Kazakhstan’s untaxed ‘shadow economy’ hits $42 billion

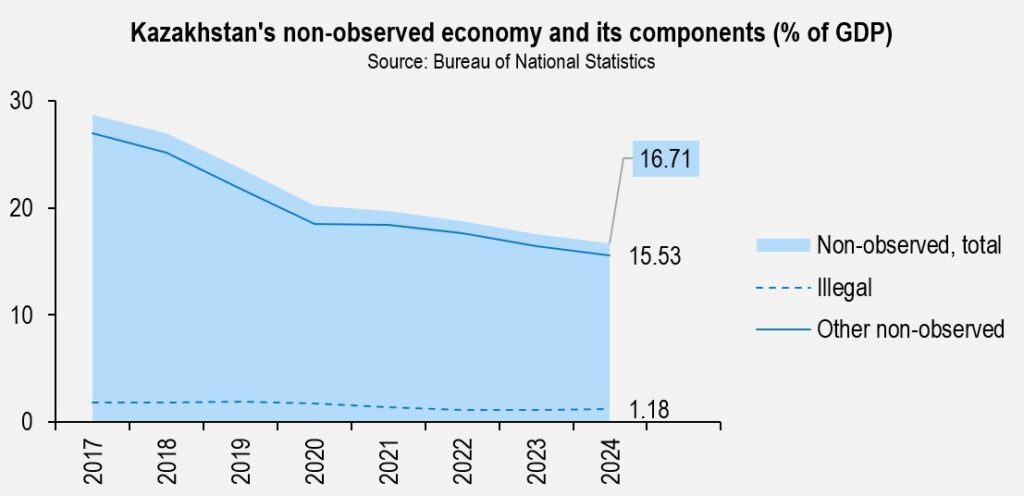

Kazakhstan’s shadow economy was estimated at 16.71% of GDP in 2024, down nearly one percentage point from the previous year, according to the Bureau of National Statistics. However, the Supreme Audit Chamber says the methodology for assessing the so-called non-observed economy is flawed and that government efforts to combat it remain insufficient.

Non-observed economy in 2024

In late July 2025, the Bureau of National Statistics (BNS) updated its estimate of Kazakhstan’s non-observed economy (NOE). The shadow sector declined from 17.58% to 16.71% of GDP in 2024, a drop of 0.87 percentage points (p.p.). In current prices, that amounts to 22.8 trillion tenge or roughly $42 billion, a decrease of about $2 billion year-on-year.

The bureau said it revised the 2023 estimate after updating industry indicators for transportation and agriculture, and making methodological clarifications. The revision added 0.06 p.p. to the 2023 figure but did not change the overall trend: the shadow economy continues to shrink by about 1 p.p. a year.

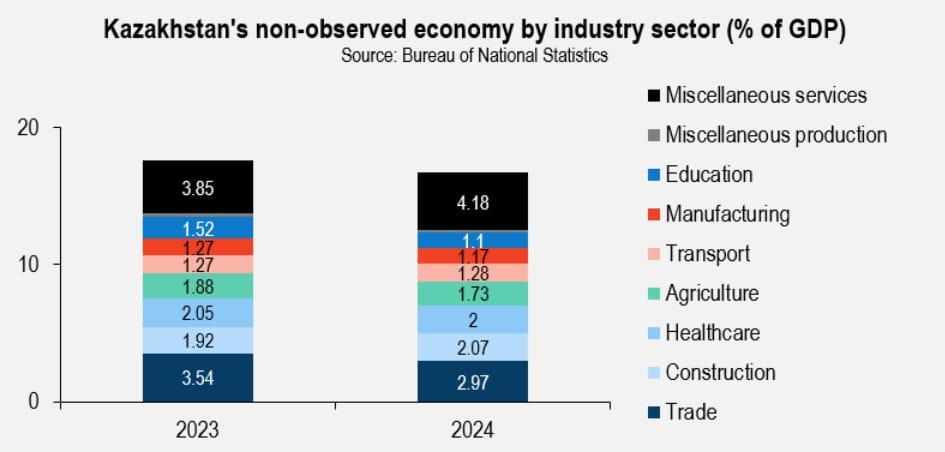

The 2024 decline was largely due to a «legitimization» of domestic trade, where the shadow share fell from 3.54% to 2.97% of GDP, a drop of 0.57 p.p. The education sector also saw a decrease, down 0.42 points to 1.1% of GDP. Officials attribute these improvements to measures such as expanding the State Revenue Committee’s authority to track peer-to-peer transfers and detect unregistered business activity.

Agriculture also showed gains, with its shadow share falling 0.15 points to 1.74% of GDP, progress likely tied to reforms in agricultural production accounting. Positive changes were recorded in other sectors, including industry (from manufacturing to mining, energy, and water supply), hospitality and healthcare.

Still, some sectors saw growth in the NOE. Shadow activity in real estate transactions rose to 0.71% of GDP, household businesses, measured for the first time, came in at 0.21%, and construction’s shadow share climbed 0.15 points to 2.07% of GDP. The financial sector and the information and communications sector also posted slight increases, likely reflecting changes in assessment methods.

BNS data shows that the illegal portion of the NOE grew from 1.12% to 1.18% of GDP in 2024 (about 1.6 trillion tenge) due to increases in shadow manufacturing (up 0.04 points to 0.35%) and trade (up 0.06 points to 0.26%). In total, BNS reports criminal economic activity in four of 20 sectors: agriculture, manufacturing, trade, and certain services, a category that includes, for example, escort services.

Long-term trends

BNS data on the shadow economy is available from 2013, though the current methodology, approved in August 2019, applies only to 2017 through 2024. The updated approach follows international standards, including the UN’s System of National Accounts 2008 and related OECD guidelines, and incorporates a broader range of sources such as tax records and other government data.

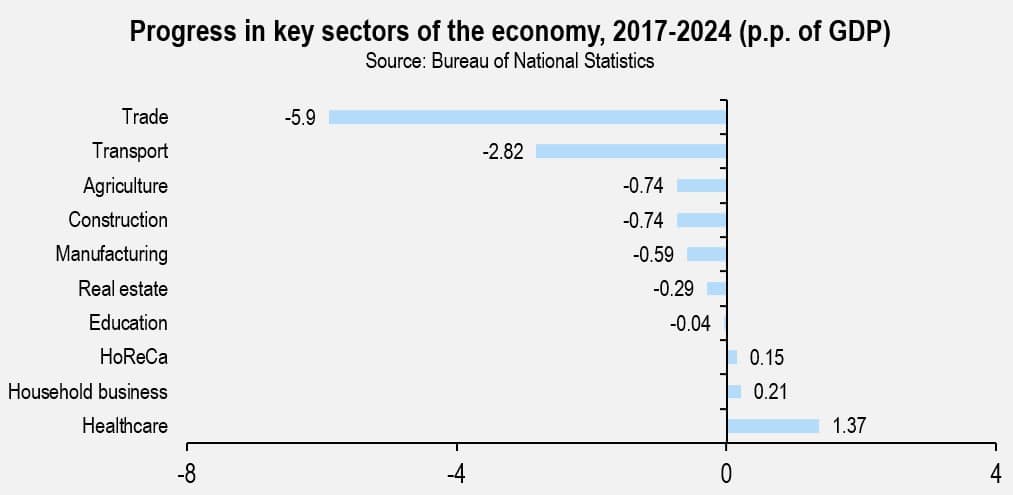

Since Kazakhstan adopted its current methodology for measuring the NOE, the sector’s share of GDP has dropped by roughly 12 p.p. The largest progress has been in trade (down 5.9 points), transport (down 2.82 points), agriculture and construction (each down 0.74 points), and manufacturing (down 0.59 points).

Only four of 20 sectors have seen a net increase in the NOE share: household businesses (mentioned in the 2024 results), hospitality (up 0.15 points), information and communications (up 0.08 points), and healthcare (up 1.37 points).

In 2023, Kursiv Research recorded an increase in the shadow economy’s share in both education and healthcare. In 2024, both sectors saw declines, but their levels remain relatively high. At 2024 prices, shadow healthcare and education services total about 4.2 trillion tenge a year, or roughly 3.1% of GDP.

Public policy assessment

In its July 2025 report on the execution of the 2024 state budget, the Supreme Audit Chamber (SAC) identified systemic weaknesses in government efforts to reduce the shadow sector.

First, the SAC says the official methodology for measuring the NOE is flawed. It excludes certain industries — such as real estate transactions and arts, entertainment and recreation — despite evidence of hidden business activity. It also omits illegal activities like synthetic drug production, weapons manufacturing and adult content.

In 2021, Kazakhstan switched from continuous to selective data collection for small businesses in wholesale and retail trade, leading to the removal of that data from NOE calculations. As a result, the shadow gross value added under the category «Other statistical deficiencies» fell by a factor of 1,000 between 2020 and 2023.

The SAC also criticized what it called the «indicative» targets used by government agencies — figures that do not require active intervention, effectively allowing for underestimation of planned results. For example, the use of a non-cash turnover coefficient can artificially lower the NOE share in GDP without any actual anti-shadow measures. Even under these easier targets, the Ministry of Agriculture, the Ministry of Industry and Construction, and the Ministry of Justice failed to meet their 2023 goals. The Ministry of National Economy met its target, but the SAC argued that the bar had been set too low from the start.

Another concern is the quality of the government’s comprehensive anti-shadow economy plans. The SAC’s review of the 2021-2025 plans found that not all economic sectors were addressed, covering no more than nine of 17 industries. About one-third of the planned activities lacked concrete implementation steps, relying instead on vague wording such as «study the issue,» «develop proposals» or «conduct analysis.»

Overall, the SAC concluded that current measures are insufficient. «State revenue authorities do not fully implement tax and customs administration measures,» the report said.

Among its recommendations, the SAC called for «the development of effective mechanisms for identifying hidden entrepreneurial activity and/or underreporting of income (shadow income) to increase tax potential.» It urged that these steps be included in Kazakhstan’s Concept of Tax Policy through 2030.