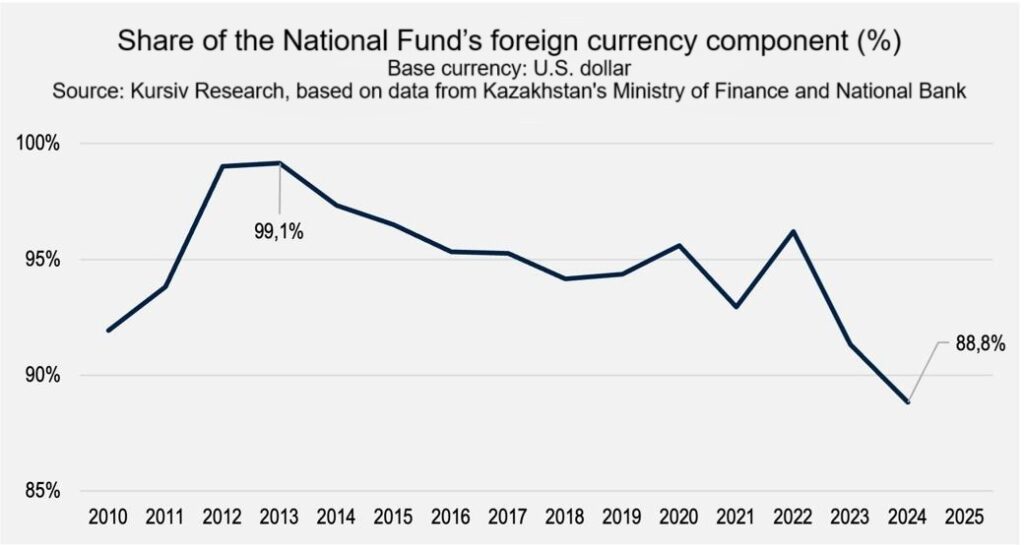

The share of foreign currency assets in Kazakhstan’s National Fund — a sovereign wealth fund financed by oil revenues — declined to approximately 89% by the end of 2024, according to Kursiv Research, which analyzed data from Kazakhstan’s Ministry of Finance and the National Bank. This development marks a significant shift, driven by increased domestic financing of the state budget and infrastructure projects led by national companies.

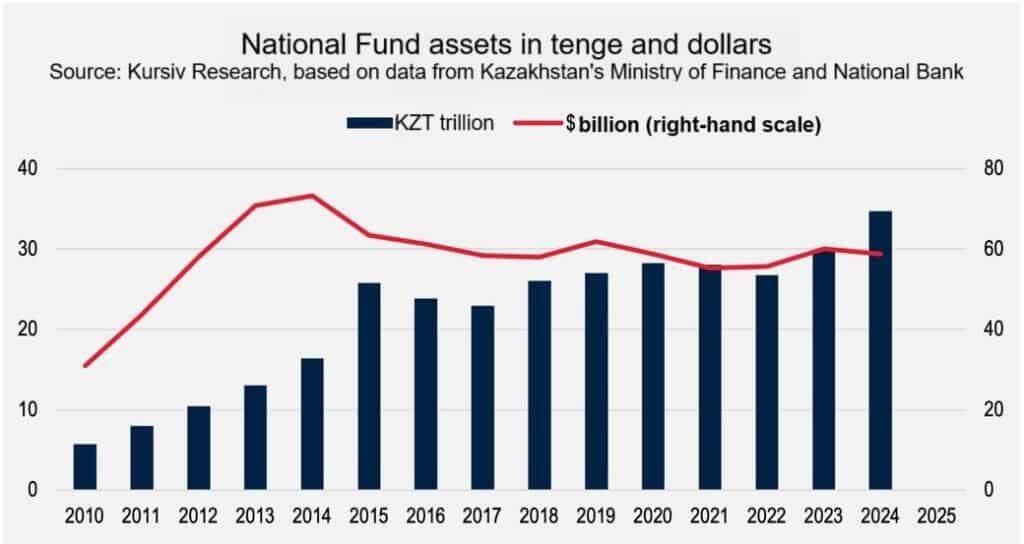

The performance of Kazakhstan’s National Fund in 2024 was mixed. On the one hand, the fund’s assets in tenge grew substantially, reaching 35.2 trillion by year-end, an 18% increase year-on-year (YoY). Net assets, adjusted for liabilities, totaled 34.7 trillion tenge (+16% YoY).

However, when measured in the fund’s base currency, the U.S. dollar, growth was rather modest. As of December 2024, the National Bank reported the fund’s total market value at $66.2 billion, reflecting just a 1% annual increase (excluding target requirements under the National Fund for Children program).

Notably, the fund’s foreign currency assets fell by 2%, ending the year at $58.8 billion.

The stabilization portfolio was valued at $3.4 billion, while the savings portfolio stood at $56.1 billion.

By the end of 2024, the assets of Kazakhstan’s National Fund amounted to 25.9% of GDP, up from 25.0% in 2023. The foreign currency portion of the assets accounted for 20.6% of GDP, compared with 22.9% the previous year.

Since 2022, the sovereign oil fund’s total assets have not exceeded 30% of GDP, well below the 2012-2021 average of 42%. Large withdrawals and relatively low investment returns have constrained the fund’s structural growth.

Profitability remains a key indicator. In 2024, the National Bank reported an overall return of 7.6%. The stabilization portfolio returned 5.28%, exceeding its benchmark of 5.20%, while the savings portfolio delivered 8.11%, also outperforming its benchmark of 7.97%.

«Favorable market conditions facilitated this,» the National Bank stated in its annual report. «All asset classes, except for government bonds of developed countries, showed growth last year, with double-digit gains in equities and gold.»

The report also noted that shifting from a conservative to a more balanced asset allocation allowed the fund’s riskier investments to make a stronger contribution to income for the reporting period.

Since the fund’s inception, cumulative investment income has reached 127.75% or an average annual return of 3.55%. This is slightly below the five-year average of 3.79% but significantly higher than the 10-year average of 2.92%.

The government has drawn on the National Fund to cover budget deficits since 2007. In 2024, withdrawals in the form of transfers totaled 5.6 trillion tenge (nearly $12 billion) or 4.4% of GDP.

Revenues to the National Fund last year totaled approximately $18 billion (6.6% of GDP), including $8 billion from tax revenues and $15 billion from investment income.

In a notable step toward greater transparency, the Ministry of Finance in 2024 released, for the first time, not only a report on the fund’s formation and usage but also audited financial statements and the National Bank’s trust management report, previously only included as part of the bank’s annual report.

The asset management concept for Kazakhstan’s National Fund, updated two years ago, set a long-term objective: to improve the profitability of the savings portfolio.

To achieve this, the strategy called for shifting the portfolio’s structure from a conservative allocation — 80% in bonds issued by developed economies and 20% in equities — to a more balanced distribution: 60% in bonds, 30% in equities and 10% split between alternative instruments and gold.

Reporting for 2024 confirms that this rebalancing has occurred, and the shift in risk profile has proven successful. The savings portfolio accounted for 84.7% of the fund’s net assets or about $62 billion. The bond portfolio stood at $34 billion (up 17% YoY), making up 55% of the savings portfolio. The equity portion reached $22 billion (up 37%) or 36%.

Gold holdings, which already represented 5.1% of total assets in 2023, rose to 5.9% of the savings portfolio or approximately $3.6 billion by the end of 2024. The share of alternative instruments remains smaller: $1.5 billion in 2023 and $1.7 billion in 2024 (2.8% of the savings portfolio).

Meanwhile, the stabilization portfolio declined from $8 billion to $3.8 billion. Its share of net assets fell from 7.9% to 5.2%.

The National Fund was originally established to combat the effects of the «Dutch disease,» the economic challenges posed by an overreliance on resource exports. By investing oil revenues abroad, the fund was designed to «sterilize» petrodollar inflows and create a financial cushion for both current fiscal needs (through the stabilization portfolio) and future generations (via the savings portfolio).

Given the high volatility of the USD/KZT exchange rate, the fund has historically prioritized foreign currency assets for both stabilization and savings purposes.

However, since 2022, the government has introduced legislation permitting the fund to acquire domestic instruments. These have included bonds issued by the National Welfare Fund Samruk-Kazyna, as well as shares in major state-owned enterprises such as KazMunayGas and Kazatomprom.

In May 2025, the government revised the list of eligible investment instruments again, removing the option to invest in national company shares and allowing only bonds issued to fund projects of national importance.

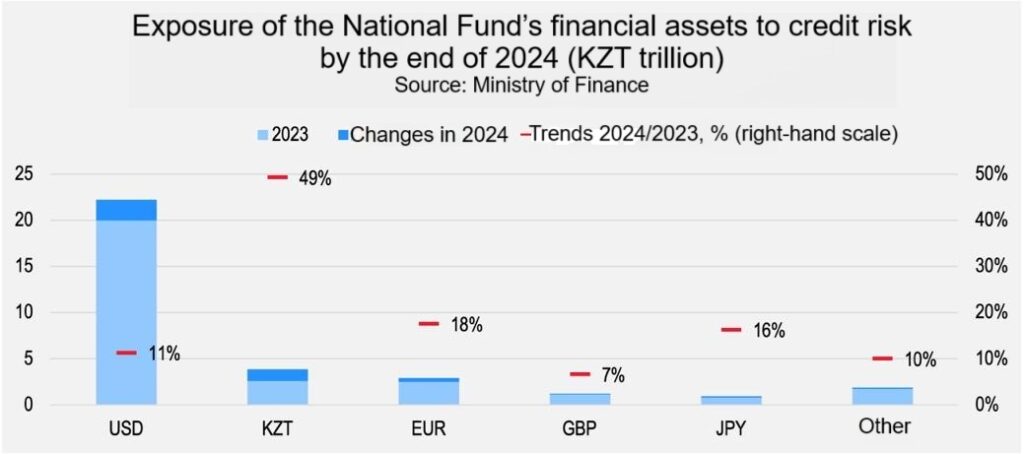

In its latest reporting, Kazakhstan’s Ministry of Finance noted the inclusion of tenge-denominated instruments in the structure of the National Fund’s financial assets assessed for credit risk. As of the end of 2024, these assets totaled approximately $8 billion, about 13% of the overall portfolio. Over the past year, the volume of tenge assets grew by 49%, increasing their share in the fund’s structure by 4 percentage points.

Estimates from both the Ministry of Finance and the National Bank, based on dollar terms, show that the share of the National Fund’s foreign currency assets has declined to 89%, the lowest level in the past 15 years.

The full composition of the tenge asset holdings has not been disclosed, raising questions about recent transactions, particularly those involving national company shares. However, the reporting does include clarification on some deals. For example, in 2024, the fund purchased several bond issues from Samruk-Kazyna, totaling nearly $507 million, to finance infrastructure projects such as the second tracks of the Dostyk-Moiynty railway and the Taldykorgan-Usharal gas pipeline. Because the interest rates on these bonds were below market rates, the fund recorded a $150 million impairment on its balance sheet.

The rising share of domestic, tenge-denominated assets in the National Fund raises several concerns. First, it deviates from the fundamental principles of sovereign wealth fund management. The fund’s base currency is the U.S. dollar, and its performance is measured in dollar terms. However, domestic assets are not evaluated with the same rigor, potentially weakening the fund’s overall return profile and undermining its capacity to generate investment income, especially important for future disbursements under the National Fund for Children program.

Second, increasing domestic asset holdings reduces the country’s foreign currency liquidity, which is essential for financial stability.

Third, it exposes the fund’s savings to greater currency and inflation risk tied to the tenge.

Additionally, using the National Fund to finance domestic projects, outside the formal transfer mechanism and budgetary rules, undermines the effectiveness of countercyclical fiscal policy and erodes financial discipline in government operations.

While the use of tenge-denominated assets offers short-term flexibility for the government — such as funding social programs or stimulating the economy — it runs counter to the fund’s long-term goals and fiduciary responsibilities.