The stunning health of Armenia’s financial sector

Following its macro review, Kursiv Research presents its first overview of Armenia’s financial sector. While banks continue to expand on the back of a housing-driven credit boom, other market participants — pension funds, insurance companies and credit institutions — largely adhere to conservative business models. Investment companies stand out against this backdrop, using digital platforms to give local investors direct access to global capital markets.

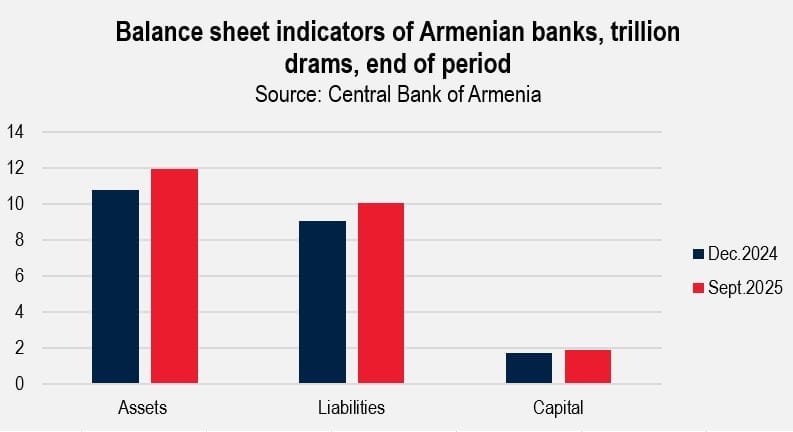

Total assets of Armenia’s financial sector reached 14.5 trillion drams (about $37 billion, or roughly 140% of GDP) in September 2025. Banks continue to dominate the system: according to Kursiv Research estimates, they accounted for 82.2% of total assets, or 11.9 trillion drams, reflecting nominal growth of 8% since the beginning of the year.

Market concentration remains unchanged. The two largest lenders, Ardshinbank and Ameriabank, still control about 40% of total assets. Both are universal banks, combining corporate and retail lending with investment operations.

Digital challengers gain momentum

Medium-sized banks compete by rolling out digital products and positioning themselves as fintech-oriented institutions. Among Armenia’s 17 banks, these players posted the fastest asset growth.

Fast Bank, the sector’s growth leader, expanded assets by 74.5% year-to-date. The bank, which converted from a credit institution in November 2022, focuses on retail digital products, particularly consumer lending. Evocabank, up 40.3%, capitalizes on brand loyalty among younger, digitally native customers, using social media as a core channel.

Credit growth and regulatory response

Loans make up the bulk of bank assets. By the end of the first nine months of 2025, the loan portfolio had reached 7.3 trillion drams, a nominal increase of 14.4% since the start of the year. Within the corporate segment, lending grew fastest in services, up 24.5%, and construction, up 22.6%.

To mitigate the risk of overheating in the credit market, the Central Bank of Armenia raised the countercyclical capital buffer to 1.75% from 1.5% in May, the most significant regulatory change during the reporting period.

Bank profitability continues to improve. By the end of the first nine months of 2025, net profit rose to 293.4 billion drams, an increase of 13.8% year-on-year.

Non-bank institutions remain small

By contrast, insurers account for the smallest share of Armenia’s financial sector. The combined assets of eight active insurance companies totaled 116.9 billion drams at the end of September 2025, up 20.3% year-to-date. Insurance reserves increased to 45.2 billion drams, a gain of 16.1%, while equity rose to 30.9 billion drams, up 8.9%.

Despite positive growth, non-bank financial institutions remain a relatively small part of the system. According to Kursiv Research calculations, they accounted for 17.8% of total financial sector assets at the end of September 2025.

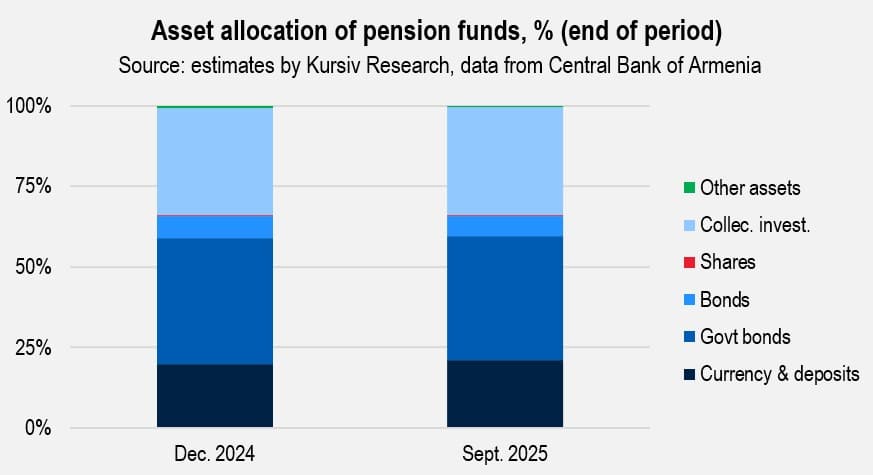

Pension funds anchor the non-bank segment

Pension funds rank second overall by asset size and are the largest non-bank players. Their net asset value reached 1.3 trillion drams by the end of the first nine months of 2025, reflecting growth of 23.9%.

Investment companies and capital markets

Armenia has 23 specialized brokerage firms, while all 17 second-tier banks also hold licenses to conduct investment activities. By the end of September 2025, assets held by investment companies rose to 285.3 billion drams, an increase of 15.5% year-to-date. Other balance sheet indicators also improved: liabilities grew to 190.3 billion drams, up 6.3%, and equity jumped to 95.0 billion drams, a gain of 40%.

Growth in this segment is supported by rising activity on the Armenia Securities Exchange. In the first half of 2025, about 14,000 transactions were completed, up 68.4% from the same period a year earlier, with total turnover reaching 566.4 billion drams, an increase of 105.8%.

The trading structure on the exchange underscores the dominance of institutional investors. Repo transactions accounted for 44.7% of turnover, government bonds for 35.6% and corporate bonds for 19.1%. In practice, banks are the primary issuers of these instruments, while various funds act as the main buyers.

Digital access for retail investors

Retail investors are gradually gaining access to new instruments. In June 2025, the Armenia Securities Exchange joined the Tabadul network, a digital platform operated by the Abu Dhabi Stock Exchange that enables cross-market trading. Other participating exchanges include those in Kazakhstan, Bahrain and Oman.

Investment companies are also building digital ecosystems to simplify access to international markets. Ameria Global Trading, developed by Ameriabank, offers trading in a broad range of instruments — from individual stocks to exchange-traded funds — on major global exchanges.

Tradernet, operated by Freedom Broker Armenia, provides similar functionality, supplemented by analytics focused on U.S. markets. The company is part of the Freedom Holding Corp. ecosystem (Nasdaq: FRHC) and is primarily oriented toward retail investors.

By the end of September 2025, total profits of investment companies reached 80.9 billion drams, up 57.6% year-on-year. The segment still has significant growth potential, as demand for investment products — particularly among individual investors — could increase amid price corrections in global markets.