Why does Kazakhstan export aircraft to Ireland? The drivers behind export expansion after five consecutive quarters of decline

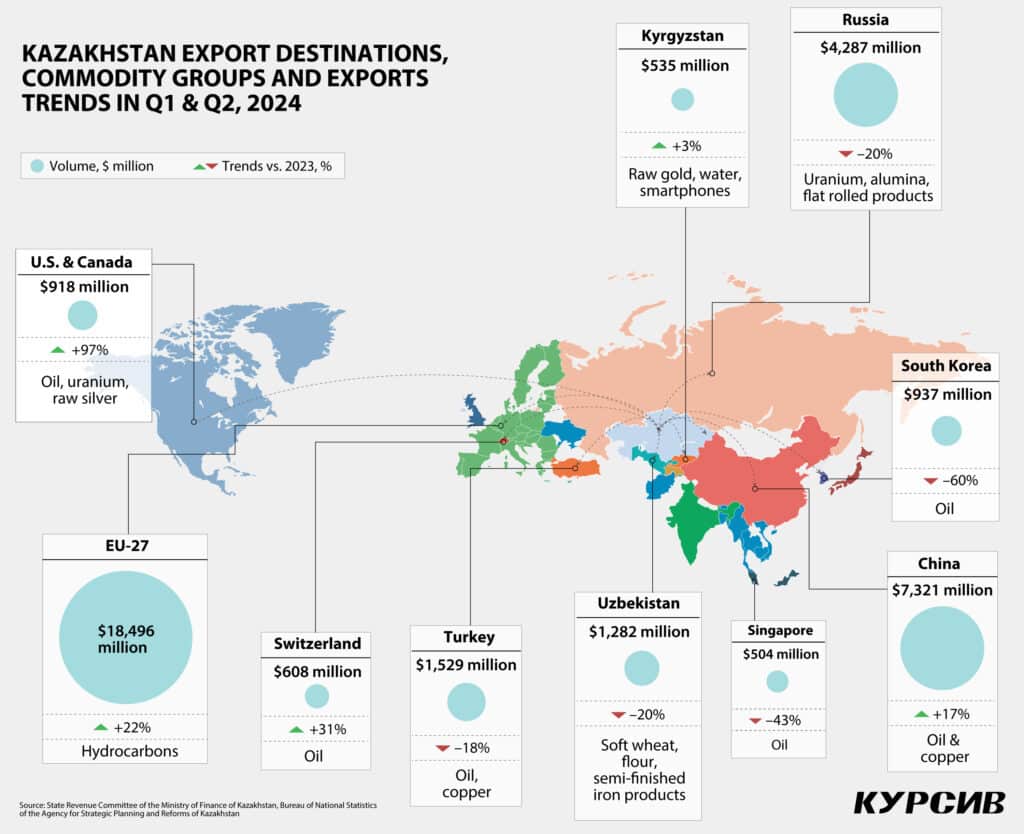

From January to June 2024, the value of Kazakhstan’s exports grew by 2.1% year-on-year (YoY), reversing the downward trend that persisted throughout last year and the first quarter of 2024. In this review, Kursiv Research examines the factors contributing to the recent growth in Kazakhstan’s commodity exports.

Petroleum outpaces aircraft exports

Kazakhstan’s commodity export revenue for the first six months of 2024 totaled $39.3 billion, reflecting a 2.1% increase YoY in nominal terms.

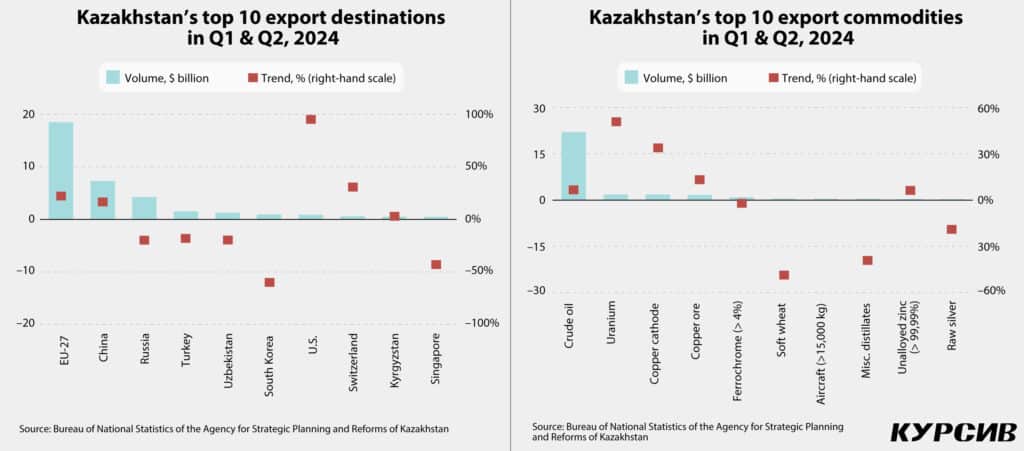

The country’s export portfolio is traditionally dominated by a limited number of goods and trading partners. During the reporting period, the top 10 key export items generated approximately 76.2% of total revenue. Six of these top 10 items posted positive turnover for the period. The most significant growth came from oil shipments, Kazakhstan’s primary export product. Oil revenue reached $21.9 billion, up 6.8% YoY, representing an increase of $1.4 billion.

Oil producers boosted shipments to 36 million tons, up 1.5 million tons (+4.3%) YoY, despite a decrease in overall oil production (including gas condensate) to 44.6 million tons (-1.8%).

Among the three major projects that primarily influence production levels, Tengiz saw a decline of 3.7% and Karachaganak experienced a decrease of 0.3%. The production decrease at Tengiz, which accounted for nearly one-third of Kazakhstan’s total oil output in 2023, was due to the overhaul of gas injection facilities in May 2024. KazMunayGas’s (KMG) production report for the first six months of 2024 indicated that «the slight reduction in liquid hydrocarbons production was due to reduced unstable condensate supplies to Condensate JSC facility and the limited acceptance of gas by the Orenburg Gas Processing Plant.»

Market conditions were favorable for Kazakhstani oil producers. With the rise in Brent crude prices (+5.2%), the oil export price per one ton increased to an average of $609 (+2.4%).

Uranium exports held the second position, trailing the leader by a noticeable margin. Uranium export revenue grew to $1.8 billion, up 50.6% YoY. There was no significant increase in uranium shipments during the reporting period, according to the Bureau of National Statistics of the Agency for Strategic Planning and Reforms (BNS ASPR) and the State Revenue Committee of the Ministry of Finance of Kazakhstan (SRC RoK).

The $608.1 million revenue boost was mainly driven by higher uranium oxide prices. In the first six months of 2024, the average selling price for the Kazatomprom group of companies was $66.2 per pound of uranium oxide, up 41% YoY. Although production increased to 10.9 tons (+6%), group sales decreased to 7.8 tons (-18%). Quarterly sales volumes can vary year to year, depending on customer demand and the timing of deliveries.

Kazakhstan’s top 10 key export items traditionally include two types of copper. In the first six months of 2024, copper cathode shipments ranked third, while copper ores and concentrates, a lower-value-added product, ranked fourth.

Copper cathode shipments generated $1.8 billion (+33.8% YoY). Revenue from copper ores and concentrates also saw double-digit growth, albeit at a slightly more modest rate of 13.3%, reaching $1.6 billion.

Copper exports grew primarily due to increased shipments, with additional growth spurred by favorable market conditions. According to the World Bank, during the analyzed period, the global price per ton of copper was $9,100, up 4.5% YoY. As global prices increased, the value of Kazakhstan’s copper products also rose: copper cathode reached $8,400 per ton (+1.8%), while copper ores and concentrates climbed to $1,700 per ton (+5.9%).

Given these favorable pricing conditions, Kazakhstani copper producers significantly ramped up output. Refined copper production increased by 32,700 tons (+16.2%) to 234,500 tons, while exports rose by 51,000 tons to 213,900 tons.

Copper ore production also grew by 4.7 million tons (+6.4%) to 77.7 million tons. In contrast, copper concentrate production slightly decreased by 2,300 tons (-0.8%) to 282,300 tons. The positive production results facilitated a 7% increase in the volume of copper ore and concentrate exports.

Surprisingly, for a country without a full-fledged aviation industry, aircraft and various aerial vehicles with curb weight of over 15,000 kilograms — essentially wide-body passenger aircraft — occupied the seventh position in terms of monetary value. Aircraft export revenue amounted to $411.7 million, a 19-fold increase, making passenger aircraft the fastest-growing export category among the top 10. Data from the SRC RoK shows that the country shipped one aircraft to Jordan, two to Turkey and seven to Ireland.

Unalloyed zinc shipments (containing 99.99% or more zinc) ranked ninth, with revenue increasing by 5.8% to $292.7 million.

Negative turnaround

Four items in the top 10 experienced a negative turnaround during the period. Export revenues declined for high-carbon ferrochrome (-2% to $894.8 million), soft wheat (-49% to $452.8 million), miscellaneous distillates (-39% to $392 million) and raw silver (-19.2% to $284.9 million). In terms of absolute losses, the declines in soft wheat and distillate shipments were most notable.

The $435.7 million drop in wheat export earnings was driven by two main factors. First, as global market prices declined, Kazakhstan’s wheat price fell by 19.4%. Second, export volumes decreased by 36.7% due to Kazakhstan’s poorest wheat harvest in three years. Adverse weather conditions, including drought during the sowing season and heavy precipitation during grain ripening and harvest, resulted in about five million tons of ungraded wheat, significantly reducing the export potential of soft varieties.

Revenue from other distillates decreased by $250.2 million, primarily due to a sharp decline in fuel oil shipments, which had previously accounted for 85% of the export revenue in this product mix. The decline was anticipated as Kazakhstan has shifted its focus to bitumen production. During the reporting period, fuel oil production fell by a quarter, causing export volumes to drop by nearly one-third. Consequently, in the «miscellaneous distillates» category, the most significant drop was in fuel oil, with export revenue plunging by $197 million (out of the total $250.2 million loss in other distillates).

Overall, in the first six months of 2024, export revenues for six of the top 10 items grew by nearly $3.1 billion while four items recorded losses totaling $771.9 million. Given that total export revenues increased by $814.5 million, the primary losses were attributed to commodities outside the top 10.

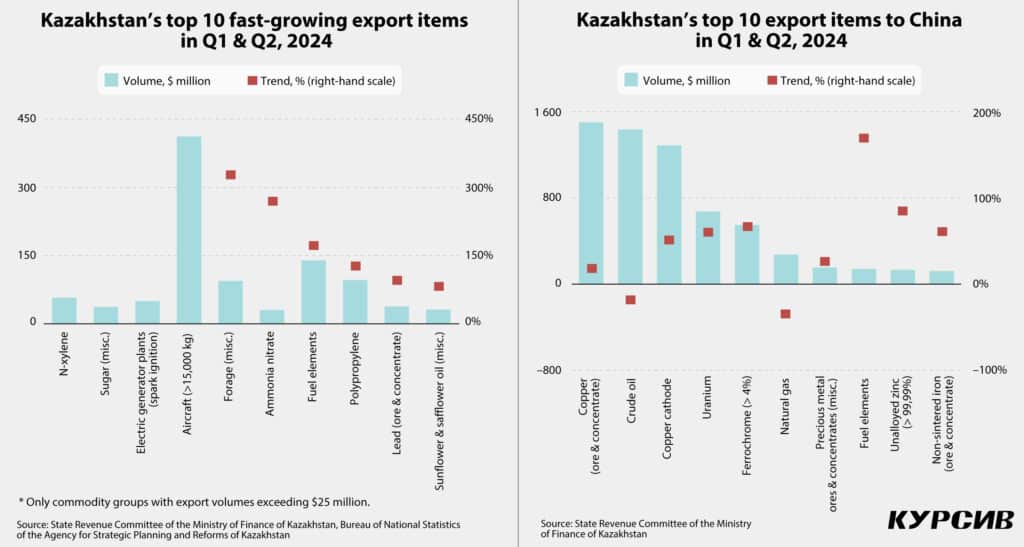

Fast- and not-that-fast-growing commodities

Kursiv Research examines the top 10 fast-growing export items to highlight economic activity in Kazakhstan. Analyzing these commodities can provide valuable insights into the systemic advances or challenges in the country’s export activities, while also helping to identify potential future export champions.

To identify fast-growing export commodities, items with a value exceeding $25 million during the reporting period were selected and their gross value was divided by the previous year’s figures. The $25 million cutoff helps exclude potentially unsustainable contracts from the analysis.

Among the 10 fastest-growing export commodities, two items exhibited explosive growth from almost zero values. N-xylene exports reached $57.1 million in the first six months of 2024, compared to zero such transactions in the same period last year. Shipments of miscellaneous sugar (in solid form) skyrocketed from $44,000 to $37.1 million over the year, an 837-fold increase.

Shipments of electric generators (with spark-ignition piston internal combustion engines) increased from $2.2 million to $49.6 million, a 22-fold increase. Additionally, revenue from aircraft and aerial vehicle shipments grew by 19 times.

The other six fast-growing export commodities, in descending order, were: miscellaneous forage (+325%, to $94.5 million), ammonium nitrate (+268%, to $30.2 million), fuel elements (+170%, to $139.3 million), polypropylene (+127%, to $96.3 million), lead ores and concentrates (+94%, to $38.1 million) and sunflower and safflower oil (+81%, to $31 million).

It seems that electric generators have been supplied as part of re-exports. First, the major players in this market come from countries with advanced economies, including KOHLER-SDMO (USA, France), Caterpillar (USA), Cummins (USA), Atlas Copco (Sweden), Aggreko (UK) and Doosan (South Korea). Kazakhstan’s economy has not yet developed the expertise to produce such complex machinery. Second, Kazakhstan’s exports of generators surpassed $1 million for the first time in 2022, following the imposition of additional sanctions on the Russian economy that restricted the supply of high-tech products from Western countries. Moreover, the lion’s share of Kazakhstan’s generator exports, in monetary terms, continues to go to Russia.

This is not the first time passenger aircraft have appeared among Kazakhstan’s top 10 fast-growing export items. The trend can be attributed to complex aircraft leasing arrangements, where lessees often register equipment in jurisdictions other than Kazakhstan to optimize taxes or streamline maintenance. According to Air Astana’s interim financial statements for the first six months of 2024, seven aircraft were delivered under operating leases during this period. Another one was re-delivered and the lease of three aircraft were extended.

In January 2024, members of the Ak Zhol faction in Kazakhstan’s parliament asked the country’s prime minister why Air Astana’s aircraft were registered in Ireland instead of Kazakhstan. Lawmakers suspected that this might be related to tax optimization. Air Astana responded that registering aircraft in Ireland ensures compliance with European standards for licensing, airworthiness and certification of flight personnel. Additionally, registration in a Western jurisdiction helps mitigate risks associated with sanctions and provides stability in obtaining maintenance and spare parts. The national carrier emphasized that there was no financial or tax benefit from the registration outside Kazakhstan.

The rapid growth of other items among Kazakhstan’s top 10 fast-growing exports appears to be largely expected. These can be grouped by their growth patterns. The first group shows significant growth due to a low base effect: shipments of N-xylene, ammonium nitrate and fractions of sunflower and safflower oil rebounded from poor results in 2023 and are returning to previous levels. The growth patterns for miscellaneous sugar (in solid state) and lead ores differ, as these items had minimal volumes for over a year and are now experiencing positive trends after years of gradual decline.

The second group includes other forage and polypropylene, where export revenue growth is linked to increased domestic production. According to KMG’s annual report for 2023, «Production of six grades of polypropylene was initiated at the KPI gas chemical facility launched at the end of 2022.» During the reporting period, the output of feed flour grew by 27.7% and finished animal feed increased by 17.4%. The third group features relatively new products for Kazakhstan’s economy, such as fuel elements, which began production in 2022.

Europe gets oil, the East gets the rest

Kursiv Research has identified four key destinations for analyzing the commodity mix of Kazakhstan’s exports: the EU-27, the Eurasian Economic Union (EEU), Central Asian countries and China.

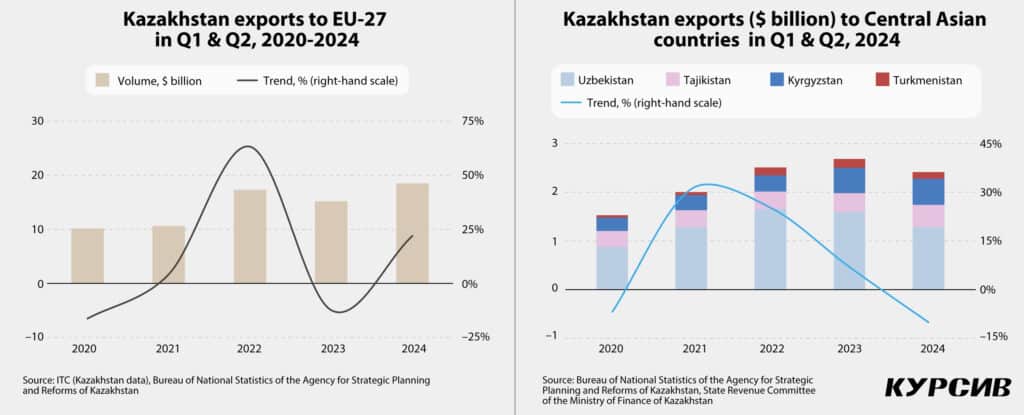

The situation with the EU is the least complicated. Most of Kazakhstan’s exports to this region consist of crude oil, gas and oil products. Fluctuations in hydrocarbon extraction or oil prices lead directly to changes in export revenues.

In the first six months of 2024, exports to the EU-27 grew to $18.5 billion, a 21.9% increase YoY. Crude oil accounted for 90.6% of this total. During the reporting period, Eurozone countries increased their oil purchases by 4.9 million tons. Combined with a slight increase in the price of oil shipped to Europe (+2.9%), this resulted in an additional $3.4 billion in revenue compared to the same period in 2023. Italy, which boosted its imports by 3.5 million tons, saw the largest rise in deliveries of Kazakhstani crude among EU-27 countries.

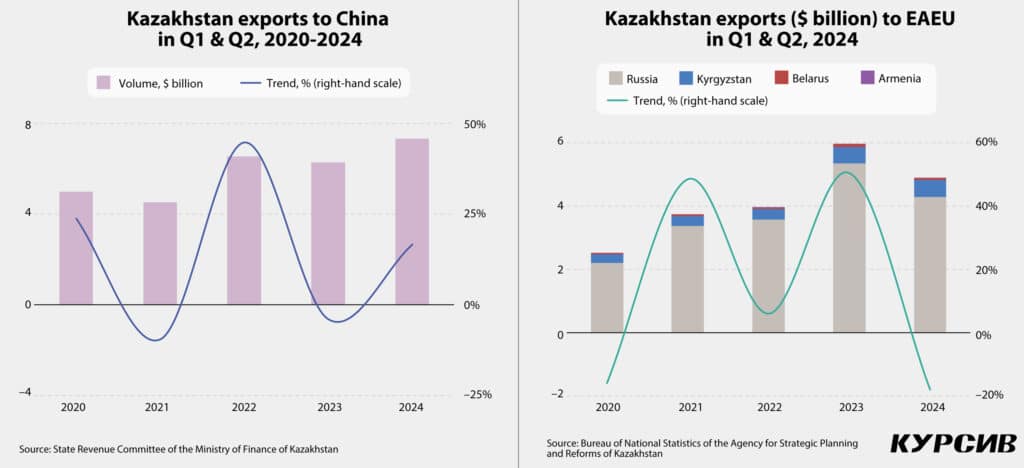

Exports to China increased to $7.3 billion, a 16.6% rise. This growth was primarily driven by higher shipments of copper ores and concentrates (+18.1% to $1.5 billion), refined copper cathodes (+50.3% to $1.3 billion), uranium (+59.8% to $672.6 million), high-carbon ferrochrome (+66.7% to $548.1 million), other precious metal ores and concentrates (+26.3% to $154.4 million), fuel elements (+169.7% to $139.3 million), 99.99% unalloyed zinc (+85.2% to $131.5 million) and non-sintered iron ores and concentrates (+61.7% to $121.2 million). However, revenue declined for two of the top 10 items: crude oil (-18.2% to $1.4 billion) and natural gas (-35% to $273.3 million).

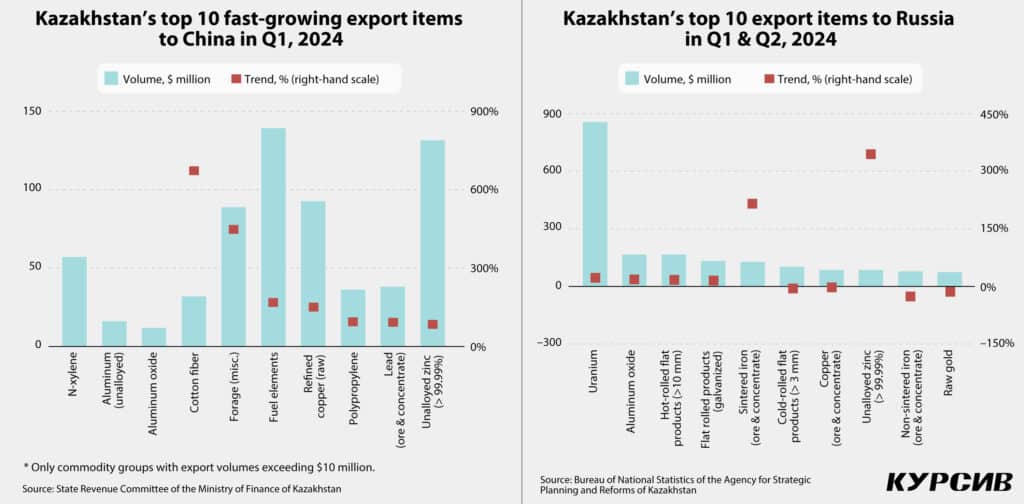

Among the fastest-growing export items to China (with a cutoff of $10 million), significant increases were observed in shipments of N-xylene, unalloyed aluminum and alumina, all of which rose from nearly zero in the same period last year.

Exports decreased to three of the four EEU countries: shipments to Russia fell by 19.8% (to $4.3 billion), to Belarus by 28.1% (to $67.4 million) and to Armenia by 19.9% (to $8.4 million). In contrast, shipments to Kyrgyzstan increased by 2.9% (to $535.1 million).

Russia, which accounts for 88% of Kazakhstan’s exports to the EEU, saw reduced shipments from Kazakhstan in the following export items: cold-rolled flat products over 3 mm thick (-2% to $102.6 million), copper ores and concentrates (-1.5% to $86.5 million), non-sintered iron ores and concentrates (-24.4% to $79 million) and raw gold (-13.8% to $74 million).

Conversely, six items posted gains: uranium (+21.3% to $855.4 million), aluminum oxide (+18.4% to $166.6 million), hot-rolled flat products over 10 mm thick (+16.8% to $166.1 million), galvanized flat-rolled products (+16.6% to $132.7 million), sintered iron ores and concentrates (+218% to $127.5 million) and 99.99% unalloyed zinc (+344% to $86.4 million).

Total export losses to Russia reached nearly $1.1 billion, with only $40.9 million of that loss attributed to goods from the top 10 export items. Given that Russia has the lowest commodity concentration compared to other key trading partners (with the top 10 items accounting for 43.8% of total exports in the reporting period), the bulk of the losses came from goods outside the top 10.

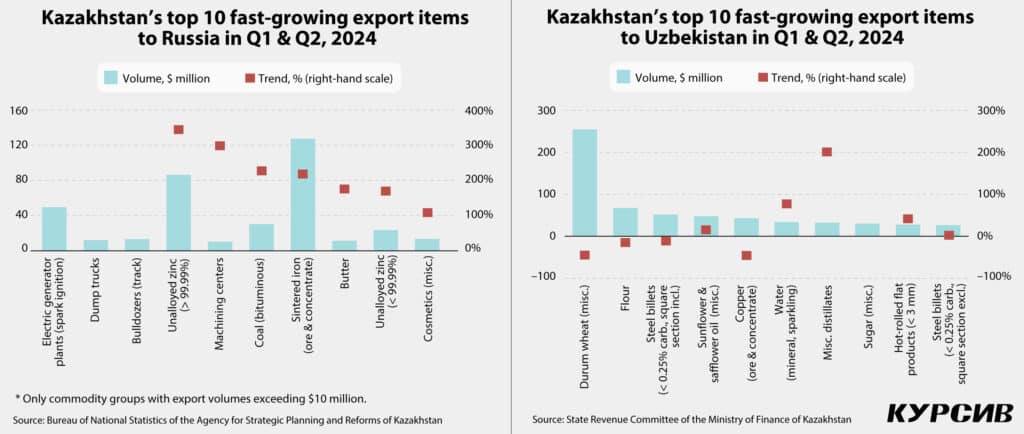

The list of fast-growing exports to Russia includes electric generators, dump trucks (+1726%) and bulldozers (+1506%). Significant growth was also observed in the exports of 99.99% unalloyed zinc (+344%) and machining centers, including milling and whirling machines (+298%).

In the first six months of 2024, exports to Central Asia declined by 10% to $2.4 billion. This decline was mainly due to reduced trade with Uzbekistan, which accounts for 53.1% of Kazakhstan’s trade in the region. Shipments to Uzbekistan fell by 31.3% to $1.3 billion and to Turkmenistan by 4.5% (o $136.7 million. In contrast, exports to Kyrgyzstan and Tajikistan increased by 1.5% to $535 million and 7.3% to $460 million, respectively.

Among supplies to Uzbekistan, Kazakhstan’s main trading partner in Central Asia, the top 10 products accounted for 48% of total exports. A decline was observed in four key items, with exports of miscellaneous soft wheat, a long-time leader in this destination, continuing to fall in the first six months of 2024. During this period, soft wheat shipments decreased by 44.4% (to $254.8 million). Flour shipments also dropped (-14.1%; to $67.7 million), as did shipments of rectangular (and square) steel billets (-11%; to $51.7 million) and copper ores and concentrates (-46%; to $43 million).

Conversely, supplies of crude sunflower and safflower oil increased by 15.6% to $47.5 million, mineral and sparkling water rose by 78.3% to $33.9 million, miscellaneous distillates grew by 201.3% to $32.6 million, hot-rolled flat products less than 3 mm thick went up by 41.8% to $27.9 million and rectangular (square) steel billets saw a 4% increase to $26.5 million.

Two products stand out among the fastest-growing exports (with shipments exceeding $10 million during the reporting period). Shipments of miscellaneous sugar, in solid form, surged 716-fold in value, securing eighth place among the top 10 key commodities exported to Uzbekistan, with nearly $30 million. Additionally, potato shipments experienced substantial growth, increasing by 167% to $18.1 million.