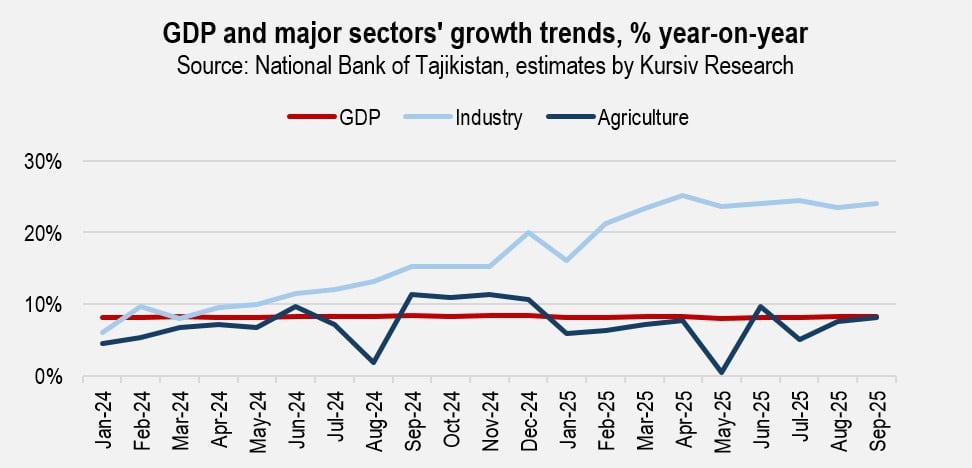

In recent years, Tajikistan has posted strong economic growth, averaging 8.5% annually. Growth slowed slightly to 8.2% in the first nine months of 2025 as weaker consumer demand dampened the expansion of trade and services. But an uptick is expected, supported by higher public-sector wages and continued inflows of remittances.

GDP and its components

In 2024, Tajikistan’s economy grew 8.4%. Despite global economic uncertainty, rising geopolitical tensions, and escalating trade disputes, the country’s GDP expanded 8.2% in the first nine months of 2025, reaching 117.8 billion somoni (about $12.7 billion). The government expects this pace to hold through the end of 2025 before accelerating to 8.5% in 2026. The World Bank forecasts 7.6% growth in 2025, while the IMF and EBRD project 7.5%.

Notably, the current recovery is driven largely by robust public and private investment, which rose 21.7% year-on-year (YoY). Manufacturing is performing especially well, expanding 24% YoY as of September 2025. Growth is being fueled by a surge in extractive industries and significant public investment in the energy sector, including the flagship Rogun Hydroelectric Power Station — set to become one of Central Asia’s most powerful hydropower plants.

Once fully operational, the project is expected to shift Tajikistan from chronic energy shortages to a position as a major regional electricity exporter. Key target markets include Afghanistan and Pakistan through the CASA-1000 transmission project, along with Uzbekistan and Kazakhstan.

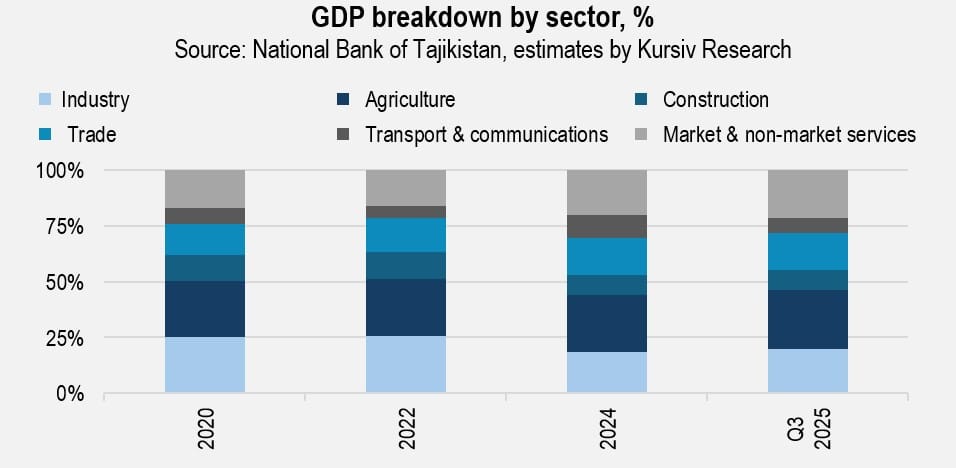

Despite strong industrial output, the sector’s share of GDP is not rising. Using 2020 as a baseline, industrial production grew 235% and agriculture 150%, while the broader economy grew 149%. However, according to the National Bank of Tajikistan, the share of industrial gross value added fell from 23.1% in 2020 to 17.7% in the first nine months of 2025. This discrepancy raises concerns about the reliability of national statistics.

Agricultural productivity remains low due to underinvestment in technology, soil degradation, and increasing climate pressures. The sector nonetheless remains the country’s largest employer, absorbing surplus labor and employing roughly 60% of the workforce.

Tajikistan’s economy could expand even faster if not for sluggish job creation. According to World Bank economists, employment rises only 0.2% for every 1% of GDP growth. High-productivity job gains are concentrated in capital-intensive industries and state-owned enterprises, while labor-intensive private sectors — such as services and trade — lag behind. Growth in construction, especially in housing, is also beginning to cool.

The services sector continues to expand, sustained by high levels of remittances and a gradually growing middle class. Household consumption has remained strong, supported by a 17.2% increase in real wages in the first half of 2025.

External sector and balance of payments

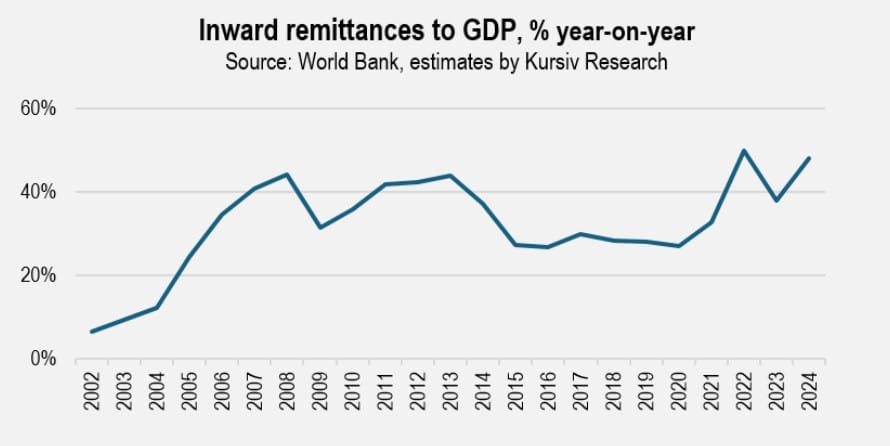

In 2024, remittances rose more than 45%, reaching 47.9% of the country’s GDP. According to a World Bank study, more than 90% of Tajik migrants work in Russia. Labor shortages in Russia, rising wages, and a stronger ruble all contributed to the sharp increase in remittance inflows.

In the first half of 2025, Tajikistan’s imports of goods and services reached nearly $3.9 billion, while exports totaled $920 million. The resulting trade deficit ($2.96 billion) amounted to 44.5% of GDP. However, strong remittance inflows pushed the current account surplus to $1.2 billion, or 18.5% of GDP.

Over the medium to long term, these factors are expected to play a smaller role as Tajikistan’s domestic labor market develops and the country’s birth rate declines.

Inflation and monetary policy

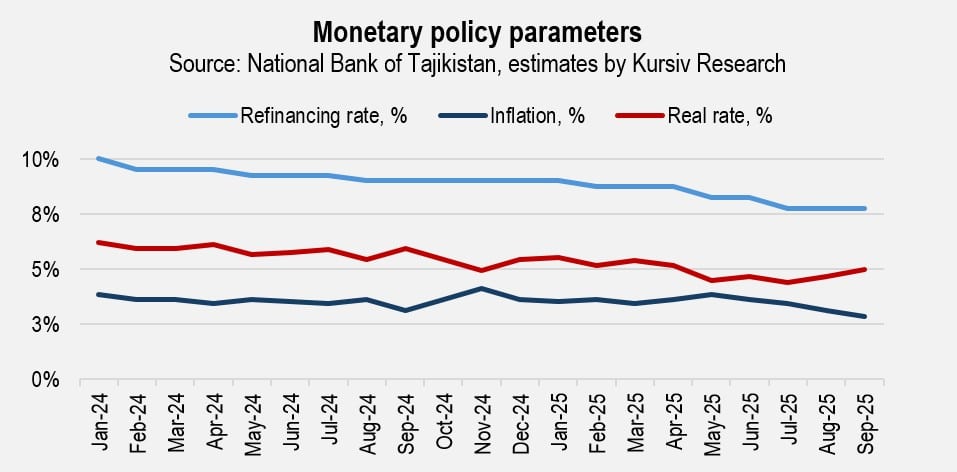

By September 2025, inflation had slowed to 2.8% YoY — the lowest level since the summer of 2023, when it hovered around 2.3% to 2.4%. The decline was driven by a stronger national currency, which reduced import costs, and by falling global food prices, which are particularly influential given food’s large share in household spending.

The easing inflation environment allowed the National Bank of Tajikistan to loosen monetary policy. In July 2025, the central bank cut the refinancing rate by 50 basis points, bringing it to 7.75%.

At the same time, the real interest rate (the nominal policy rate minus inflation) remains relatively high at about 4.9% on average during the first nine months of 2025. This suggests the bank is maintaining a tight monetary stance aimed at sterilizing excess foreign-currency inflows.

Public finances and debt

Between January and September 2025, government revenues rose 27.2% YoY to 37.3 billion somoni (about $4 billion), while expenditures increased 22.9% to 33.8 billion somoni. These trends indicate the government is adhering to a moderate fiscal consolidation strategy designed to support a countercyclical fiscal stance.

The overall state budget surplus reached 3.5 billion somoni, up 93% YoY, and amounted to nearly 3% of GDP for the period.

For full-year 2025, the budget deficit is projected at 2.5% of GDP. Public debt trends have improved significantly: after peaking at 50% of GDP in 2020, the debt-to-GDP ratio fell to 24.9% by the end of 2024.

However, debt sustainability risks persist due to rising debt-service obligations, including Eurobond repayments, scheduled for 2025-2027. Maintaining fiscal sustainability will require keeping the budget deficit near 2.5% of GDP and further developing the domestic government-securities market.