Kazakhstan’s claims against a group of international oil majors involved in developing the Kashagan field have increased to $160 billion. The government recently raised its demand by more than $10 billion, alleging that certain deals were tainted by corruption, according to Bloomberg. This latest development has sparked speculation about who leaked the compromising details and who might be the target of this discrediting action.

So, who cooked the shashlik?

Bloomberg’s Aug. 9, 2024, article reported that Kazakhstan’s claims against NCOC, the operator of the Kashagan oil field, have grown by $10 billion. The publication stated that,

«Kazakhstan’s arbitration claims […] escalated above $160 billion after the country alleged that certain deals were tainted by corruption,» citing sources familiar with the matter.

The following day, Nurlan Zhumagulov, head of the Energy Monitor fund, pushed back against these claims on his Telegram channel, citing unnamed sources. He stated,

«Kazakhstan has not made any new demands. The amount of Kazakhstan’s claim against the Kashagan operator has not increased, as it was already factored into the final claim calculation formula.»

Journalist Oleg Chervinsky questioned whether this wording suggests that allegations of corruption in the awarding of contracts were immediately factored into the lawsuit’s total amount.

«If that’s the case, it’s a hopeful sign that the ‘New Kazakhstan’ is serious about cleaning up the tarnished image of its oil and gas industry,» Chervinsky wrote. He then posed a second question: «If claims target those who made the payments, will recipients of those payments also be investigated? So, who was the ‘cook’ that grilled the ‘takeaway shashlik’?» (This refers to a journalistic investigation alleging corruption at Kashagan involving KazMunayGas officials codenamed «shashlik.»)

Sifting and Excluding

As expected, the parties involved in the dispute have not commented on the proceedings, given the confidentiality of the arbitration. However, this hasn’t stopped them from exchanging public signals. For instance, in this recent episode, Nurlan Zhumagulov’s source appears to be «sending a message» to a Bloomberg informant.

«The Kazakhstani side is well aware of which company is facilitating these publications and to what end,» Zhumagulov’s source claimed.

Zhumagulov’s informant suggests that this leak also indicates how concerned the company is about the potential consequences of losing the arbitration. A defeat would not only impact its financial standing but also tarnish its reputation.

These latest developments have prompted Askar Ismailov, head of PACE Analytics, to raise some thought-provoking questions on his Telegram channel:

«1. Which other major [oil] field does Kazakhstan have claims against?

2. Which participants of the Kashagan project are involved in [developing] that field?

3. Who would not be affected by the financial and reputational fallout of the arbitration in the event of a loss?

4. Which company would rather prefer not to draw attention to corrupt dealings?»

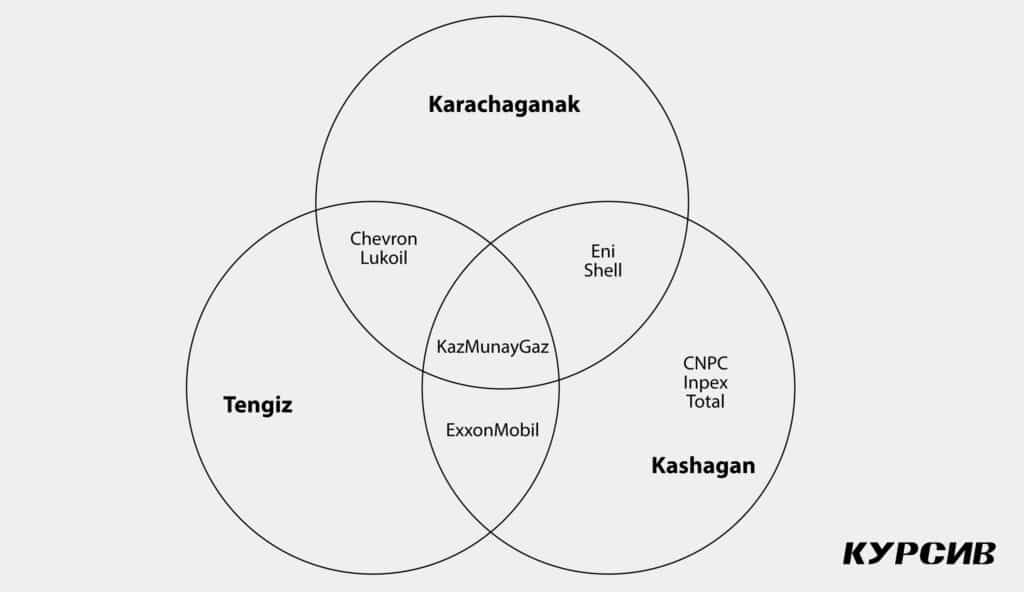

Ismailov accompanied these questions with a diagram of intersecting circles and a concluding remark: «Ultimately, it seems to me that … is leaking information…»

When asked by Kursiv to clarify which company he was referring to, Ismailov refused to answer, citing a lack of documented evidence to support his conclusion.

However, based on the diagram, it appears that the ones most at risk are Eni (Italy) and Shell (the U.K.). This conclusion becomes evident by answering Ismailov’s questions.

Given that KazMunayGas is the national oil company in Kazakhstan, it is fully on Kazakhstan’s side and, like Caesar’s wife, «ought not even to be under suspicion.» There are no pending arbitrations concerning Tengiz, but one involves Karachaganak. ExxonMobil, Total, CNPC and Inpex, which are not engaged in the Karachaganak project, are also not under suspicion. Likewise, Lukoil and Chevron, which are not developing Kashagan, should also be considered beyond reproach. This leaves Eni and Shell as the primary suspects.

According to oil and gas experts, Eni would prefer not to highlight corruption in this case, as it has already faced bribery allegations at Kashagan. Additional accusations could further harm its reputation. Conversely, negative media coverage might unsettle Kazakhstan, prompting the government to reduce its claims to preserve its appeal to investors or for other reasons.

At the same time, both Eni and Shell could individually benefit from a reduction in the claim amount. The strained relations between the two majors within the consortium are well-known among those familiar with their operations. Consequently, it’s plausible that the recent media coverage—which could lead to actionable outcomes (not necessarily criminal)—might be used to «kick out» the Italian company.

In 2023, Kazakhstan filed a lawsuit against NCOC, seeking to deduct $13 billion in «unauthorized expenditures» from $60 billion in investments made between 2010 and 2018. In 2024, Kazakhstan expanded its claims by an additional $138 billion, citing lost profits and bringing the total amount of the claim to $151 billion.