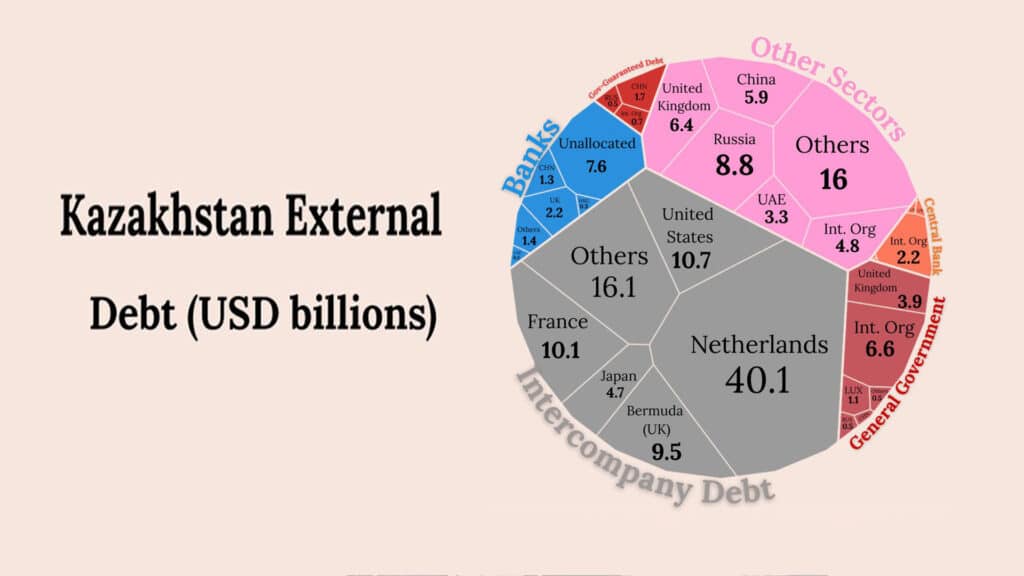

Kazakhstan’s external debt reached a historic high in 2025. Below is an overview of the country’s external debt profile by sector, creditor type and creditor country. The data are visualized by Nurasyl Abdrazakuly, a Kazakh data scientist and a frequent contributor to our infographics, using official figures from Kazakhstan’s National Bank.

How the debt is distributed by sector

In the sector-by-creditor visualization, the top five creditor countries are shown for each sector, while all remaining countries are grouped under «Others» to maintain clarity.

Kazakhstan’s external debt by sector breaks down as follows:

- Intercompany debt (foreign direct investment): about 54.3%

- Other sectors: about 27.0%

- Banks: about 7.8%

- General government: about 7.6%

- Government-guaranteed external debt: about 1.8%

- Central bank: about 1.5%

Total external debt: approximately $167.7 billion.

What portion is owed by the state?

Government obligations consist of just two components:

- General government debt: about $12.8 billion

- Government-guaranteed external debt: about $3.0 billion

Together, total state-related external debt amounts to roughly $15.8 billion. That means only about 9% to 10% of Kazakhstan’s external debt directly or indirectly affects the state budget.

The remaining roughly 90% consists of private and corporate liabilities, including bank debt and intercompany obligations owed by Kazakh companies to foreign owners and investors.

Kazakhstan’s largest creditor countries

The Netherlands is Kazakhstan’s largest creditor, largely due to intercompany debt linked to foreign direct investment.

Kazakhstan’s top five creditors are:

- Netherlands: about $42.2 billion

- International organizations: about $14.7 billion

- Russia: about $13.7 billion

- UK: about $13.2 billion

- U.S.: about $12.0 billion

In total, Kazakhstan has debt obligations to more than 30 major creditor countries.

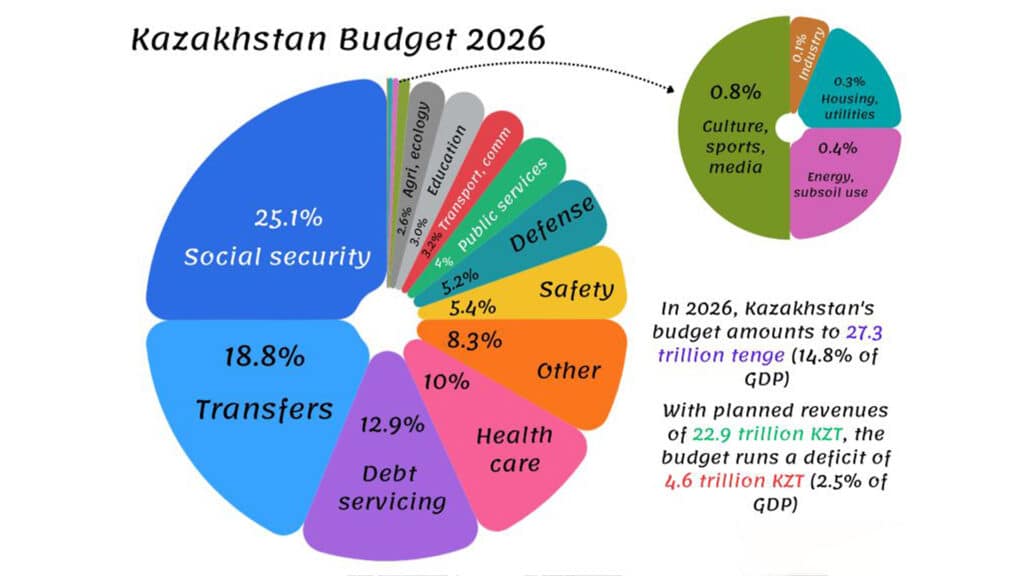

Debt servicing outlook and budget for 2026

Looking ahead, Kazakhstan plans to allocate about 12.9% of state budget spending in 2026 to servicing its debt.

As in previous years, social security accounts for the largest share of the country’s budget, followed by transfers to the National Fund and regional governments. Government debt servicing ranks third.

Smaller portions of the budget are allocated to education, transportation, agriculture, culture, energy, housing and industry.