ITS is set to boost its monthly trading volume

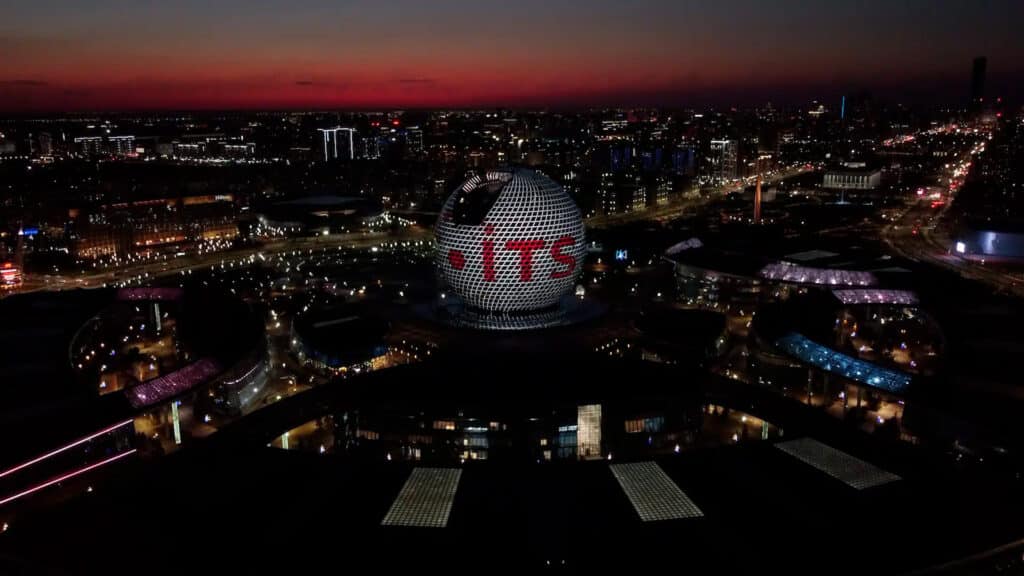

The Astana trading platform ITS aims to expand its daily trading volume to $100 million or $3 billion per month next year. In November, the platform reported a trading volume of $66 million.

«In October, we reported a trading volume slightly less than $40 million and $66 million in November. Our moderately optimistic goal is to reach $100 million per month by December. In fact, we are targeting $100 million per day in 2025. These goals are ambitious indeed but still achievable. We are connecting new players from various jurisdictions and launching new products. We also work with repos, FX and other interesting instruments. In addition, ETF and single stock futures are planned for launch,» Chingiz Kanapyanov, CEO of the ITS, told journalists during a press briefing.

According to ITS representatives, the platform plans to develop a series of its own exchange-traded funds (ETFs), with more than 20 new funds already scheduled for launch in 2025. Additionally, the company may introduce trading of securities issued by Indian companies. The Indian securities market is considered one of the most closed markets, with no market makers and no foreigners allowed to open investment accounts there.

Earlier this month, Managing Director of the ITS Alex Diakovskiy revealed a plan to launch a Sharia-compliant stock trading ETF (Shariah ETF) starting next year. He estimated that approximately 1 million retail investors may want to invest in the fund.

Furthermore, the ITS is exploring the potential launch of derivative security trading. According to the company’s shareholder Roman Goryunov, the current options market (a type of derivative security) is one of the world’s most liquid.

Goryunov also added that the ITS is considering the launch of a liquidity hub for international securities trading, enabling Kazakhstani investors to trade when other markets are closed. The potential investor base is estimated in the hundreds of millions of individuals. The platform also promises to deliver the best results, ensuring the highest prices in the market. The ITS asserts that it is ready to share liquidity.