Kazakhstan’s trade is slowing amid falling demand

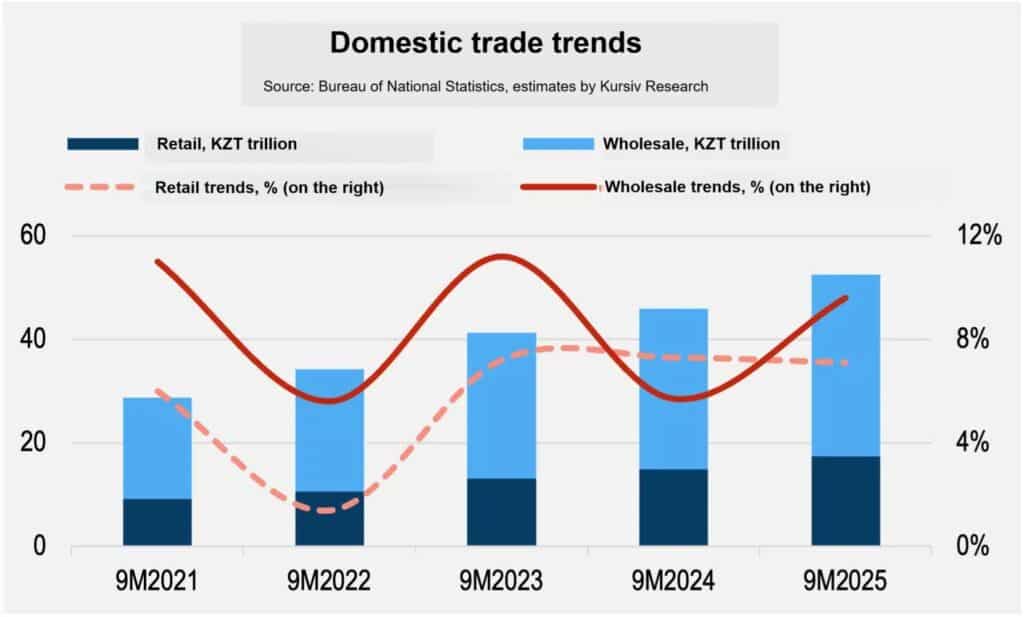

Between January and September 2025, Kazakhstan’s domestic trade grew 8.8%, driving economic growth along with transportation and warehousing (up 21.2%), construction (up 14.9%) and industry (up 7.4%).

Wholesale trade

During the period, Kazakhstan’s trade turnover reached 52.8 trillion tenge (approximately $98 billion), a 14.5% year-on-year (YoY) increase. The physical volume of services grew 8.8% YoY, largely driven by strong wholesale sales.

From January through September, wholesale trade grew 9.6% (9.8% in January-August), suggesting a possible slowdown.

Most growth came from nonfood products, which made up 81.9% of wholesale trade.

Retail sector

Retail, comprising 33.2% of total trade turnover, grew 7.1% in the first nine months of 2025, exceeding the 6.9% growth through August.

Nonfood products led the way, making up 67.2% of retail sales and rising 7.4% YoY. Food sales increased 6.6%.

Notably, e-commerce expansion could partly offset retail slowdown by shifting wholesale transactions to small and medium-sized enterprises engaged in business-to-consumer (B2C) sales.

However, the sustainability of retail growth is uncertain, as incomes and consumer lending show weak momentum.

Influencing factors

Amid high inflation and growing concerns about household debt, the National Bank of Kazakhstan and the Agency for Regulation and Development of the Financial Market have moved to cool the consumer lending market.

Unsecured consumer loans now face caps on maximum amounts, and issuing loans without spousal consent is prohibited. Rules for short-term payday loans from microfinance organizations have also been tightened, limiting terms to 45 days and amounts to roughly 177,000 tenge (about $330).

As a result, payday loan issuance declined sharply: in the first half of the year, the number of loans fell 36.5% in nominal terms and 42.5% in real terms.

Another key factor is the National Bank’s base rate increase, which will raise borrowing costs and likely restrain sales of durable goods.