In June, the Consumer Confidence Index (CCI) continued to grow after transitioning into the positive zone in May. The pessimism toward inflationary expectations is growing, although consumers reported increased prices primarily for internet and mobile communication services and for domestic services. Forecasts for the labor market are still quite moderate, while credit and deposit confidence continue to grow.

Here we present the results of the 20th wave of consumer confidence research Freedom Finance Global PLC has been conducting under the United Research Technologies Group’s methodology every month since November 2022.

Strengthening of an «optimistic» trend

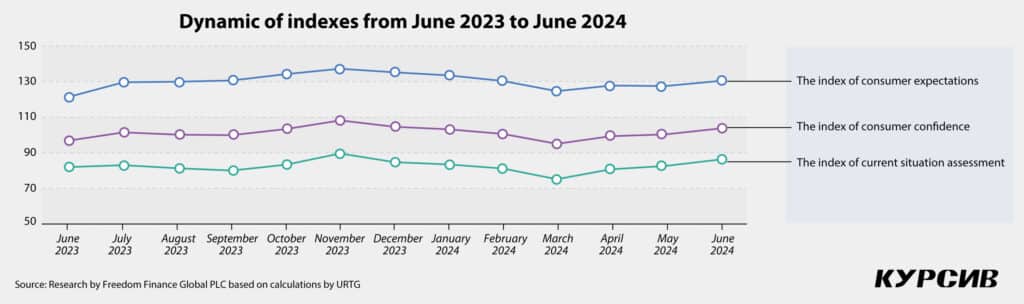

Even though the CCI dipped into the negative zone in March, it grew in the other two spring months (by 99.4 points in April and 100.4 points in May). In June, this positive trend led the indicator to 103.7 points (+3 points). The index of current situation assessment showed a greater growth in June (by 3.5 points to 86.2 points), whereas the index of consumer expectations rose by just 2.9 points to 130.3.

The growth of the CCI was primarily driven by subindexes. For instance, Kazakhstanis were more positive toward assessing the current economic situation (+3.9 points) and conditions favorable for major purchases (+3.7 points). The June survey also showed that Kazakhstanis were prone to more positively assess their personal and economic perspectives: the personal finance index and the index of expected changes in the economic situation in the short term showed significant growth (+3.2 points and +3.1 points, respectively), although the assessment of the economic situation in the long term was rather moderate in June (+2.3 points).

The June survey was one of the most «optimistic» surveys in the entire history of the research from a consumer confidence point of view. Only in November and December 2023 was this rate higher than in June 2024 (108.2 and 104.7 points, respectively). Consumer confidence is quite common for summer months (according to consumer confidence surveys in other countries), although in the summer of 2023, Kazakhstanis demonstrated rather moderate evaluations.

Adult consumers remain in the negative zone

Despite some gender differences in consumer confidence in June, both men and women stayed in the positive zone with 102 points (+1.3 points) and 105.2 points (+5.1 points), respectively. Men were prone to over-assess the current situation (86.6 points vs. 85.8 points for women), whereas women reported higher consumer expectations (134.8 points vs. 125.3 points for men).

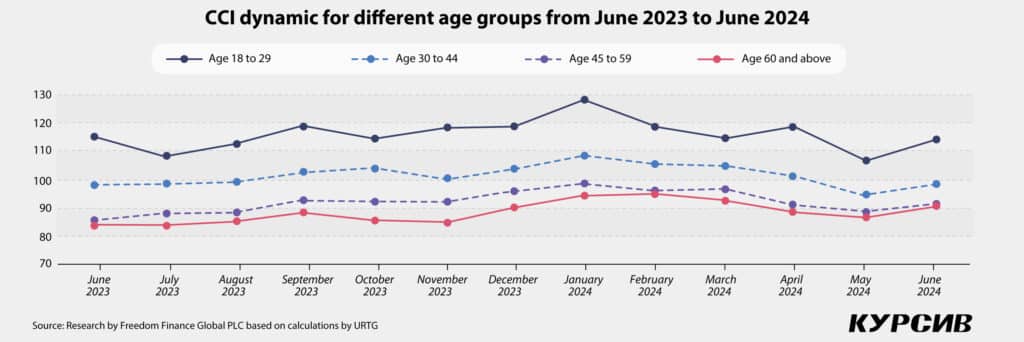

The positive attitude was common for all age groups in June, although only youth (115.8 points) and young adults (105.5 points) were in the positive zone of consumer confidence. Still, youth showed the least increase in optimism (+0.1 points) compared to previous surveys. On the other hand, young adults and consumers of retirement age reported the highest growth of consumer optimism (+4.8 points and +5.1 points, respectively) in June. Retired people showed their optimism for the first time since February 2023 (+96.9 points), which didn’t help, though, as they remained in the negative zone. Consumers of early retirement age were a bit less optimistic (94.8 points, +2.5 points).

More than half of Kazakhstani regions reported optimism

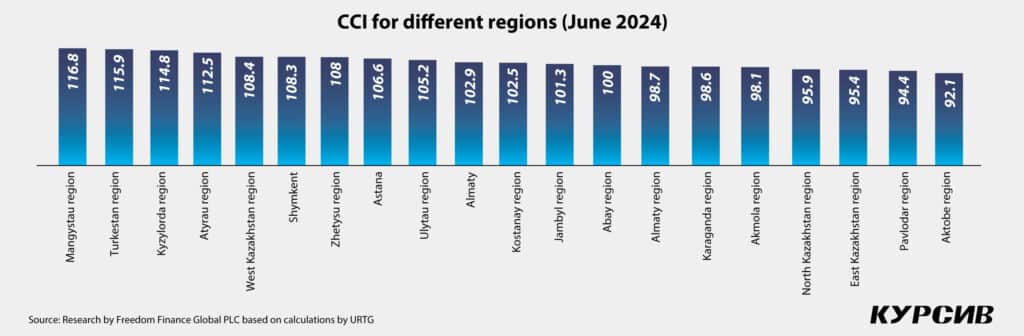

The increase in consumer confidence was noticeable not only in terms of index and subindex growth but at the regional level as well. Unlike previous months, 13 Kazakhstani regions were in the positive zone in June. Along with the western macro-region, which has been demonstrating optimism since the start of the research, Astana (106.6 points, +0.1 points), Almaty (102.9 points, +2.1 points) and Shymkent (108.3 points, +5.3 points), as well as the Jambyl (101.3 points, +1.5 points), Zhetysu (108 points, +14.4 points), Kyzylorda (114.8 points, +3.4 points), Turkestan (115.9 points, +8.6 points), Ulytau (105.2 points, +6.5 points), Abay (100 points, +7.7 points) and Kostanay (102.5 points, +11.3 points) regions also reported consumer confidence.

Even though optimistic assessments dominated the country at the regional level, four regions reported a decline in consumer confidence in June. The Aktobe region went into the pessimistic zone after a previous spike in optimism (92.1 points, -8.3 points), the Almaty region (98.7 points, -1.2 points), along with the traditionally pessimistic Pavlodar (94.4 points, -4.2 points) and North Kazakhstan (95.9 points, -2.7 points) regions.

Money issue

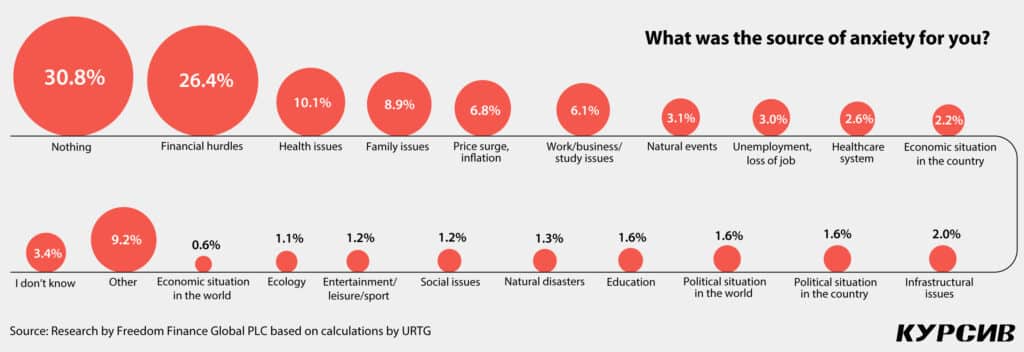

Less than a third of Kazakhstanis said that nothing bothered them in June, a slight decrease from the May survey (30.8%, -0.6 p.p.).

The share of those worried about financial hurdles, such as lack of money, debts or no money to pay them off, grew by 3.4 p.p. to 26.4%. At the same time, Kazakhstanis once again became more annoyed by inflation and price surges, which entered the top five causes of concern in June (6.8%, +1.3 p.p.).

The most popular concerns—bigger than inflation or price and tariff increases—were health (10.1%, +0.2 p.p.) and household issues (8.9%, +0.3 p.p.).

Furthermore, Kazakhstanis have become more concerned about the healthcare system (2.6%, +1.3 p.p.) and the economic situation in the country (2.2%, +1.2 p.p.), showing less concern over natural events (3.1%, -0.5 p.p.) and disasters (1.3%, -2.2 p.p.).

The slowing trend continues

According to the Bureau of National Statistics of the Republic of Kazakhstan, annual inflation continues to decline, reaching 8.4% in June (0.1% year-on-year).

The share of Kazakhstanis believing that the price surge in the prior year was higher than before decreased once again (52%, -3.1 p.p.), beating the record of the previous month, which was the most optimistic in terms of inflationary processes assessment. More than a quarter of Kazakhstanis believe that the tempo of the price surge hasn’t changed (26.7%, +3.8 p.p.).

Monthly inflation in June was the same as in May (0.4%). Consumers less often reported significant (39%, -0.7 p.p.) and moderate (32.3%, -1 p.p.) price surges for goods and services over the past months, although about a quarter of Kazakhstanis (24.8%) described that surge as insignificant or didn’t notice it at all.

Increase in inflationary expectations

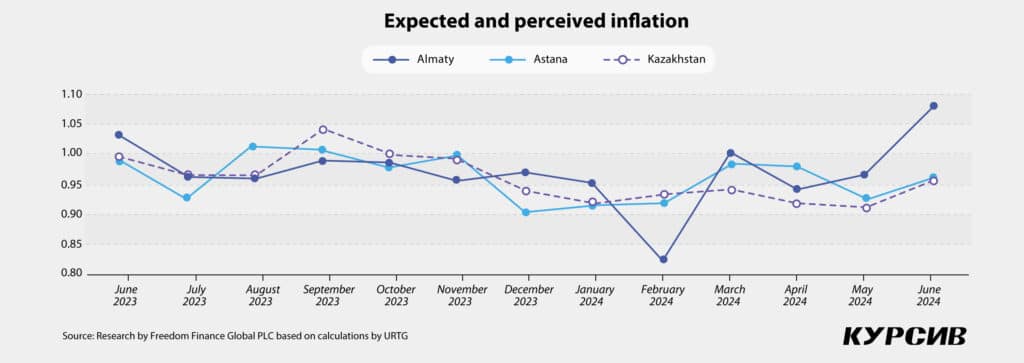

Expected annual inflation grew for the first time in June, reaching 8.2% (+0.3 p.p., compared to 7.9% in May), causing a 0.96 p.p. increase in the ratio between expected inflation and perceived inflation (0.91 p.p. in May).

People’s expectations are still below the actual dynamic of inflationary processes, with a slight increase in pessimistic evaluations. Speaking about regional differences in inflationary expectations throughout the country, we noticed a significant increase in inflationary pessimism in Almaty (+1.08 p.p.), whereas residents of Astana mainly followed the overall trend of inflationary expectations in the country (+0.96 p.p.).

Young adults expect growth

Even though the gender gap in assessments of good and service price changes over the past month is shrinking, it is still high. Women (41.5%) more often than men (36.6%) report price surges over the past month, although their share has shrunk (-2.2 p.p. for women and +1 p.p. for men). In terms of the annual assessment of price changes, the share of women reporting a sharp price surge declined (56.5%, -4.8 p.p.) more than men (47%, -1.3 p.p.).

In terms of a month perspective, there were no significant changes in the evaluation of the price change dynamic—the youth (-0.9 p.p., to 33.2%) and the retired (-3.3 p.p., to 39.5%) tended to give quite moderate assessments to those changes, unlike other age groups. In a year-wise perspective, only retired people changed their assessments of price increases to more pessimistic (+2.2 p.p., to 54.3%), although young adult Kazakhstanis are still the most pessimistic group in their assessment of price surges.

From a regional perspective, residents of the Abay (48.3%, +1.1 p.p.) and Ulytau (50.5%) regions were the ones who reported the sharpest price increase in June month-on-month. People living in the Ulytau region also reported a less moderate assessment of price surge year-on-year (65.3%, -3.9 p.p.).

Kazakhstanis report surge in prices for internet and mobile communication services

Even though the group of key staple products and utilities that reported the highest price increase nearly didn’t change, many Kazakhstanis said in June they had observed soaring costs for internet and mobile communication services (12.1%, +7.5 p.p.).

Moreover, many respondents pointed out a price increase for products such as meat and poultry (38.1%, +2.3 p.p.), pharmacy products (6.2%, +2.6 p.p.) and consumer services (4%, +2.1 p.p.). At the same time, the Bureau of National Statistics reported a 13.6% increase for barbershops and other personal care services, which has become one of several service categories that reported the highest surge.

On the contrary, respondents were less concerned in June about increases in prices for bread and bakery products (24.6%, -7.2 p.p.) as well as sugar and salt (18.7%, -3.9 p.p.), flour (17.4%, -3.7 p.p.), eggs (15.3%, -2 p.p.) and vegetable oil (13.1%, -2.9 p.p.).

Expecting (a slight) growth

The trend of correcting forecasts toward less moderate assessments continued in June – the share of those expecting a significant price surge next month was growing (49.5%, +1 p.p.), driven by the increasing number of Kazakhstanis anticipating a moderate price increase (33.5%, +0.9 p.p.).

Predictive assessment in the perspective of a year is stabilizing – 41.8% of respondents expect price increases to be the same as last year (+1.9 p.p.), while the share of those anticipating a more rapid price surge has also risen (+1.6 p.p., to 20.9%).

Price-related concerns

Unlike all previous research waves, the June survey revealed a significant shift in gender differences: women, who traditionally expect a higher price surge, in June, were more optimistic (15.8%) than men (16.3%) in a month perspective. However, in a year perspective, women continue to be more pessimistic toward price dynamics (21.4%) than men (20.2%).

Young adults aged 30 to 44 are the most pessimistic group both in the year (21.6%) and month (17.7%) perspectives in their predictive assessment of price surges. The youth (aged 18 to 29) are less pessimistic (23.5%) in assessing price dynamics in the next year.

The regional analysis showed that residents of the Atyrau (30.8%) and West Kazakhstan (31.7%) regions were more concerned about price surges next year, whereas people in the Ulytau region were the most annoyed with price surge expectations next month (25.2%).

Soaring devaluation expectations

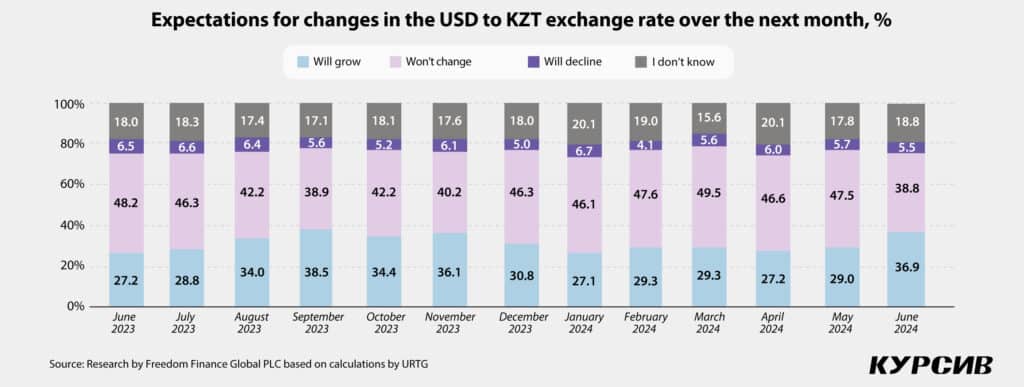

The June survey showed an increase in devaluation expectations in both month and year perspectives, a shift from a stabilizing trend that had been reported since February 2024. In June, Kazakhstanis’ assessment of changes in the exchange rate between the USD and the tenge was more polarized: more than a third believed (36.9%, -7.9 p.p.) that USD was going to cost more, whereas the share of those giving a stable assessment significantly dropped (38.8%, –8.7 p.p.). In a year perspective, forecast estimates were less moderate as well; more than half (56.2%, +7.3 p.p.) of Kazakhstanis believe that the USD value will grow.

Men are more prone to believe in USD exchange rate growth in the perspective of a month and a year (40.7% and 60.1%), as they were during previous surveys. However, this picture isn’t that solid from different age group perspectives. Believers in USD growth in a month perspective are primarily young adults and preretirement age people (38.8% and 40.4%), while youth are the leaders in a year-long perspective (66.3%).

In terms of regional differences, residents of the Kyzylorda region (63.1%), Astana (65.3%) and Almaty (62.6%) reported the biggest confidence in USD growth within the next 12 months, while residents of the Almaty region (42.3%) and the city of Almaty (43.1%) showed higher anticipation of USD exchange rate increase within a month.

The labor market gives no reason for concern

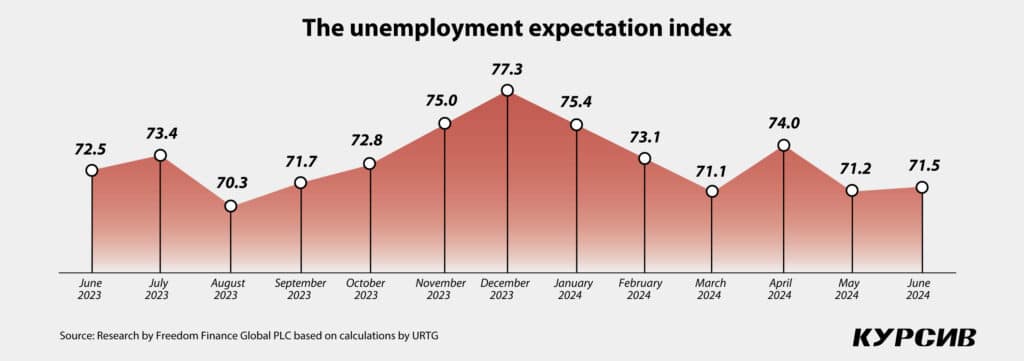

The unemployment expectation rate continues to swing in the range of several points: after growth in April and a decline in May, the index grew to 71.5 points (+0.3 p.), indicating a slight decrease in concerns over the labor market.

Many gender differences over the unemployment issue were nearly mitigated. Even though men are still more concerned about the labor market, their concern (41.5%, –0.8 p.p.) is declining more rapidly than for women (41.3%, –0.4 p.p.). In terms of age, Kazakhstanis of preretirement age (45–59) continue to demonstrate the most pessimistic assessments (46.6%, +0.5 p.p.).

At the regional level, residents of the Atyrau (52.6%, -11.6 p.p.) and Mangystau (52.2%, +0.3 p.p.) regions once again showed the highest concern over the labor market. On the contrary, people in the Jambyl region (17.8%) and the city of Shymkent (18.7%) tend to believe that the number of unemployed is going to decrease.

It’s still not a good time for taking loans but credit confidence is growing

The share of people planning to take a loan slightly dropped in June (–0.3 p.p.) compared to May. Interestingly, men and women reported different approaches to loans. Thus, men are more likely to fall back on lending facilities (20.6%, +0.4 p.p.) than women (17.2%, –1 p.p.). However, the number of those planning to take a loan declined at the expense of younger age groups, whereas Kazakhstanis aged 45 to 59 are the leading group among those planning to take a loan next year (22%, +4.4 p.p.). At the regional level, residents of the Turkestan region (28.4%) more often reported their intention to take a loan, unlike residents of the North Kazakhstan region who are the least interested in borrowing money (11.2%).

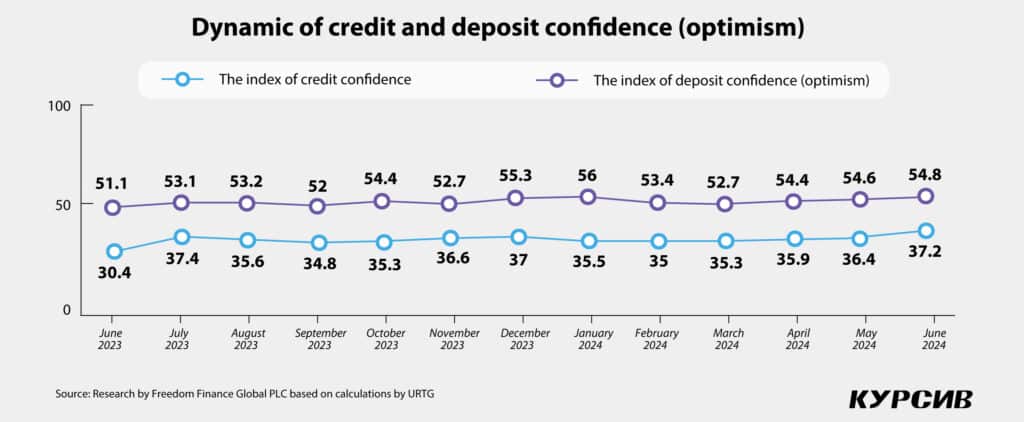

In parallel with growing consumer optimism in June, credit confidence was also growing (37.2%, +0.7 p.p.) thanks to an increasing number of Kazakhstanis who believe that it is a good time to take a loan (15.7%, +2 p.p.).

At the gender level, women reported credit confidence a bit more often (+1 p.p., to 38.3 points) than men (+0.5 p.p., to 36 points). In terms of age groups, Kazakhstanis aged 45 to 59 have also shown an active growth of credit confidence (+2.1 p.p., to 36.7 points) along with people over 60 (+1.1 p.p., to 37.5 points), which is a little dissonant with the overall credit confidence dynamic. At the regional level, residents of the Kyzylorda region reported the highest rate of credit confidence (45.6%), while respondents in the Ulytau region reported the lowest (29.7%, -1.7 p.) trust in loans.

Deposit confidence was also slightly growing in June (+0.2 points to 54.8 p.) thanks to the increased number of those who believe that today is a good time to fall back on banking deposits and save money (36%, +1.6 p.p.).

The growth in deposit trust in June was driven primarily by women (+1.1 p., to 56.6 points) as the rate for men slipped by 0.7 points to 53 points. Young adults (+2.2 p., to 56.5 points) and retired people (+1 p., to 51 points) were the most confident in banks in terms of different age groups. Residents of the West Kazakhstan region (60 points) reported the highest rate of deposit confidence, while residents of the neighboring Mangystau region were on the opposite side of the scale (47.7).

Calm June

In June, the share of those noting a calm mood around them rose by 3.4 p.p. to 57.3%, while the number of Kazakhstanis who report living with anxiety dropped by 2.2 p.p.

Like in many previous surveys, women are more likely to be anxious (41%, -2.9 p.p.) than men (35%, -1.5 p.p.). In terms of age, people aged 45 to 59 reported the highest level of anxiety, as nearly half of them (42.3%, -2.7 p.p.) said they were surrounded by anxious sentiments. At the regional level, the highest rate of anxiety was reported in the Akmola region (46.1%) and the lowest in the Ulytau region (22.1%).

Nearly one in two respondents in Kazakhstan said that they didn’t deal with stress in June (44.5%, +1.3 p.p.). On the other hand, more than half of Kazakhstanis (53.4%, –1.7 p.p.) continue to deal with stress at least one to two times per month.

The situation has changed drastically in terms of gender: in June, men reported daily stress (11.9%, +3.3 p.p.) more often than women (10.1%, -1.4 p.p.). Among different age groups, youth aged 18 to 29 reported the highest rate of stress in June (61%, -0.1 p.p.), outpacing Kazakhstanis aged 30 to 44 (58.4%, -3.4 p.p.). At the regional level, residents of the Abay region (64.4%) and Shymkent (62.6%) most often dealt with stress in June, while respondents in the Akmola region reported the lowest frequency of stress (43.9%).

Strengthening of consumer confidence

In June 2024, the CCI was still growing and strengthening in the optimistic zone thanks to the more positive approach Kazakhstanis have demonstrated toward the predictive assessment of their personal and economic (of the country) perspectives.

More than half of Kazakhstan’s regions (13) have entered the consumer optimism zone for the first time in a long period. For example, young adult Kazakhstanis, who used to balance in the neutral zone, have entered the positive zone of consumer confidence, continuing to strengthen their positions there. On the other hand, retired people haven’t reached the positive zone, even though they showed higher consumer confidence in June.

During the survey, we noticed a decline in inflationary assessments of the previous month and year. However, predictive assessments of price changes over the next month continue to trend towards less moderate (and more pessimistic) evaluations. Additionally, predictive assessments of inflationary expectations among the population have increased. More Kazakhstanis report a surge in prices for internet and mobile communication services, pharmacy products, and consumer services, while assessments of price changes for key food products have remained unchanged.

Alongside the rising consumer confidence, credit confidence has also grown, as many consumers believe it is a good time to take out loans. However, the share of those planning to take loans this year has slightly declined. Trust in deposits is also increasing, though it is slightly lagging behind credit confidence. The overall anxiety level among Kazakhstanis is still decreasing, despite a spike in concerns over financial situations, inflation and tariff increases. Nevertheless, money issues were not acute in June and the situation on the labor market was also reported as stable by respondents.