Consumer confidence reaches positive zone in May in Kazakhstan

The Consumer Confidence Index (CCI) returned to the positive zone in May, after experiencing quite a noticeable decline in March and reaching the neutral zone in April. Although inflationary expectations among Kazakhstanis are below the actual dynamic, more and more respondents report cost increases of key food products, showing a more pessimistic outlook for price changes within a month. On the other hand, customer confidence in financial institutions is growing, despite more concerns over the labor market compared to April.

In this article, we are going to present the results of the 19th wave of consumer confidence research Freedom Finance Global PLC has been conducting monthly since November 2022, following the methodology developed by the United Research Technologies Group (URTG).

Positive zone

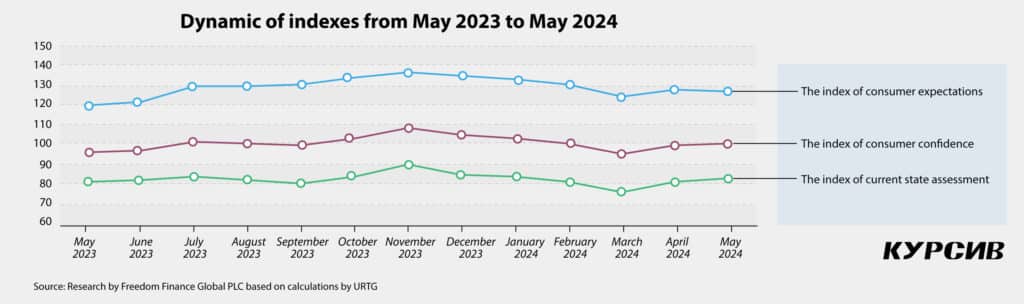

Even though the CCI dipped into the pessimistic zone, reaching 95.1 points in March, it returned to the neutral zone in April (99.4 points) and reached the positive zone later in May (100.4 points).

The current state assessment index grew by two points to 82.7 in May, while the consumer expectation index declined by 0.3 points, reaching 127.4 points. Subindexes also showed some growth in May: the index of the economic situation changes grew by 4.3 points to 72.3 and the index of favorability of conditions for major purchases increased by 1.7 points, reaching 72. Usually, they both demonstrate quite moderate increases.

In other words, the spring seasonal effect of consumer confidence decreasing (first noticed in spring of 2023) was reported in 2024 once again, exacerbated by the crisis of spring floods. However, this effect was nearly offset by June, pushing consumer confidence in Kazakhstan back to moderate optimism.

Optimism among men and young adults

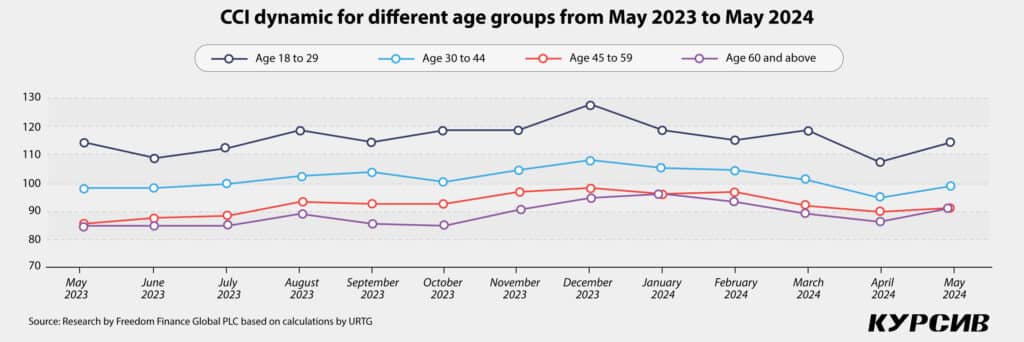

Unlike April, when both men and women showed the same level of consumer confidence (99.4 points), in May, men were much more confident (a 1.3-point increase) than women (a 0.7-point increase). That being said, consumer confidence for both men (100.7 points) and women (100.1 points) was in the positive zone.

Last month, different age groups reported an increase in consumer confidence. The biggest growth showed youth (by 1.5 points, reaching 115.7) and young adults (by 1.5 points to 100.7), which helped the latter group break into the positive zone of consumer confidence. Adult Kazakhstanis are still in the negative zone, even though they have shown moderate growth this month. CCI reached 92.3 points (grew by 0.8 points) for people aged 45 to 59 and 91.9 points (grew by 0.3 points) for people aged 60 and above.

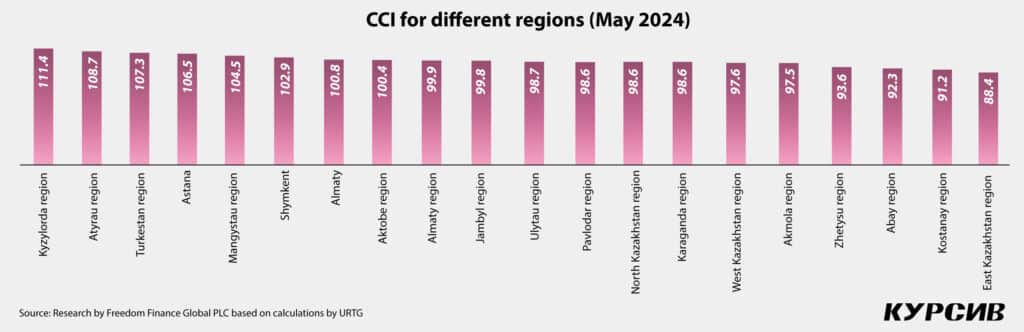

Consumer confidence returns to big cities

Eight regions have found themselves in the positive zone once again. In May, this includes Aktobe (100.4 points; -4 points), Atyrau (108.7 points, +9.1), Kyzylorda (111.4 points, +6.8), Mangystau (104.5 pints, –3.6) and Turkestan (107.3 points, no changes) regions, the capital city of Astana (106.5 points, +5.2) and the cities of Shymkent (102.9 points, –7) and Almaty (100.8 points, +1.9).

At the same time, in the Jambyl (99.8 points; –3.9), West Kazakhstan (97.6 points, –3.9) and Ulytau (98.7 points, –7.6) regions, consumer confidence slipped to the negative zone in May.

Therefore, it is safe to say that consumers in southern and western macro-regions, as well as in the big cities of Astana, Almaty and Shymkent, were more confident in May.

Disasters and inflation aren’t the highest priorities

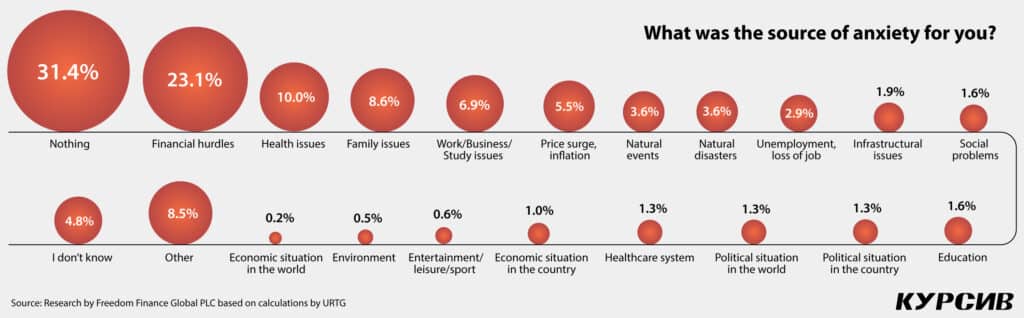

The share of people who said that nothing was bothering them during the past month increased for the first time in a long time; the rate grew by one percentage point, reaching 31.4%, which is very close to February’s rate of 31.5%.

However, the share of those disturbed by financial difficulties, lack of money and debts increased by 2 p.p. to 23.1%. Among other sources of worries were health (grew by 1.4 p.p. to 10%), family and household issues (grew by 0.7 p.p. to 8.6%) and matters related to work, study and business (increased by 0.7 p.p. to 6.9%).

Natural disasters and natural events that bothered Kazakhstanis in March and April were less annoying in May, decreasing by 7.4 p.p. from 10% to 3.6% and by 1.4 p.p. from 5% to 3.6%, respectively. Inflation and price surge (5.5%), which were among the top three concerns for Kazakhstanis last year, haven’t been as acute in 2024 so far, dropping out of the top five reasons to be worried about.

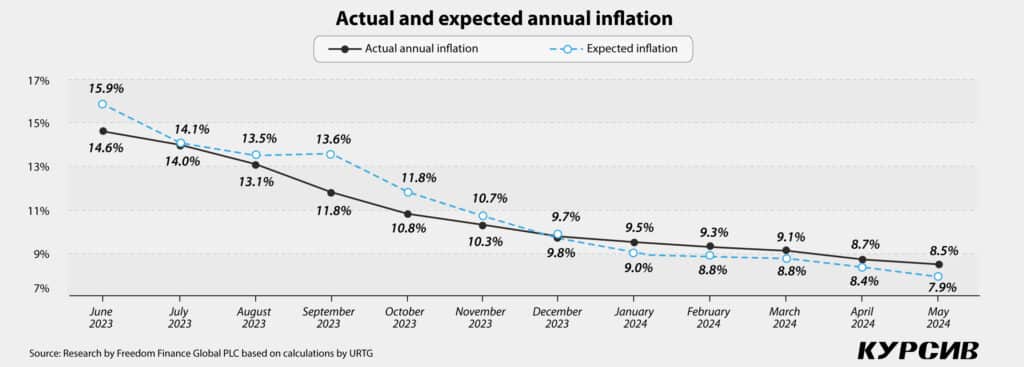

Declining inflation

According to the Bureau of National Statistics of the Republic of Kazakhstan, annual inflation has continued to slow down since September 2023, reaching 8.5% in May, a 0.2% decline compared to April (8.7%). More than half of Kazakhstanis (55.1%; –1.2 p.p.) still believe that the current price surge is higher than before. This is the lowest point since November 2022, the starting point of this research. Every fifth Kazakhstani (22.9%, +0.2 p.p.) believes that prices are surging at the same rate as before, while one in ten (11.4%, +1.5 p.p.) thinks that price increases are slower than last year.

Monthly inflation reached 0.4% in May, a 0.2% decline compared to April (0.6%). Last month, fewer consumers reported a sharp price surge for goods and services (–3.7 p.p. to 39.7%) than in April. On the other hand, the share of those who reported moderate growth has grown by 2 p.p. to 33.2%. Nevertheless, nearly two-quarters of Kazakhstanis (73%) said that the price surge in April was higher.

Below actual figures

Expected annual inflation continues to go downward, reaching 7.9% in May 2024 (8.4% in April), which is lower than the actual annual inflation estimated by the Bureau of National Statistics at 8.5%.

Like April, expectations in May were lower than the actual dynamic of inflationary processes with a ratio between expected inflation and perceived inflation at 0.91.

In May, residents of Astana and Almaty were a bit more pessimistic about inflationary processes (0.92 and 0.97, respectively) compared to average estimates for the entire country. It is worth noting that the country’s population as a whole expects some decline in price surge.

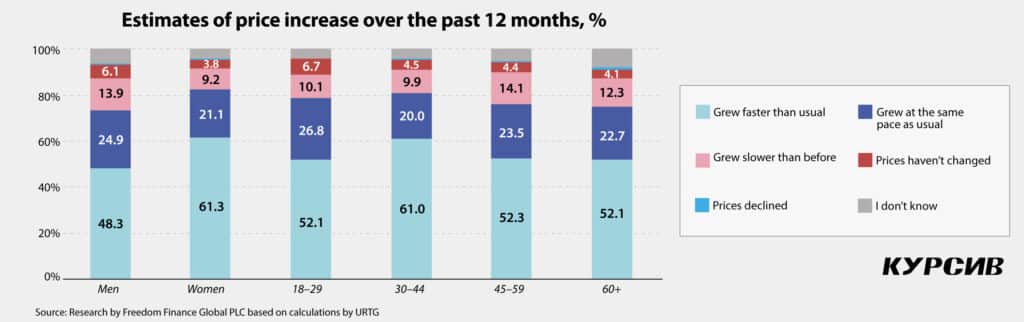

Persisting gaps

The gender gap in evaluation of price surges for goods and services was still quite big in May. Women (43.7%) more often than men (35.3%) reported sharp price surges over the past month, even though both gender groups reported price surges less often in May (–4 and –3.3 p.p., respectively). However, women more often estimated annual price fluctuation negatively (+2.2 p.p. 61,3%), whereas the number of those reporting rapid price surges among men dropped to 48.3% (–4.9 p.p.).

In May, almost all age groups were a bit more positive in their evaluation of monthly price changes. However, youth (–5.3 p.p.) and people from the late-middle-age group (–6.1 p.p.) were those who reported sharp price surges less often in May. On the contrary, people aged 30 to 44 were the only age group (+3.5 p. p. to 61%) that reported being annoyed with soaring prices.

Sharp price surges month-on-month were reported by residents of the Abay (47.2%) and Akmola (47.4%) regions. Respondents in the Ulytau (69.2%) and Abay (66.8%) regions reported slightly fewer moderate estimates year-on-year.

Stable top ten products and services

The top ten list of goods and services with the fastest-growing costs didn’t change. It still includes the cost of key food products and utilities (the 9th place), which grew the most since January 2024, according to respondents.

In May, almost all goods and services in the top 10 became more expensive, except for flour (–1.2 p.p., to 21%) and eggs (–1.5 p.p. to 17.3%). Currently, consumers report a higher rate of price surge for vegetables and fruits (+2.2 p.p. to 31.9%), bread and bakery products (+1.9 p.p. to 31.9%), as well as sugar and salt (+1.9 p.p. to 22.6%).

Consumers reported less significant growth for products and services such as utilities (+1.5 p.p. to 16.3%), grains and pastries (+1.3 p.p. to 21.8%), meat and poultry (+1.1 p.p. to 35.8%), milk and dairy (+0.9 p.p. to 33%) and vegetable oil (+0.1 p.p., reaching 16%).

Among products outside of the top ten, cheese and kielbasa (+1.1 p.p. to 11%), tobacco and cigarettes (+1 p.p. to 8.1%) reported the highest price surge; household detergents (–1 p.p. to 7.3%) and confectionary (–1 p.p. to 7.2%) reported there opposite.

Stable forecasts

In May, predictive assessments of price changes for goods and services in the prospect of a month were quite stable with a slight increase among those who anticipated stronger growth (+0.2 p.p. to 16%). At the same time, half of Kazakhstanis (48.5%) continue to wait for a significant price surge within the next month.

The majority of respondents reported more stable expectations for the year: 39.9% expect a price surge at the level of last year (+3.8 p. p.), while the number of those expecting a sharp price increase declined (–1.3 p. p. to 19.2%).

Worries about the future

In May, the gender gap in goods and services price change evaluation within the next month increased after a significant drop in April. Women are more likely to expect a sharp price increase (+1 p.p. to 16.8%) compared to men (–0.6 p.p. to 15.1%). This is also true for expectations within the year: women (+0.3 p.p.) are more critical than men (–3.1 p.p.) when it comes to price changes.

Young adults are the only age group expecting a sharp price surge within a month – 18.6% (+2.6 p.p.). They’re also the most pessimistic group in their assessment of price changes within the year (20.2%), although in May this rate slipped by 1.2 p.p.

The geographic slice shows that residents of the Abay (29.5%), West Kazakhstan (24%) and Ulytau (24.2%) regions were the most concerned with price surges in the prospect of a month, whereas people in the Abay (25.6%), West Kazakhstan (33%), Kyzylorda (28.7%) and Ulytau (25.8%) regions reported the highest concern over price surges within the year.

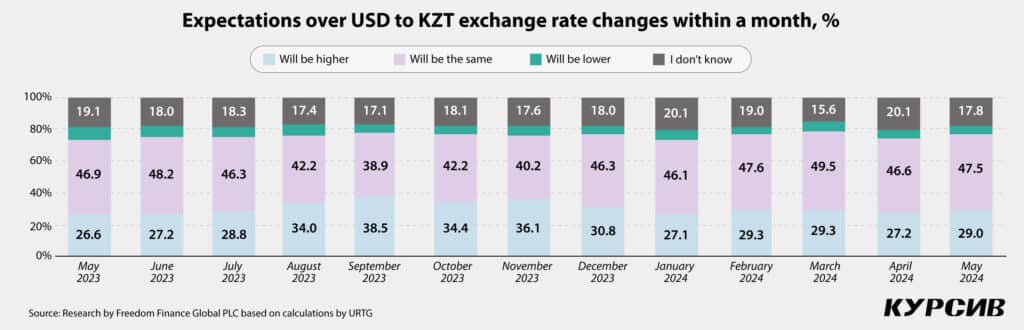

Less confidence in foreign exchange projections

Optimistic expectations about the US dollar in the perspective of month and year emerged in February and March and continued in May. In that month, Kazakhstanis were a bit more likely to expect the USD to KZT exchange rate to grow (by 0.7 p.p. to 48.9% and by 1.8 p.p. to 29%, respectively). These expectations were quite stable in May in the prospect of the month, as the share of those who believed nothing would change about the dollar was growing (+0.9 p.p. to 47.5%).

Concerning dollar exchange rate changes within the year and a month, men (51.7 and 30.6%) and youth (59.4 and 31.1%) were among those who believed in USD exchange rate growth the most in May. The youth have also shown the biggest decline in upward outlooks in the perspective of the year (–3.7 p.p.). Residents of the Aktobe region (62.4%, +9.5 p.p.) are the most optimistic about the USD exchange rate within the year, whereas people in the Mangystau region (39.1%, +6.2 p.p.) expect some changes within a month.

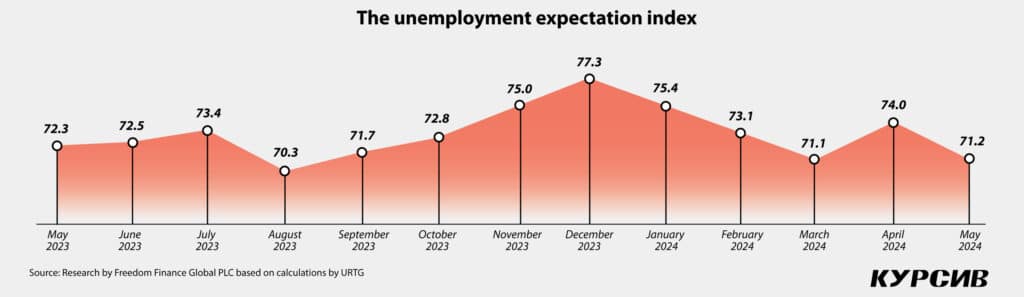

Worries about the labor market

In May, unemployment expectations slipped by 2.8 points from 74 to 71.2 back to its rate in March, although it showed some growth in April. These fluctuations were driven by those who expect an increase in unemployment (+0.7 p.p. to 42%) and those who think the rate would stay the same (+1.8 p.p. to 34.5%).

Men were worried about jobs in May as much as in April (42.3%, –1 p.p.), although women accounted for a bigger growth of concern over the labor market in May (41.7%, +2.2 p.p.). People aged 45 to 59 once again showed the most pessimistic estimates (46.1%, +1.7 p.p.), whereas retired people are gradually catching up, also showing an increase in pessimism (+2.4 p.p. to 41%).

The regional slice showed that the labor market was a pain in the neck primarily for residents of the Atyrau (64.2%, +6 p.p.), Mangystau (51.9%, –4.8 p.p.) and Turkestan (59.4%, +4.3 p.p.) regions. People in the Kyzylorda region (17.6%) and Shymkent (17.7%) were more positive in their evaluation of the labor market, expecting a decrease in unemployment.

No appetite for loans

In May, the number of those ready to take a loan shrunk by 1.3 p.p., reaching 19.2%. This decline was driven by men (–2.3 p.p. to 20,2%), whereas women’s approach to the issue was more stable (–0.5 p.p. to 18.2%). The decrease in the number of those who planned to take a loan was also driven by people aged 18 to 29 (–3.9 p.p. to 21.9%) and people aged 30 to 44 (–1.4 p.p. to 23.6%). In terms of regions, respondents from the Zhetysu region (28.3%) and Shymkent (28.5%) reported a bigger appetite for loans. Residents of the Kostanay (10.6%) and Abay (11.3%) regions reported the opposite.

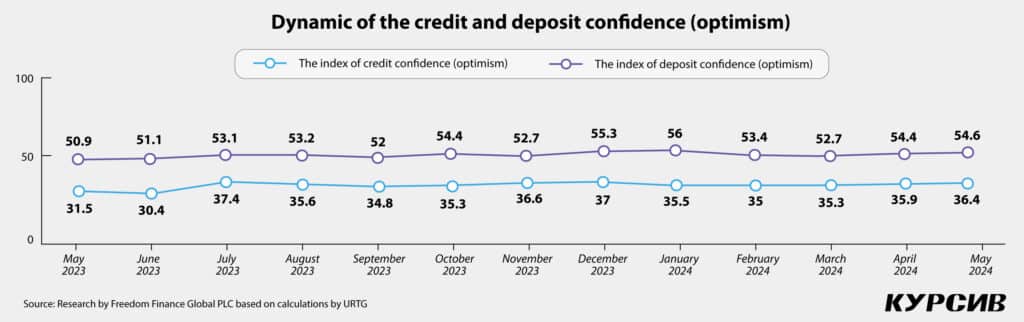

Credit confidence (credit trust) grew by 0.6 points, reaching 36.4% in May, thanks to an increase in those who believe the current moment is neither bad nor good for taking loans (+1.3 p.p. to 26.5%). However, the share of people believing that it is not the right time to borrow money is still quite high (47.7%, –1.5 p.p.).

Both men (+0.6 points to 35.4 points) and women (+0.5 points to 37.3) showed an increase in borrower confidence. In terms of age, the youth (+1.6 points to 37.7) and the retiree (+2.6 points to 36.5) categories were quite confident to borrowing, whereas people aged 45 to 59 reported a decline in borrowing confidence (–1.7 points to 34.6). Residents of the capital city Astana (41.1 points) and the Turkestan region (41) showed the highest rate of borrowing confidence in May. The opposite tendency was reported by respondents in the Abay (32.9 points) and Ulytau (31.4) regions.

Deposit trust also showed weak growth in May (by 0.2 points to 54.6), driven by optimistic (by 0.3 p.p.) and moderate (by 1.6 p.p.) estimates of money-saving practices. More than a third of Kazakhstanis (34.4%, +0.3 p.p.) believe that it is a good time to save money using banking deposits.

Deposit confidence has been equally growing for both men (+0.2 points to 53.7) and women (+0.2 points to 55.5), primarily driven by the youth (+1.8 points to 61.9) and people aged 45 to 59 (+0.7 points to 52). The highest rate of deposit trust showed residents of the Atyrau region (60.9, –1 point) and Astana (59.5 points, +4.6); the lowest – respondents in the Abay (47.6 points) and West Kazakhstan (48.6 points) regions.

A bit more calm but still stressful

More than half of respondents (53.9%, +1.4 p.p.) said they were surrounded by calm sentiment as the latter was growing in May (+2.4 п. п.).

The share of those who believed that they were surrounded by concerns declined in May (–2 p.p.).

Women have traditionally shown a higher rate of anxiety (43.9%) than men (36.5%), although their stress slipped a bit more in May (–2.3 p.p.) than what men reported (–1.7 p.p.).

Kazakhstanis aged 45 to 59 reported the highest level of anxiety (45%, –3.4 p.p.), pointing out there was a mood of anxiety around them. In the regional slice, the Atyrau regions showed the highest level of anxiety (50.8%), whereas the Zhetysu regions reported the lowest (31.5%).

On the other hand, the number of those who didn’t deal with stress in May also declined (–2.3 p.p.). Nearly one in two Kazakhstanis said that there was no stress in April for them (43.2%). However, more than half of respondents (55.1%) said they dealt with stress at least on one to two occasions per month. The share of those facing stressful situations several times per week also grew (+1.9 p.p. to 11.7%).

The situation stabilized in the gender slice in May, though. Men reported a 2.9 p.p. decline (to 8.6%) in their daily stress, while women started noticing stressful situations daily or almost daily (+1.4 p.p. to 11.5%). In terms of age, people aged 30 to 44 (61.8%, +3.6 p.p.) and young Kazakhstanis aged 18 to 29 (61.1%, +4.9 p.p.) dealt with stress most often. People dealing with stress primarily live in Almaty (62.6%), Astana and Shymkent (64.2%). Residents of the Pavlodar region reported the least stress (46.3%).

Back to optimism

After plummeting in March and entering the neutral zone in April, the CCI came back to the positive zone in May 2024. It made it thanks to an increase in subindexes such as the index of economic changes and the index of favorability of conditions for major purchases.

This month, residents of big cities that left the positive zone in the spring have returned to consumer optimism (except for Shymkent). Young adult Kazakhstanis, balanced in the neutral zone, have also entered the zone of consumer confidence.

In May, Kazakhstanis less often reported sharp price surges in the prospect of both month and year. However, projected estimates for the future month have become a little bit more pessimistic, whereas price surge expectations in the prospect of the year are still stabilizing with moderate estimates. At the same time, almost all products from the top ten staples reported a slight growth in price change expectations.

Even though the number of those who are eager to take a loan decreased, the credit and deposit confidence is still growing, which proves the stable condition of the economy, although concerns over the labor market have slightly risen. The overall anxiety level dropped in May, as inflation and natural events and disasters were less annoying for the vast majority of Kazakhstanis, although people reported more stress in the current month.