Actively criticized by the government, the Development Bank of Kazakhstan (DBK) has funded hundreds of projects for approximately $10.3 billion in total. In 2022, President Kassym-Jomart Tokayev called it a «private bank for an inner circle,” and last month, Alikhan Smailov, head of the Supreme Audit Chamber and former Prime Minister of Kazakhstan, said that the DBK “turned into a private bank for ten big businessmen.» Kursiv.media has reviewed a list of the most frequently funded companies and their owners. Here is what we have found.

In order to reveal the names of the most frequently financed entrepreneurs, Kursiv.media analyzed the list of the DBK-approved projects, its website and media reports. Even though the list has no data for 2012 and the period between 2001 and 2007, the bank’s financial statements for the relevant time span indicate that multibillion-dollar loans were indeed issued during that period.

The list of approved entities does not include every borrowing company, as it does not record repaid loans. Although Kursiv.media has officially requested the DBK to disclose the full list of its projects from 2001, the bank hasn’t responded as of the time this text was published.

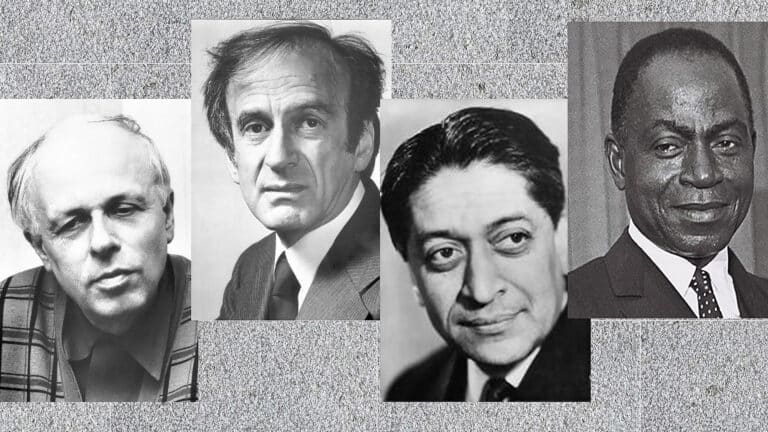

Excluding the public sector, the most frequently mentioned names include billionaire Vladimir Kim; various relatives of Nurlan Nigmatulin, the former chairman of the parliament; entrepreneur Eduard Ogay; family members of former president Nursultan Nazarbayev; and the owners of Eurasian Resources Group (ERG), Alexander Mashkevitch, Patokh Chodiev and relatives of the late Alijan Ibragimov. The loans were aimed at projects such as hotel and factory construction, tourism development, road work, trading-logistics center renovation, export operations, renewable energy development, railroad modernization, gas pipelines and internet network renovation.

When it comes to companies, the majority on the list are enterprises with partial state ownership, which have received 24 loans since 2007 totaling slightly more than $3.1 billion. Among the recipients are Kazchrome mining and smelting enterprise (40% owned by the Ministry of Finance through ERG), Kazakhstan Electricity Grid Operating Company (KEGOC), QazAvtoJol road operator, Kazakhstan Aluminium Smelter, Makinsky Thermal Insulation Plant, Tethys Aktau II construction company, Kazzinc mining and metallurgical company, Astana Gas Service KMG, Kazakhtelecom, the Pavlodar Oil Chemistry Refinery and the Port of Aktau. The largest loan, approximately $941.6 million, went to QazAvtoJol. This funding, provided in U.S. dollars for a 10-year term at 2.44% interest per annum, was used for intermediate repair of nationwide road networks.

Ventures owned by relatives of former parliament chairman Nurlan Nigmatulin — including his sons, Nurkhan and Nurzhan Nurlanov, his brother, Yerlan Nigmatulin and his father-in-law, Gabbas Bekturov—received funding six times, totaling approximately $334.3 million. These companies include Kazphosphate, Novozhambyl Phosphate Plant, Ekibastuz FerroAlloys, Asia FerroAlloys, YDD Corporation and the Turgusun-1 hydropower plant project. The largest portion, $148.7 million, was invested in the construction of a ferroalloy plant in Ekibastuz by Ekibastuz FerroAlloys in 2021. The plant’s shareholders are Yerlan Nigmatulin and Shmagi (David) Kemertelidze, allegedly a Georgian citizen. The companies also received loans for the acquisition of raw materials and supplies.

Companies with shares held by billionaire Vladimir Kim (ranked 4th on the Forbes Kazakhstan list with a fortune of $3.6 billion) received funding from the DBK totaling slightly more than $968.6 million across five occasions. Among these enterprises are Kazphosphate and Novozhambul Phosphate Plant (a part of Kazchrome), Kazenergocable, Kaz Green Energy and Kaz Minerals Aktogay. Meanwhile, Eduard Ogay, ranked 13th among the 75 richest Kazakhstanis with an estimated fortune of $800 million, is also a shareholder in all of these companies except the last one. The funds were primarily allocated for acquiring raw materials, pre-export financing, and the construction of solar power plants, among other projects. The largest loan, $1.2 billion, was granted to KAZ Minerals Aktogay in 2016 for the construction of the Aktogay mining and processing plant in the East Kazakhstan region.

Companies under Eurasian Resources Group (ERG) — owned by Patokh Chodiev, an Uzbek native who holds Belgian citizenship, Alexander Mashkevitch, an Israeli, and the late Kazakhstani citizen Alijan Ibragimov, whose shares have been transferred to his family — received funding from the DBK on four occasions. These include Kazakhstan Electrolysis Plant (which received funds twice), Kazchrome, and Eurasian Energy Corporation. The total funding amounted to $553.1 million, with the largest loan of $256.1 million issued to Eurasian Energy Corporation for the reconstruction of Power Plant No. 5 and the Vostochny coal mine in 2018. Additionally, $14.4 million was provided to Continental Logistics, whose list of shareholders includes Chodiev’s nephew, Orifjan Shadiev, for the modernization of a trade and logistics center.

The Seitzhanov family, led by Serikzhan Seitzhanov — ranked 23rd among the 50 richest individuals in Kazakhstan in 2023 — has received funding from the DBK on four separate occasions. Among his ventures are the Talas Investment Company, which has secured loans three times, and the Innovation Complex Sastobe. In total, the loan volume amounted to $174.5 million. These funds were primarily allocated for pre-export financing and the construction of facilities for producing sodium cyanide and caustic soda. The largest loan was obtained in 2023 to establish a plant in the Turkestan region for the production of caustic soda, PVC and calcium carbide.

The DBK has financed Qazaq-Astyq Group, an oilseed crop processing company founded by Daulet and Erkinbek, sons of Asemkan Duskuzhanov, member of the regional parliament of the East Kazakhstan region. The enterprise obtained $159 million in loans in total for pre-export financing. Duskuzhanov Sr. is also a managing director at the SemAz and Daewoo Bus vehicle assembling plants.

The DBK has also provided multiple rounds of financing to companies linked to relatives of Ex-President Nursultan Nazarbayev. Among them are Kazakhtelecom, whose shareholders over the years have included Nazarbayev’s nephew Kairat Satybaldyuly, the Kulibayev family, entrepreneur Alexander Klebanov, and more recently, the Samruk-Kazyna national welfare fund, which holds a significant stake in the communication operator. Other financed companies include Transtelecom, with 75% of its shares of belonging to a company controlled by Nazarbayev’s grandson Nurali Aliyev and Dmitry Pokupatelev; Crystal Management, owned by Nazarbayev’s middle daughter Dinara Kulibayeva and her husband Timur Kulibayev; and Shymkent Chemical Company, also owned by the Kulibayev family.

In addition, the DBK has issued loans to Zhel Electric, Mistral Energy, Abay 1 wind power station (100 megawatts), and Abay 2 wind power station (50 megawatts), whose founders include Oraz Zhandosov, the founder of the National Fund and former head of the Ministry of Finance. The total amount of financing amounted to $154.9 million invested in the construction of the renewable energy sources.

Makinsk Poultry Farm, owned by millionaire Serik Tolukpayev (ranked 42nd among the 75 richest Kazakhstanis according to Forbes), has also been financed by the DBK on three occasions for a total amount of $91.3 million.

Among the owners of companies that received DBK financing are several prominent figures. These include businessman Vladimir Dzhumanbaev, who used to be on Kyrgyzstan’s international wanted list, and Aidyn Rakhimbayev, founder of BI Group and number 11 on Kazakhstan’s Forbes list. Other recipients of public loans include Gulnara Dossayeva, wife of Almaty Mayor Yerbolat Dossayev; Yuriy Pak and Berik Kaniyev, both ranked 73rd among Kazakhstan’s richest individuals in 2024, are also on the DBK list. Additionally, Gauhar Kapparova ranked 45th among the 50 most influential entrepreneurs in Kazakhstan in 2021, and the Utemuratov family, led by Bulat Utemuratov, who ranks 6th on the 2024 list of Kazakhstan’s wealthiest people, also benefited from DBK financing.

Timur and Askar Turisbekov, sons of former Deputy Head of the Presidential Administration and Ex-Minister of Internal Affairs Zautbek Turisbekov, used to co-own Shymkent Chemical Company along with the Kulibayev family. Among other recipients of public assets were Sagat Tugelbayev, former governor of the Atyrau region, ranked 68th on the Forbes list of Kazakhstan’s richest, and businessman Pavel Selivanov, owner of Maslodel food company. Talgat Akhmetov, son of former governor of the East Kazakhstan region Daniyal Akhmetov, secured financing for the Tursugun-1 hydropower plant; Arsen Dzhamaludinov, son-in-law of Russian billionaire Suleyman Kerimov, and businessman Andrey Lavrentyev, owner of Allur Group (a vehicle manufacturing company), also received loans from the DBK. Lavrentyev has recently acquired Qarmet, formerly controlled by ArcelorMittal Temirtau.

The development bank has also issued loans to foreign companies, including Russian Transmashholding (a locomotive manufacturer), Swiss Glencore (Kazzinc’s shareholder), Chinese CNPC (PetroKazakhstan Oil Products) and ArcelorMittal, co-owned by Indian entrepreneur Lakshmi Mittal, in the amount of $994.9 million in total.

In the middle of September, Head of the Supreme Audit Chamber Alikhan Smailov criticized the work of the bank and its subsidiary, the Industrial Development Fund. He pointed out that the bank exists «mainly for 10 large, well-known entities,» and the fund is financing projects with a major risk and doubtful efficiency.

According to the results of the bank’s audit, large companies accounted for half of the bank’s five-year loan, leasing and investment portfolios, which continues effectively making it a «personal bank for a narrow circle of individuals.» This is how President Tokayev described the DBK in early 2022.

The DBK was established by Nazarbayev’s decree in 2000. As a national institution, the development bank focuses on financing private investment projects in non-resource industries and public infrastructure initiatives. The DBK offers medium- and long-term low-interest loans to companies. Its sole shareholder is Baiterek Holding, which operates under the Ministry of Economy. In the first half of 2024, the bank reported a net profit of $141.9 million, a 4.2% decrease compared to the previous period. Between January and June, the DBK issued loans totaling $3.6 billion, primarily to corporate clients. Currently, there are 59 additional projects under the bank’s consideration.