Kazakhstan’s oil industry braces for a prolonged investment slump

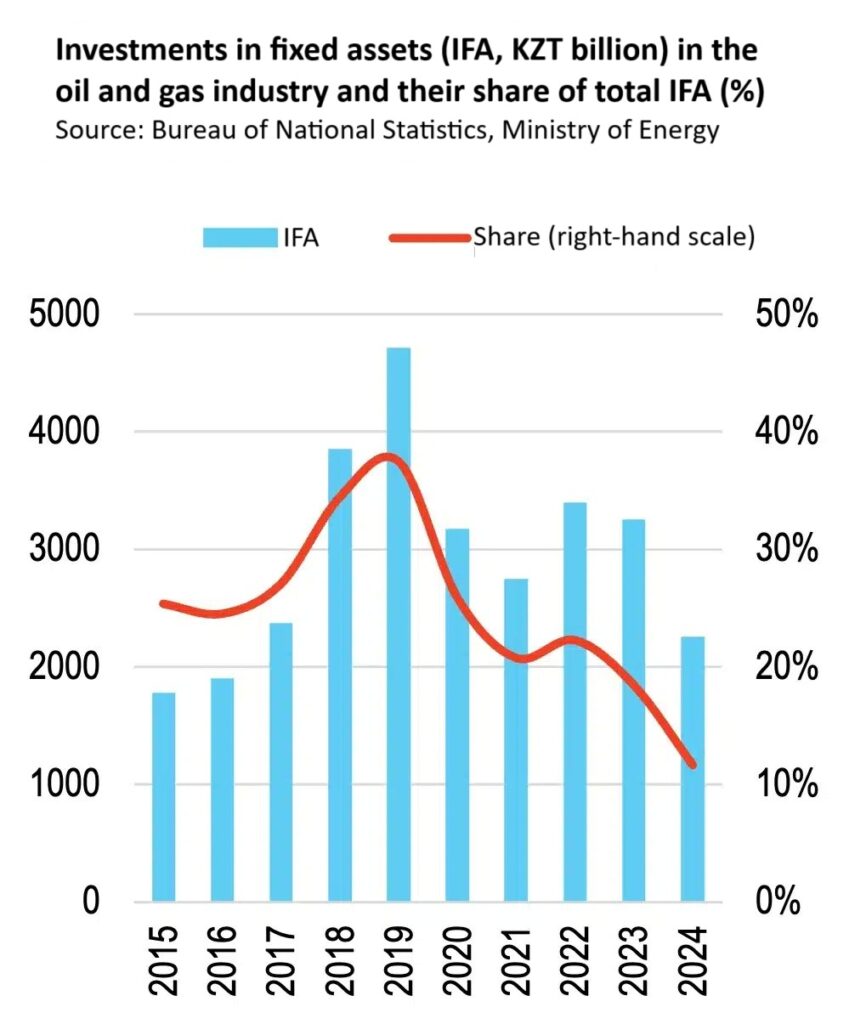

Oil and gas companies are investing less and less in fixed assets in Kazakhstan. In 2024, capital investment by oil and gas enterprises dropped to 2.3 trillion tenge (approximately $4.9 billion), marking a 32.8% year-on-year decline in real terms. With non-residents serving as the primary investors in Kazakhstan’s oil sector, foreign direct investment (FDI) also declined. Gross FDI inflows into oil and gas production fell to $3.1 billion, a nominal decrease of 46.4% over the year.

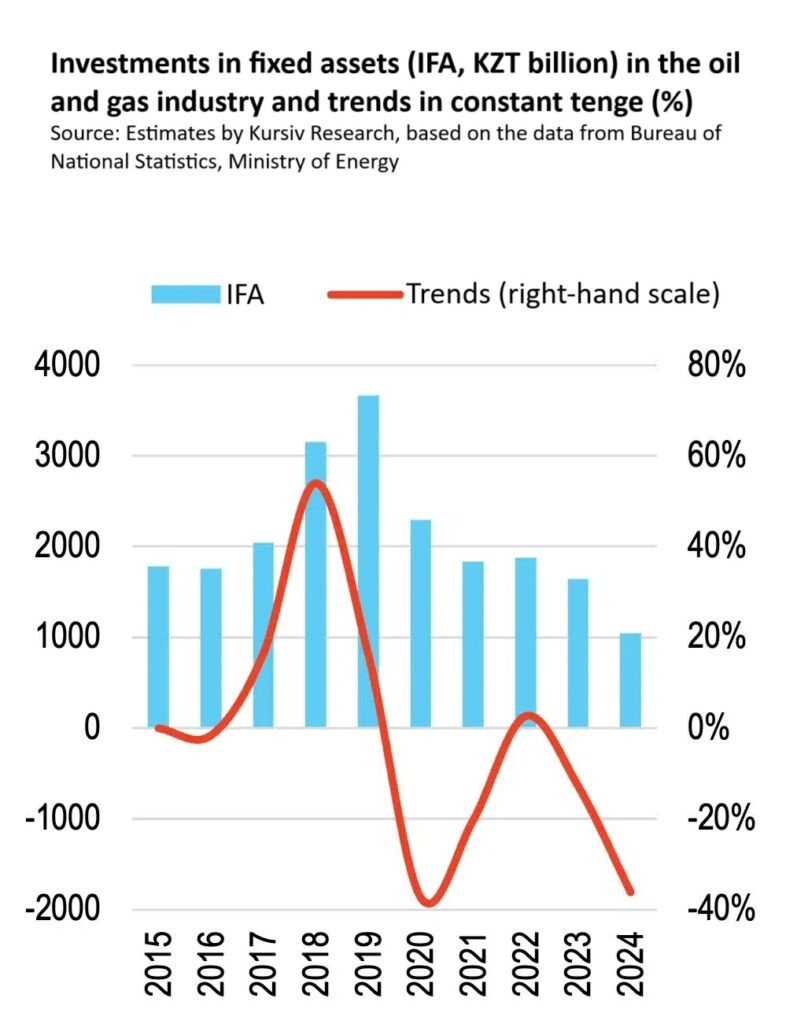

This drop in investment activity is not a temporary dip driven by external shocks. It rather reflects the winding down of an investment cycle tied to major oil field expansion projects.

In the summer of 2016, the shareholders of Tengizchevroil, Kazakhstan’s largest oil producer, made a final investment decision on the Future Growth Project/Wellhead Pressure Management Project (FGP/WPMP). Initially estimated at $36.8 billion, the project’s total cost ballooned to $48.9 billion by completion.

Expansion projects at Karachaganak, aimed at maintaining production levels, were smaller in scale and cost. In 2018, a $1.1 billion project was launched to remove gas production constraints. The following year, work began on the fourth reinjection compressor, with an investment of more than $578 million. In late 2020, the Karachaganak Expansion Project-1A (KEP-1A) was approved, authorizing the construction of a fifth reinjection compressor for $970 million. A sixth compressor, valued at $735 million, received final investment approval in November 2022.

In 2024, the stalled project to construct a gas processing plant near Kashagan was revived, thanks to Qatari investment. The $1 billion facility, designed to process 1 billion barrels of raw gas, is expected to boost daily output at the field from 407,000 to 450,000 barrels.

Data compiled by Kursiv Research shows that the current investment cycle began in 2017 and peaked in 2019. That year, capital expenditures in constant prices reached 3.7 trillion tenge (4.7 trillion tenge in nominal terms or approximately $12 billion). By then, more than 74% of the Tengiz expansion project had been completed, meaning most of the capital had already been deployed. Although investment volumes in fixed assets declined in the subsequent three years, they remained high relative to historical levels.

According to calculations by Kursiv Research, capital expenditures in Kazakhstan’s oil and gas sector fell to their lowest level in 2024, estimated at just $2.2 billion in constant prices. The sharp decline in investment activity stems from the completion of several large-scale projects that have dominated the industry in recent years.

In April 2024, all facilities under the WPMP at the Tengiz oil field were commissioned. In January 2025, the first oil was produced at the Third-Generation Plant, one of the centerpiece components of the FGP. Meanwhile, at Karachaganak, the fifth reinjection compressor was launched in 2023, and construction progress on the sixth compressor had reached 70.9% by early 2025. At Kashagan, a refinery capable of processing 1 billion cubic meters of gas is nearing completion.

These recently launched projects, particularly at Tengiz, have pushed Kazakhstan closer to a key production milestone. By the end of 2025, the Ministry of Energy expects oil production to reach 96 million tons, up from 87.6 million tons in 2024. As the country approaches the symbolic 100- million-ton mark, the oil industry is entering a new phase. While production may reach record levels, capital investments are likely to decline or at the very least, stop growing at the pace seen over the past two decades.

No major new investment projects are expected in the medium term. Tengiz is set to reach its maximum production capacity this year. At Kashagan, further expansion plans, including the shift to full industrial development with daily production of 700,000 barrels, are unlikely to move forward soon, especially as the Kazakh government pursues a $160 billion arbitration case against the field’s shareholders.

Among the few near-term prospects is a new gas refinery capable of processing 2 billion cubic meters annually, which could boost daily production at Kashagan to 500,000 barrels. However, additional phases of Kashagan’s development face serious headwinds, including high project costs and mounting geopolitical risks.

Outside of the country’s three mega-projects — Tengiz, Kashagan and Karachaganak — the oil sector has little to drive new investment. Recent government initiatives to stimulate exploration, such as online auctions and a revamped model contract, have yet to produce meaningful results. Despite reforms and incentives, companies remain hesitant to invest in the sector, discouraged by the wide gap between domestic and export oil prices, limited access to transportation infrastructure and state-imposed obligations to sell a portion of production on the local market at prices below global benchmarks.