Tajikistan’s banking sector continued to show steady growth through the third quarter of 2025, supported by strong macroeconomic indicators. The loan portfolio expanded by 16% quarter-on-quarter (QoQ) in Q3 2025, offsetting weak performance in the first half of the year.

Monetary policy

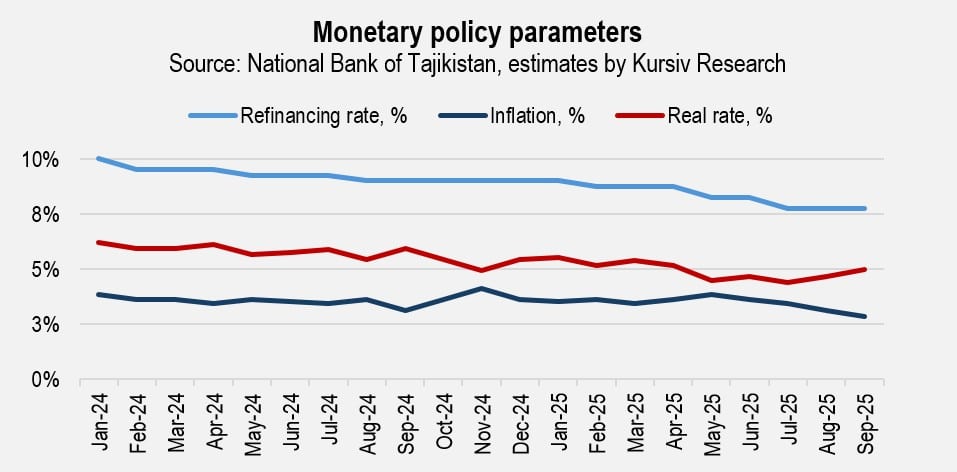

Amid low consumer inflation — steady in the 3% to 4% range since early 2025 — the National Bank of Tajikistan lowered the refinancing rate three times, bringing it to 7.75% in mid-August 2025, one of the lowest levels in a decade. The real interest rate gradually declined from 5.5% in January to between 4.5% and 5% in Q3 2025, enabling the regulator to contain inflationary pressure and advance its core monetary-policy goals.

With consumer inflation down to 2.8% in September and the real interest rate rising above 5%, the central bank further eased monetary policy by 25 basis points on Nov. 3, 2025.

This consistent easing supported credit expansion. The total loan portfolio of credit institutions grew 18.8% year-on-year (YoY) in Q3 2025, while total assets increased 27.4%, driven largely by a 40.3% rise in liquid assets. Despite lending growth outpacing GDP growth, Tajikistan’s economy remains underleveraged. Total loans from credit institutions equaled 15.4% of GDP in 2024 — far below the Central Asian average of 37.5%. For comparison, the ratio in Kazakhstan was 27.6% in 2024.

The faster growth of liquid assets relative to the loan portfolio indicates ongoing challenges in attracting reliable borrowers, especially given that a significant share of household income depends on remittances from abroad.

Assets

In Q3 2025, total banking-sector assets rose 35.4% YoY to 48.6 billion somoni. The International Bank of Tajikistan posted the strongest asset growth among the top five banks, surpassing Oriyonbonk to become the third-largest bank by assets. Its assets grew 10.2% QoQ and 58.8% YoY.

Amonatbonk and Eskhata also recorded notable quarterly asset growth, at 8.7% and 7.7% respectively, though both trailed the market average.

Ranking of Tajikistan’s banks by asset value, top 5 in Q3 2025

| Rank in Q3 2025 | Rank in Q2 2025 | Bank | Asset value Q3, TJS million | Quarter-on-quarter change, % | Year-on-year change, % |

| 1 | 1 | Amonatbonk | 10,430 | 8.7 | 31.9 |

| 2 | 2 | Eskhata Bank | 7,933 | 7.7 | 21.6 |

| 3 | 4 | International Bank of Tajikistan | 5,064 | 10.2 | 58.8 |

| 4 | 3 | Oriyonbonk | 4,932 | 4.5 | -4.1 |

| 5 | 5 | Dushanbe City Bank | 3,821 | -10.6 | 48.0 |

| Source: National Bank of Tajikistan, estimates by Kursiv Research | |||||

Loan portfolio

Consumer lending remains the main driver of growth. The loan portfolio for individuals rose 41.1% YoY, reaching 12.4 billion somoni, or 51% of the total portfolio.

Lending to state-owned enterprises fell sharply, declining 4.9% QoQ and 47% YoY. This drop is likely tied to the rollout of large-scale government programs and increased financing from international development institutions.

Among second-tier banks, Eskhata (+8.1% QoQ; +36.6% YoY) and Arvand (+6.8% QoQ; +38.9% YoY) posted the fastest loan portfolio growth among the top five by volume. Both institutions rank among the most credit-focused banks in Tajikistan.

Deposits

Deposits remain the largest component of banking-sector liabilities, accounting for 71.9% of the total. Bank deposits reached 28.7 billion somoni in September 2025 (+6% QoQ; +38.9% YoY). Deposit growth outpaced the increase in cash in circulation (+12%), a positive sign that suggests rising public confidence in the banking system and the somoni as a savings vehicle. Even so, cash continues to dominate the money supply (M2), underscoring an ongoing structural issue.

Deposit concentration among the five largest banks decreased slightly, to 72.8% from 74.1% in Q2 2025. The most dynamic quarterly growth was recorded by newcomer Freedom Bank (+47.4%) and by Tavhidbonk (+38.9%). The banks’ business models differ sharply: Freedom offers innovative products for the Tajik market, such as deposit cards, while Tavhidbonk focuses on Islamic finance. Still, both reflect rising demand for nontraditional financial instruments and the gradual evolution of the Tajik banking sector.

Return on equity

The banking sector’s average return on equity held steady at 18.6% in Q3 2025, remaining well above the year-earlier level of 12.8%.

Market events

A key development in the sector in recent months has been the imposition of anti-Russian sanctions. On Oct. 23, 2025, the European Union adopted its 19th sanctions package, which included measures targeting several financial institutions and companies in third countries, including Tajikistan.

The National Bank of Tajikistan later confirmed that Dushanbe City Bank, Spitamen, and Commerzbank were subject to restrictions but emphasized that client services continued as usual. Even so, the sanctions prompted additional measures within the domestic system: Investment and Credit Bank (ICB) announced a temporary suspension of money transfers to banks in Russia.

Long-term challenges

Despite robust economic growth, Tajikistan still faces structural challenges that could weigh on long-term sustainability. World Bank experts highlight the need to strengthen competition and reduce asset concentration among the largest banks to support more balanced and resilient growth.