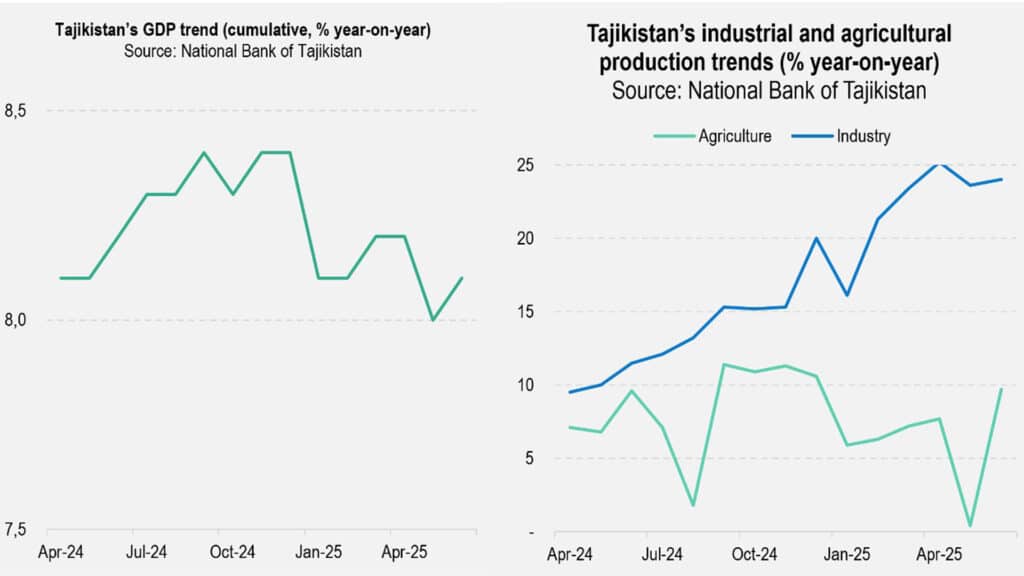

Tajikistan’s economy reported 8.1% growth over the first six months of 2025, supported by steady increases in industry and agriculture. The ongoing strengthening of the somoni — the national currency in Tajikistan — may widen the trade deficit but it is also boosting consumer demand.

GDP and its components

At the end of the first half of the year, Tajikistan’s Ministry of Economic Development and Trade reported GDP growth of 8.1%. «Despite global challenges, we have managed to ensure steady economic growth, proving that Tajikistan’s economy is capable of adapting to new conditions and sustaining a positive trend,» the agency said in a statement.

More than half of that growth came from three sectors of the country’s economy, which together account for around 52% of GDP: domestic trade (1.7 percentage points), agriculture (1.6 p.p.) and industry (1.2 p.p.).

Industrial growth is primarily linked to positive trends in the processing industry — the key industrial sector of Tajikistan’s economy — which reported a 5.0% increase. The food (+8.0%) and rubber (+6.2%) industries led the gains, while production in the metallurgy sector stabilized (+0.6%). The mining sector saw explosive growth, increasing 1.7 times from a low base, thanks to a 1.7-fold rise in metal ore production. At the same time, mining accounts for about one-third of Tajikistan’s industrial output.

As part of the country’s accelerated industrialization drive, 218 new industrial facilities were launched in the first six months of 2025.

Agricultural output increased by 9.7% year-on-year (YoY), with crop production rising 9% and livestock production growing 11.2%. Reporting on the first-half results, Tajikistan’s Ministry of Agriculture emphasized the increase in the production of melons, grapes and other fruits. According to statistics, national production of melons rose 43% YoY, grapes by 38% and fruits by 32%.

A heavy harvest of fruits and melon crops coincided with moderate production of vegetables (-3.8% YoY) and grains (-0.9%), particularly wheat — the crop for which Tajikistan is dependent on imports, mainly from Kazakhstan. Wheat production declined by 3.8% YoY, despite the cropping period ending in the third quarter — in July for winter wheat and in September for spring wheat. A distinctive feature of Tajikistan’s agriculture is the high concentration of production in private farmsteads, which accounted for an estimated 46% of agricultural output in the first six months of 2025.

The increase in the domestic trade sector is attributed to a 27.1% growth in wholesale trade turnover and 6.2% in retail — the sector’s main segment, which accounts for 85% of the entire sector. The retail segment saw increases in sales of fuel (+12%) and cattle (+18.9%), as well as sales in markets (+2.4%) and shops (+1.3%).

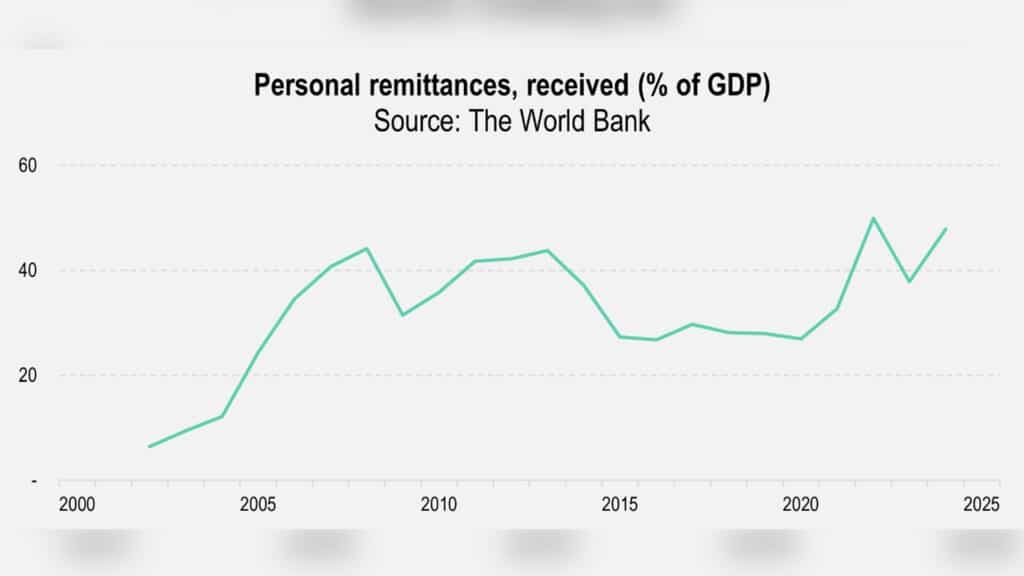

International financial institutions expect Tajikistan’s economy to slow down to somewhere between 7% and 7.5% by the end of 2025. According to the World Bank, growth will slow to 7% in 2025 and 4.9% in 2026 due to «the anticipated normalization of remittance inflows.» Experts at the International Monetary Fund, who also expect slowdowns in 2025 and 2026 to 7% and 5%, respectively, highlight the Tajik economy’s vulnerability «to a less favorable external environment» due to its high dependence on remittances and a «narrow export base.»

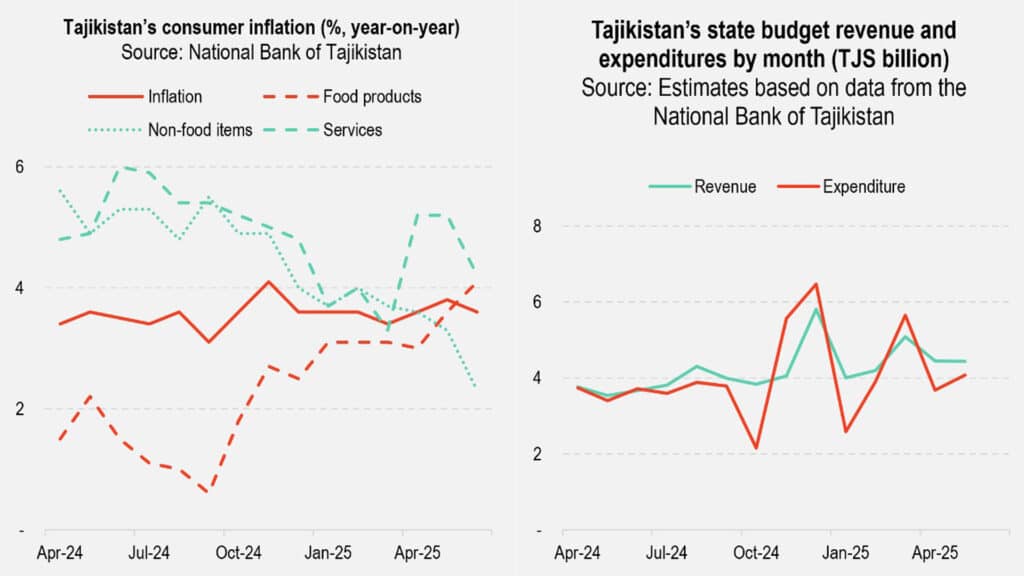

Inflation

At the end of June 2025, consumer inflation slowed to 3.6% YoY, following 3.8% in May and 3.4% in March. The main drivers of inflation were food products (+4.1%) and paid services (+4.2%), while the non-food item segment has been steadily slowing down since the beginning of the year and reached a post-COVID low of 2.3% YoY.

Prices for food products rose by the end of June 2025, driven by higher prices for beef (+25% YoY), vegetables (+24.1%) and eggs (+22.1%). Among paid services, electricity and telecommunications saw price increases of 14.1% and 7.8%, respectively. Non-food inflation was driven by higher prices for medicines (+2.9%), other fuels (excluding fuel and lubricants; +1.5%) and clothing and footwear (+1.4%).

Despite a fairly low inflation rate — considering the economic growth rate and the National Bank’s target rate of 5% — pro-inflation risks remain. In June 2025, industrial production prices rose 8% YoY, while prices for purchased construction materials increased by 2%. Housing and utility service tariffs also increased.

Public finance

Available data covering the first five months of 2025 suggest that Tajikistan’s budget system remains stable. The state budget has run a surplus of 1% of GDP so far (2.2 billion somoni, about $235.9 million). Revenues for January through May 2025 increased by 26.8% YoY (to 22.2 billion somoni or $2.4 billion), expenditures rose by 22.4% (to 19.9 billion somoni or $2.13 billion), and the positive balance saw an increase of 85.5%.

In the state budget revenue structure, tax proceeds increased by 27.5% to 14.8 billion somoni ($1.59 billion), with the highest growth and surplus coming from income taxes — both individual net income and corporate — which rose by 38.3% to 4.5 billion somoni ($482.42 million). The value-added tax, one of the most significant sources, generated 5.9 billion somoni ($632.6 million) for the treasury, up 22.2%.

To some extent, the surplus is due to the government’s failure to fulfill the expenditure plan. Nevertheless, state expenditure over the first five months of 2025 increased by 22.4%, while the government completed only 75% of the plan. There is no budget item this year that has been fully executed among the enlarged items. Of the three budget items that account for around 50% of Tajikistan’s state expenditure — education, social protection, and the fuel and energy complex — only the fuel and energy complex surpassed 80% of the planned implementation. At the same time, expenses increased by 32.9% for education, reaching 3.9 billion somoni ($418.15 million); by 15.7% for the fuel and energy complex (to 3.4 billion somoni or $364.5 million); and by 24.5% for social protection (to 2.6 billion somoni or $278.8 million).

Judging by experience of the developing countries, there might be several reasons behind this situation, including imperfections and chronic deficiencies in budget planning and management systems, severe administrative or bureaucratic barriers hindering the implementation of projects and programs, and widespread, systematic financial irregularities. However, the amount of publicly available information is insufficient to draw confident conclusions.

From a macroeconomic perspective, Tajikistan’s fiscal policy is appropriate for the current situation. By rapidly increasing budget revenues, the government is somewhat cooling the national economy and slowing the growth of household spending on final consumption amid high economic growth. In any case, this policy has not sparked criticism from analysts. The aforementioned IMF report highlighted that Tajikistan demonstrated «strong growth performance,» «prudent fiscal policy» and «a continued reduction in public debt.»

External sector

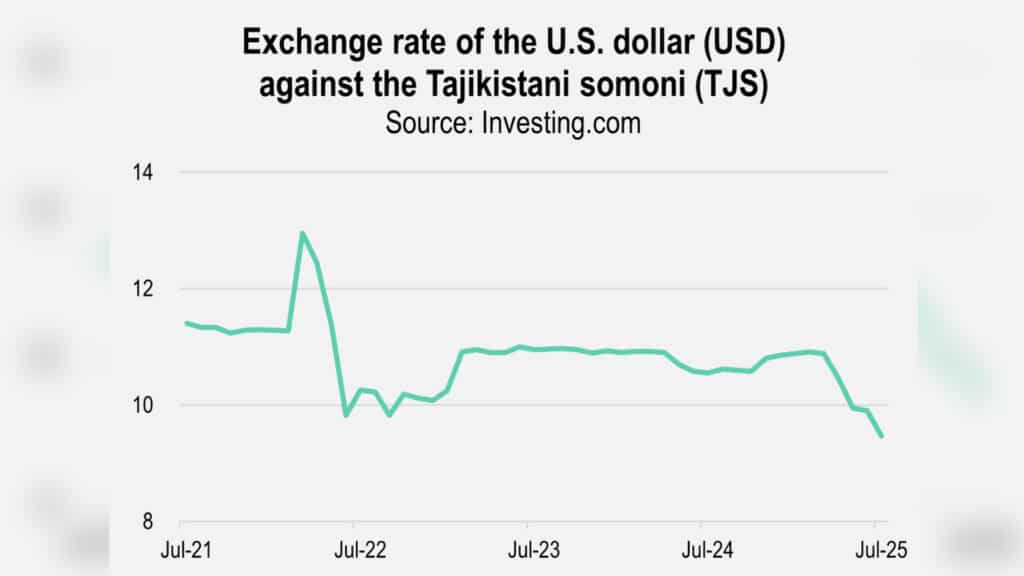

Over Q2 2025, the somoni exchange rate continued to strengthen. The average USD/TJS exchange rate in June fell by 9% compared to the March average. The dollar declined from 10.9 somoni in March to 9.9 and for the first time since September 2022, dropped below the 10-somoni mark. In July, the strengthening continued, with the dollar falling to 9.48. Overall, exchange rate fluctuations from April to June were insignificant.

The second important currency pair for Tajikistan’s economy, which is RUB/TJS, also showed somoni strengthening, appreciating by 3.5%. In March, one somoni could buy 7.6 rubles, rising to 7.9 in June and reaching 8.6 by the end of that month.

The reason behind the strengthening is financial injections through remittances, the ratio of which to GDP at the end of 2024 was 48%. These funds largely contribute to the trade deficit (imports in the first six months of 2025 grew by 10.5%, while exports fell 4.3%), a gap that continues to widen.

At the end of the first half of 2025, foreign trade once again demonstrated a negative balance, with exports decreasing by 4.3% to $955 million and imports growing by 10.5% to $3.8 billion. The decline in exports was due to a 43% plunge in cotton fiber shipments, while the growth in imports was driven by increased shipments across all major product groups, including investment and intermediate goods, as well as consumer goods. An important factor behind the growth in imports is the continued strengthening of the somoni.

It’s worth noting that at the end of January through June 2025, Tajikistan’s main trade partner changed. Thus, trade turnover with China reached $964 million, accounting for 24.8% of total external turnover, surpassing turnover with Russia, which stood at $900 million, or 23.2% of the total.

However, thanks to remittances from abroad, the current account of the balance of payments continues to run a surplus. According to experts at the Eurasian Fund for Stabilization and Development (EFSD), the account surplus stood at 15.3% of GDP at the end of Q1 2025, compared to the deficit of 4.4% of GDP in Q1 2024. This growth was supported by a 65% increase in remittances. The EFSD also reported a financial account outflow of 7.6% of GDP, which analysts attribute to debt repayment on Eurobonds in March 2025. In the current circumstances, Tajikistan faces an increasing need for foreign investment. Tajikistan’s State Committee on Investments and State Property Management reported that foreign investment inflows in the first half of 2025 amounted to $3.3 billion (up 59% YoY). The government has developed a strategy to attract investment until 2040, the goal of which is to «improve the country’s investment climate, stimulate investment activity, strengthen cooperation between the state and the private sector, develop entrepreneurship and attract investment, especially foreign direct investment.»