Kazakhstan’s hidden wealth: a closer look at the National Fund portfolio

The results of the investment activities of Kazakhstan’s National Fund are comparable to those of its peers – the Norwegian and Azerbaijani sovereign funds. However, the Ministry of Finance of Kazakhstan, which supervises the fund, has been gradually reducing the amount of publicly available information about the geographic and industrial diversification of its portfolio.

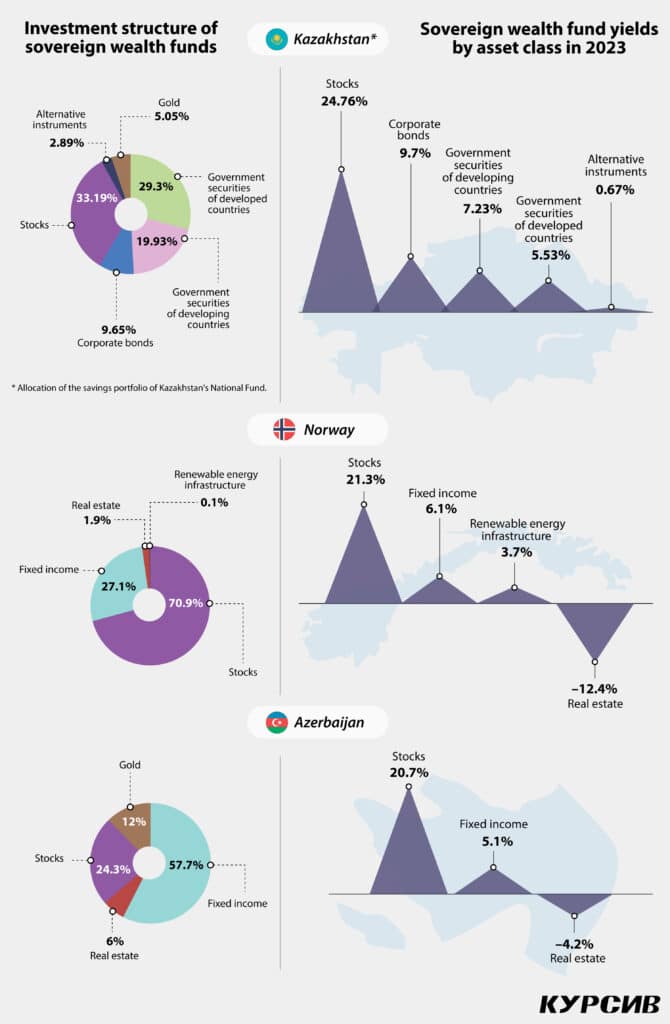

Kazakhstan’s National Fund and Azerbaijan’s State Oil Fund both claimed remarkable returns for 2023, reporting yields at 11.38% and 7.1%, respectively. The world’s largest sovereign fund, the Government Pension Fund of Norway, reported earning an unprecedented amount in krona, the national currency, for the year. However, its percentage of investment income has been higher in the past.

Norway’s sovereign fund issued a 132-page annual report, while Azerbaijan’s oil fund published a 114-page document. In contrast, Kazakhstan’s National Fund does not release full annual reports at all.

For several years, the Ministry of Finance of Kazakhstan published a «Report on Formation and Use of the National Fund of the Republic of Kazakhstan,» which, at 23-25 pages, did not match the depth of a comprehensive annual statement. This year, the ministry decided such scant details were unnecessary, opting instead to publish a brief note in the Kazpravda newspaper titled «Information About the Report on Formation and Use of the National Fund of the Republic of Kazakhstan for 2023,» labeling it as an «advertisement.»

Kursiv’s editorial staff requested the full report from the ministry twice, receiving the same recommendation each time: to read Kazpravda.

«In accordance with paragraph 3 of Article 134 of the Budget Code of the Republic of Kazakhstan, information on the annual report on the formation and use of the National Fund of the Republic of Kazakhstan and the results of the audit is published in the media. According to subparagraph 2) of paragraph 2 of the operative part of Decree No. 567 by the President of the Republic of Kazakhstan, dated June 10, 2024, the Government is instructed to ensure the publication of information on the report on the formation and use of the National Fund of the Republic of Kazakhstan for 2023 and the audit results in periodic print media,» said Kairat Miyatov, a department head at the Ministry of Finance.

The National Bank’s annual report devotes almost four pages to the management of the National Fund’s assets. However, even this information, combined with the Kazpravda article, fails to offer a clear view of the geographical or sectoral breakdown of the fund’s investments. The only available details pertain to asset allocation and returns by asset class (see Infographics).

For instance, Norway’s sovereign wealth fund offers detailed insights into its equity investments, breaking down the portfolio by country and industry sector. In 2023, the technology sector reported the highest return (51.9%), with technology companies accounting for 22.3% of the portfolio.

As of the end of 2023, Norway’s wealth fund had investments in 8,859 companies, down from 9,228 in the previous year, which the fund attributed to portfolio adjustments. The most profitable investments were in Microsoft, Apple and Nvidia, while the least successful were in Pfizer, Meituan and NextEra Energy. The fund also participated in 45 IPOs, with its largest investments in Birkenstock and Maplebear Inc.

The «Information About the Report…» published by Kazakhstan’s Ministry of Finance reveals that last year, the National Fund purchased KazMunayGas shares for $2.7 billion. This is the only detailed information provided about its equity investments. Information on investments in corporate bonds is similarly sparse. The Kazpravda note mentions that in 2023, the National Fund acquired Samruk-Kazyna bonds worth $360 million. Additionally, the ministry chose not to disclose the total size of the tenge-denominated bond portfolio of Kazakhstani issuers.