Consumer сonfidence in Central Asia in August 2024: Mixed month with worsening inflation sentiment

For the fourteenth month, Freedom Finance Global has been researching consumer confidence, inflation and devaluation expectations of residents of four Central Asian countries: Kazakhstan, Uzbekistan, Kyrgyzstan and Tajikistan. In August 2024, there is an ambiguous trend with an increase and decrease in consumer confidence in two different pairs of countries. Moreover, a similar situation is observed in the dynamics of inflationary sentiment, which has significantly increased in the two countries. Nevertheless, devaluation expectations generally remained unchanged in the region, despite the end of the four-month strengthening of the region’s three national currencies.

In August, the Consumer Confidence Index (CCI) fell in Kazakhstan after four months of growth in a row, but optimism slightly prevails over pessimism. Kyrgyzstan has shown an increase in confidence for the sixth month in a row reaching new records. In Uzbekistan, the CCI continued to recover for the second month in a row after a sharp drop earlier. Tajikistan, on the other hand, continues to maintain its leadership despite a slight decline after a sharp increase in consumer confidence in July.

In Kazakhstan and Uzbekistan, analysts collect 3,600 questionnaires each month, in Kyrgyz In Kazakhstan and Uzbekistan, analysts collect 3,600 questionnaires each month, 1,600 in Kyrgyzstan, 1,200 in Tajikistan, pro rata the size of the population in the countries under research. The research is based on the methodology used to obtain consumer confidence indexes in many countries around the world and adapted to local needs by the United Research Technologies Group company. Data collection method: telephone survey. The survey questionnaire is localized: the research is conducted in the native language of the respondents.

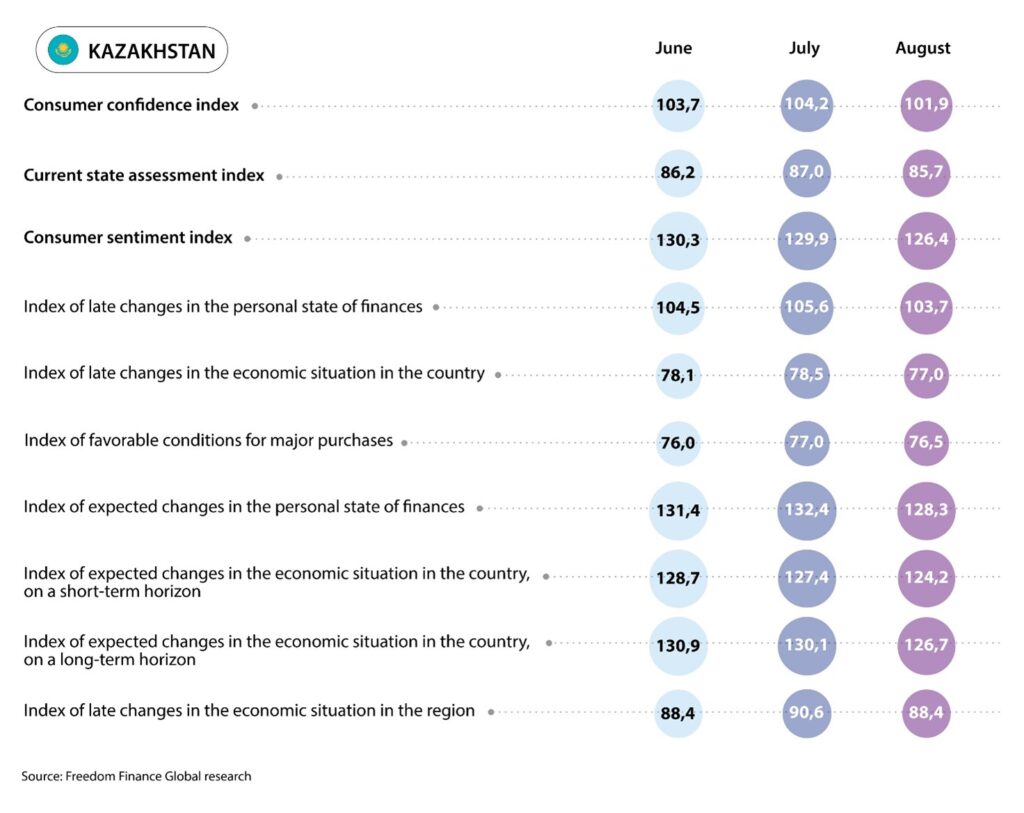

Kazakhstan

In Kazakhstan, the Consumer Confidence Index (CCI) fell in August after four months of growth in a row. The CCI fell from 104.2 to 101.9 points, which, however, indicates a slight predominance of positive responses over negative ones. Sentiment worsened in all five sub-indexes. However, the largest decline occurred in forecasts of personal financial situation in the one-year horizon. In comparison with last August, the CCI increased by 1.6 points, largely due to a significant improvement in the assessment of the current favorable conditions for large purchases.

Deterioration of forecasts for personal financial situation

The sub-index of the forecast of changes in personal financial situation in the horizon of the next 12 months fell by a noticeable 4.1 points and reached 128.3 points. The share of those who believe that their personal financial situation will improve fell from 50.3% in July to 47.6% in August.

Among the age groups, the decline occurs at all ages, but the most severe deterioration is recorded among people aged 30-44 years. The share of positive respondents fell from 53.6% to 49.1% in this group. Nevertheless, the older generation over 60 continues to show the worst result, among which the same share reached only 30.7%. On the other hand, young people under the age of 29 continue to exude the greatest optimism, among whom 66.4% expect an improvement in their financial situation.

In the regional context, the greatest decrease in positive forecasts in personal financial situation is observed in the Akmola and Zhetysu Regions, where the share of positive responses fell by 14 and 13.9 p.p., respectively. Nevertheless, the lowest share of optimists is recorded in Atyrau region, where it reaches 35.5%. The best response was given in the Kyzylorda region, where this indicator, on the contrary, increased by 5.1 p.p. and amounted to 58.7%.

Conditions for large purchases have improved markedly over the past year

Compared to August 2023, the largest increase is shown by the sub-index of current favorable conditions for large purchases, which increased by 6.8 points and reached 76.5 points in August 2024. This result is the second highest for the entire research after the July record. The share of Kazakhstanis who believe that the conditions for purchases are favorable for the previous 12 months increased from 28.7% to 32.8%.

Among the age groups, the greatest increase in the level of optimism is observed in people over 60 years of age. Among them, 25.1% gave a positive response, while last year their share was only 16.5%. However, despite this growth, the result of the older group was the worst among all age groups. Young people under the age of 29 responded better than the rest, among them the share of optimists increased from 36.6% to 41.8% over the past year. We also note moderate growth (+2-2. 4 p.p.) of the same indicator in the other two middle age groups.

In the regional context, the Kyzylorda Region showed the best progress, where the share of positive responses increased from 25.1% to 45.9%. This result was the best among all regions in August. Moreover, a large increase is observed in Ulytau and East Kazakhstan Regions. On the other hand, the share of those who positively assess the current conditions for large purchases fell sharply from 33.1% to 22.7% in the Almaty Region, which is the worst August result in the regional context.

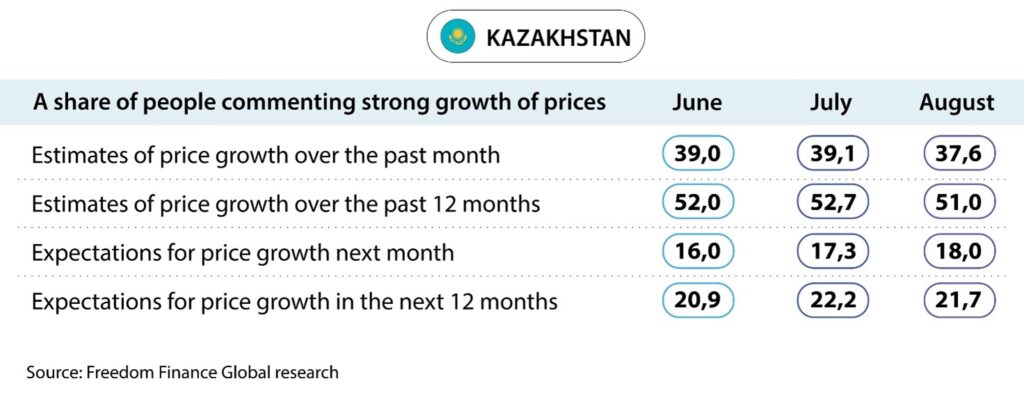

Inflation estimates and expectations of Kazakhstanis remained at the same level

Kazakhstan residents’ inflation estimates fell slightly further in August, hitting record lows. Over the past month, 37.6% of residents (39.1% in July) noticed a strong increase in prices. And in the horizon of the past year, there was also a drop to record lows. The share of those who noticed a faster increase in prices also fell from 52.7% in July to 51%.

Inflation expectations of Kazakhstanis generally remained at the same July levels. The share of people who expect a strong price increase in the one-month horizon increased from 17.3% to 18%, in the next 12-month horizon, slightly fewer people expect an acceleration in price growth: from 22.2% in July to 21.7%.

A similar survey of the National Bank of Kazakhstan of inflation estimates and expectations showed a significant downward trend, mostly updating multi-month lows. According to this survey, the share of people expecting strong price growth during the year fell from 24.4% to 20.9%. While in the one-month horizon, the same indicator sharply decreased from 19.7 to 14.7%. Inflationary estimates in different time horizons showed a multidirectional movement. If, according to the price growth estimate, the share of respondents fell from 30.5% to 26% over the past year, which is the lowest since April 2019, then the share indicating rapid price growth increased from 41.6% to 43.4%.

Among certain goods and services, the majority of respondents are still concerned about a significant increase in food prices. The list of top-4 most noticeably expensive goods for the population remains unchanged for the tenth month in a row. It includes the categories of ‘Meat and Poultry’, ‘Milk and Dairy Products’, ‘Bread and Bakery Products’ and ‘Vegetables and Fruits’. We note an increase in the share of people who noticed a strong increase in prices for all the above products: on average, by 3.6 p.p., the indicator for the ‘Meat and Poultry’ category increased from 37.7% to 40.5%, which is the highest since January. The share of responses for products in ‘Cheese, Sausages’ and ‘Tobacco, Cigarettes’ categories also increased significantly (by 5 p.p.). However, according to official statistics, poultry prices increased in August by only 0.5% MoM, and beef prices by 0.2% MoM. Sausages increased in price by 0.3% MoM, and hard cheese even fell in price by 0.2% MoM. Fruit and vegetable prices also seasonally decreased in price by 1.7% compared to July.

Devaluation expectations rose again

In August, the devaluation expectations of Kazakhstanis remain at a high level and continue to grow amid the recent weakening of the tenge. According to the survey, the share of Kazakhstanis waiting for a weakening of the tenge in the one-year horizon increased from 56.8% to a record 58.7%. In the one-month horizon, there was an increase from 34.3% to 35.7%. It should be noted that the share of pessimists on these two issues increased by 4 and 1.7 p.p., respectively, in comparison with last August.

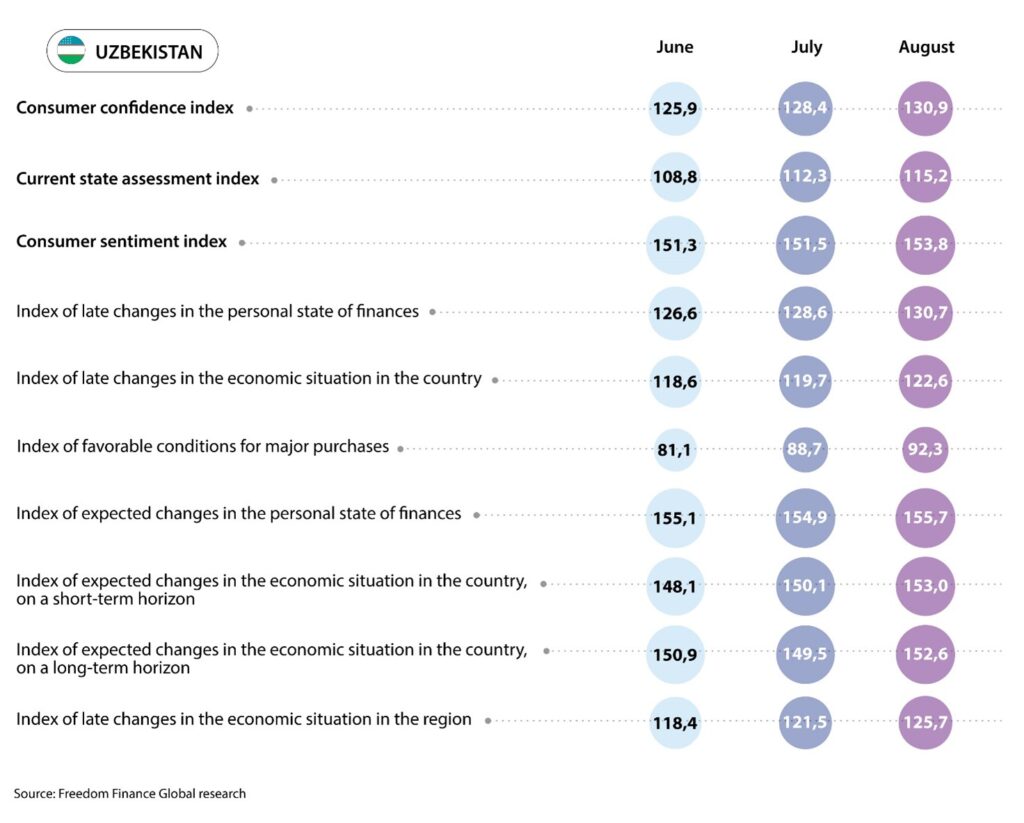

Uzbekistan

In August 2024, the Consumer Confidence Index of Uzbekistanis continued to recover after a recent decline in April-June. The CCI rose from 128.4 to 130.9 points. Separately, growth occurred in all five sub-indexes that define the index. The largest increase was again shown by the sub-index of favorable conditions for large purchases. Compared to August 2023, the CCI increased by 1.3 points, largely due to increased optimism about personal financial situation.

Record optimism on conditions for large purchases

The sub-index of favorable conditions for large purchases and spending improved by 3.5 points and reached 92.3 points, which is a new record for Uzbekistan. 41.8% of residents of the Republic of Uzbekistan chose a positive answer, while there were 41.2% of such answers in July. However, the share of unambiguously positive responses increased much more significantly – by 1.9 p.p.

Among the age groups, people over 60 years of age showed the greatest improvement in ratings. If in the previous month, the share of positive responses reached 38.6% in this group, it increased to 42.6% in August. Nevertheless, young people under the age of 29 still showed the best result, where 46.7% of optimists were scored. The results of the 30-44 years and 45-59 years age groups were similar to each other: around 39-40%.

In the regional context, the greatest improvement in this indicator occurred in the Jizzakh Region. There, the share of respondents who chose positive answers increased from 32.7% to 42.6%. However, the leader of August was the Navoi Region, which was the only region with a share above 50%. The lowest result is recorded in Tashkent, where this indicator still increased from 34.9% to 36.2%.

Personal financial situation has improved over the past year

Over the past year, the sub-index of changes in personal financial situation showed the greatest growth. The sub-index increased by 6 points compared to August 2023 and reached 130.7 points. 57.7% of Uzbekistan respondents chose positive answers, which is 3 p.p. higher than last year’s result.

Among the age groups, the most positive dynamics is observed among young people under the age of 29. The share of young people who have improved their personal financial situation increased from 60.8% to 66.6%, which is the best result by age groups. In the other three groups, there was also a slight increase in optimism. The outsider is the older generation over 60 years of age, where this share was only 47.6%.

In the regional context, the largest increase is recorded in the Syrdarya Region compared to last August. There, the share of people who felt an improvement in their personal financial situation increased from 45.5% to 58%. On the other hand, the opposite situation is observed in the Khorezm Region: the share of optimists fell from 61.5% to 55.1%. At the same time, the lowest indicator is again in Tashkent, where the share of positive responses was 50.3%. The leader of August was the Ferghana Region with a similar indicator of 62.9%.

Inflation expectations and estimates have risen sharply

Inflation estimates and expectations of Uzbekistan residents rose sharply in August. Thus, 48.2% of residents felt a very strong increase in prices over the past year, compared to 42.6% in July. Over the past month, their share has grown even more: from 22.7 to 31.9%.

Inflation expectations also showed a noticeable increase compared to July. The share of people expecting a strong price increase next month increased from 11.4% to 20%. Over the next year, 27% of respondents expect faster price growth, which is 2.3 p.p. higher than in July.

According to official statistics, a monthly price increase of 0.5% was recorded in August. However, annual inflation remained unchanged at 10.47%. While some items showed a sharp increase in prices. Namely, meat prices rose by 4.9–5.3% in one month, which also negatively affected the mood of respondents. In the case of the most strongly increased prices of goods and services, a 12-month high was recorded for meat and poultry. 57.8% of respondents chose this product, compared to 45.2% in July. Housing services and utilities grew by only 0.2% MoM in August, and the share of those who marked this option decreased from 44.8% to 31.9%. There is also a large decrease in the number of drugs and medications: from 23.9% to 13.7%, which is a new minimum for the entire research. The monthly increase in drug prices was only 0.8% MoM.

Another decline in devaluation expectations

In August, Uzbekistan residents’ devaluation expectations fell for the fourth month in a row. The record low indicators for the entire research were updated again. In August, the Uzbek sum weakened slightly after four months of strengthening in a row. The share of those who expect the national currency to weaken against the dollar over the next 12 months fell from 53% in July to 49.1% in August. However, the share of pessimists decreased from 33 to 32.2% in the one-month- horizon. In comparison with August 2023, their share on these issues fell by 13.6 and 15.2 p.p., respectively.

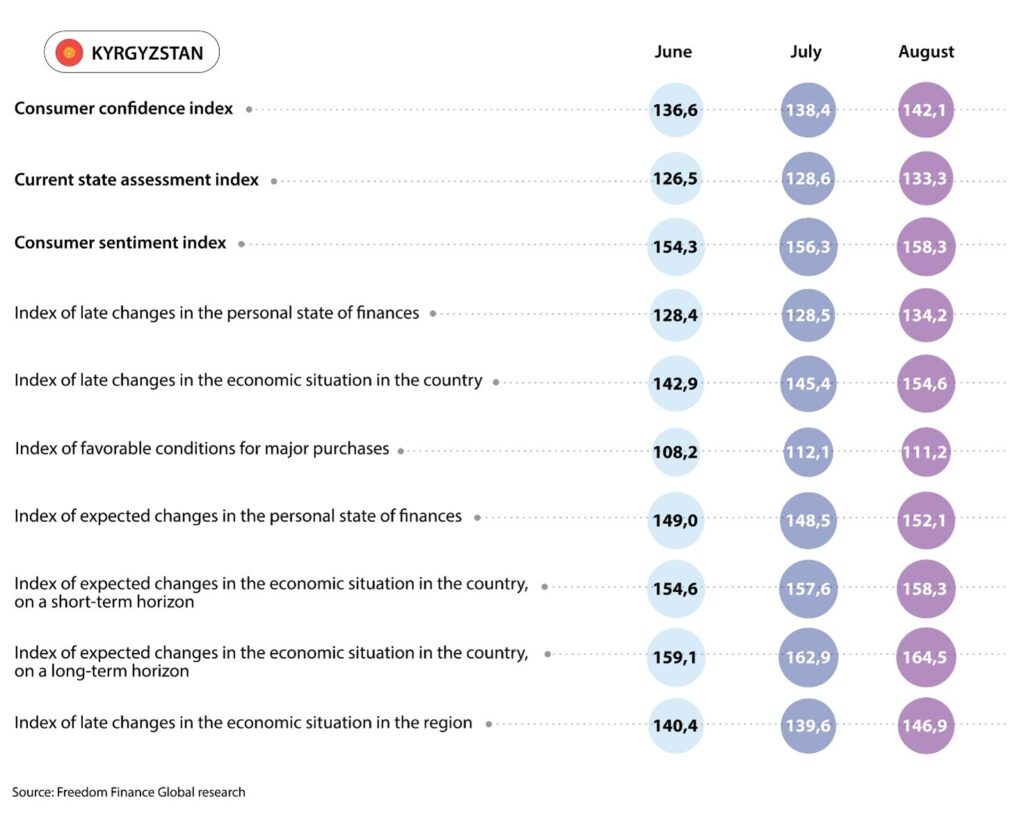

Kyrgyzstan

In Kyrgyzstan, the Consumer Confidence Index rose in August for the sixth month in a row. Moreover, the growth rate accelerated to 3.7 points, and the CCI reached a record 142.1 points for the entire research. This time, four of the five sub-indexes that define the composite index level have increased. The greatest growth is observed in the question of changes in the economic situation over the previous 12 months. Compared to August 2023, the CCI grew by an impressive 16.8 points.

Sharp improvement in optimism in the economy

The sub-index of assessments of changes in the economic situation increased by 9.2 points and reached a record level of 154.6 points, which indicates overwhelming optimism among respondents. The share of people who positively assess changes in the economic situation increased from 66.4% in July to 72.9% in August.

All four age groups showed an increase in optimism, but it is most strongly observed among young people under the age of 29. There, the share of respondents who chose positive answers increased from 67.9% to 75.3%, which, however, is not the highest indicator among all age groups. The leader continues to be the older generation over 60 years of age, the same indicator increased from 73.1 to 78% among them. While in two middle-aged groups, this share barely exceeded 70%.

In addition, we note that the improvement is recorded in all regions. The strongest growth of 10.4 points occurred in two regions at once: Jalal-Abad and Issyk-Kul. At the same time, the share of those noting that the economic situation had improved reached as much as 86.3% in the first region. Bishkek residents responded the worst in August, where the share of positive responses was only 57.6%.

Estimates of personal financial situation have increased markedly

The sub-index of estimates of changes in personal financial situation over the past 12 months also showed a noticeable increase. In August, the sub-index rose by 5.7 points and reached a record 134.2 points. 56.4% of residents indicate an improvement in their personal financial situation, while this figure reached 49.7% in July.

Among the age groups, respondents aged 45-59 years showed the greatest improvement. If the share of positive responses reached 41.1% among them in July, then it sharply increased to 51.6% in August. However, this is still the worst result among the age groups. Young people under the age of 29 gave the best response: among them, the same indicator increased to 62.5%. We also note a good increase in the share of optimists in the other two age groups by 7-7. 4 p.p.

In the regional context, there is no such unity, as the share of positive responses decreased in two regions. These regions were Talas (-3.1 p. p.) and Chui (-0.9 p. p.). As a result, Talas Region with a result of 44.7% is on the last line. On the other hand, a sharp increase of more than 15 p.p. was recorded in the city of Osh, Osh and Naryn Regions in August. Thanks to this, Osh Region with an indicator of 66.1% has risen to the first place among all regions.

Inflation estimates and expectations were almost unchanged

In August, inflation estimates of Kyrgyzstanis showed mixed dynamics, remaining close to record lows. If 27.5% of respondents felt a very strong increase in prices over the past month in July, then there were 26.2% in August. However, estimates of price growth over the past 12 months, on the contrary, increased slightly. In August, 46.6% of Kyrgyzstanis recorded an acceleration in price growth, while this figure was 45.8% in July.

Kyrgyzstanis’ inflation expectations have increased slightly, which is within the margin of error, given the record-low July base for comparison. The share of respondents expecting faster price growth in the next 12 months increased from a record low of 10.9% to 12.4%. The share of those who believe that prices will rise very strongly in the next month also increased from an absolute minimum of 5.9% to 7.7%.

Among the individual goods and services, for which residents noticed the greatest price increase, we once again note flour, which continues to be the leader of the rating for at least the last 12 months. The share of respondents who chose this product, however, fell to a record low: from 47.9 to 41.6%. We also note that the list of the top-5 products with the highest price increases has not changed for 12 months in a row. In addition to flour, 37.9% of respondents mentioned vegetable oil, 35% – meat and poultry, 31.5% – sugar and salt, and 28.1% – vegetables and fruits in August. On average, these indicators of the top-5 products fell by 5.6 p.p. compared to July.

Devaluation expectations remain low

Kyrgyz som weakened by 1% in August after four months of strengthening in a row. Nevertheless, the devaluation expectations of Kyrgyzstanis have changed slightly in comparison with July. If in July, 24.2% of residents expected the national currency to weaken in a year, the share of such people fell to a record 23.2% in August. On the contrary, the share of pessimists in the issue of dollar growth in the one-month- horizon increased from 16.3 to 17.5%.

Tajikistan

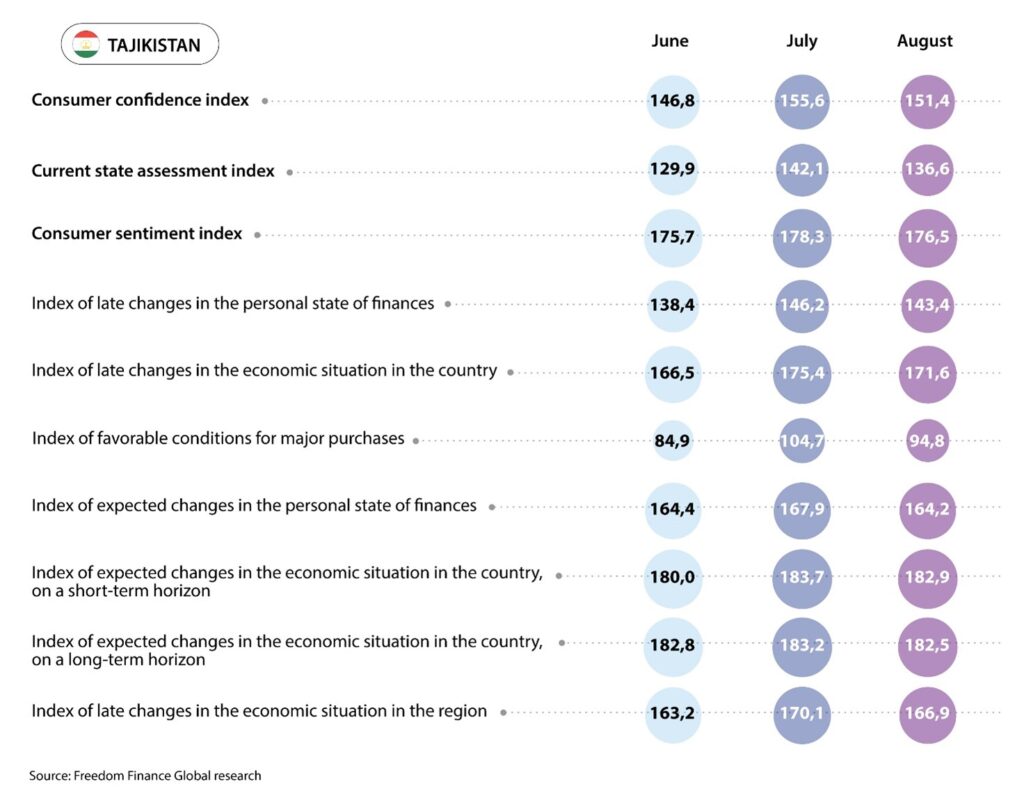

In Tajikistan, the Consumer Confidence Index fell from 155.6 to 151.4 points in August after the July regional record. All five sub-indexes declined. While, the assessment of the current favorable conditions for large purchases, which also fell from the record values of July, showed the greatest deterioration. In comparison with last year’s August, the CCI rose by 10.6 points, mainly due to improved assessments of changes in the economic situation and favorable conditions for large purchases.

Conditions for large purchases worsened after the July record

In August, the sub-index of the current favorable conditions for large purchases and spending fell by 9.8 points to 94.8 points. The figure is the second highest this year, and July’s growth was only half lost. 46.9% of respondents gave positive answers, compared to 51% in July.

Among the age groups, a sharp decline is observed only for respondents aged 30-44 years. In July, this group showed the greatest growth, but the share of optimists fell from 54 to 42.9% among them in August, which is the weakest result among respondents. The highest results are shown by the older generation from 60 years and young people up to 29 years, half of whom give a positive answer. Moreover, the share of the older generation increased by 3.8 p.p.

In the regional context, the deterioration is observed everywhere except Gorno-Badakhshan Autonomous Region, where the share of optimists increased from 46.8% in July to 56.2%. However, the biggest setback occurred in Dushanbe, where only 38.7% of respondents believe that the current conditions are favorable for large purchases (48.5% in July). Thus, the capital became the leader in August in terms of the lowest indicators, ahead of the Gorno-Badakhshan Autonomous Region.

Estimates of changes in the economic situation have slightly decreased

Residents’ assessments of changes in the economic situation showed a much less noticeable drop compared to July. This sub-index fell from 175.4 to 171.6 points, which is nevertheless the second result for the entire research. In August, the share of optimistic Tajikistan residents was 83.5% against 85.8% in July.

Among the age groups, the decrease in optimists is recorded in all age groups. However, the generation over 60 years of age showed the most noticeable dynamics, where the share of positive responses fell from a record 92.2% to 80.3%. As far as people over 60 are the least represented in the survey, this drop had little effect on the overall result. For other age groups, the decrease was only 0.9–1.8 percentage points. As a result, respondents under 29 answered the best with a share of 85.1%.

In all regions, except for Districts of Republican Subordination, there is a decrease in the proportion of residents who noticed an improvement in the economic situation in the past 12 months. The above-mentioned region became the leader in August with a result of 88.7% of positive responses. On the other hand, the largest decline is observed in the Gorno-Badakhshan Autonomous Region, where the share of optimists fell from 87.7% to 78%, which is also the worst result among the regions.

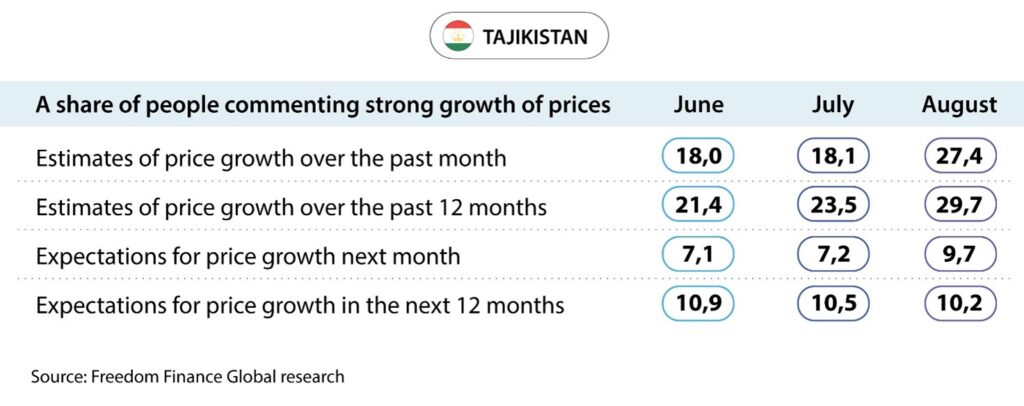

Inflation estimates have increased sharply

In August, Tajikistanis’ inflation estimates showed a noticeable increase after record lows over the previous few months. The share of respondents who noted a strong increase in prices over the past month increased sharply from 18.1 to 27.4%, which is a 10-month record. Over the past 12 months, the share of those who felt a faster increase in prices also increased from 23.5 to 29.7%. Inflation expectations in Tajikistan showed a less significant increase compared to July. 9.7% of residents expect a very strong increase in prices in the coming month, while there were 7.2% in July. Moreover, the share of pessimists fell from 10.5 to 10.2% over the next 12-month horizon.

Official inflation data for August has not yet been released, but annual inflation fell slightly in July: from 3.5% to 3.4%. Among specific goods, residents of Tajikistan are also very concerned about the prices of meat and poultry. Over the past month, the share of people who noticed a strong increase in prices for meat and poultry increased from 36.2% to a record 45.1% for the entire research. However, there is no such increase in concern for other food products. For flour, this indicator fell from 35.6% to 33.4%, and for vegetable oil from 31.7% to 28.3%. We note that the top 4 items, along with vegetables and fruits, remain unchanged. According to official statistics, prices for meat and meat products increased by 2.3% MoM in July, and separately for beef by 3.2% MoM. Thus, meat prices have been growing monthly throughout 2024 and, judging by media publications, they also grew in August. For fruits, prices fell seasonally by 9.8% MoM in July, while vegetable prices fell by only 0.1% over the month.

Devaluation expectations rose slightly

Devaluation expectations in Tajikistanis increased slightly in August and continue to be near the average values of the previous 10 months. The dollar exchange rate against somoni rose by 0.35% in August after four months of decline in a row. The share of those who expect the national currency to weaken during the month increased from 16.4% to 17.2%. Moreover, 24.4% of the country’s population is waiting for a weakening in the one-year- horizon (23.1% in July).

Conclusions

August 2024 turned out to be a mixed month for Central Asian countries. In Kazakhstan, the Consumer Confidence Index (CCI) has declined after four months of growth in a row. However, the index continues to remain above the neutral limit of 100 points. The decline is occurring across all sub-indexes, but the greatest deterioration in sentiment occurred in forecasts of changes in personal financial situation. It should be noted that, Kazakhstanis showed slightly higher consumer confidence compared to last August. In Kyrgyzstan, the CCI grew in August for the sixth month in a row. At the same time, this time the growth rate increased, and the index updated its record for the third time in a row. Such growth occurred largely due to improved assessments of changes in personal financial situation and the economic situation over the past 12 months. Moreover, the CCI showed a significant increase of almost 17 points compared to August 2023, thanks to a strong improvement in estimates and forecasts for the economic situation and favorable conditions for large purchases.

The regional leader in the CCI, Tajikistan, saw a slight decline in August. After the index was at approximately the same levels for four months in a row and rose in July, it corrected downwards in August. Moreover, there was a reverse partial decrease in the assessments of the favorable conditions for large purchases, which nevertheless turned out to be higher than the June values. Yet, the fall in the index and the above-mentioned sub-index was not so large as to be below the June level. In addition, compared to last year, the CCI index grew quite well by 10.6 points in Tajikistan. On the other hand, Uzbekistan has shown growth in the CCI for the second month in a row, having partially recovered and turned out to be higher than the April level. The growth again occurred due to an improvement in the favorable conditions for large purchases, which reached a new record for the entire research. Nevertheless, the index did not grow so significantly, only by 1.3 points, compared to August 2023.

It is interesting to note that in August, the dynamics of inflation estimates and expectations was largely influenced by the rise in meat prices in some countries. A sharp increase in inflation estimates occurred in Tajikistan, where a record number of people noticed an increase in meat prices in August. The situation is similar in Uzbekistan, where inflation estimates and expectations rose to multi-month highs. In addition, almost 58% of people noticed a sharp increase in the price of meat and poultry, which is also a record for the past year. Moreover, in Uzbekistan, unlike Tajikistan, official statistics did not particularly notice the increase in meat prices. In Kazakhstan and Kyrgyzstan, the situation is quite neutral. In Kazakhstan, inflation estimates fell slightly, but reached new record lows, while inflation expectations remained at the same level. However, slightly more people also noticed an increase in the price of meat and a large number of different goods. In Kyrgyzstan, inflation expectations that were already at a very low level increased slightly, and inflation estimates ultimately did not change.

Generally, devaluation expectations remained at the same levels in Central Asian countries. Moreover, there was a slight weakening of the national currency in August in all countries. Recall that earlier, for four months in a row, the dollar exchange rate fell in all countries except Kazakhstan. In August, devaluation expectations continued to decline only in Uzbekistan and reached new record lows. For the first time in the entire research, the share of people expecting the sum to weaken in a year was below 50%. In addition, last year, the share of those expecting the dollar to rise was almost 63%. In Kazakhstan, the continued slow weakening of the tenge led to a further increase in the share of pessimists. We note that the number of people expecting the tenge to weaken within a year reached record highs. However, the August increase in the share of pessimists was small, amounting to 1.4-1.9 p.p. In Tajikistan, devaluation expectations also increased slightly in both periods, but they are within the average values for the past 10 months. In Kyrgyzstan, the situation with devaluation expectations also remains stable. A new minimum was again updated on a one-year horizon, as the share of those expecting the som to weaken fell by 1 p.p. On the contrary, a slight increase is observed on a one-month horizon.

The fourteenth wave of the consumer confidence research in four Central Asian countries showed very different results. While the previous growth trend continued at an even faster pace in Kyrgyzstan, it was replaced by a slight decline in Kazakhstan. On the other hand, Uzbekistan has been recovering for the second month in a row after a recent sharp decline. It will be interesting to see in the next waves whether the growth trend in Kyrgyzstan and Uzbekistan will continue. There is also a question of the Kazakhstan President’s address impact on the mood of residents in September, and whether it will be able to turn consumer confidence towards growth again. The leader of the region, Tajikistan, has seen its CCI fall slightly after a sharp increase in July, which probably indicates some correction and error in the results. We also note a sharp increase in the concerns of many residents of the region regarding the prices of meat and poultry, which negatively affected inflation expectations and estimates in two countries at once. As a result, August can be called contradictory with some hint of worsening inflation sentiment. Still, consumer confidence showed growth in all countries in comparison with 2023, it was especially noticeable in Tajikistan and Kyrgyzstan.