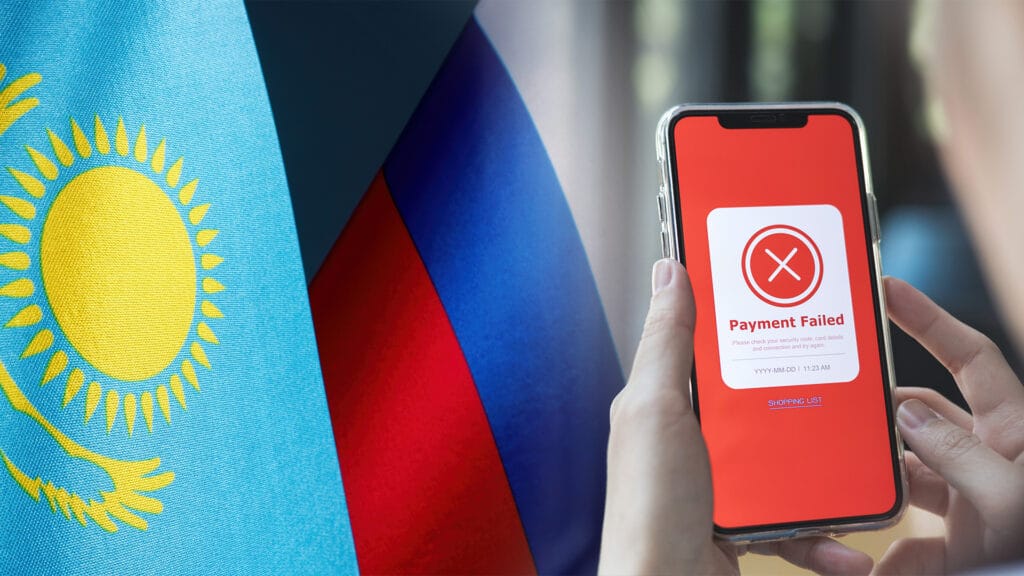

Kazakhstani banks deny blocking payments from Russia

According to RBC, a Russian business media outlet, many Russian companies have reported new obstacles to doing business with Kazakhstan. However, nearly all Kazakhstani banks told Kursiv.media that they haven’t noticed an increase in rejected transactions for clients from Russia, as long as they aren’t on the sanctions list.

In late July, RBC reported that the share of rejected payments in banks across Kazakhstan, Uzbekistan, Kyrgyzstan and Tajikistan rose to 30%, citing a survey by large Russian transportation companies. Additionally, the average timeline for a transaction increased by roughly 15% or two weeks.

Although banks have never explained the reasons for payment rejections or delays to their clients, experts believe that the key reason for these complaints is the strengthening of internal compliance in Central Asian banks.

Kursiv.media asked the six largest Kazakhstani banks—Halyk Bank, Kaspi Bank, Bank CenterCredit (BCC), ForteBank, Jusan Bank and Eurasian Bank—to comment on the situation. Halyk Bank, Jusan Bank and Eurasian Bank did not reply when this article was published. The other banks stated that they haven’t changed their internal rules for Russian clients.

«This issue is a bit irrelevant for us because first and foremost our services are designed for Kazakhstani clients and businesses; we haven’t changed our rules and procedures,» said the press service of Kaspi Bank.

BCC said that compliance with all existing international sanctions is part of its business practices. The bank is constantly updating and analyzing its sanctions lists. On the other hand, the bank provides all it’s regular services to clients who are not on the sanctions lists.

A representative of Forte Bank also noted that the bank hasn’t seen any increases in rejected transactions (executing payments from Russian companies), highlighting that the bank has always followed a conservative policy.

In the spring of 2022, many large Russian banks were hit with blocking sanctions from the U.S., the EU, the U.K. and Japan. Since then, they haven’t been able to conduct any transactions in these currencies and have lost access to the international capital market. Russia is heavily relying on banks in CIS countries, including Central Asia, for opening banking card accounts and conducting various transactions after the two main international payment systems—Visa and MasterCard—left the Russian market.

However, reports about stricter rules for Russian clients in foreign banks and longer transaction deadlines for such clients pop up quite regularly. In June, the U.S. Department of the Treasury strengthened its sanctions regime, equating Russian banks with the defense industry. Collaboration with these banks is prohibited and commercial banks from third-party countries, including Kazakhstan, may be hit with secondary sanctions if they do so.