Strong growth continues in Tajikistan’s banking sector

In the first half of 2025, Tajikistan’s banking sector saw double-digit growth in assets, loan portfolios and profits among leading banks. The boom is also attracting new players to the market.

Monetary policy and the financial sector

Monetary policy and the financial sector

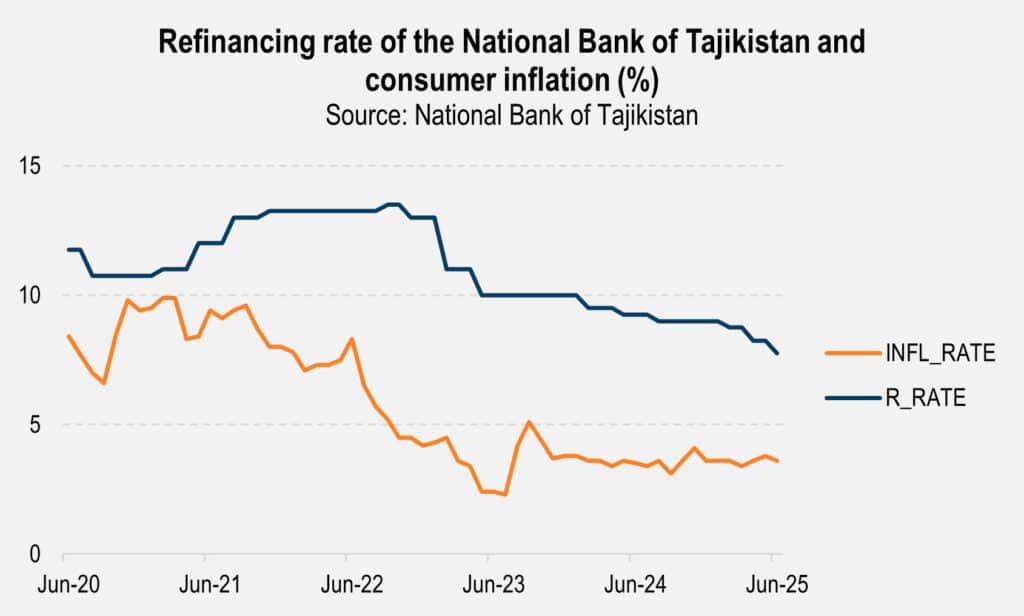

Background factors continue to support Tajikistan’s banking sector. Earlier, Kursiv Research highlighted signs of monetary policy easing in the country, which continued in Q2 2025. Since the start of the year, the National Bank of Tajikistan has lowered the refinancing interest rate three times. In August, the base rate stood at 7.75%, while consumer inflation was 3.6%. That placed the real interest rate between 4.1% and 4.7% in Q2 2025 — one of the lowest levels in the past six years and the lowest since September 2021.

Easing monetary policy has positively influenced lending activity in the economy. According to the country’s National Bank, in the first half of 2025 total assets of all Tajikistan’s credit institutions rose by 26.8% year-on-year (YoY), while the loan portfolio grew by 19.2%. On the one hand, growth slowed compared with Q1 2025, when assets rose by 36% YoY and the loan portfolio by 23.2%. On the other hand, the expansion remains strong, letting new players easily gain market share from incumbents.

The banking sector in Tajikistan is the main segment of the financial market, with banks accounting for 85% of credit institutions’ assets and 78% of their loan portfolio.

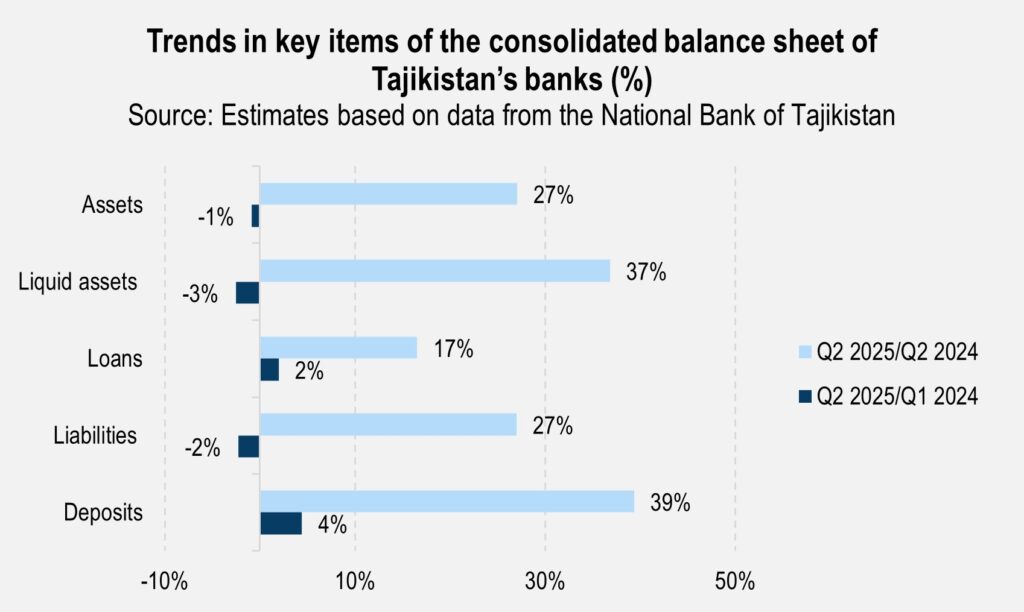

According to the National Bank’s statistics, at the end of Q2 2025, the total assets of Tajik banks reached 44.1 billion somoni (around $4.6 billion), down 1% quarter-on-quarter (QoQ) and up 27% YoY. The decline occurred amid a slight contraction in liquid assets of 3% (to 20.8 billion somoni, around $2.2 billion) QoQ. At the same time, in annual terms, the growth of liquid assets reached 37%.

The loan portfolio grew both quarterly and annually — up 2% and 17% respectively — reaching 17.6 billion somoni (approximately $1.8 billion) at the end of June 2025, of which 70% (approximately $1.3 billion) was in the national currency. The volume of delinquencies continued to decline, reaching 2.2 billion somoni (about $231 million), down 3% QoQ and 33% YoY.

The increase in assets was driven by growth in both liabilities and equity, which rose by 27% and 26% respectively. The ratio of liabilities to equity in Tajikistan’s banking sector traditionally stands at 80:20.

At the end of Q2 2025, the bank ranking by asset value saw some mid-table reshuffling. Alif Bank, which increased its assets by 24% over the quarter, pushed Commerce Bank of Tajikistan down from seventh place, while Sanoatsdirotbonk moved Investment and Credit Bank down from 10th place.

The lead of the top three banks is so huge that even a 5% drop in Eskhata Bank’s assets and a 21% decline at Oriyonbonk would still be insufficient to move these institutions from second and third places.

Nevertheless, if current growth rates persist, both the International Bank of Tajikistan — in fourth place with assets of 4.6 billion somoni ($483 million) — and Dushanbe City Bank — in fifth place with assets of 4.3 billion somoni ($451.7 million) — could easily catch up with the leaders as soon as this year. The latter recorded quarterly asset growth of 16.5%, with its loan portfolio expanding by 10.7%.

| Ranking of Tajikistan’s banks by asset value (Q2 2025) | |||||||

| Rank in Q2 2025 | Rank in Q1 2025 | Bank | Asset value, TJS million | Quarter-on-quarter change, % | Loans, financial lease and overdraft, TJS million | Quarter-on-quarter change, % | Loan share in assets at the end of the reporting quarter |

| 1 | 1 | Amonatbonk | 9,595 | 4.0 | 2,722 | –1.2 | 28% |

| 2 | 2 | Eskhata Bank | 7,363 | –4.5 | 4,252 | 7.8 | 58% |

| 3 | 3 | Oriyonbonk | 4,720 | –20.8 | 1,925 | –17.3 | 41% |

| 4 | 4 | International Bank of Tajikistan | 4,596 | 4.7 | 731 | 2.7 | 16% |

| 5 | 5 | Dushanbe City Bank | 4,273 | 16.5 | 173 | 10.7 | 4% |

| 6 | 6 | Spitamen Bank | 2,841 | –19.0 | 1,381 | –0.9 | 49% |

| 7 | 8 | Alif Bank | 2,673 | 24.0 | 1,100 | 14.2 | 41% |

| 8 | 7 | Commerce Bank of Tajikistan | 2,635 | –9.9 | 794 | –3.1 | 30% |

| 9 | 9 | Bank Arvand | 1,720 | 4.0 | 1,465 | 7.4 | 85% |

| 10 | 11 | Sanoatsodirotbonk | 1,353 | 15.3 | 534 | –1.0 | 39% |

| 11 | 10 | Investment and Credit Bank of Tajikistan | 1,336 | 2.6 | 839 | 8.9 | 63% |

| 12 | 12 | Activ Bank | 548 | 6.6 | 148 | 14.6 | 27% |

| 13 | 13 | Tawhidbank | 362 | 15.1 | 186 | 19.1 | 51% |

| 14 | 14 | Bonki Rushdi Tojikiston | 204 | 41.6 | 67 | 30.2 | 33% |

| 15 | 15 | The branch of the Bank Tijorat of the Islamic Republic of Iran in Dushanbe | 112 | 51.2 | 29 | –0.3 | 25% |

| 16 | 16 | Freedom Bank Tajikistan | 92 | –1.1 | – | – | – |

| Source: National Bank of Tajikistan | |||||||

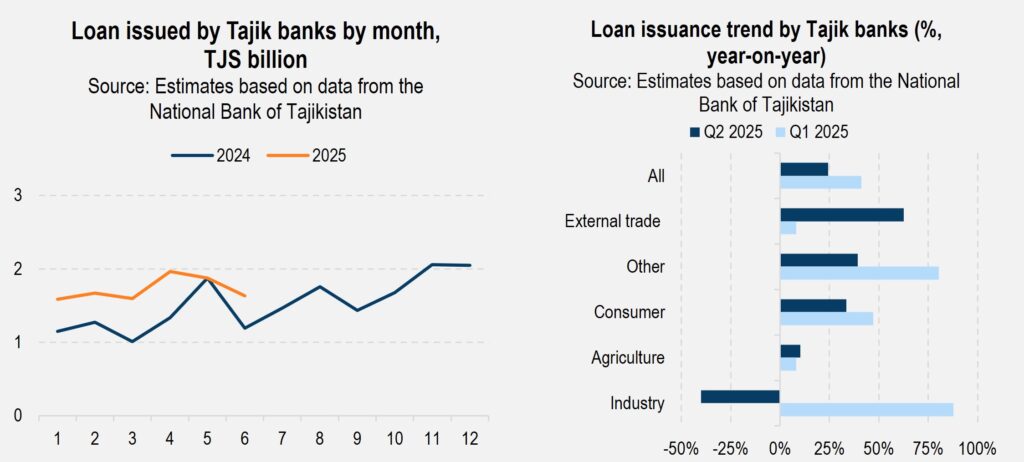

A 17% YoY rise in the total loan portfolio coincided with a 32% increase in loans issued, signaling an increase in turnover and shorter loan issuance times.

The volume of new loans issued in Tajikistan exceeded last year’s level in every month of 2025. For example, growth reached 58% YoY in March and 37% in June. Annual growth rates from the beginning of 2025 ranged from 28% to 37% YoY, slowing during the summer months.

In terms of borrower sectors, consumer lending predictably led the way. The volume of new loans issued in Q2 2025 grew by 34% YoY and by 39% in the first half of 2025, reaching 5.3 billion somoni ($556.7 million). Every second somoni lent by Tajikistan’s banks went to the consumer sector. At the same time, foreign trade lending showed solid cumulative growth: in the first half of 2025, the increase was 34%, with the portfolio reaching 1.9 billion somoni (around $199.5 million). The pace of lending to industry declined by 1% on an annual basis, with most of the contraction occurring in Q2 2025, when the portfolio of this group of borrowers shrank by 40% YoY.

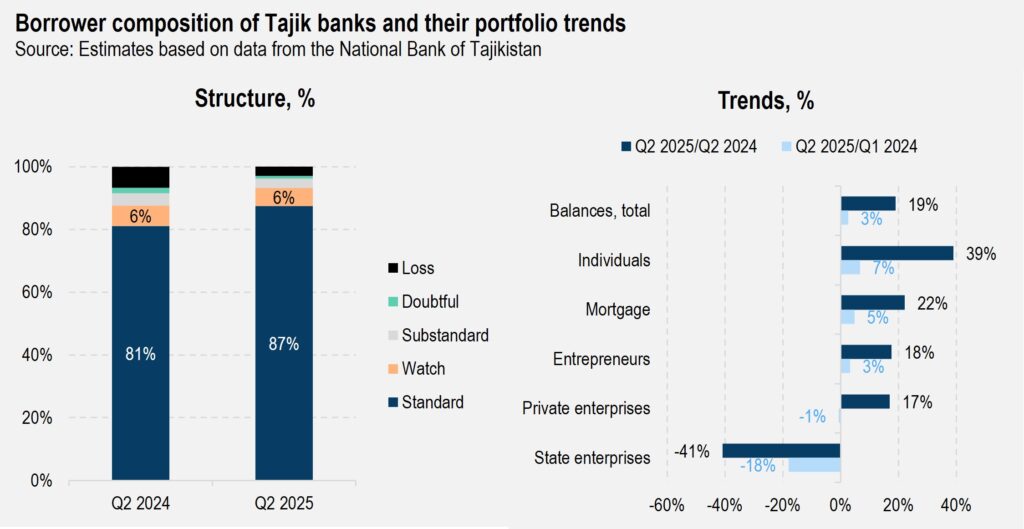

Analyzing loan portfolio trends confirms that consumption remains the main driver of lending growth, with 49% of the portfolio consisting of loans to individuals. The volume of such loans grew by 39% YoY. This represents the most dynamic annual growth among all borrower groups. The portfolio of loans to entrepreneurs increased by 18% and loans to private enterprises by 17%.

The share of standard consumer loans increased by 6 percentage points (p.p.) at the end of Q2 2025, indicating that the quality of Tajik banks’ portfolios had improved on an annual basis.

Eskhata Bank retained its position as the most active lender to the economy, with 58% of its assets concentrated in the loan portfolio, which grew by 32% YoY to reach 4.3 billion somoni ($451.6 million). Aktiv Bank, Dushanbe City Bank and Bonki Rushdi Tojikiston (Development Bank of Tajikistan) reported the strongest loan portfolio growths: up 89%, 82% and 78%, respectively. The latter was also notable for the largest quarterly increase, rising 30% in Q2 2025.

Against the backdrop of a 0.8 p.p. decrease in the refinancing interest rate in Q2 2025, lending rates for legal entities fell across the board. For all term loans in somoni, the rate declined by 0.6 p.p. to 22.75%, while loans with maturities of six months to one year reported a smaller reduction of 0.2 p.p.

Deposits are the main component of Tajikistan’s banking sector liabilities. At the end of June 2025, they accounted for 74% of total liabilities or 26.9 billion somoni ($2.8 billion), increasing 4% QoQ and 39% YoY.

The top five deposit-holding banks drove YoY growth:

- Amonatbonk: up 32% to 7.7 billion somoni ($808.8 million)

- Eskhata Bank: up 33% to 4.3 billion somoni ($451.6 million)

- International Bank of Tajikistan: up 39% to 3.2 billion somoni ($336.1 million)

- Dushanbe City Bank: up 99% to 2.9 billion somoni ($304.6 million)

- Commerce Bank of Tajikistan: up 68% to 2.1 billion somoni ($220.6 million)

On a quarterly basis, Dushanbe City Bank and Amonatbonk posted the largest increases, rising 31% QoQ to 683 million somoni ($71.7 million) and 5% QoQ to 369 million somoni ($38.7 million), respectively. Only Tawhidbank’s deposit portfolio declined on a YoY basis, while quarterly declines were also reported at Commerce Bank of Tajikistan and Oriyonbonk, down 13% QoQ and 11% QoQ, respectively.

Deposit concentration among key players remains high: the top three banks hold 57% of total deposits, while the top five hold 75%.

Despite a reduction in the refinancing rate, aggregate interest rates on fixed-term deposits in somoni rose by 1 p.p. during the quarter, reaching 11.68%. This increase was primarily driven by deposits with maturities of 12 months or longer. It appears that depositors have already responded to such incentives, which warrants further explanation.

In Tajikistan, 78% of the M2 money supply (cash and deposits in the national currency) consists of M0, i.e., cash, based on 2024 averages. For comparison, in Kazakhstan it is only 11%. High cash volumes — ranging from 70% to 80% of M2 — have persisted in the country’s economy for at least the past 10 years. On one hand, this situation supports the view of a large informal economy. According to Ernst & Young, it accounts for 33% of GDP, the highest rate among the reviewed post-Soviet countries (excluding Kyrgyzstan and Moldova). On the other hand, this trend reflects low trust in the national currency as a savings instrument, as well as limited confidence in bank deposits overall.

However, the situation appears to have started changing this year. Amid explosive economic growth, all money aggregates have been rising at double-digit rates. For example, M2 increased 20% YoY at the end of the first half of 2025. At the same time, the cash component grew by only 15%, while deposits — excluding demand deposits, for which Tajik banks pay near-zero interest — rose 36%. This is a positive signal that could potentially develop into a long-term trend under more liberal banking sector regulation.

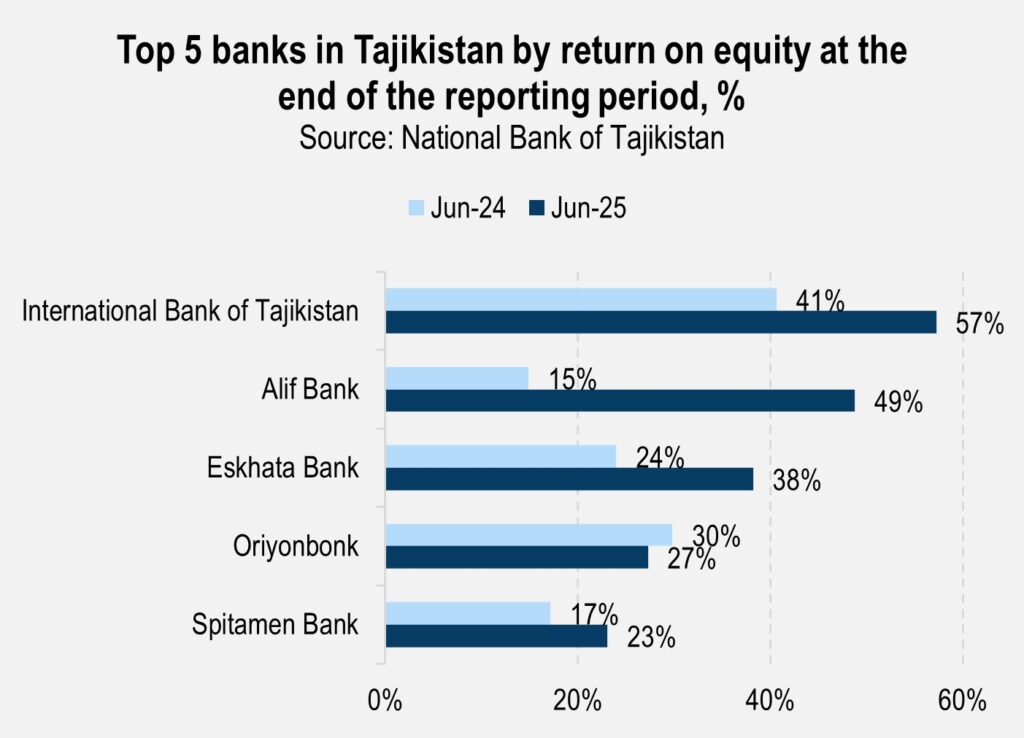

By the end of Q2 2025, average banks’ return on equity (ROE) shrank from 23% to 20% QoQ but increased by 5 p.p. on an annual basis. ROE growth was reported at eight out of 15 banks in the last quarter, while nine improved ROE on an annual basis.

The banks sitting in the top five by ROE remained unchanged from the previous quarter. The leader is the International Bank of Tajikistan, with 57% ROE. The bank has significantly improved its result from last year, which was 41%, as well as from Q1 2024, when it stood at 52%. The reason for the bank’s consistently high profitability is fee-based specialization in charged international card products and transactions. According to the audited financial statements for 2024, fee income accounted for two-thirds of the bank’s total income and about 70% of profit before taxes.

Alif Bank surged to the second position with 49% ROE, up from 45% in the previous quarter and 15% at the end of Q2 2024. Alif’s product line includes international card products and installment plans. Additionally, the bank recently launched its own marketplace. Notably, the institution began 11 years ago as a microfinance organization and obtained its banking license in 2019.

Eskhata Bank maintained the profitability level achieved in Q1 2025 (39%), ranking third with an ROE of 38%. At the end of Q2 2024, the bank’s ROE was just 24%. Given the bank’s size and versatility, this growth in profitability is impressive. The bank traditionally earns a high level of interest income, along with a significant share of net income from foreign currency transactions.

Oriyonbonk and Spitamen Bank — the two banks rounding out the top five — posted ROE of 27% and 23%, respectively. Oriyonbonk’s ROE declined 3 p.p. from last year’s 30%, while Spitamen slightly improved, rising 3 p.p. from 17%.

The market is expecting at least two new players this year. The first is Freedom Bank Tajikistan, licensed in October 2024. The institution is currently operating in a preliminary mode and preparing to launch its product line this fall. The bank stated that it will focus on developing small and medium-sized enterprises, as well as retail banking.

Humo, a microcredit deposit organization operating in Tajikistan for 20 years, has begun its transformation into Humo Bank. According to its unaudited balance sheet for the first half of 2025, the company’s assets totaled 2.2 billion somoni ($231 million), and its loan portfolio reached 1.7 billion somoni ($178.5 million), comparable to the bottom of Tajikistan’s top 10 second-tier banks. At the time of obtaining its banking license, Humo reported a customer base of 350,000, including 120,000 active borrowers, mainly from small and medium-sized enterprises. The controlling shareholder is Japan-based Gojo and Company Inc., which operates in 14 developing countries, including Georgia, India and Cambodia. Humo also has a subsidiary in Uzbekistan — Orzu-Fintech.

In June, Oriyonbonk agreed to cooperate with the LakLak Market startup — operated by Dastras Tochikiston LLC — which runs a marketplace and a fleet of parcel lockers in the country’s largest cities. According to the statement, the startup provides a platform and logistics solutions, while the bank provides settlement instruments and locations for equipment placement. In July, the bank established correspondent relations with the UAE-based First Abu Dhabi Bank for settlements in dirhams. In June, the organization closed its representative office in Uzbekistan, the only office of a Tajik bank in that country.

The main trend in Tajikistan’s banking sector is the transformation of banks into fintechs with marketplaces — a path followed by the most successful Kazakhstani banks — while consumer lending remains the source of the sector’s booming growth. The outlook for private players after the end of the consumer boom depends on how quickly they complete their transformation into fintechs.