The consumer confidence index (CCI) declined in August but remained optimistic despite decreases across all subindices. Inflation expectations, rising for the fourth consecutive month, exceeded the actual inflation rate. However, consumers have adjusted their price growth estimates to more moderate levels.

Kazakhstanis are increasingly reporting price hikes, particularly in key food items. Despite heightened overall anxiety, the labor market appears stable, as do deposit instruments. Additionally, consumers plan to delay seeking loans for the time being.

This report highlights the findings from the 22nd wave of Freedom Finance Global PLC’s Consumer Confidence Survey, conducted monthly since November 2022 using United Research Technologies Group’s methodology.

An «optimistic» decline

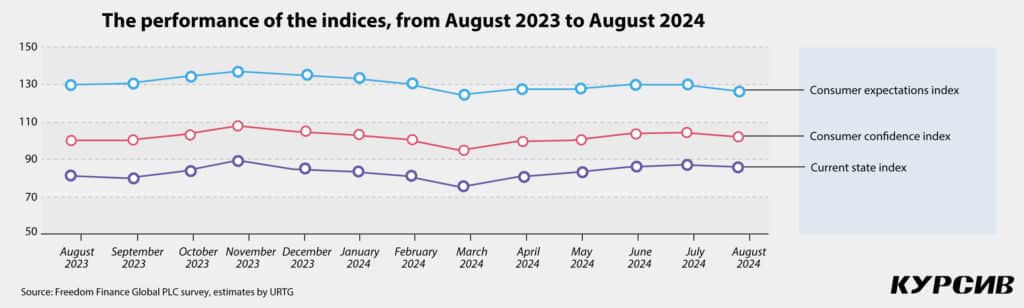

The optimism in consumer confidence observed in May and throughout the summer reversed in August, with the CCI dropping by 2.3 points to 101.9. This decline was reflected in the current state index, which decreased by 1.3 points to 85.7, and in the consumer expectations index, which fell by 3.6 points to 126.4. The latter had already shown a slight decrease in the previous month.

Continuing the trend from July, where some subindices declined, August saw all subindices drop, including the economic assessment index and the personal financial situation index. The most significant drops occurred in subindices measuring economic prospects: the expected personal financial situation index (down 4.1 points to 128.3), the short-term economic expectations index (down 3.2 points to 124.2) and the long-term economic expectations index (down 3.4 points to 126.7). Meanwhile, the major purchases index decreased by only 0.5 points to 76.5, indicating that Kazakhstanis are not yet abandoning their purchasing plans.

Despite the standard assumption that consumer confidence grows in the summer (consistent with CCI trends in other countries), we observed a decline in the consumer confidence index in August. However, the index remains in the optimistic zone, though the trend for further decline may continue into the fall.

Women and young adults on the verge of the pessimistic zone

Socio-demographic trends shifted again in August. Unlike in July, when women were more optimistic, women’s CCI dropped to the brink of the pessimistic zone at 100.9 points, a decrease of 3.7 points. In contrast, men experienced a slight increase in consumer confidence, rising to 103 points, an increase of 0.4 points.

While women continue to show a higher consumer expectations index (127.6 points compared to 125.1 points for men), men are more optimistic about the current state (88.4 points for men versus 83.2 points for women).

The overall decline in the CCI has further stressed previous trends across age groups. Although the youth (115.1 points) and young adults (103.7 points) remain in the consumer optimism zone, those aged 30 to 44 are again approaching the pessimistic point. In August, all age groups, except for retirees (92.5 points, up 0.6 points), experienced a decline in consumer confidence. Young people were down by 3.6 points, young adults by 1.3 points and adults by 4.2 points to 94.4.

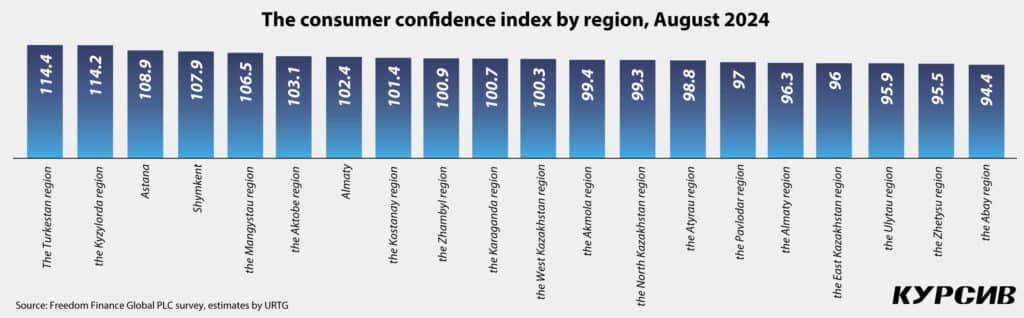

Only half of Kazakhstan’s regions remain in the optimistic zone

August saw a return to the trend of fewer regions displaying consumer optimism. While 17 regions were in the optimistic zone in July, only 11 regions remained in that zone in August.

The East Kazakhstan region (96 points) and the Ulytau region (95.9 points) remained in the pessimistic zone since the July survey. In August, the northern and central regions joined the ranks, including the Abay (94.4 points), Akmola (99.4 points), Pavlodar (97 points), North Kazakhstan (99.3 points) regions, as well as the city of Almaty (96.3 points), the Atyrau (98.8 points) and Zhetysu (95.5 points) regions.

A decline in consumer confidence was recorded in nearly all regions of Kazakhstan, except the West Kazakhstan (up 2.6 to 100.3 points), Kostanay (up 0.3 to 101.4 points), Kyzylorda (up 1.7 to 114.2 points) and Turkestan regions (up 6.2 to 114.4 points), as well as the cities of Almaty (up 2.4 to 102.4 points) and Astana (up 0.3 to 108.9 points).

The sharpest decline in consumer confidence in August was observed among residents of the Abay (down 6.9 points), Almaty (down 6.3 points), Atyrau (down 14.7 points), Zhambyl (down 4.8 points) and Zhetysu (down 4.6 points) regions.

Rising anxiety over finances

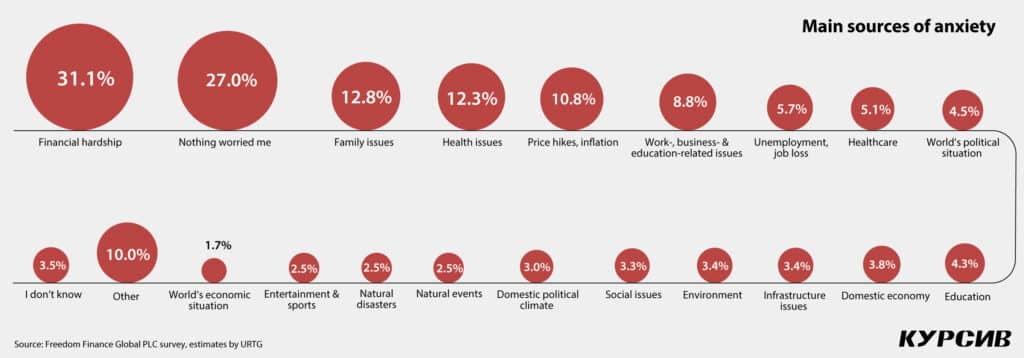

For the first time in a long while, anxiety over personal finances took the lead in August. The percentage of people worried about financial hardship or a lack of money rose by 2.9 percentage points (p.p.) to 31.1%. In contrast, the share of those who reported no concerns dropped significantly, falling by 7.4 p.p. to 27%.

Concerns about family issues also increased, rising by 5.6 p.p. to 12.8%. Additionally, health worries — whether personal or related to family members — grew as well, up 1.4 p.p. to 12.3%. Inflation has become a more pressing concern for Kazakhstanis, with one in ten expressing worries about rising costs (10.8%, up 3.1 p.p.). Issues related to work, business or education rounded out the top concerns, with the percentage of those worried increasing by 3.3 p.p. to 8.8%.

Moreover, Kazakhstanis are increasingly concerned about healthcare (up 3 p.p. to 5%), education (up 2.5 p.p. to 4.3%) and the global political situation (up 3.1 p.p. to 4.5%). While concerns about healthcare and education may be seasonal, worries about the political situation are likely influenced by media coverage.

A slower pace

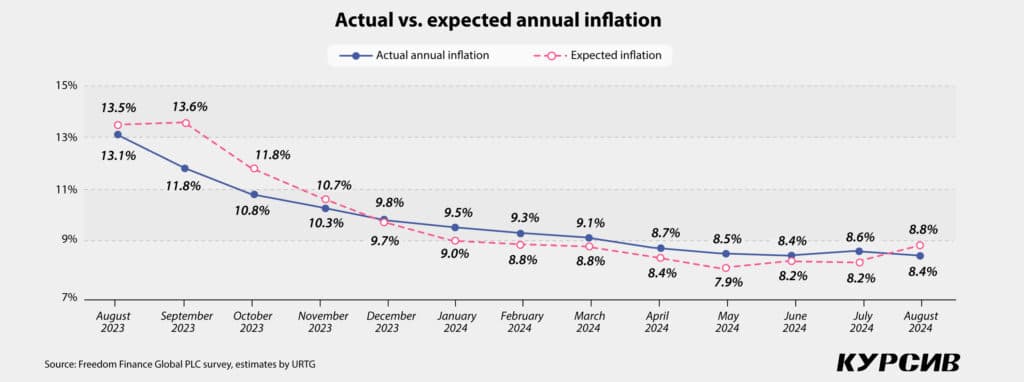

According to the Bureau of National Statistics of Kazakhstan, the annual inflation slowed in August to 8.4%, a 0.2% decrease year-on-year (YoY), following July’s acceleration.

The August data slightly balanced out consumers’ assessments of price trends YoY, easing the pessimism seen in July. Fewer consumers noted that prices had risen faster than before (51%, down 1.7 p.p.), though more than half still believe prices rose faster than last year. There was also a decrease in optimistic views on price trends, with fewer consumers believing that prices grew slower than before (down 3.1 p.p. to 9.7%) or remained unchanged (down 0.9 p.p. to 4.2%). As a result, August saw a shift toward more moderate consumer assessments (up 5.9 p.p. to 30.1%).

Monthly inflation also eased slightly, reaching 0.6%. Price growth estimates for August stabilized, aligning with year-end forecasts. Fewer consumers noted a strong price increase by the end of the month (37.6%, down 1.4 p.p.) and the percentage of those reporting no price changes also declined (6%, down one p.p.). Consumers were more likely to report moderate (up 1.7 p.p. to 35.5%) and insignificant (up 1.3 p.p. to 16.7%) price growth in August.

Inflation expectations surpass actual rates

This survey employs probabilistic quantification based on Burke’s methodology to calculate inflation expectations, which are inherently inertial.

In August 2024, the expected annual inflation rate rose by 0.6 p.p. to 8.8%. Meanwhile, actual YoY inflation (8.4%) was lower than the population’s expectations for the first time since December 2023. The ratio of expected inflation to perceived inflation has been increasing for four consecutive months, reaching 1.02 in August 2024. This rise suggests growing inflationary pressure in the late summer and early fall, likely tied to the rising dollar exchange rate during the same period.

Women and adults concerned about price increases

In August, the gender gap in price trend assessments widened. Women were more likely than men to report significant price hikes (42.2%, up by 0.4 p.p.), while men tended to reduce their pessimistic assessments (down by 3.4 p.p. to 32.6%). A similar pattern was observed in the annual price trend estimates, with women showing more pessimism (55.8%, down by one p.p.) and men displaying a greater reduction in pessimistic views (down 2.5 p.p. to 45.6%).

Optimistic assessments of price trends over the past month and year were more common among the youngest (34.6% and 49.4%, respectively) and oldest (36.6% and 46.5%) consumers. Previously, retirees held some of the most pessimistic views on price growth, but in August, their assessments shifted toward more moderate or even optimistic outlooks (down 6 points to 36.6% and down 6.6 points to 46.5%, respectively). The most pessimistic group remains Kazakhstanis aged 30 to 44 (40.1% and 54.3%), though the increase in their pessimistic assessments was not as significant.

At the end of the month, residents of the East Kazakhstan (45.2%) and Abay (46.6%) regions were most likely to report sharp price hikes. By year-end, the East Kazakhstan (57.9%), Almaty (57.6%) and Pavlodar (60.7%) regions showed the least moderate assessments.

Less concern over communication costs

In August, prices rose for almost all goods and services. However, due to the significant rise in the cost of key food items, internet and mobile communications costs were less of a concern. Even though the percentage of respondents reporting price increases for these services grew by 2.6 p.p. to 16.1%, it did not top the list of consumer concerns.

Unlike the previous summer months, in August, Kazakhstani consumers increasingly felt the impact of rising prices for key food items, particularly milk and dairy products (up 5.1 p.p. to 35.9%), bread and baked goods (up 4.5 p.p. to 28.8%) and cheese and sausages (up 5 p.p. to 16.4%). Consumers also became more aware of rising housing and utility costs, with one in four residents reporting noticeable price increases (up 3.8 p.p. to 20.7%), affecting their budgets.

Among goods and services outside the traditional top categories, the most significant price increases in August were noted in tobacco and cigarettes (up 5 p.p. to 14.3%), clothing and footwear (up 4.8 p.p. to 13.4%), confections (up 4.1 p.p. to 12.3%) and household services (up 4.3 p.p. to 7.7%).

Forecasting price growth

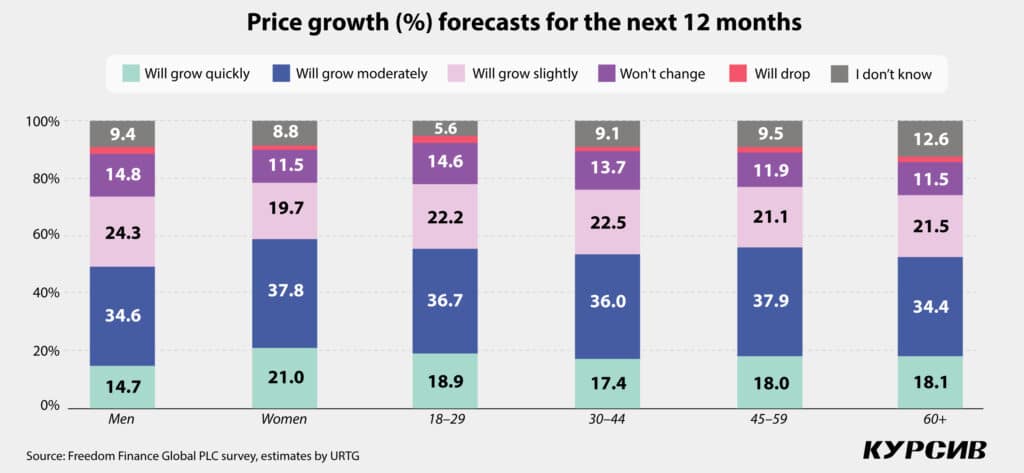

Unlike previous assessments, consumers’ forecasts have shifted toward more pessimistic outlooks. A growing number of respondents have been expecting either strong (18%, up 0.8 p.p.) or moderate (36.3%, up 2.1 p.p.) price growth over the next month.

For the yearly outlook, in August, consumers’ expectations have become more moderate and stabilized. The share of those who expect price growth has significantly increased (up 10 p.p. to 49.3%) compared to the previous year, while the share of those expecting otherwise has decreased.

Women and young people anticipate price hikes

The gender gap in price growth forecasts for the next month is widening. While no such disparity existed in July, August saw women increasingly predicting strong price hikes (21%, up 3.6 p.p.) compared to men (14.7%, down 2.6 p.p.). For the next year, men also became less pessimistic (20.1%, down 3.2 p.p.), while women remained more concerned (23.1%, down 1.9 p.p.), reversing the July trend where men showed greater concern about future price growth.

Young people are now the most pessimistic group in both yearly (23.1%, down 0.1 p.p.) and monthly (18.9%, up 1.8 p.p.) forecasts of strong price hikes, overtaking the previous pessimistic outlooks from young adults (22.6% and 17.4%, respectively). Among older Kazakhstanis, those over 60 also reported increased pessimism about price growth over the month (18.1%, up 3.1 p.p.).

Residents of the Abay (25%), East Kazakhstan (24.7%) and Ulytau (23.9%) regions expect strong price growth within the next month. Over the next year, residents of the Akmola (27.1%), Aktobe (27.3%) and Ulytau (28.7%) regions foresee significant price increases.

Moderate pessimism

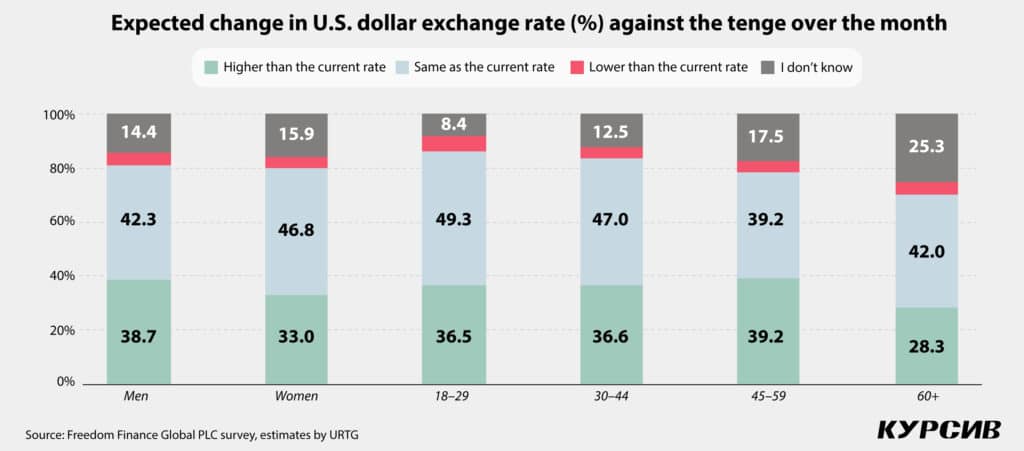

August saw an increase in pessimistic assessments. More than a third of Kazakhstanis (35.7%, up 1.4 p.p.) expect the U.S. dollar to rise against the tenge over the next month, while almost half (44.7%, up 4.9 p.p.) believe the exchange rate will remain stable. For the yearly outlook, forecasts changed less significantly: more than half (58.7%, up 1.9 p.p.) continue to expect the U.S. dollar to strengthen against the tenge, while every fourth respondent believes there will be no change in the exchange rate (19.6%, up 2 p.p.).

Traditionally, men are more likely to predict dollar growth over a month (38.7%) and a year (62.4%), with their estimates increasing by 3 p.p. and 2.7 p.p., respectively. As for the age groups, younger people are more inclined to expect dollar growth over the next year, although their forecasts have slightly decreased (64.9%, down 2 p.p.). Meanwhile, those aged 45 to 59 are more likely to predict a rise in the exchange rate within the next month (39.2%, up 3.9 p.p.).

Residents of Almaty (68.1%) and Astana (66.2%) are the most confident in the prospect of dollar growth over the next year. For the next month, residents of the West Kazakhstan (43.3%), Turkestan (41.5%) and Almaty (42.3%) regions are more likely to expect an increase in the dollar’s value.

Unemployment is not alarming

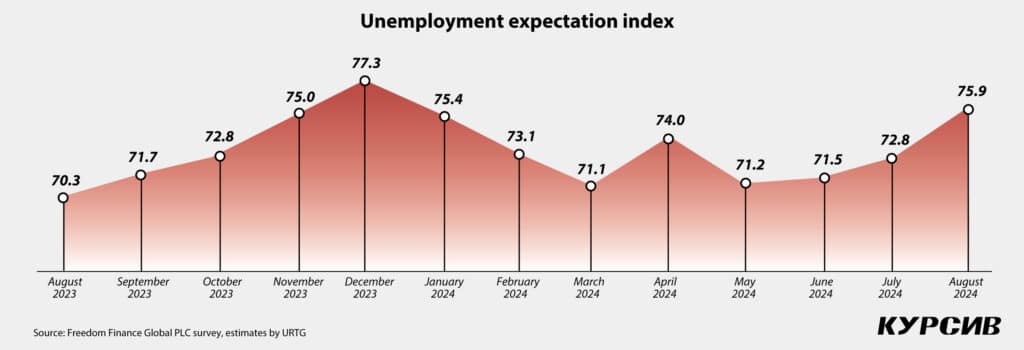

After a decline from May to July, the unemployment expectation index saw a significant increase in August (up 3.1 p.p. to 75.9). This trend is largely due to a rise in the share of those who believe the unemployment rate will remain about the same (up 5 p.p. to 40.7%), reflecting more moderate estimates.

Women are more likely to express pessimistic (38.3%, down 2.6 p.p.) and moderate (42.2%, up 4.5 p.p.) views about the labor market compared to men (36.8% and 39.1%). The greatest concerns about a rise in unemployment over the next year are among older age groups, particularly those nearing retirement age (40%) and retirees (38.6%). Although all age groups are shifting their pessimistic outlooks toward more moderate views, adults aged 45 to 49 are again leading in stable labor market expectations (42.5%).

Residents of the Aktobe region (45.4%) and Zhetysu region (46.7%) expressed more concern about potential job reductions in August. In contrast, residents of the Kostanay region (25.9%) and North Kazakhstan region (27.7%) were less worried about unemployment.

A shift towards saving and avoiding loans

In August, there was a sharp drop in the number of people planning to take out loans (down 2.7 p.p. to 17.5%), reversing the high rate observed in July. This decline was most evident among women (17.4%, down 3.4 p.p., compared to men at 17.6%, down 1.9 p.p.), who had previously shown greater interest in taking out loans. All age groups, except young people, indicated less interest in borrowing. Regionally, residents of the Abay (25.6%) and Mangystau (23.3%) regions, as well as Astana (22.7%), were more likely to plan on taking loans, while residents of the Akmola (14.8%), East Kazakhstan (13.1%) and Pavlodar (12.7%) regions were less inclined.

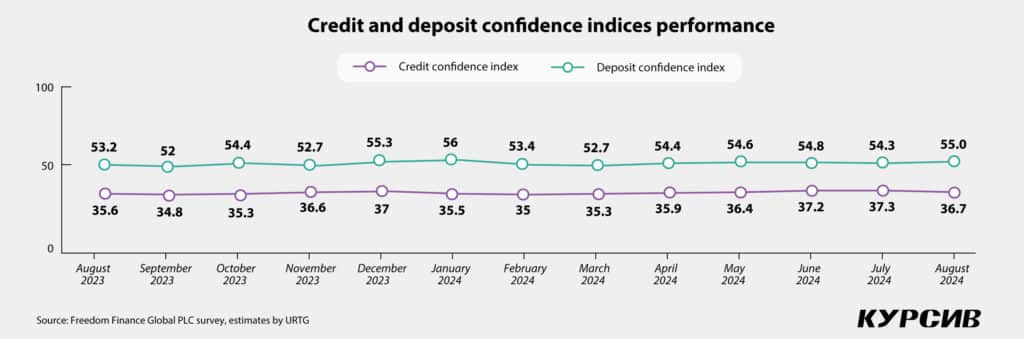

In August, the credit confidence index fell by 0.6 points to 36.7, nearly returning to its May value of 36.4. This decrease was driven by a drop in optimistic assessments (down 3.7 p.p. to 13.6%), with the primary shift towards moderate views (up 7.4 p.p. to 29.7%). Although almost half of Kazakhstanis (46.9%) still believe it is not a good time for lending, this share fell in August (down 2.3 p.p.).

In August, gender differences in the credit confidence index equalized, with men and women recording an index of 36.7 points. Since July, men’s confidence increased by one point, while women’s confidence decreased by 1.9 points. Young adults were the only group to show an increase in credit confidence (up 0.5 points to 37.5), though they still rank the highest (38.5 points, down 0.2 points). A trend of decreasing credit confidence as age increases is noticeable. Regionally, the highest levels of credit confidence were observed in the Kyzylorda region (41.5 points, down 2.3 points) and Astana (40.4 points, up 2.2 points). The lowest levels were found in the Akmola region (31.9 points, down 6.1 points).

Despite similar trends in assessments of favorable deposit instruments, the deposit confidence index increased by 0.7 points to 55, recovering from the decline in July. Similar to credit confidence, the share of moderate assessments rose (up 9.4 p.p. to 32.3%), while optimistic views declined (down 2.6 p.p. to 35%) and pessimistic views also decreased (down 4.3 p.p. to 22.4%).

Interestingly, in August, the rise in deposit confidence was driven largely by men (up 1.8 points to 54.3), while women’s confidence slightly dropped by 0.3 points to 55.7. All age groups, except adults aged 30 to 44 (down 0.6 points to 56), contributed to this growth. However, similar to credit confidence, deposit confidence tends to decrease with age. The highest levels of deposit confidence were observed among residents of the North Kazakhstan (59.1 points) and Ulytau (60.9 points) regions, while the lowest levels were recorded in the Zhetysu region (47.9 points).

Rising anxiety and stress

In August, more than half of Kazakhstanis (56.3%) felt the overall sentiment around them was calm, though this share dropped by 1.9 p.p. since the July survey. This decline was driven by a reduction in those who believed the prevailing sentiment was calm (down 6.8 p.p. to 27.9%). Anxious moods became more prevalent (39.2%), largely due to a rise in rather uneasy sentiments (up 4.5 p.p. to 25.1%).

Women continued to report higher levels of anxiety (41.9%, up 1.6 p.p.), though men saw a sharper increase in anxiety in August, reaching 36.3% (up 3.6 p.p.). Among age groups, adults reported the highest levels of anxiety, with nearly half of respondents aged 45 to 59 (44.6%) and those over 60 (44.3%) experiencing it in August. Regionally, the highest level of anxiety was recorded in the Ulytau region (52.9%), while the lowest was in the Kyzylorda region (21.2%, up 2 p.p.).

As anxious moods rose, the share of Kazakhstanis who did not experience stress during the month decreased (40.5%, down 8 p.p.). The drop was most notable among those experiencing stress daily (down 0.6 p.p. to 10.7%). In contrast, those experiencing stress several times a month increased by 3.5 p.p. to 21.4% and those encountering stress one to two times also rose by 3.5 p.p. to 13.9%.

Women continued to lead in the frequency of experiencing stress (60.6% vs. 53.9% for men). Among age groups, young people reported the highest frequency of stress (65.3%, up 12.6 p.p.), with stress frequency decreasing as age increases. Regionally, the highest stress levels were observed in the West Kazakhstan (60.8%) and Karaganda (61%) regions, as well as among residents of Almaty (65.5%) and Astana (66.7%). The lowest stress levels were reported by residents of the Aktobe (49.5%) and Kyzylorda (49.4%) regions.

Decreasing optimism and rising concerns

August marked a break in the optimistic trend in consumer confidence, with the CCI declining, though it remains in the optimistic zone. All subindices saw a decline, with the sharpest drop in those measuring both national and personal economic prospects.

Only 11 regions remain in the optimistic zone. Three previously pessimistic regions were joined by six more, shifting from optimism to pessimism. Men showed a slight increase in consumer confidence, but women are edging closer to the pessimistic zone, as are young adults.

There’s a growing concern about personal finances, as well as the state of the healthcare and education systems. Despite this, the labor market did not cause significant anxiety among Kazakhstanis in August. However, overall anxiety and stress levels, and the frequency of stress, continued to rise significantly.

For the first time since the end of 2023, the actual annual inflation was below public expectations. In terms of forecasting price trends, the share of pessimistic outlooks continued to grow. Yet, when assessing price trends over the past month and year, consumers in August were more inclined to offer moderate evaluations. Rising food prices remained a primary concern, outpacing even the previously noticeable increases in communications and internet costs.

Additionally, fewer people plan to take out loans, and credit confidence dipped as consumers increasingly view this as the wrong time for borrowing. In contrast, deposit confidence continued to strengthen gradually.