Ukraine’s war drives Kazakhstan’s exports of laptops, bulldozers to Russia

Since the start of the war in Ukraine, Kazakhstan’s exports have played an increasingly significant role in its trade with Russia. However, this does not necessarily mean that Kazakhstani companies are helping Russia circumvent sanctions; trade patterns may have shifted for other reasons. Kursiv Research analyzed which goods have seen dramatic changes and what might be driving these shifts.

How has the war in Ukraine reshaped Kazakhstan-Russia trade?

Three years ago, on Feb. 24, 2022, the war between Russia and Ukraine began. In response, Western nations imposed sweeping sanctions on Russia, including sectoral, financial and individual restrictions. Trade bans targeted dual-use goods and high-tech products, while the threat of secondary sanctions loomed over companies and countries that might aid Russia in their circumvention. Additionally, some Western nations, along with Japan and South Korea, suspended Russia’s most-favored-nation trade status, prompting retaliatory sanctions from Moscow.

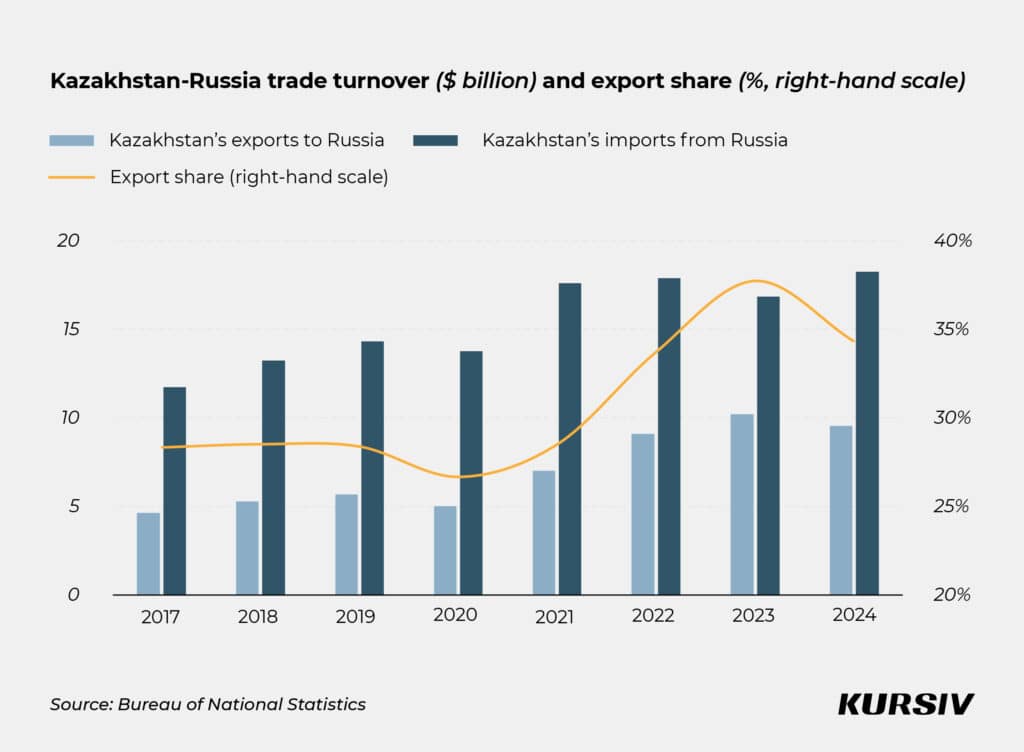

Kazakhstan remained neutral, but trade between the two countries has inevitably shifted. The two nations share deep economic ties and the world’s longest continuous land border. By the end of 2024, Kazakhstan’s exports accounted for 34% of total trade between the two countries, down slightly from a record 38% the previous year but significantly higher than the pre-war five-year average of 28%.

This surge does not necessarily indicate that Kazakhstani entrepreneurs, or Russian-registered companies operating in Kazakhstan, are actively helping Russia evade sanctions. Trade patterns may have evolved for other reasons.

Several factors could explain the surge in Kazakhstan’s exports to Russia:

- Kazakhstani manufacturers may have stepped into market niches vacated by Western companies, supplying domestic products previously absent in Russia.

- The share of standard products exchanged between Kazakhstan and Russia may have grown.

- The re-export of unsanctioned goods could have expanded.

Kursiv Research analyzed Kazakhstan’s exports to Russia (imports will be examined separately), focusing on three major commodity groups. These groups were selected based on a key trend: at least once in the past three years, Kazakhstan exported more of these products than it imported, making it a net exporter in these categories.

The three commodity groups, classified under the two-digit Harmonized System (HS) codes, are:

- Photographic or cinematographic goods (HS code 37).

- Nuclear reactors, boilers, machinery and mechanical appliances; parts thereof (HS code 84).

- Electrical machinery and equipment, sound recorders and reproducers, television image and sound recorders and reproducers, and related parts and accessories (HS code 85).

To better understand the reasons behind this growth, Kursiv Research examined these exports at the six-digit HS code level, analyzing trade flows in greater detail.

What photographic goods does Kazakhstan supply to Russia?

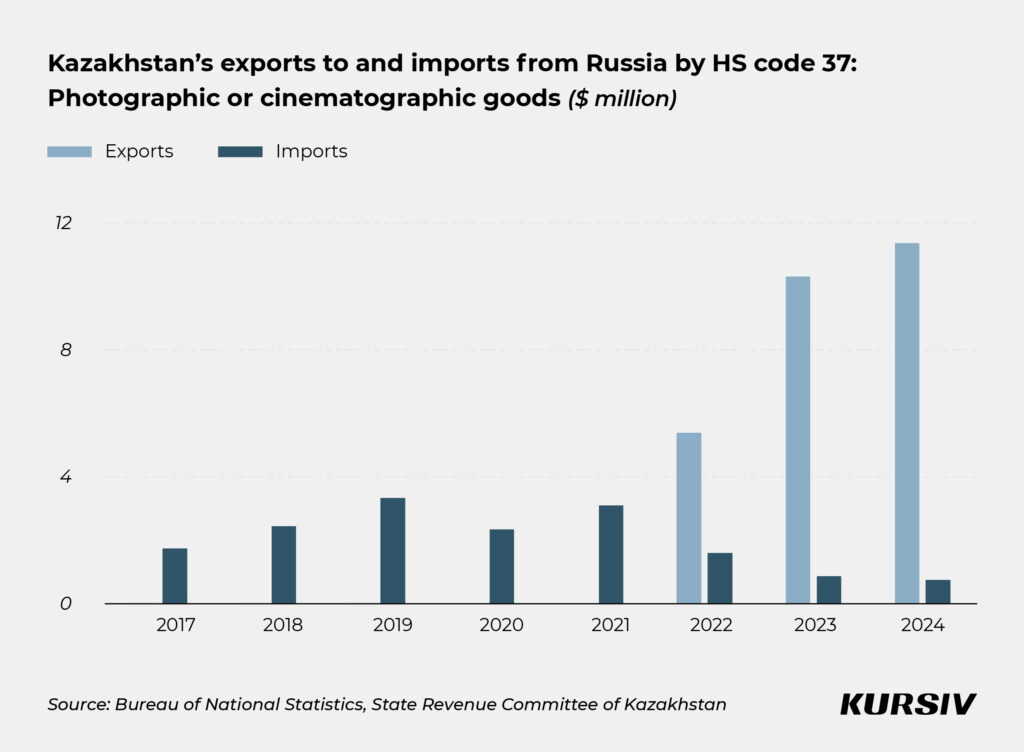

Before the war, Kazakhstan’s exports of photographic and cinematographic goods (HS code 37) to Russia were minimal. In 2021, for example, Kazakhstan shipped just $1,100 worth of these products to Russia, while Russia supplied $3.1 million worth to Kazakhstan.

Historically, Kazakhstan has been a net importer of photographic and cinematographic goods, sourcing them primarily from Belgium, the U.S., Japan, China and Russia. While the shares of these suppliers fluctuated, the list of major importers remained relatively stable.

However, since 2022, despite still being a net importer overall, Kazakhstan has started exporting more of these goods to Russia than it imports from there. In 2022, the first year of the war, Kazakhstan’s exports of photographic and cinematographic goods to Russia skyrocketed to $5.4 million or 5,000 times the 2021 level. This growth continued in 2023 and 2024, reaching $10.3 million and $11.4 million, respectively.

An analysis of trade flows at the six-digit HS code level reveals that over the past three years, Kazakhstan has primarily supplied Russia with flat photographic films, photographic films in rolls and finished photochemicals (such as toners and cartridges). Exports of other photographic and cinematographic goods have remained below $1 million.

Notably, Kazakhstan does not currently produce these goods; at least, that’s the conclusion suggested by data from the Bureau of National Statistics (BNS). The aggregated statistics do not indicate whether such manufacturers exist in the country.

The sharp increase in Kazakhstan’s imports of these goods from other countries also suggests re-exporting. While imports of photographic and cinematographic goods (including photographic films) declined between 2019 and 2021, they surged 98% in 2022, reaching a record $24 million in 2023, a 52% increase year-on-year.

For the past three years, Kazakhstan has remained a net exporter of photographic and cinematographic goods to Russia, likely due to re-exported goods. This category provides a clear example of how the war has reshaped trade between Kazakhstan and Russia. However, its overall impact is limited: by the end of last year, photographic and cinematographic goods accounted for just 0.1% of Kazakhstan’s total exports to Russia.

More significant trade shifts have occurred in two other commodity groups, which are discussed below.

What mechanical devices does Kazakhstan supply to Russia?

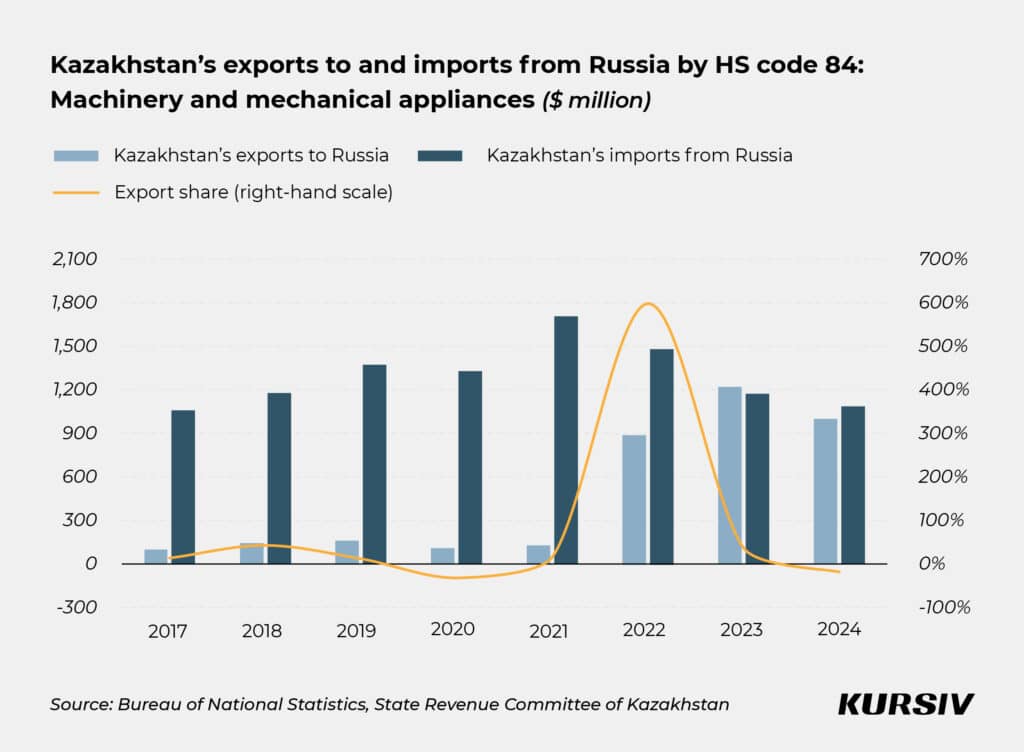

Kazakhstan has significantly increased exports of goods classified under HS code 84: «Nuclear reactors, boilers, machinery and mechanical appliances» (hereafter referred to as «mechanical devices»).

- In 2021, mechanical devices made up less than 2% of Kazakhstan’s total exports to Russia, amounting to $128.2 million.

- By the end of 2024, their share had jumped to 10.4%, with exports reaching $996.2 million.

Kazakhstan became a net exporter of mechanical devices to Russia in 2023 but lost this status by the end of 2024.

Before the war, Kazakhstan was already actively supplying bearings and fittings to Russia. In 2021, two specific items — cylindrical roller bearings (HS code 848250) and appliances for pipes (HS code 848180) — accounted for half of Kazakhstan’s total mechanical device exports to Russia.

Notably, Kazakhstan has the industrial infrastructure and engineering expertise to manufacture these products. In 2021, the country ranked 15th in global exports of cylindrical roller bearings. Stable supply is ensured by:

- Stepnogorsk Bearing Plant. Established during the Soviet era, it specializes in roller and radial bearings for railway transport.

- Ust-Kamenogorsk Valve Plant. One of Kazakhstan’s largest engineering enterprises, it manufactures pipeline valves and oilfield equipment and is an approved supplier for Transneft, Rosneft, Gazprom and Lukoil in Russia.

With the start of the war, Kazakhstan began exporting new types of mechanical devices to Russia, i.e. goods that previously made up only a small share of this group and for which Kazakhstan lacks significant production capabilities.

One of the most striking examples is data-processing machines (HS code 847130), a group that typically includes personal computers and laptops. In 2021, Kazakhstan exported just $210,000 worth of these products to Russia. In 2022, this figure skyrocketed to $147.4 million.

Although exports declined in 2023 and 2024, they remained significant at $60.6 million and $38.9 million, respectively.

Other goods in this category saw even more dramatic growth:

Digital processing units (HS 847150; servers)

- 2021: $92,000.

- 2022: $72 million.

- 2024: $5.8 million.

Units for data-processing machines (HS 847180; video cards, card readers, etc.)

- 2021: $11,000.

- 2022: $31 million.

- 2024: $726,000.

While re-exports of these specific products have declined significantly, trade data suggests that Kazakhstan continues to re-export other mechanical devices it does not manufacture. Some of these products only began appearing in high volumes during the second or third year of the war, indicating a shifting trade landscape.

By the end of 2024, only three of the top 10 mechanical device exports between Kazakhstan and Russia can be considered typical for their trade relationship: cylindrical roller bearings, pipeline fittings and ball bearings. Kazakhstan has been producing and exporting these items to Russia for years.

The remaining seven items in this category are less typical. These include computers and laptops, full-swing machines such as bulldozers and loaders, boilers, mobile loaders, automobile engine parts and components for internal combustion engine fuel systems. Altogether, these exports amounted to $175.4 million, representing 18% of Kazakhstan’s total mechanical device exports.

Kazakhstan’s electrical machinery exports surge

Since February 2022, Kazakhstan has significantly increased its exports of electrical machinery and equipment (HS code 85) which includes sound recorders, television equipment and related accessories. The share of these goods in Kazakhstan’s total exports to Russia grew from 1.8% ($122.9 million) in 2021 to 6.7% ($637.1 million) by the end of 2024. Kazakhstan was a net exporter in this category only once, in 2023.

Before the war, Kazakhstan mainly exported lead batteries for piston engines and various transformers to Russia, produced by local manufacturers Kainar-AKB and Alageum Electric. In 2021, total electrical machinery exports amounted to $122.9 million, with lead batteries accounting for $58 million, transformers with a capacity of up to 650 kilovolt-amperes (kVA) for $17.7 million and transformers in the 650 to 1,000 kVA range for $12.1 million, together making up 72% in the exports of this product group.

The landscape shifted dramatically in the first year of the war. In 2022, the top three electrical machinery exports to Russia consisted entirely of products Kazakhstan had not previously supplied in significant volumes. Most of these were re-exports rather than domestically produced goods. The Silk Road Electronics factory in Saran, which manufactures TVs, washing machines, range hoods and gas stoves, only began operations in early 2024.

In 2022, Kazakhstan exported $151.9 million worth of TVs to Russia, up from just $7,000 in 2021, and $142.7 million worth of telephones, including smartphones, after having recorded no exports in previous years. The country also shipped $78.2 million worth of electrical equipment parts (HS code 851190, including generator and starter components), compared to just $6,900 in 2021.

By the end of 2024, the re-export flow of TVs and smartphones from Kazakhstan to Russia had significantly declined. Kazakhstan shipped $27.2 million worth of TVs, but it remains unclear what portion of these devices was assembled domestically at the new Silk Road Electronics facility. Exports of telephone sets, including smartphones, also dropped to $16.8 million. Meanwhile, exports of generator and starter parts fell back to pre-war levels, totaling just $336,900.

However, much like in the mechanical devices group, there was a rotation in electrical machinery exports. While some re-export flows diminished, others increased. By the end of 2024, four of the top 10 electrical machinery exports were considered standard in Kazakhstan’s trade with Russia: lead batteries for piston engines, transformers with a capacity of up to 650 kVA, transformers with a capacity of 650 to 1,000 kVA and ceramic insulating fittings. These products had consistently recorded significant export volumes before the war. If most of the TVs shipped to Russia by the end of 2024 were assembled at Silk Road Electronics’ new facility, then five of the top 10 products would be domestically manufactured.

The remaining five positions in the top 10 were occupied by non-standard exports: electric generators with internal combustion engines, spark plugs, other electrical conductors with a voltage of no more than 80 volts, coffee machines and smartphones. Combined, these exports totaled $152.5 million, accounting for 24% of all electrical machinery exports by the end of 2024. Thus, despite entering the third year of the war, Kazakhstan’s re-export flow has not yet fully dried up.