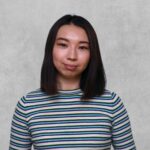

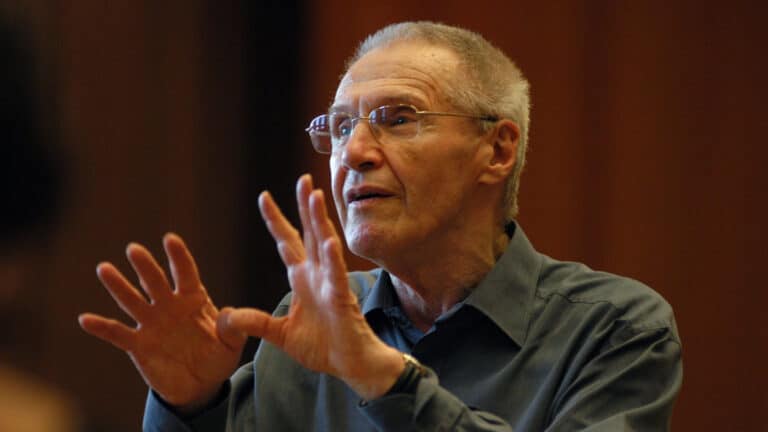

According to Timur Turlov, CEO of Freedom Holding Corp., it is often a good idea to invest in microcap stocks. During his speech at the ITS Ideas conference, he encouraged investors to consider buying shares in microcap businesses. He explained that while large businesses report impressive financial results, they are increasingly subject to stricter public regulations. Although these companies may continue to generate profits, a significant portion of these earnings would likely be redirected to the government, leaving less for minority shareholders.

«I think it’s safe to say that we are entering a period where governments will place much more pressure on the most productive companies due to budget shortfalls. Public spending is rising, while tax collection is becoming more difficult. The budget deficit is quite large, which could threaten economic stability and fuel inflation. For many economic experts, the budget deficit is the primary source of inflation, which we have observed recently. As a result, governments will seek to extract funds from companies deemed highly profitable,» Turlov said.

He cited recent reports on an antitrust investigation into Nvidia, the largest AI chip producer in the U.S. Following this news, the company lost 9.5% of its market capitalization ($278.9 billion), marking the biggest one-day loss for any American company. Jensen Huang, Nvidia’s founder, saw his fortune decrease by $10 billion to $94.9 billion, setting an anti-record.

«This will happen again. So, be cautious with the Magnificent Seven stocks (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla). These companies won’t lose their markets and will remain leaders in efficiency. I mean, there is no need to avoid these stocks as investments. They are excellent businesses that know how to generate returns for their investors, but they will face increasing risks of tougher regulation. That’s why bold predictions that these companies will return $4 trillion to shareholders over the next decade may not come to fruition. The government will likely claim a significant portion of that money for its benefit,» the businessman emphasized.

Turlov urged investors to consider companies that are currently overlooked. According to the FRHC CEO, small and medium-sized businesses are likely to face less pressure from tax authorities, antitrust agencies, and public regulation compared to large corporations. He pointed to Kazakhstan as an example, citing a recent address by President Kassym-Jomart Tokayev.

«You need to view large, successful companies from an economic perspective and within the broader context of the rules at play. Governments will inevitably intervene, changing the rules and limiting shareholders’ profits. That’s why, my dear shareholders, you should be cautious when investing large amounts in these companies, as their ability to generate profits could be constrained. These businesses may be forced to operate in a way that benefits a significant number of people the government is concerned about, redistributing more and more money into the economy,» Turlov warned.

Turlov suggested that investors consider companies operating within the ecosystems of larger corporations, providing services to them. He acknowledged that investing in microcap companies can be challenging because of a lack of transparency, proper governance and shareholder-friendly practices. However, there are still many promising opportunities. He advised investors to diversify their portfolios by including high-yield bonds, bonds from developing economies and shares of small and medium-sized companies.

In closing, Turlov noted that Corporate Social Responsibility (CSR) has become a global trend, as the social burden on governments is growing and they are struggling to meet their obligations. He believes that companies can secure more favorable conditions if they built a reputation as reliable partners of a state that follow ESG principles and focus on sustainable development. On the other hand, ignoring the ESG agenda poses business risks in the U.S. and globally.