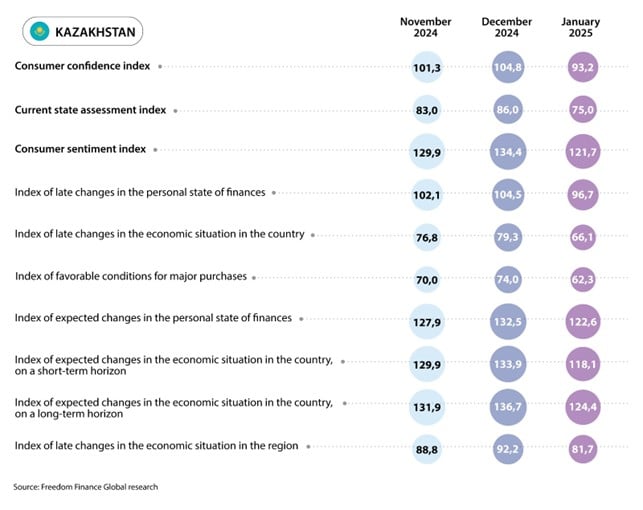

Freedom Finance Global has been researching Kazakhstan residents’ consumer confidence, inflation and devaluation expectations for the twenty-seventh month. January 2025 showed a significant decline at 93.2 points, which is the second lowest indicator for the entire research. Negative responses began to prevail over positive ones. The decline in optimism occurs in all aspects but is especially noticeable in the assessment of the economic situation. Inflation estimates also increased over the month amid rising prices for vegetables and fruits. On the other hand, inflation expectations remained at the same level, and devaluation expectations decreased amid the strengthening of the tenge since mid-January.

Analysts collect 3,600 questionnaires monthly in Kazakhstan, which provides a sufficient sample to assess various parameters. The research is based on the methodology used to obtain consumer confidence indexes in many countries around the world and adapted to local needs by the United Research Technologies Group company. Data collection method: telephone survey. The survey questionnaire is localized: the research is conducted in the native language of the respondents.

The economic future is in question

The sub-index of the forecast for changes in the economic situation over the next 12 months fell by 15.8 points and reached its lowest for the entire research. The share of those who believe that the economic situation will improve fell from 54.9% in December to 45% in January.

Among the age groups, the monthly decline in optimism is observed in all groups. The most noticeable deterioration is recorded among people over 60, where the share of positively-minded respondents fell from 52 to 39.5%. This indicator is the worst among all age groups. The share of those expecting an improvement in their economic situation among young people under 29 also fell by more than 10 p.p. Nevertheless, this age group remains the leader with an indicator of 49.8%. The smallest decline in positivity was recorded among people aged 45-59, whose similar indicator fell from 49.9 to 43.5%.

In the regional context, a decrease in optimism regarding forecasts for changes in the economic situation is observed almost everywhere. A rare exception was the East Kazakhstan region, where the share of positive answers increased from 40.8 to 44.7%. Nevertheless, the leaders were residents of Shymkent in January, where 51.5% chose positive answers. The largest decrease in the share indicator was recorded in the West Kazakhstan region: from 61.7 to 38%. A significant decrease of more than 12 p.p. per month is observed in the following regions: Kyzylorda, Aktobe, Almaty, North Kazakhstan, Atyrau and Akmola regions.

Conditions for large purchases have fallen to record lows

The sub-index of estimates of favorable conditions for large purchases fell by 11.8 points compared to December and reached 62.3 points. This result was the lowest for the entire research. The share of Kazakhstanis who believe that the current conditions for large purchases are favorable fell from 31.8 to 26.4%.

Among the age groups, respondents over 60 years old showed the greatest drop in optimism. The share of positive answers fell from 26.8 to 19.3% among them, which was the worst result among age groups. Here, young people under 29 gave the best answer – 34.2 %, but this figure is 3.9 p.p. lower than it was in January. Moreover, a noticeable decrease in the share of those noting the current favorable conditions for large purchases is observed among people aged 45-59: from 29.8 to 23%.

In the regional context, the deterioration is observed in all regions except for these three: Zhetysu, Atyrau regions and the city of Astana. In these regions, the share of positive responses has slightly increased compared to December. However, the leader in January was the Kostanay region with a result of 33.3%, which is only 4 p.p. less than in December. While in several regions, the drop in the share of positive responses was more than 10 p.p. The largest decrease was recorded in Kyzylorda region – 16 p.p. The indicator also fell by more than 10 p.p. in the Akmola, West Kazakhstan, Mangystau and Ulytau regions. On the other hand, the respondents from the East Kazakhstan region showed the worst result, where the same indicator was only 20.5%, which is 6.2 p.p. less than the December value.

Sharp Deterioration in the Forecast for Personal Financial Situation

The sub-index of the forecast of changes in personal financial situation over the next 12 months also fell significantly by 9.8 points and turned out to be the lowest since September 2023. This makes the indicator the second lowest for the entire research. The share of those who believe that their financial situation will improve fell from 50.8% in December to 44.8% in January.

Among the age groups, the monthly increase in pessimism is observed in all groups. However, the older generation over 60 stands out more than others. The share of those expecting an improvement in their financial situation fell in this age group from 35.9 to 23.8% in a month. This became the worst value of January among all age groups. At the same time, for other ages, the decrease in the share of positive answers is not so significant and amounted to approximately 3-4 p.p. Young people under 29 continue to be the absolute leaders, among whom the same indicator fell from 66.5 to 62.1%.

In the regional context, the indicators have worsened almost everywhere except for the Zhetysu and Mangystau regions. In these regions, the share of respondents who are optimistic about their financial situation has increased by almost 5 p.p. Thus, the Mangystau region became the leader in January with an indicator of 59.8%. On the other hand, the most noticeable deterioration in the share of positive answers is recorded in the Pavlodar region: from 51.8 to 35.8%. The same share has fallen by more than 10 p.p. in a month in Akmola and Kostanay regions, as well as in the city of Shymkent. Yet, the worst result in January was shown by North Kazakhstan region, where the share of positively minded residents was only 27.9%, which is 9.7 p.p. less than in December.

Inflation estimates of residents have risen sharply

Inflation estimates of Kazakhstan residents have been growing for the third month in a row, and this time the increase was quite significant. Over the past month, 51.8% of respondents (42.6% in December) indicated a strong increase in prices. Over the year, the share of those who noticed a rapid increase in prices has grown at a similar rate: from 52.4% in December to 57.8% at the time of the last data collection. Thus, the first indicator reached its maximum for the entire research and the second indicator since March 2024.

Nevertheless, the inflation expectations of Kazakhstanis as a whole showed a neutral result, in contrast to inflation estimates. The share of people expecting a strong increase in prices in the one-month horizon fell from 24.7 to 23%, while in the horizon of the next 12 months, the share of those expecting an acceleration in price growth increased slightly from 25.6% in December to 26.3% at the time of the last survey.

A similar research of inflation estimates and expectations performed by the National Bank of Kazakhstan demonstrated the same, but less significant dynamics in the estimates issue, while there was a noticeable decrease in the expectations issue. According to the presented data, the share of those expecting a strong price increase during the year fell from 30.2 to 26.9%. While in the one-month horizon, the same indicator sharply decreased from 32.8 to 23.3%. In general, there was a reverse recovery of optimism after a sharp jump in indicators in December. Inflation estimates continued to grow. If the share of respondents in assessing price growth over the past month increased from 37.8 to 39.4%, then the share of those indicating a rapid price increase over the previous 12 months increased from 45 to 47%.

Among certain goods and services, the majority of Kazakhstanis continue to be concerned about the significant increase in food prices. However this time, for the first time in sixteen months, the list of the top 4 goods that have noticeably increased in price, according to the population, has changed. This happened due to housing services and utilities, a strong increase in tariffs for which was noticed by almost 25% of respondents (17.2% in December). Thus, this name took 4th place, slightly ahead of ‘Bread and Bakery Products’. The first place in January was taken by the ‘Vegetables and Fruits’ category. For them, the share of people who noticed a strong increase in prices amounted to a record 52.7% for the entire research, which is significantly higher than the December value of 30.1%. Moreover, an increase in a similar indicator occurred for «Meat, Poultry»: from 37.2 to 43.5%. We note a noticeable increase in the share of gasoline and fuels, from 7.4 to 11.3%, probably amid the abolition of price regulation. However, prices have not increased significantly enough for the majority of the population to notice. According to official statistics, prices for vegetables and fruits increased by an average of 3.6% MoM in January. The most noticeable increase in price over the month was for potatoes (+16%), followed by cabbage (+8.8%) and cucumbers (+5.4%). Thus, official data fully confirms the sentiments of residents. There is no such significant increase in prices for meat and poultry, amounting to 1.1% MoM. Housing services and utilities increased in price by an average of 1.4% MoM in January. A monthly increase in tariffs of more than 2% is recorded for housing maintenance and central heating.

Devaluation expectations have eased slightly

Devaluation expectations of Kazakhstanis have decreased after three consecutive months of growth and a recent update of record values for the entire research. The dollar exchange rate fell by about 1.2% in January, however, given that the survey was conducted in February amid a stronger fall in the exchange rate, the sentiments of residents have improved slightly. According to the results, the share of Kazakhstanis expecting a weakening of the tenge over a one-year horizon fell from 64.2 to 61.3%; and over a month, from 46.1 to 39.1%.

Conclusions

The beginning of the new 2025 turned out to be negative in terms of consumer confidence among Kazakhstanis, given the achievement of multi-month lows and the final index value below 100 points, which indicates the prevalence of negative responses over positive ones. A significant and widespread deterioration in sentiment was recorded in almost all regions and all age categories. At the same time, a decrease in optimism occurred on all issues that determine the index. Far fewer Kazakhstanis, compared to December, express a positive opinion regarding the economic situation, both in terms of forecasts and assessments. As a result, estimates of the economic situation fell to absolute minimums for the entire research: so few people have believed that the economy has improved over the previous 12 months. The share of optimists in the question of economic forecasts also fell significantly. The factors for this could have been the heated discussions about increasing the value-added tax, which began at the end of January, as well as the abolition of gasoline price regulation. However, these events did not affect the inflation expectations of the residents. In addition, we note a slightly less significant decrease in optimism regarding personal financial situation, which nevertheless also reached multi-month lows.

The dynamics of inflation estimates and expectations in January turned out to be rather negative, given the sharp increase in inflation estimates. Most likely, this happened amid a strong January increase in prices for vegetables and fruits. Residents also note this, since slightly more than half of the respondents surveyed mentioned a strong increase in prices for vegetables and fruits. This share of these goods turned out to be a record for the entire research. In addition, estimates are also growing according to similar research by the National Bank. Nevertheless, inflation expectations generally remained at the same level. Probably, Kazakhstanis consider the current price increase as temporary. Moreover, the dollar exchange rate in January, and especially in early February, noticeably decreased after several months of growth. This also had a positive effect on devaluation expectations. Slightly fewer people now expect the tenge to weaken in the next month and year. In the next February survey, we should certainly expect a further decline in the share of pessimists. As a result, the 27th wave of consumer confidence research in Kazakhstan showed a significant and sharp deterioration and multi-month anti-records. In January, many more residents were worried about the economic situation in the country than in December. If in the coming months, we do not see similar heated discussions in society about VAT, then together with the strengthening of the tenge, this may improve the sentiments of residents in February and March. In addition, inflation expectations remain at the same level, and according to the National Bank research, they even decreased, which may also help consumer confidence to recover.