The volume of new office space construction in the first 11 months of 2024 has already exceeded the figures from the previous four years. The office market in Almaty is now set to see truly large-scale projects in the coming years, with major Kazakhstani real estate developers — BI Group and Rams Kazakhstan — now entering the office space sector.

Over 40,000 square meters of new office space have been built in the first 11 months of this year in Almaty. Additionally, about 23,000 square meters of commercial space are expected to be commissioned by the end of the year. If developers’ plans succeed, the annual volume of new office space in 2024 could match the total area commissioned over the past four years combined.

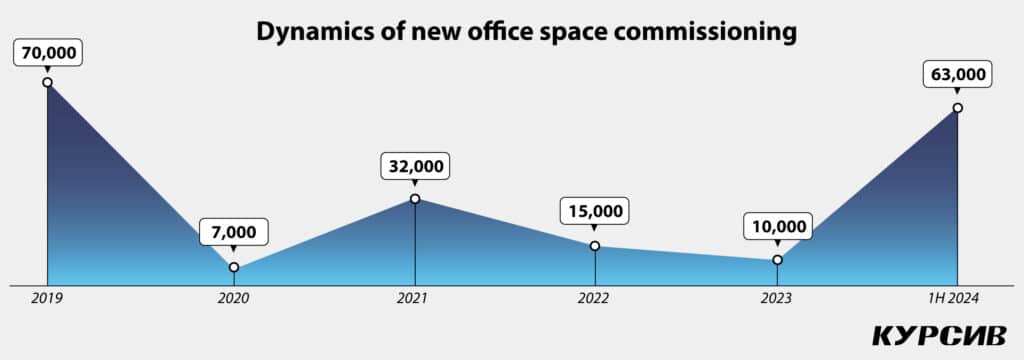

More importantly, 2024 has already set a trend in restoring developer’s interest in office property. Over the past five years, only 2019 saw a higher volume of new office space, with 70,000 square meters commissioned.

«I think it’s safe to say that developer activity in Almaty is experiencing a revival,» confirmed Artemiy Pestovsky, a partner at Bright Rich | CORFAC International Kazakhstan.

What changes did the office market face?

According to Bright Rich | CORFAC International, Almaty currently has a gross leasable area (GLA) of 1.132 million square meters of high-quality office areas (Classes A and B).

This year was expected to see the commissioning of 100,000 square meters of new office space, reflecting 9% growth. But in fact, the market will deliver just 63,000 new square meters (+5.5%) at best. Of these, 40,800 square meters have already been commissioned, and another 22,500 square meters are scheduled to be commissioned by the end of the year or in the first quarter of 2025.

The initial plans have undergone significant adjustments due to uncertainty surrounding one of the largest anticipated projects — Deniz Park. This project, with a gross building area (GBA) of 47,000 square meters, is being constructed in the vicinity of Esentai Tower. The land beneath this business center previously belonged to the Al-Farabi Kazakh National University. After multiple secondary sales, ownership was transferred to Atlas Development LLP, a company controlled by Kazakh tycoon Timur Kulibayev. The developer had already begun constructing an eight-story Class A+ business center when, in late 2023, Almaty prosecutors questioned the legality of the land transfer from the university. In April 2024, the city court ruled that the property should be returned to communal ownership. A representative of the developer in court claimed this decision could result in a $66.6 million loss — the estimated value of loans raised for the project. As a result, construction activities at the site have been suspended, and no final decision regarding the property’s future has been made.

Furthermore, the Almaty office market has lost the Kaisar Tower business center, with a GBA of 9,000 square meters and an estimated value of $15.48 million. This building was previously owned by Kairat Satybaldy, a nephew of ex-President Nursultan Nazarbayev. The businessman was accused of embezzlement and convicted. As part of a deal with the government earlier this year, Satybaldy transferred that building to public ownership. It has since been used as an educational facility of the Kazakh National Women’s Teacher Training University.

Among new commercial properties introduced in Almaty this year were: Business Center on Mendekulov Boulevard (GBA: 11,500 square meters; commissioned in Q3 2024), Nurly-Tau Polyfunctional Center (GBA: 10,000 square meters; commissioned in Q1 2024), Premier Business Center on Zhamakayev St. (GBA: 7,900 square meters), West Town Business Center in the Taugul neighborhood (GBA: 7,500 square meters) and East Town Business Center (GBA: 7,200 square meters).

The volume of new office space commissioned in the first 11 months of 2024 has already surpassed the annual totals of the past four years, during which the market added an average of just 16,000 square meters annually. Only the pre-pandemic of 2019 outperformed 2024, with 70,000 square meters of office space commissioned.

Office property promises a quick payback of investments

Despite high demand for high-quality office space, Almaty has not seen the development of a truly major business center in recent years. All projects implemented over the past five years have been relatively small and infilled into already built-up areas.

«In Almaty, it is virtually impossible to build something like Esentai due to housing unit density and a lack of land. There is little to none of high-quality offers except us [Esentai Tower, GLA 19,600 square meters — Kursiv.media] and Park View [GLA 16,000 square meters — Kursiv.media],» CEO of Capital Tower Development Tair Balgabekov explained. The company owns and manages Esentai Tower (its final beneficiaries are Kairat Boranbayev, Serzhan Zhumashov, Burak Gursel Oymen and Erken Mehmet Erkan).

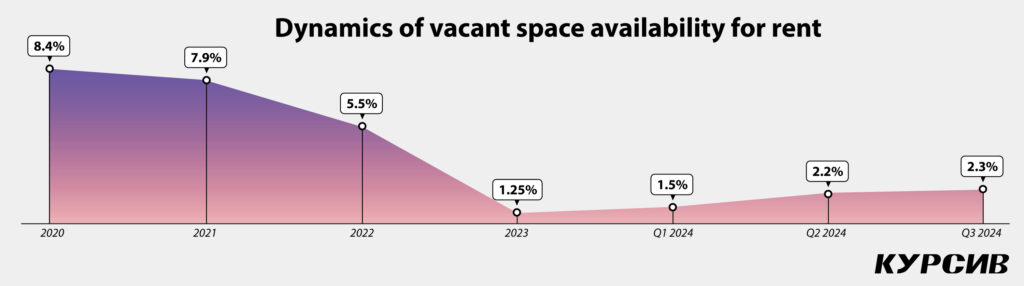

However, the situation may change over the coming years. Developer engagement is rising as prime office rental rates exceed the market average, according to industry players. At the beginning of this year experts indicated that the profitability of office projects was 15% with loan servicing fees at 19%. However, the payback period has since become more attractive for investors.

«The resurgence of developer activity and the increase in investments in the office market are driven by high demand from tenants and rising rental rates over the past few years. Thus, the weighted average rental rate increased by 23% just in the last year alone,» Zakir Kaliyev, head of brokerage department at Colliers Kazakhstan said.

«Lease rates have reached the level where rapid construction of office spaces for sale or rent is becoming more profitable for developers. We estimate that a Class A business center with an area of 20,000 square meters in Almaty may pay off in six years and six months, with an internal rate of return (IRR) potentially as high as 34%,» Pestovskiy added.

Tatiana Tokareva, a consultant at Scot Holland | CBRE Kazakhstan, believes a business center in Almaty could pay off even faster — within four or five years.

Colliers Kazakhstan expects the commissioning of approximately 19,000 square meters of office space in the first half of 2025. On the other hand, Bright Rich | CORFAC International Kazakhstan says that two major projects with floor size of 60,000 and 70,000 square meters, are expected to be commissioned between 2026 and 2027. These projects will be located along Al-Farabi Avenue, although the broker did not specify the exact locations or investors involved.

Kursiv.media has identified more than 10 prospective business centers that have been approved by the urban council of Almaty and announced or projected by developers.

What kind of business centers to appear in Almaty

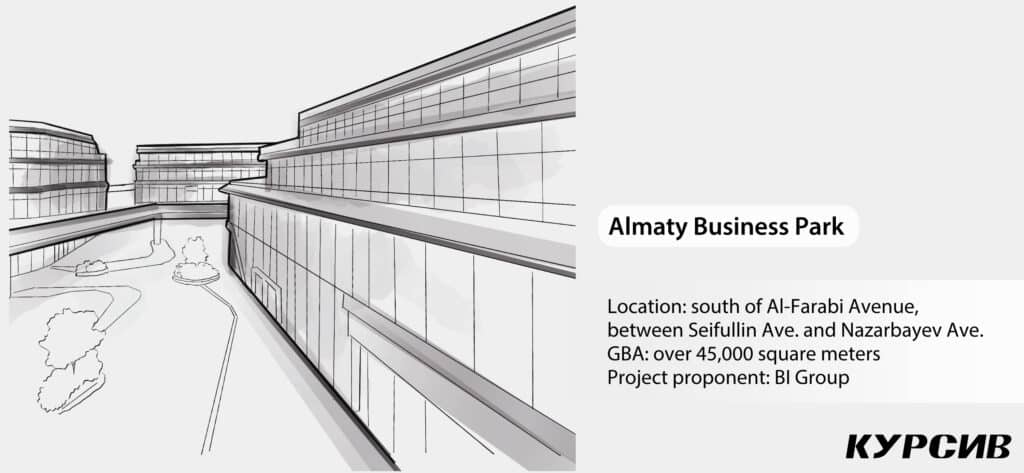

The largest of the currently announced projects is Almaty Business Park, with renderings available on the BI Group website. The project is described as an elite Class A+ business center, positioned at the heart of Almaty’s business area. The planned construction site is located south of Al-Farabi Avenue, behind the financial center, between Seifullin Avenue and Nazarbayev Avenue. The total office and commercial area of Almaty Business Park is expected to exceed 45,000 square meters. in addition to office area, a conference hall, retail spaces and a public garden are expected to emerge here by late 2026.

Another major business center is being developed by Ziraat GYO Kazakhstan, a subsidiary of the Turkish real estate investment trust Ziraat GYO. In the spring, the Turkish company announced on the Public Disclosure Platform (KAP) that it had purchased 4,770 square meters of land in Almaty for the construction of a Class A business center. Public hearings on the project were held in August. The proposed development is a 12-story building with three underground levels, covering a total area of 39,900 square meters. It is planned to be infilled between residential buildings at the intersection of Klochkov Street and Satpayev Street (132 Klochkov St.). According to the project, the construction site is only 13 meters away from a five-story apartment block.

The first floor of the building will house a branch of Ziraat Bank, while the remaining floors will be available for speculative lease. The construction site is already enclosed by a fence, although no construction site billboard has been installed yet.

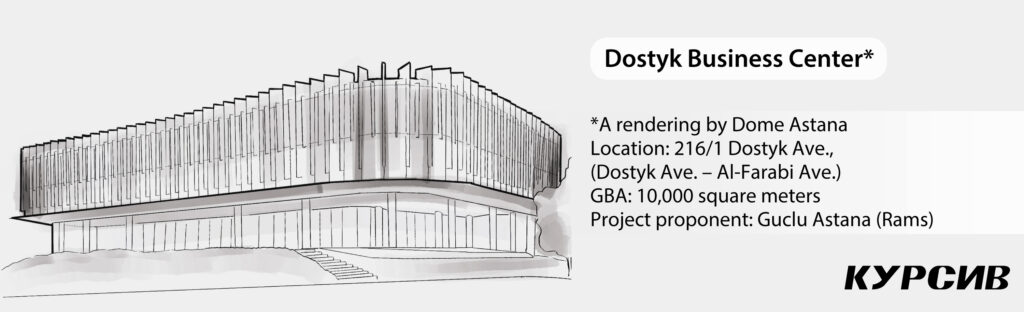

Another project with Turkish roots is the Dostyk Business Center, located at the southeastern corner of Dostyk Avenue and Al-Farabi Avenue. The project proponent is Guclu Astana, founded by Dogan Bulbul, who also serves as chairman of the board of directors at Rams Global. Design documents for Dostyk Business Center present conflicting information about the number of floors — three in the explanatory note and five in the construction management plan. It is likely that the developer revised the project to reduce the number of stories due to regulatory restrictions on development above Al-Farabi Avenue, which may also explain the delay in implementation. According to the documents, construction was originally scheduled to begin in August 2024 and be completed by late 2025. Although the project was approved during public hearings in 2024, the site hasn’t even been enclosed by a fence.

The list of new Class A and B projects with planned commissioning deadlines before the end of 2024 includes the Element Tower Business Center (11 floors, GBA: 7,200 square meters) on Seifullin Avenue, south of Satpayev Street, proposed by Nartay Kurmankulov of Capital Invest Construction. Another addition is the three-story OFFICE A (GBA: 4,950 square meters) located at 98 Al-Farabi Avenue.

Demand for new business centers in Almaty is projected to remain strong

Experts believe that the deficiency of high-quality offices in the Almaty business area will remain over the foreseeable future, and the lease rate will keep increasing. This will ensure great financial indicators for both investors and developers currently building Class A and B+ business centers.

«We expect lease rates to continue rising by 10% to 15% by mid-2025 due to adjustments in rates to match inflation. Another factor is the limited availability of land plots in the business district for business center development, as well as their high price and increasing construction costs,» Kaliyev highlighted.

«Developers currently working on Class A properties in Almaty are likely to fill them with tenants quickly, as there is a shortage of available space in high-quality office buildings. Tenants accustomed to Class A standards — including advanced infrastructure, engineering and services — often sign contracts for such spaces even during the construction phase. The market has reached a point where negotiations with tenants for new high-quality projects, even those with commissioning deadlines as far out as 2026, may already be underway,» Pestovskiy explained.