Kazakhstan improves its position in global pension system rankings

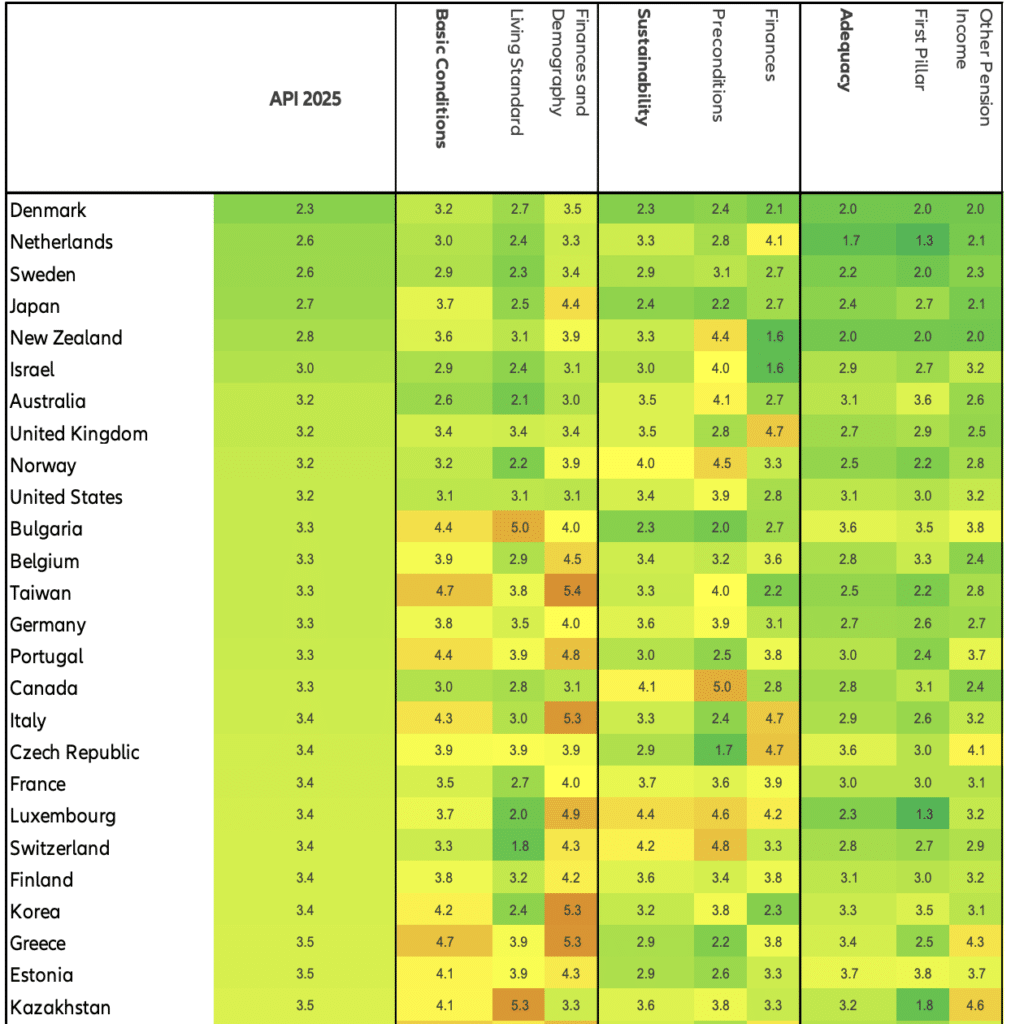

According to the latest pension index, published annually by the prominent insurance company Allianz, Kazakhstan was ranked 26th out of 71 countries, with a grade of 3.5. This marks a significant improvement since 2023, as the country climbed eight positions. This year, Kazakhstan outperformed Slovakia, Indonesia, Cyprus, Malta, Austria, Singapore and China, but fell behind Greece, South Korea and Finland. The top three leaders are Denmark, the Netherlands and Sweden.

The index’s authors considered several parameters divided into three sub-indexes: starting points, sustainability and adequacy. Adequacy refers to the ability of pension benefits to cover basic human needs, the sustainability sub-index assesses how well a pension system is prepared to cushion the impact of demographic change, while starting points reflect the financial and demographic situation in a country, along with living standards.

The rating system uses a scale ranging from grades one to seven, where grade one indicates that no reforms in the pension system are needed. Kazakhstan received a solid grade of 1.8 in the First Pillar category, which assesses the coverage and benefit level of the pension system. Meanwhile, the country’s lowest score was in the living standards criterion.

According to Tengenomika, a Telegram channel focused on economics, Kazakhstan’s pension system is socially stable but economically vulnerable. It helps mitigate poverty among the elderly but heavily relies on the state budget, while failing to meet the interests of businesses and the financial sector.

«Given an aging population, weak economic growth and an emerging budget burden, the current model is gradually losing its resiliency. Under these conditions, financial literacy should be improved, and the private sector should be involved in long-term pension planning. It is important to seize the window of opportunity before it closes. Otherwise, in 10 years from now, we would be discussing the risk of payment failures instead of global ratings,» the channel’s statement said.

The Allianz Global Pension Report 2025 highlights a global need for reforms in pension systems amid demographic aging. Countries with sustainable pension systems, like Denmark, the Netherlands and Sweden, serve as role models due to their early implementation of capital-funded mechanisms. Japan, on the other hand, demonstrates an alternative approach by prolonging labor activity. Developing nations face issues of low coverage, while many European countries struggle with unsustainable pay-as-you-go pension plans, which fund pension payouts through contributions from active employees.