How many billions of dollars does Kazakhstan have to pay and to what countries

As of April 1, 2024, Kazakhstan’s external debt amounted to $162.5 billion, $0.2 billion less than at the start of the year, according to the National Bank.

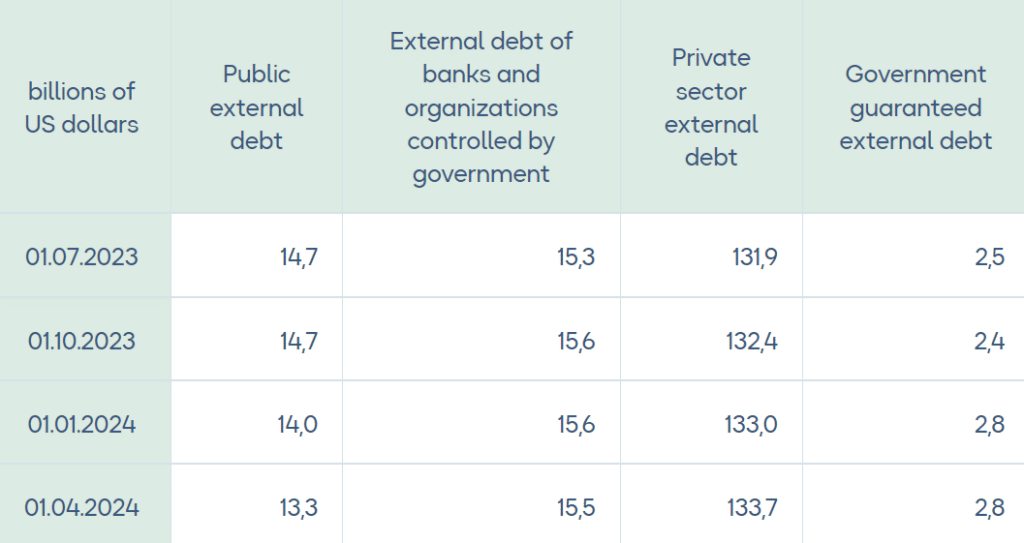

This overall figure includes $13.3 billion in public external debt, $15.5 billion in external debt of banks and organizations controlled by the government, $2.8 billion in government-guaranteed external debt and $133.7 billion in private sector external debt.

The Netherlands ($42.7 billion), Russia ($12.9 billion), the U.K. ($12.4 billion), the U.S. ($11.7 billion) and France ($11.1 billion) are the five largest investors in Kazakhstan, followed by China ($9.5 billion) and Bermuda ($9.3 billion).

Kazakhstani industry and mining account for more than $80.9 billion of foreign borrowings, the financial and insurance sectors for $17.7 billion and the processing industry for $13.4 billion. Additionally, significant amounts have been allocated to the public governance and defense sectors ($11.2 billion), the automobile industry ($10.9 billion), and scientific and technical activities ($10.5 billion).

About $116 billion was borrowed in USD, $9.3 billion in tenge, $5.7 billion in euros and $4.1 billion in rubles.

By the end of 2024, Kazakhstan has to pay about $32.6 billion, including $8.8 billion in interest and $6.1 billion in the form of goods and services.

In 2025, the total payments are expected to be $32.6 billion, including $11 billion in interest. More than $8 billion of the debt will be paid in goods and services. Overall, about a third ($60.9 billion) of the $162 billion external debt is expected to be paid with the help of goods, works and services.

Due to foreign exchange rates and cost changes, the external debt has declined by $500 million since January 2024. However, the actual decline in the debt was just $200 million because of a $300 million increase in balance transactions.

More than 88% of the borrowings are long-term external debt, which, on the one hand, can minimize risks of liquidity and on the other hand, gives more power to overall market conditions that can affect debt serving.

In terms of financial tools, the external debt structure mainly includes loans and lending facilities from non-residents (74.2%) and debt securities held by non-residents (8.3%). In 2023, Kazakhstan’s GDP amounted to $259.7 billion, with its external debt accounting for 62.5% of this sum, according to the World Bank.