and some representatives of the agricultural sector, development institutions might be a great source of investment. Overall, the key indexes are still in the optimistic zone due to the growth of investments. This is especially true for the industrial and construction sectors. The situation in the trade sector is rather neutral.

In terms of short- and medium-term prospects, almost all business representatives are quite optimistic as they heavily rely on investment. The business activity decline in the service and agricultural sectors is causing concerns as pessimistic sentiments in these sectors not only prevailed in the past but will prevail in the future, according to respondents’ answers. What makes the situation even worse are the floods that already affected many farms and enterprises in several regions of Kazakhstan. We believe that respondents’ opinions don’t yet reflect the impact of the natural disaster that hit about half of the country’s regions either due to a delayed effect for those who were outside affected areas or because we haven’t yet reached those directly affected by the floods. There is also a possibility that some of the respondents were surveyed before the floods, as the interview process under this survey started in late March and ended in early April.

Considering the above, we want to believe that Kazakhstani businesses will successfully cope with all the difficulties that have arisen and implement their long-term plans, leaving the pessimistic zone. However, growing barriers and uncertainty, along with natural and man-made challenges, are still posing high risks for SMEs. Many of them appear unable to deal with these challenges or their problems will be delayed for a long-term perspective without support from the government (including changes in its economic policy and improving business environment for SME) and other external sources.