Kazakhstan’s oil production remains heavily reliant on its three flagship megaprojects. In 2024, the country’s top three producers — Tengizchevroil (TCO, operates the Tengiz and Korolevskoye fields), the North Caspian Operating Company (NCOC, manages the Kashagan, Kairan and Aktokty fields) and Karachaganak Petroleum Operating (KPO, oversees the Karachaganak field) — accounted for 66% of total crude oil output. To put the scale of oil producers in context within the broader economy, Kursiv Research has compiled a ranking of the country’s largest oil companies.

| KAZAKHSTAN’S LARGEST OIL COMPANIES RANKED BY 2024 OUTPUT | ||||

| Source: Data from Kazakhstan’s Ministry of Energy, KazMunayGas and the listed companies | ||||

| No. | Company | Output in 2024, thousand tons | Trend against 2023 | Share of Kazakhstan’s oil production in 2024, % |

| 1 | Tengizchevroil | 27,811 | -3.7% | 31.7% |

| 2 | NCOC (Kashagan) | 17,424 | -7.2% | 19.9% |

| 3 | Karachaganak Petroleum Operating | 12,200 | 0.8% | 13.9% |

| 4 | Mangistaumunaigas | 6,170 | 0.3% | 7.0% |

| 5 | Ozenmuniagas | 5,098 | 4.5% | 5.8% |

| 6 | CNPC-Aktobemunaigas | 2,497 | -6.8% | 2.8% |

| 7 | Embamunaigas | 2,790 | 2.5% | 3.2% |

| 8 | Karazhanbasmunai | 2,154 | 4.9% | 2.5% |

| 9 | PetroKazakhstan Inc. | 1,430 | -8.3% | 1.6% |

| 10 | Kazgermunai | 1,043 | -6.7% | 1.2% |

Tengiz

In 2024, Tengizchevroil reduced production to 27.8 million tons, a 3.7% decrease year-on-year (YoY). After completing two scheduled overhauls in the fall, the facility hit a new production high. However, localized corrosion damage discovered at another unit led to further repair work at the second-generation plant in late October. This caused daily output to fall by 20% to 30%.

Despite the setbacks, TCO still accounted for 31.7% of Kazakhstan’s crude oil production in 2024. That share is expected to grow. In April 2024, TCO brought all facilities under the Wellhead Pressure Management Project (WPMP) online and began converting its wells from high- to low-pressure operation.

In January 2025, the company announced it had received its first oil from the Third-Generation Plant, one of the cornerstone components of the Future Growth Project (FGP). With the integration of FGP and WPMP, the $48.9 billion expansion was effectively completed, making it the largest oil industry project in Kazakhstan in the last decade.

Looking ahead, the Ministry of Energy forecasts that Tengiz will produce 34.9 million tons in 2025. If that projection holds, Tengiz alone will account for 36.2% of all oil produced in Kazakhstan next year.

Kashagan

Production at the Kashagan oil field declined to 17.4 million tons in 2024, down by 7.2% YoY. By year’s end, Kashagan’s share of Kazakhstan’s total oil production had fallen to 19.9%. The field is still in the first phase of pilot industrial development, limiting output to a maximum of 408,000 barrels per day.

A key constraint on production growth is the processing of associated gas, which is released during oil extraction. Existing gas processing facilities are already operating at full capacity. In response, QazaqGaz, Kazakhstan’s national gas company, is constructing a new gas processing plant near Kashagan, with a capacity of 1 billion cubic meters. The facility is expected to come online in the third quarter of 2026. Once operational, it could allow production to reach 450,000 barrels per day or up to 19.3 million tons per year, according to Kursiv Research estimates.

Ambitions for a more dramatic increase in output — up to 700,000 barrels per day or 30 million tons annually — are tied to the second phase of industrial development (Stage 2B). This project involves tapping new sites and launching a much larger gas processing plant with a capacity of 6 billion cubic meters. However, Stage 2B remains uncertain due to ongoing legal disputes between the Kazakh government and shareholders of the NCOC.

In 2024, Kazakhstan filed several lawsuits against the NCOC consortium, claiming losses of approximately $160 billion. Legal proceedings could stretch into 2028, casting doubt over the project’s timeline and viability.

Karachaganak

Karachaganak’s oil output in 2024 totaled 12.1 million tons, a modest 0.8% increase YoY. The field accounted for 13.9% of Kazakhstan’s total oil production for the year.

In 2024, the first phase of the Karachaganak Expansion Project (KEP-1A) was completed. In July, KPO announced the commissioning of its fifth compressor unit. This upgrade extended the so-called «production shelf,» helping sustain current production levels of liquid hydrocarbons.

To further support long-term output, a sixth compressor unit is under construction as part of KEP-1B, the project’s second stage. Construction is progressing ahead of schedule, with 70.9% of the work completed by the end of 2024. The sixth compressor is scheduled to launch in the fourth quarter of 2026.

Other major oil projects

Oil companies ranked below third place are mostly developing mature fields, where output is expected to decline over time. In some cases, these companies have managed to stabilize production through enhanced recovery methods. However, a major reason for relatively stable production figures in 2024 was a notable reduction in emergency power outages.

Mangistaumunaigas ranked fourth among Kazakhstan’s oil producers in 2024, with a slight output increase of 0.4%, reaching 6.2 million tons. Jointly owned by Kazakhstan’s KazMunayGas (KMG) and China’s CNPC, the company stabilized production by successfully implementing several geological and technical initiatives, which collectively contributed an additional 440,000 tons of output.

Ozenmunaigas, ranked fifth, increased production by 4.5%, ending the year at 5.1 million tons. This recovery brought the company back to production levels last seen before widespread power outages disrupted operations.

Karazhanbasmunai, eighth in the ranking, boosted production to 2.2 million tons, the highest relative growth among the top 10 producers with a 4.9% increase YoY. However, only about a quarter of this growth stemmed from technical interventions; the rest resulted from uninterrupted operations without power failures.

Embamunaigas, 100% owned by KMG, also stabilized production last year, increasing output to 2.8 million tons, a 2.5% rise YoY, 17,000 tons above target. The company is currently implementing a modernization project that includes equipment replacement and process flow upgrades. The initiative is expected to increase annual production to 3 million tons from newly developed fields.

KMG also holds stakes in two additional companies in the top 10:

PetroKazakhstan Inc. (ninth place, 33% owned by KMG, 67% by CNPC) saw an 8.3% drop in production to 1.4 million tons.

Kazgermunai (tenth place, 50% owned by KMG, 50% owned by a subsidiary of PetroKazakhstan Inc.) posted a 6.7% decline, producing 1.04 million tons.

According to KMG’s report, both companies are experiencing natural depletion in the Kumkol group of mature fields.

The only company in the top 10 without KMG involvement is CNPC-Aktobemunaigas, which ranked sixth. Fully controlled by China’s CNPC, it produced approximately 2.5 million tons in 2024, a 6.8% decrease YoY. While the company did not disclose the cause of the decline, it reported an increase in recoverable reserves totaling 1.3 million tons.

Forecast for 2025

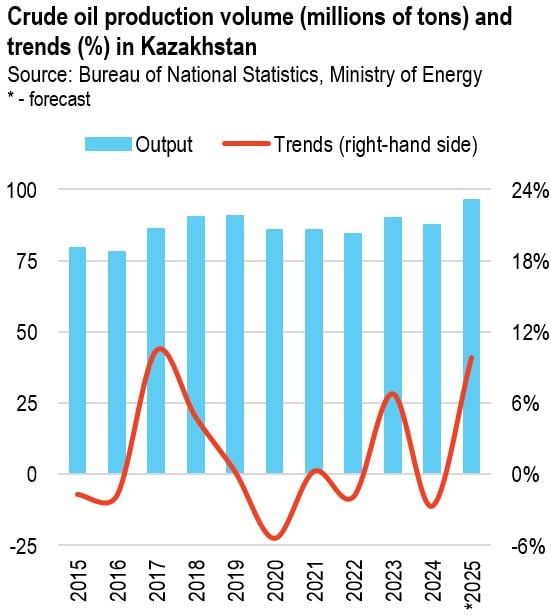

In 2024, Kazakhstan’s top 10 oil companies accounted for nearly 90% of the country’s crude oil output, even though more than 100 oil and gas enterprises operate nationwide. According to the Bureau of National Statistics, Kazakhstan produced 87.6 million tons of crude oil last year, a 2.7% decline YoY.

Over the past eight years, annual crude oil production has fluctuated between 85 million and 90 million tons. However, 2025 is expected to set a new industry record. The Ministry of Energy projects that crude oil production will rise to 96.2 million tons, representing a 10% increase YoY.

Production at Kashagan and Karachaganak is expected to remain mostly flat, reaching 17.9 million tons (+2.9% YoY) and 12.4 million tons (+1.6%), respectively. The bulk of the growth will come from Tengiz, where expanded capacity is expected to significantly boost output.

In 2024, the three largest oil projects — Tengiz, Kashagan and Karachaganak — accounted for 65.5% of national production. By the end of 2025, their share is projected to increase to 67.7%.

These three megaprojects primarily focus on oil exports. As their share of total output grows, the Kazakh government is increasingly relying on smaller producers to supply crude to the domestic market at subsidized prices. This raises a strategic concern: as the dominance of export-oriented producers increases, domestic fuel availability may be at risk.

No significant changes to the structure of Kazakhstan’s top 10 oil producers are expected soon. In recent years, no major new oil field discoveries have been publicly reported, despite government efforts to boost exploration. These efforts include a digital auction platform launched in 2020 for licensing hydrocarbon exploration and production rights, as well as the introduction of an Improved Model Contract (IMC) in 2023. The IMC offers preferential terms for projects with high geological risk but has yet to deliver significant breakthroughs.