For the fifteenth month, Freedom Finance Global has been researching consumer confidence, inflation and devaluation expectations of residents of four Central Asian countries: Kazakhstan, Uzbekistan, Kyrgyzstan and Tajikistan. In September 2024, a negative trend was recorded with a decrease in consumer confidence in three countries, although the decline turned out to be small. In addition, a similar situation is observed in the dynamics of inflationary sentiment, which increased in all four countries. Nevertheless, devaluation expectations remained unchanged in the region as a whole, except of Uzbekistan, where concerns about this have grown significantly.

In September, the Consumer Confidence Index (CCI) fell in three countries of the region at once. Kyrgyzstan showed a slight decline in the index after six months of growth in a row and reached records. In Uzbekistan, the drop was slightly more significant and almost completely canceled the entire August progress. Tajikistan also experienced a slight decline, but it continues to maintain its leadership in the region. Kazakhstan was the only country in the region that recorded positive monthly dynamics of the index in September.

In Kazakhstan and Uzbekistan, analysts collect 3,600 questionnaires each month, 1,600 in Kyrgyzstan and 1,200 in Tajikistan, pro rata the size of the population in the countries under research. The research is based on the methodology used to obtain consumer confidence indexes in many countries around the world and adapted to local needs by the United Research Technologies Group company. Data collection method: telephone survey. The survey questionnaire is localized: the research is conducted in the native language of the respondents.

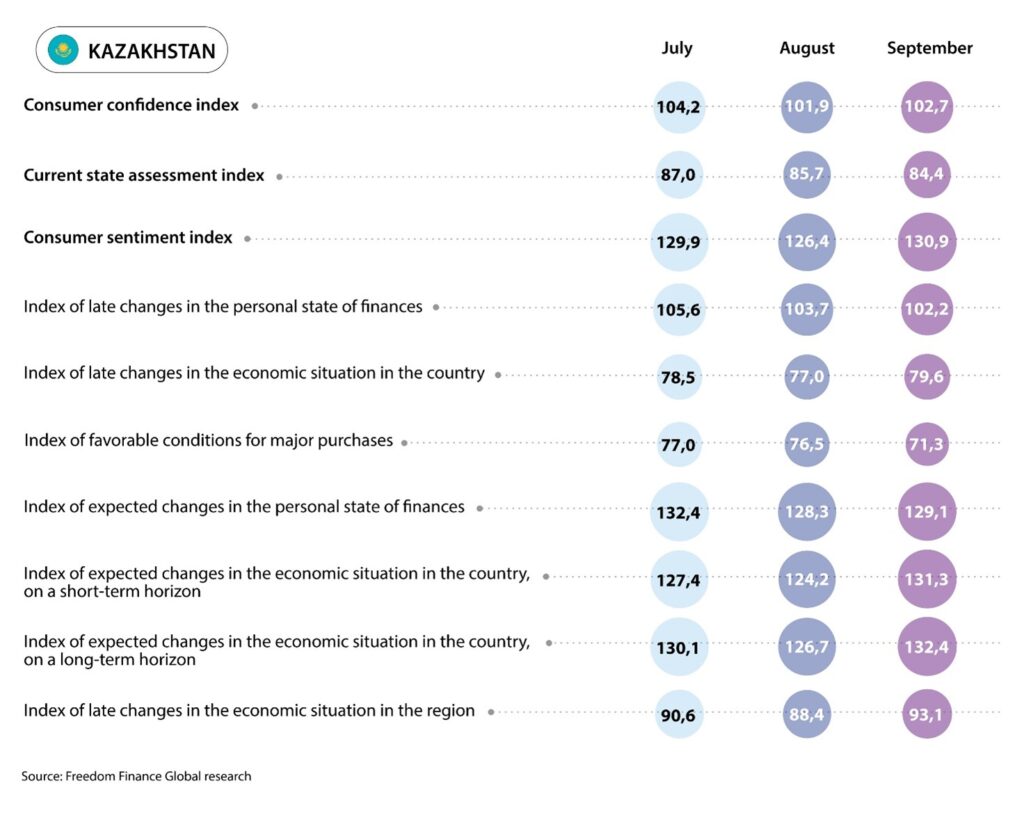

Kazakhstan

In Kazakhstan, the Consumer Confidence Index showed a partial recovery in September after the August fall and rose from 101.9 to 102.7 points. Sentiment improved in three of the five sub-indexes. The largest increase occurred in forecasts of changes in the economic situation over a one-year horizon. Compared to last September, the CCI rose by 2.7 points, largely due to a significant improvement in estimates of changes in personal financial situation.

Significant increase in economic optimism

The sub-index of forecasts of changes in the economic situation over the next 12 months increased by a noticeable 7.1 points and reached 131.3 points, which is the second-best result of this year. The share of those who believe that the economic situation will improve increased from 49.3% in August to 53.1% in September.

Among the age groups, growth occurs in all groups, but the strongest improvement is recorded among people aged 45-59 years. The share of positive respondents increased from 45.8% to 51.7% in this group. However, this is still the lowest rate among all age groups. Young people under the age of 29 continue showing the best result, among whom the same share reached 55.8%.

In the regional context, the largest increase in positive responses to forecasts of changes in the economic situation is observed in the Atyrau, Mangystau and Zhetysu regions, where the share of positive responses increased by 17.5, 14 and 12.3 p.p., respectively. As a result, the leader of September is the Mangystau region, where the share of those predicting an improvement in the economy in the next 12 months was 70.6%. The worst response was given in the Ulytau region, where this indicator, on the contrary, fell by 1.2 p.p. and amounted to 40.2%.

Conditions for large purchases have become less favorable

Compared to August, the largest drop is shown by the sub-index of current favorable conditions for large purchases, which fell by 5.2 points and reached 71.3 points. This result is the lowest in the last five months. The share of Kazakhstanis who believe that the conditions for purchases are favorable decreased from 32.8% to 30.2%.

Among the age groups, the greatest drop in the level of optimism is observed among young people under the age of 29 (the share of positive responses fell from 41.8 to 36.8%) and respondents aged 30-44 (the share of positive responses fell from 33.4 to 28.6%). At the same time, the dynamic was not negative in other age groups. The share of respondents aged 45-59 who note favorable conditions for large purchases has not changed, while the indicator for the older generation aged 60 and over has increased to 26.1%. However, this result is the worst among all ages.

In the regional context, the Kyzylorda region showed the largest regression, where the share of positive responses fell from 45.9% to 20.4%. This result was also the worst among all regions in September. In addition, a large monthly drop is observed in Ulytau (-17.4 p. p.) and Atyrau regions (-10.1 p. p.). On the other hand, respondents from the Karaganda region responded best, where the share of positive responses fell slightly, from 34.8 to 34.6%.

Inflation estimates and expectations of Kazakhstanis have increased

Kazakhstan residents’ inflation estimates rose slightly in September after a record low in August. Over the past month, 39.7% of residents (37.6% in August) noticed a strong increase in prices. Moreover, in the past year’s horizon, there was a slight drop in the share of those who noticed a faster increase in prices: from 51% in August to a record low of 50.8%.

Inflation expectations of Kazakhstanis as a whole have significantly increased and reached the highest values this year. The share of people who expect strong price growth in the one-month horizon increased from 18% to 19.9%, while the share of people who expect an acceleration in price growth in the next 12 months increased from 21.7% in August to 24.9%.

A similar survey of the National Bank of Kazakhstan of inflation estimates and expectations showed a significant increase in pessimism after the multi-month lows of August. According to that survey, the share of people expecting strong price growth during the year increased from 20.9% to 24.3%. While in the one-month horizon, the same indicator increased sharply from 14.7 to 19.5%. Inflationary estimates in different time horizons showed a multidirectional movement. The share of respondents who estimated price growth over the past month increased from 26% to 29%, but the share indicating rapid price growth over the previous 12 months decreased from 43.4% to 42.7%, which is the second lowest value since April 2020.

Among certain goods and services, the majority of respondents are still concerned about a significant increase in food prices. The top four most noticeably expensive goods for the population remain unchanged for the eleventh month in a row. It includes the categories of ‘Meat and Poultry’, ‘Milk and Dairy Products’, ‘Bread and Bakery Products’, and ‘Vegetables and Fruits’. Nevertheless, on average, the share of people who noticed a strong increase in the prices of all the above products fell by 4.4 p.p. For vegetables and fruits, the indicator fell from 32.6% to 27.2%, which is the lowest for the entire research. The share of people who chose dairy products also fell significantly (by 4.9 p.p.), and the indicator reached 31%, which is only 0.2 p.p. higher than the record low. According to official statistics, prices for dairy products increased by only 0.4% MoM in September, and by 0.2% MoM for meat. Prices for fruits and vegetables also seasonally decreased by 3.6% compared to August.

Devaluation expectations decreased slightly

The devaluation expectations of Kazakhstanis remained at a high level in September, although they showed a slight decrease after a slight strengthening of the tenge in September. According to the survey, the share of Kazakhstanis who expect the tenge to weaken within one year has fallen from a record 58.7% to 57.5%. In the one-month horizon, there was a decrease from 35.7% to 35.2%. It should be noted that in comparison with last September, the share of pessimists increased by 1.1 p.p. on the first question and fell by 3.3 p.p. on the second question.

Uzbekistan

The Consumer Confidence Index of Uzbekistanis declined in September 2024 after two months of recovery in a row and fell from 130.9 to 128.7 points. Separately, the decline occurred in all five sub-indexes that define the index. The biggest drop was shown by the sub-index of favorable conditions for large purchases. Compared to September 2023, the index also declined by 2.7 points, largely due to a drop in optimism about the economic situation.

Reduced optimism about conditions for large purchases

The sub-index of favorable conditions for large purchases and spending decreased by 5.4 points after a record August and reached 86.9 points. 40.1% of Uzbekistan residents chose a positive answer, compared to 41.8% in August. The share of negative responses increased significantly by 3.9 p.p.

Among the age groups, people over 60 years of age showed the greatest deterioration in ratings. In the previous month, the share of positive responses reached 42.6% in this group, but in September, it fell to 35.5%, which is the lowest result among all age groups. Young people under the age of 29, who scored 44.4% of optimists, which is 2.3 p.p. lower than in August, still showed the best result. Results of the other two average age groups were similar-38-40%.

In the regional context, the greatest deterioration of the indicator occurred in the Navoi region. There, the share of respondents who chose positive answers fell from 50.7% to 36.4%. Tashkent region showed the lowest results in September, where the share of positive responses fell from 39.9% to 31%. On the other hand, the share of optimists increased compared to August in Namangan, Fergana, Khorezm, Surkhandarya regions and the Republic of Karakalpakstan.

Opinions about the economic situation have worsened over the past year

Over the past year, the largest drop was shown by the sub-index of changes in the economic situation. The sub-index fell by 8.4 points compared to September 2023 and reached 119.5 points, which is two points higher than the anti-record set in May 2024. 49% of Uzbekistan respondents believe that the economic situation has improved over the previous year, which is 8.1 p.p. less than the result of last year.

Among the age groups, a noticeable negative trend is observed among all age groups. The largest change was recorded in a group of people aged 45-59, 50.1% of whom believe that the economic situation has improved. However, last year there were 60.7% of such respondents. The older generation over 60 years of age showed the best result, where this share reached 52.1%. Young people under the age of 29, among whom the figure was 46.9% in September, occupied the last positions.

In the regional context, compared to last September, the largest decline was recorded in the Namangan and Andijan regions, where the share of positive responses fell by 16.8 and 16 p.p., respectively. Nevertheless, the situation has not changed over the past year, and Tashkent still closes the list – the share of those who positively noted changes in the economy reaches 36.9%. The Republic of Karakalpakstan, where the same indicator fell by only 0.8 p.p., showed the best. However, the leader is the Khorezm region with a share of 59.5%.

Inflation expectations and estimates remained unchanged

Generally, inflation estimates and expectations of Uzbekistan residents changed insignificantly in September and remained at high levels. Over the past year, 51.4% of residents felt a very strong increase in prices in September against 48.2% in August. However, in the horizon of the past month, their share, on the contrary, slightly fell from 31.9 to 31.8%.

Inflation expectations showed a slight improvement over August in both time horizons. The share of those expecting a strong price increase next month fell from 20% to 19.6%. Over the next year, 25.6% of respondents expect faster price growth, which is 1.5 p.p. lower than in August.

According to official statistics, a monthly price increase of 1.23% was recorded in August. However, annual inflation declined slightly from 10.47% to 10.46%. At the same time, prices for meat, vegetables and fruits continue to rise sharply on a monthly basis. So, meat went up in price in September by 2,8–3,1% (+4,9–5,3% in August), and this continues to have a negative impact on the mood of respondents. In addition, the highest increase in the price of goods and services was again recorded for meat and poultry for the entire research. 61.9% of respondents indicated this name, while in August there were 57.8%. The share of those who indicated vegetables and fruits increased slightly (+3.2 p.p.) amid a seasonal increase in prices for a number of vegetables and fruits by 10-16% MoM. Housing services and utilities increased in price by only 0.5% MoM in September, and the share of those who noted this option decreased from 31.9 to 28.5%. However, a separate sharp increase in propane prices by 15.7% MoM did not particularly affect the sentiment of the respondents.

Sharp rise in devaluation expectations

In September, Uzbekistani’s devaluation expectations rose sharply after four months of declines in a row. In September, the Uzbek sum showed a slight weakening of 0.6% for the second month in a row. The share of those who expect the national currency to weaken against the dollar over the next 12 months increased from 49.1% in August to 59.4% in September. Nevertheless, the share of pessimists increased from 32.2% to 41.2% in the one-month horizon. However, in comparison with September 2023, it fell by 3.9 and 7.9 p.p., respectively.

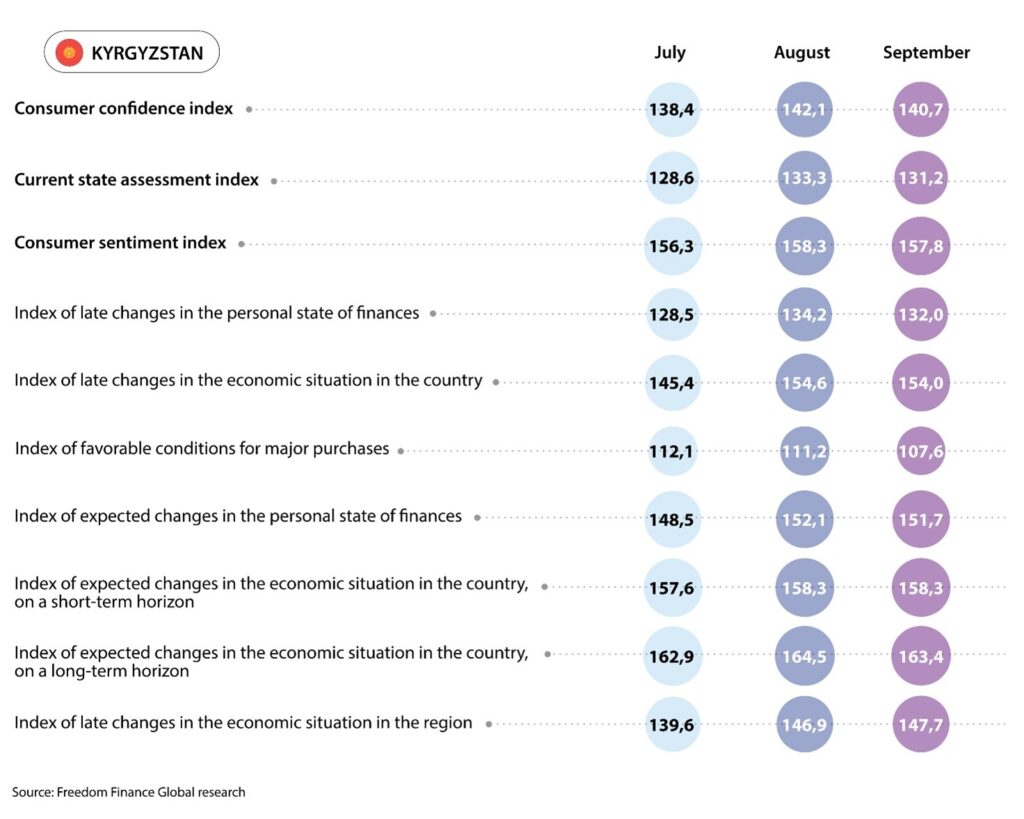

Kyrgyzstan

In Kyrgyzstan, the Consumer Confidence Index showed a slight decline in September after six months of growth in a row. The CCI fell by 1.3 points for the month and reached 140.7 points. This time, four of the five sub-indexes that determine the composite level of the index showed a decline. The greatest decline is recorded in the matter of favorable conditions for large purchases. Compared to September 2023, the index grew by an impressive 12.9 points.

A small pullback in estimates of favorable conditions for large purchases

The sub-index of the current favorable conditions for large purchases fell by 3.5 points compared to August and reached a level of 107.6 points, which is still the highest value in Central Asia. The share of people who indicate favorable conditions for large expenditures fell from 45.2% in August to 43.5% in September.

All age groups showed an increase in pessimism, but it is most pronounced among respondents aged 45-59 years. There, the share of those who chose positive responses fell from 43.8% to 40.1%. The lowest rate is recorded among the older generation over 60 years, where the same indicator fell from 40.5 to 37.2%. Young people under the age of 29 showed the best result with an indicator of 48.2%.

It should also be noted that the deterioration is recorded in all regions, except the Talas, Naryn and Batken regions. The strongest drop is observed in the Chui region, where the share of positive responses decreased by 10.9 p.p., which moved the region to the last place. On the other hand, a sharp improvement is observed in the Talas and Naryn regions, where the share of favorable conditions for large purchases increased by 29 and 19 p.p., respectively. As a result, Naryn region became the leader of September with a score of 57.1%.

Estimates of the economic situation have improved significantly over the year

The sub-index of estimates of changes in the economic situation over the past 12 months showed a noticeable increase compared to September 2023. For the year, the sub-index grew by 26.1 points and reached a record 154 points. 71.7% of residents indicate an improvement in the economic situation, while this indicator reached only 54.4% last year.

Among the age groups, a significant increase is observed across the entire spectrum, but the greatest improvement was shown by the older generation from 60 years of age. In 2023, the share of positive responses reached 50.9% among them, and it increased to 72.8% in September this year. At the same time, respondents aged 45-59 responded best, where the same indicator rose to 74.3% (+19.4 p. p.). We also note a strong annual increase in the share of optimists in the other two age groups, by 14.9-16.3 p. p.

In the regional context, there is also complete unity in improving assessments of changes in the economic situation. Batken region became the leader in September and showed the greatest growth over the past 12 months, where the share of positive responses increased from 65.5% to 88.2%. Shares also increased by 19-20 p.p. in Bishkek and Jalal-Abad region. Respondents from the Chui region, where only 57.7% note positive changes in the economy, responded worse than the rest.

Inflation estimates and expectations rose slightly

In September, inflation estimates of Kyrgyzstanis showed a noticeable increase for the first time since March of this year. In August, 26.2% of respondents felt a very strong increase in prices over the past month; in September, 30.8% of respondents felt a very strong increase in prices over the past month. Estimates of price growth over the past 12 months have also increased at a similar pace. In September, 50.7% of Kyrgyzstanis recorded an acceleration in price growth, while this figure was 46.6% in August. In addition, official data on annual inflation indicate its sharp increase in September from 3.8% to 4.9%, which is the highest since April.

The inflation expectations of Kyrgyzstanis did not grow as significantly as the inflation estimates, but they were at the highest levels this year. The share of respondents who expect faster price growth in the next 12 months increased from 12.4% to 12.9%. The share of those who believe that prices will rise very strongly next month also increased from 7.7% to 8.7%.

As in other countries of the region, we note meat and poultry among the distinct goods and services for which residents noticed the greatest price increases. This product confidently took the lead from flour, which was held on the first line for 12 months. The share of respondents who chose this product increased from 35 to a record 51.6%. It should also be noted that the list of the top five products with the greatest price growth has not changed for 13 months in a row. In September, 39.5% of respondents noted flour, 37.4% – vegetable oil, 29.9% – vegetables and fruits, and 26.8% – sugar and salt, in addition to meat and poultry. Among the products mentioned, an increase in concern is observed only for vegetables and fruits. It should be noted that meat prices rose sharply during the month by 5.3% MoM in September, according to official statistics, which has not happened since May 2007. Vegetable prices also increased significantly by 2.9% MoM, although fruits continued to fall in price compared to the previous month (-4.7%). Prices for oils and fats increased by 1.8% MoM. The last time prices rose so rapidly in April 2022.

Devaluation expectations fall to new records

The Kyrgyz som strengthened again by 0.8% in September after a slight weakening in August. As a result, the devaluation expectations of Kyrgyzstanis decreased slightly in comparison with August and reached new absolute lows during the research. While, in August 23.2% of residents expected the national currency to weaken in a year, in September the share of such people fell to 23.1%. However, the share of pessimists fell much more significantly in the issue of dollar growth in the one-month horizon: from 17.5 to 14.4%.

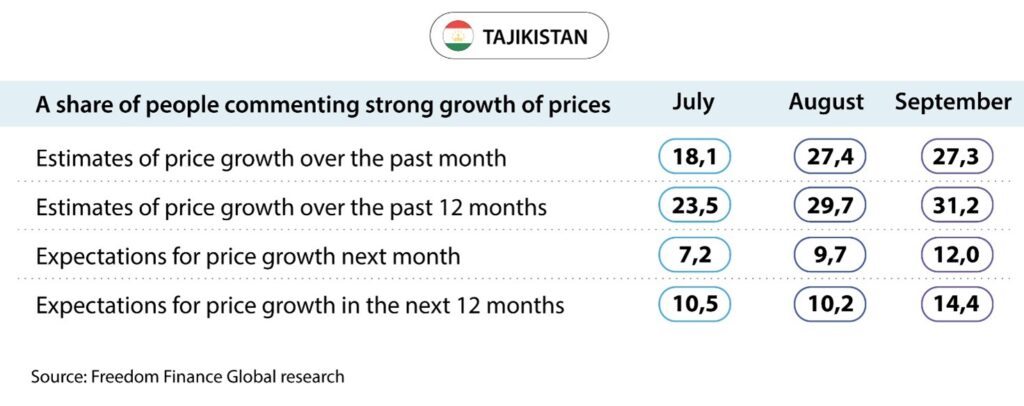

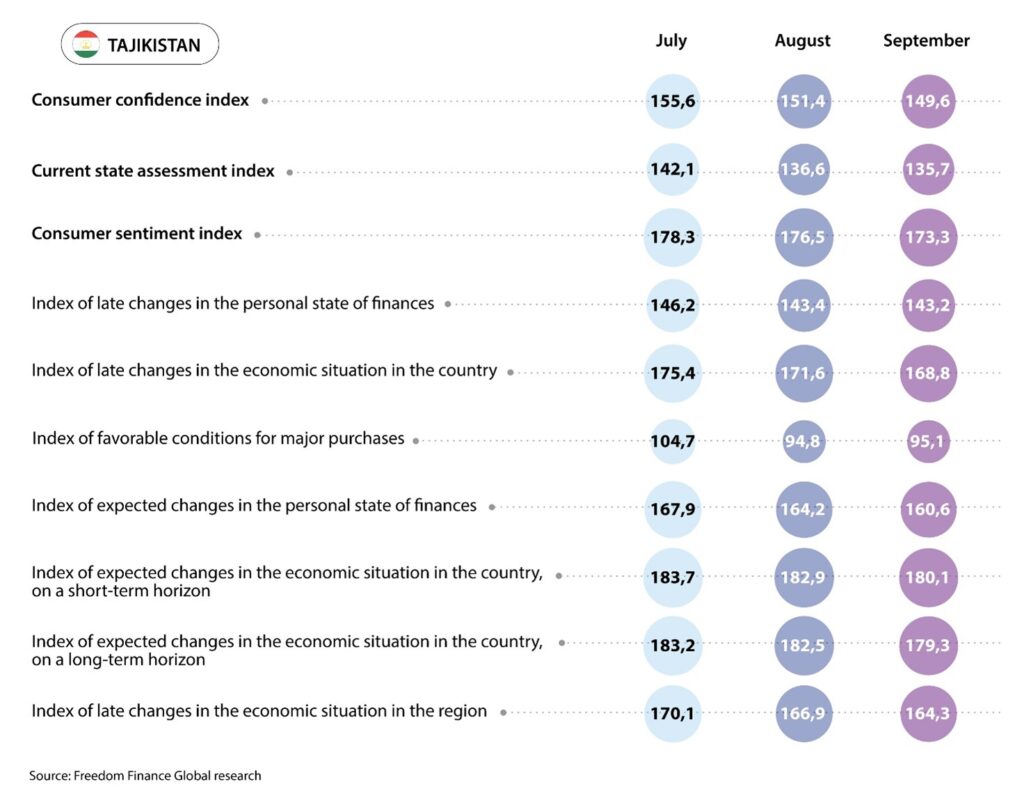

Tajikistan

In Tajikistan, the Consumer Confidence Index fell from 151.4 to 149.6 points in September, which implies the second month of decline in a row. This time, four out of five sub-indexes showed a decline, and the largest drop occurred in the forecasts of personal financial situation. In comparison with last September, the CCI increased by 6.3 points, mainly due to improved assessments of changes in the economic situation and favorable conditions for large purchases.

Forecasts of personal financial situation have worsened

Forecasts of residents regarding the expected changes in their personal financial situation showed the most noticeable drop in comparison with August. This sub-index fell from 164.2 to 160.6 points, which was the second-lowest result this year. The share of optimistic Tajikistanis was 72.7% in September versus 75.3% in August.

Among the age groups, the decrease in optimists is recorded in all age groups, except for the older generation of 60 years and older. In this group, the share of those who expect their personal financial situation to improve increased from 68.7% to 75.2%. Nevertheless, the best result is still recorded among young people under the age of 29, where the share reaches 79%. On the other hand, the share of positive responses fell by 4.7 p.p. among respondents aged 45-59, which was the largest rate of decline in September. The absolute result of 67.5% was the smallest.

In all regions, except the Gorno-Badakhshan Autonomous Region, a decrease in the share of residents expecting an improvement in their personal financial situation over a 12-month horizon is recorded. The above-mentioned region showed a share of positive responses of 72.9% versus 65.4% in August. The highest indicator of 78.4% is observed in the Sughd region. At the same time, it was there that the largest drop in the indicator for the month occurred. Residents of Dushanbe, where the share of positive responses reached 66.3%, continue to respond worse than others.

Conditions for large purchases have improved significantly over the past year

The sub-index of the current favorable conditions for large purchases and spending rose by 14.6 points in September compared to last year’s September and reached 95.1 points. This figure is the second highest this year after the July record. 45.6% of respondents gave positive answers, compared to 39.7% last year.

Among the age groups, the highest growth is observed among the older generation over 60 years of age. Among them, the share of optimists reached 39.2% in 2023, and this year it was 49.9%, which is the best result among all age groups. In general, all age groups showed an increase, but among young people under the age of 29 it turned out to be small, at 1.5 p.p., while the share increased by 7.7–7.8 p.p. among middle-aged people. The worst result of 42.7% is recorded among respondents aged 45-59.

In the regional context, improvements over the past year are observed everywhere, except for the Gorno-Badakhshan Autonomous Region, where the share of optimists fell from 53.1% in 2023 to 45.3%. The largest increase occurred in the Districts of Republican Subordination, where 42.4% of respondents believe that the current conditions are favorable for large purchases (28.5% in 2023). Nevertheless, this indicator still turned out to be the worst among all regions, and the Sughd region became the leader in September.

Inflation expectations have increased markedly

Tajikistani’s inflation estimates showed a slight increase in September after a sharp increase in August. The share of respondents who noted a strong increase in prices over the past month fell slightly from 27.4% to 27.3%. Over the past 12 months, the share of those who experienced faster price growth increased from 29.7% to 31.2%, which was the highest figure this year. Inflation expectations of Tajikistan residents showed a much more significant increase compared to August. 12% of residents expect a very strong increase in prices in the coming month, compared to 9.7% in August. Over the next 12 months, the share of pessimists increased from 10.2% to 14.4%.

Official inflation data for September have not yet been released, but annual inflation accelerated from 3.4% to 3.6% in August, which is probably the reason for the sharp increase in inflation estimates in August. Among some goods, residents of Tajikistan continue to be very concerned about the prices of meat and poultry. Over the past month, the share of people who noticed a strong increase in prices for meat and poultry increased from 45.1% to a record 50.8% for the entire research. For other food products, the level of concern continues to decrease. For flour, this indicator fell from 33.4% to 30.7%, and for vegetable oil – from 28.3% to 25.1%. It should be noted that the top 4 items, along with vegetables and fruits, remain unchanged. According to official statistics, prices for meat and meat products increased by 1.2% MoM, and for beef separately by 2.7% MoM in August. Thus, meat prices have been growing monthly throughout 2024. In August, prices for fruits fell seasonally by 7.9% MoM, while prices for vegetables increased by 1.3% over the month.

Devaluation expectations decreased slightly

Tajikistani’s devaluation expectations declined slightly in September and continue to be near the average values of the previous 11 months. The dollar exchange rate against somoni fell by 0.1% in September after a short pause in August. The share of those who expect the national currency to weaken during the month fell from 17.2% to 15.8%. In the horizon of one year, 24.5% of the country’s population is waiting for a weakening (24.4% in August).

Conclusions

September 2024 turned out to be mostly negative for the Central Asian countries. Only Kazakhstan recorded a slight increase in the Consumer Confidence Index (CCI) after a decline in August. However, the index has not fully recovered; but it is still above the neutral limit of 100 points. At the same time, we note a strong improvement in residents’ forecasts for changes in the economic situation. Although, on the other hand, there was also a noticeable drop in estimates of the favorable conditions for large purchases. In Kyrgyzstan, the CCI fell in September after six months of growth in a row and reached new records. Yet, the decline was not catastrophic and, for the most part, residents’ estimates and forecasts remained at about the same levels. However, the most noticeable decline also occurred in the estimates of the favorable conditions for large purchases, which continues to be the highest in all of Central Asia. In addition, the CCI index still shows a significant increase of almost 13 points compared to September 2023.

Tajikistan, the CCI regional leader, has seen a slight decline for the second month in a row. This time, the rate of decline was even smaller, and the index itself is the third highest this year. The main decline occurred in terms of forecasts for both personal financial situation and the economy. Nevertheless, the indicators are still the highest in Central Asia among the fallen sub-indexes, and the vast majority of residents are optimistic. Compared to last year, the CCI shows an increase of 6.3 points in Tajikistan. Negative dynamics of the index were also recorded in Uzbekistan after two months of recovery in a row. At the same time, the index turned out to be slightly higher than the July value, and the fall occurred due to a reverse decline in estimates of the favorable conditions for large purchases after a record figure in August. Estimates of changes in the economic situation also fell noticeably. It should be noted that Uzbekistan was the only country whose index decreased by 2.7 points relative to September 2023.

In September, the dynamics of inflation estimates and expectations turned out to be negative across the region. After a sharp increase in August, inflation estimates and expectations continued to grow for the most part in Tajikistan and Uzbekistan in September. In Tajikistan, the increase in inflation expectations is particularly noticeable and reached a maximum of this year. In Uzbekistan, inflation estimates have increased: they have reached a record for the entire research in the horizon of the past 12 months. However, inflation expectations have slightly decreased, becoming the only country in the region where such a decrease occurred. In Kazakhstan, inflation expectations have increased significantly and reached their highest values in 2024. In Kyrgyzstan, the situation with inflation expectations is similar, although their growth was not as large as in Kazakhstan. It should also be noted that the share of those who note a strong increase in prices over the past month and year has increased significantly in Kyrgyzstan. In general, the population continues to be concerned about rising prices for meat and poultry in the region. This is especially true in Tajikistan, Uzbekistan and Kyrgyzstan, where it has reached multi-month records.

Generally, devaluation expectations remained at the same levels in Central Asian countries. However, we note a sharp increase in devaluation expectations in Uzbekistan, which stands out among other countries. After reaching record-low devaluation expectations in August, the share of those expecting the sum to weaken increased by 9-10 p.p. Although the figures were still lower than in September 2023. In Kazakhstan, the minimal strengthening of the tenge in September probably led to a slight decrease in devaluation expectations, which had previously grown for four months in a row amid the same exchange rate dynamics. In Tajikistan, devaluation expectations also generally fell slightly and are within the average values for the past 11 months. In Kyrgyzstan, the situation with devaluation expectations also remains calm and stable. A new minimum for the entire research was updated in both time horizons. That is, never before have such a small number of respondents expected the exchange rate to rise in a month or a year in Kyrgyzstan.

The fifteenth wave of the consumer confidence research in four Central Asian countries showed an increase in overall pessimism across almost the entire region. Three countries saw a decrease in consumer confidence. However, it should be noted that the decrease was not that large. In Kyrgyzstan, the decrease in the index was quite expected after continuous growth for six months. But in Uzbekistan, consumer confidence never recovered after a sharp drop in the spring. Even a slight recovery in July-August was interrupted in September. In Tajikistan, despite a slight drop in consumer confidence, everything is quite stable and the vast majority of residents still exude optimism. Kazakhstan turned out to be the only country that showed growth in September, although its pace was insignificant and only partially compensated for the August drop. In this wave of the survey, an important event was the almost universal increase in inflation estimates and expectations of the population. Almost all countries have recorded an increase in these parameters for the second month in a row, including the continued strong concern of the majority of residents about the rise in prices for meat and poultry. As a result, September can definitely be called negative for Central Asia due to the deterioration in consumer confidence and inflationary sentiment. Finally, we have to note that consumer confidence showed growth in all countries except Uzbekistan compared to 2023.